PHILLIPS AREA MICRO LOAN PROGRAM LOAN APPLICATION Form

What is the PHILLIPS AREA MICRO LOAN PROGRAM LOAN APPLICATION

The PHILLIPS AREA MICRO LOAN PROGRAM LOAN APPLICATION is a formal request form designed for individuals and small businesses seeking financial assistance through micro loans. This program aims to support local entrepreneurs and promote economic development in the Phillips area. The application collects essential information about the applicant, including personal details, business plans, and financial needs, to assess eligibility for funding.

Eligibility Criteria

To qualify for the PHILLIPS AREA MICRO LOAN PROGRAM, applicants must meet specific criteria. Generally, this includes being a resident of the Phillips area, having a viable business idea or existing small business, and demonstrating the ability to repay the loan. Additionally, applicants may need to provide proof of income, credit history, and a detailed business plan outlining how the loan will be utilized.

Steps to complete the PHILLIPS AREA MICRO LOAN PROGRAM LOAN APPLICATION

Completing the PHILLIPS AREA MICRO LOAN PROGRAM LOAN APPLICATION involves several key steps:

- Gather necessary documents, including identification, proof of income, and a business plan.

- Fill out the application form with accurate and detailed information.

- Review the application for completeness and correctness.

- Submit the application either online or in person, depending on the program's submission guidelines.

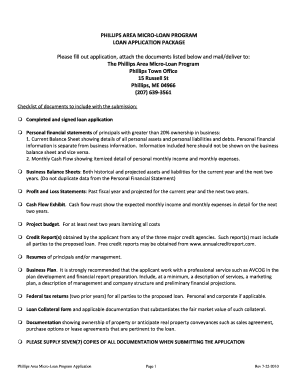

Required Documents

Applicants must prepare several documents to support their PHILLIPS AREA MICRO LOAN PROGRAM LOAN APPLICATION. Commonly required documents include:

- Government-issued identification (e.g., driver's license or passport).

- Proof of income (e.g., pay stubs or tax returns).

- A detailed business plan outlining objectives, market analysis, and financial projections.

- Credit history or score, if applicable.

How to obtain the PHILLIPS AREA MICRO LOAN PROGRAM LOAN APPLICATION

The PHILLIPS AREA MICRO LOAN PROGRAM LOAN APPLICATION can typically be obtained through various channels. Applicants may access the form online via the program's official website or visit local community organizations that support small businesses. In some cases, printed copies may be available at local government offices or economic development centers.

Form Submission Methods

Applicants have multiple options for submitting the PHILLIPS AREA MICRO LOAN PROGRAM LOAN APPLICATION. Common submission methods include:

- Online submission through the program's designated website.

- Mailing a printed application to the program's office.

- In-person submission at local offices or designated community centers.

Quick guide on how to complete phillips area micro loan program loan application

Easily Prepare [SKS] on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely preserve it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly and without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to Modify and Electronically Sign [SKS] Effortlessly

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight signNow sections of your documents or redact sensitive information using the tools that airSlate SignNow specifically provides for this purpose.

- Generate your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors requiring new document copies to be printed. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and electronically sign [SKS] to ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to PHILLIPS AREA MICRO LOAN PROGRAM LOAN APPLICATION

Create this form in 5 minutes!

How to create an eSignature for the phillips area micro loan program loan application

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the PHILLIPS AREA MICRO LOAN PROGRAM LOAN APPLICATION?

The PHILLIPS AREA MICRO LOAN PROGRAM LOAN APPLICATION is designed to provide small businesses with the funding they need to grow. This program offers accessible microloans to eligible entrepreneurs in the Phillips area, simplifying the process through an easy-to-navigate application.

-

How can I apply for the PHILLIPS AREA MICRO LOAN PROGRAM LOAN APPLICATION?

To apply for the PHILLIPS AREA MICRO LOAN PROGRAM LOAN APPLICATION, you can complete the application online through the official program website. The application is straightforward, ensuring that all prospective borrowers can provide the necessary information without hassle.

-

What are the eligibility requirements for the PHILLIPS AREA MICRO LOAN PROGRAM LOAN APPLICATION?

Eligibility for the PHILLIPS AREA MICRO LOAN PROGRAM LOAN APPLICATION typically includes being a small business owner within the Phillips area. Applicants should demonstrate a viable business plan and the capacity to repay the loan, contributing to the local economic development.

-

What are the interest rates associated with the PHILLIPS AREA MICRO LOAN PROGRAM LOAN APPLICATION?

Interest rates for the PHILLIPS AREA MICRO LOAN PROGRAM LOAN APPLICATION can vary based on the loan amount and the applicant’s creditworthiness. Generally, the program aims to offer competitive rates to make financing more accessible for small businesses.

-

What benefits does the PHILLIPS AREA MICRO LOAN PROGRAM LOAN APPLICATION offer to small businesses?

The PHILLIPS AREA MICRO LOAN PROGRAM LOAN APPLICATION provides numerous benefits, including quick access to funds, a straightforward application process, and supportive resources for borrowers. This enables small businesses to invest in growth opportunities and increase their operational capacity.

-

Are there any fees associated with the PHILLIPS AREA MICRO LOAN PROGRAM LOAN APPLICATION?

While the PHILLIPS AREA MICRO LOAN PROGRAM LOAN APPLICATION is designed to minimize costs, there may be nominal processing fees involved. It is advisable to review all terms and conditions to understand any potential costs associated with the application process.

-

How long does it take to process the PHILLIPS AREA MICRO LOAN PROGRAM LOAN APPLICATION?

Processing times for the PHILLIPS AREA MICRO LOAN PROGRAM LOAN APPLICATION vary based on several factors, but most applications are reviewed within a few business days. This efficiency helps borrowers secure funding promptly to meet their business needs.

Get more for PHILLIPS AREA MICRO LOAN PROGRAM LOAN APPLICATION

- Foccus test questions pdf form

- Dispenser course syllabus form

- Imatu membership form

- Aaron buman boarding house form

- How do i get a restraining order in illinois form

- Section 125 plan document template 38120271 form

- Eyelash extensions consent form lashescanada com

- A practical guide to autodesk civil 3d pdf form

Find out other PHILLIPS AREA MICRO LOAN PROGRAM LOAN APPLICATION

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement