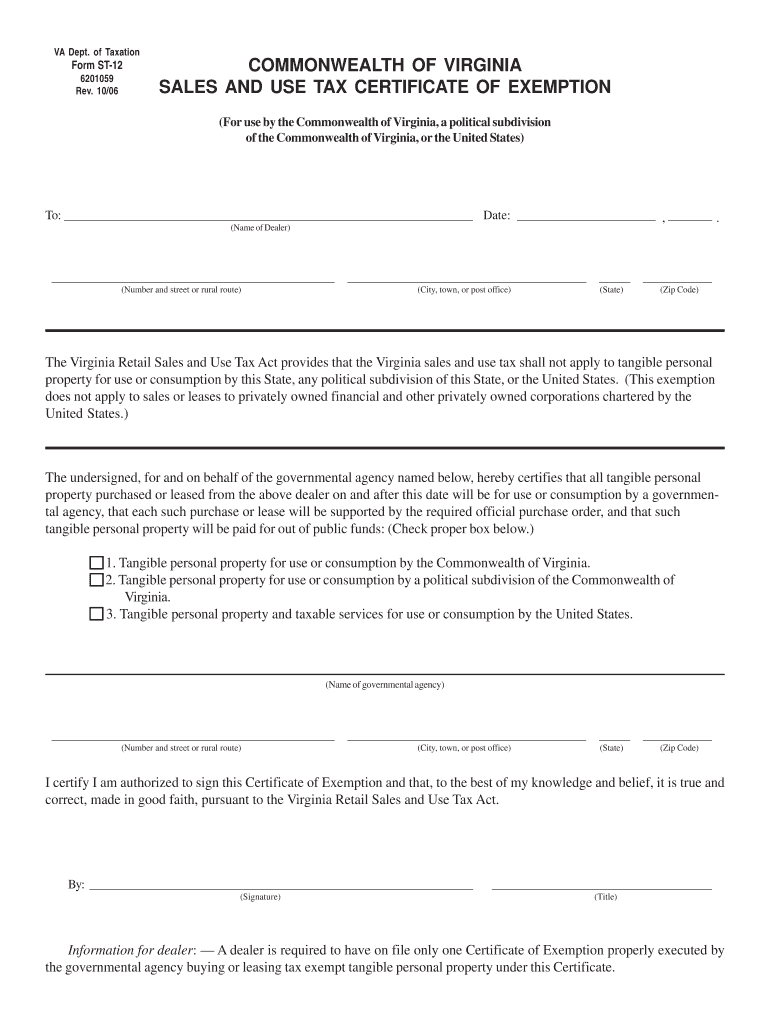

COMMONWEALTH of VIRGINIA SALES and USE TAX Form

Understanding the COMMONWEALTH OF VIRGINIA SALES AND USE TAX

The Commonwealth of Virginia Sales and Use Tax is a tax imposed on the sale of goods and services within the state. This tax applies to both tangible personal property and certain services. The general sales tax rate in Virginia is six percent, but specific localities may impose additional local taxes, resulting in varying rates across the state. Businesses and consumers alike must understand how this tax operates to ensure compliance and proper tax management.

Steps to Complete the COMMONWEALTH OF VIRGINIA SALES AND USE TAX

To properly complete the Commonwealth of Virginia Sales and Use Tax, follow these steps:

- Determine if your purchase is taxable. Most tangible goods are subject to sales tax, while some services may not be.

- Calculate the total amount of sales tax due based on the applicable rate for your locality.

- Gather necessary documentation, such as receipts and invoices, to support your tax calculations.

- Complete the appropriate tax form, ensuring all information is accurate and up-to-date.

- Submit your completed form along with any payment due by the established deadlines.

Required Documents for the COMMONWEALTH OF VIRGINIA SALES AND USE TAX

When filing for the Commonwealth of Virginia Sales and Use Tax, certain documents are essential for a smooth process. These include:

- Invoices or receipts for all taxable purchases.

- Completed tax forms, such as the ST-9 for sales tax or ST-8 for use tax.

- Any exemption certificates if applicable, to justify non-taxable purchases.

Filing Deadlines and Important Dates

Staying informed about filing deadlines for the Commonwealth of Virginia Sales and Use Tax is crucial. Generally, sales tax returns are due on the 20th of the month following the end of the reporting period. For example:

- Monthly filers must submit their returns by the 20th of each month.

- Quarterly filers have deadlines on the 20th of the month following the end of the quarter.

It is important to mark these dates on your calendar to avoid penalties for late submissions.

Legal Use of the COMMONWEALTH OF VIRGINIA SALES AND USE TAX

The legal framework surrounding the Commonwealth of Virginia Sales and Use Tax requires compliance with state regulations. Businesses must register with the Virginia Department of Taxation to collect sales tax. Additionally, they are responsible for remitting collected taxes to the state. Failure to comply with these legal requirements can result in penalties, including fines and interest on unpaid taxes.

Examples of Using the COMMONWEALTH OF VIRGINIA SALES AND USE TAX

Understanding practical applications of the Commonwealth of Virginia Sales and Use Tax can help clarify its impact. For instance:

- A retailer selling clothing in Virginia must charge sales tax on each sale unless the clothing is exempt during designated sales tax holidays.

- A business purchasing equipment for use in its operations must pay use tax if the equipment was bought out of state and brought into Virginia.

These examples illustrate how the tax applies in various scenarios, highlighting the importance of awareness for both consumers and businesses.

Quick guide on how to complete commonwealth of virginia sales and use tax

Manage [SKS] effortlessly on any device

Digital document administration has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Handle [SKS] on any platform using airSlate SignNow's Android or iOS applications and streamline any document-centric process today.

How to modify and eSign [SKS] with ease

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign feature, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to deliver your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choosing. Modify and eSign [SKS] and ensure effective communication at every stage of the form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to COMMONWEALTH OF VIRGINIA SALES AND USE TAX

Create this form in 5 minutes!

How to create an eSignature for the commonwealth of virginia sales and use tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the COMMONWEALTH OF VIRGINIA SALES AND USE TAX, and how does it apply to my business?

The COMMONWEALTH OF VIRGINIA SALES AND USE TAX is a tax levied on the sale or use of goods and services in Virginia. Businesses are required to collect this tax on sales and report it to the state. It's essential to understand your obligations to ensure compliance and avoid any penalties.

-

How can airSlate SignNow help with documentation related to COMMONWEALTH OF VIRGINIA SALES AND USE TAX?

airSlate SignNow allows businesses to easily create, send, and eSign documents that are crucial for managing COMMONWEALTH OF VIRGINIA SALES AND USE TAX documentation. This platform streamlines the process of invoicing and tax compliance, helping to secure important signatures in a timely manner and maintain organized records.

-

Is airSlate SignNow a cost-effective solution for handling COMMONWEALTH OF VIRGINIA SALES AND USE TAX documents?

Yes, airSlate SignNow is designed to offer a cost-effective solution for businesses managing COMMONWEALTH OF VIRGINIA SALES AND USE TAX documents. With competitive pricing plans, it eliminates the need for expensive software, allowing SMEs to streamline their operations without breaking the bank.

-

What features does airSlate SignNow offer to assist with COMMONWEALTH OF VIRGINIA SALES AND USE TAX compliance?

airSlate SignNow provides various features tailored for COMMONWEALTH OF VIRGINIA SALES AND USE TAX compliance, such as customizable templates, real-time tracking, and automated reminders. These features ensure that all necessary documents are signed and submitted efficiently, reducing the risk of errors.

-

Can I integrate airSlate SignNow with my accounting software for COMMONWEALTH OF VIRGINIA SALES AND USE TAX?

Absolutely! airSlate SignNow can integrate with various accounting software solutions, making it easy to manage COMMONWEALTH OF VIRGINIA SALES AND USE TAX. This integration simplifies the process of record-keeping, preventing duplication of efforts and enhancing overall productivity.

-

How can I ensure that my team is trained to use airSlate SignNow for COMMONWEALTH OF VIRGINIA SALES AND USE TAX?

airSlate SignNow offers comprehensive training resources and support to help your team effectively use the platform for COMMONWEALTH OF VIRGINIA SALES AND USE TAX documentation. You can access tutorials, webinars, and customer support to ensure that every user is comfortable and capable of utilizing the features available.

-

What industries can benefit from using airSlate SignNow for COMMONWEALTH OF VIRGINIA SALES AND USE TAX?

Various industries, including retail, eCommerce, and professional services, can benefit from using airSlate SignNow for COMMONWEALTH OF VIRGINIA SALES AND USE TAX documentation. Regardless of your industry, the platform's ease of use and efficiency makes it a valuable tool for any business looking to comply with sales tax requirements.

Get more for COMMONWEALTH OF VIRGINIA SALES AND USE TAX

Find out other COMMONWEALTH OF VIRGINIA SALES AND USE TAX

- How To Sign Arkansas Collateral Agreement

- Sign New York Codicil to Will Now

- Sign Oregon Codicil to Will Later

- How Do I Sign Oregon Bank Loan Proposal Template

- Help Me With Sign Oregon Bank Loan Proposal Template

- Sign Michigan Gift Affidavit Mobile

- How To Sign North Carolina Gift Affidavit

- How Do I Sign Oregon Financial Affidavit

- Sign Maine Revocation of Power of Attorney Online

- Sign Louisiana Mechanic's Lien Online

- How To Sign New Mexico Revocation of Power of Attorney

- How Can I Sign Ohio Revocation of Power of Attorney

- Sign Michigan Mechanic's Lien Easy

- How To Sign Texas Revocation of Power of Attorney

- Sign Virginia Revocation of Power of Attorney Easy

- Can I Sign North Carolina Mechanic's Lien

- Sign Maine Payment Guaranty Myself

- Help Me With Sign Oklahoma Mechanic's Lien

- Sign Oregon Mechanic's Lien Simple

- How To Sign Utah Mechanic's Lien