Ir526 2018-2026

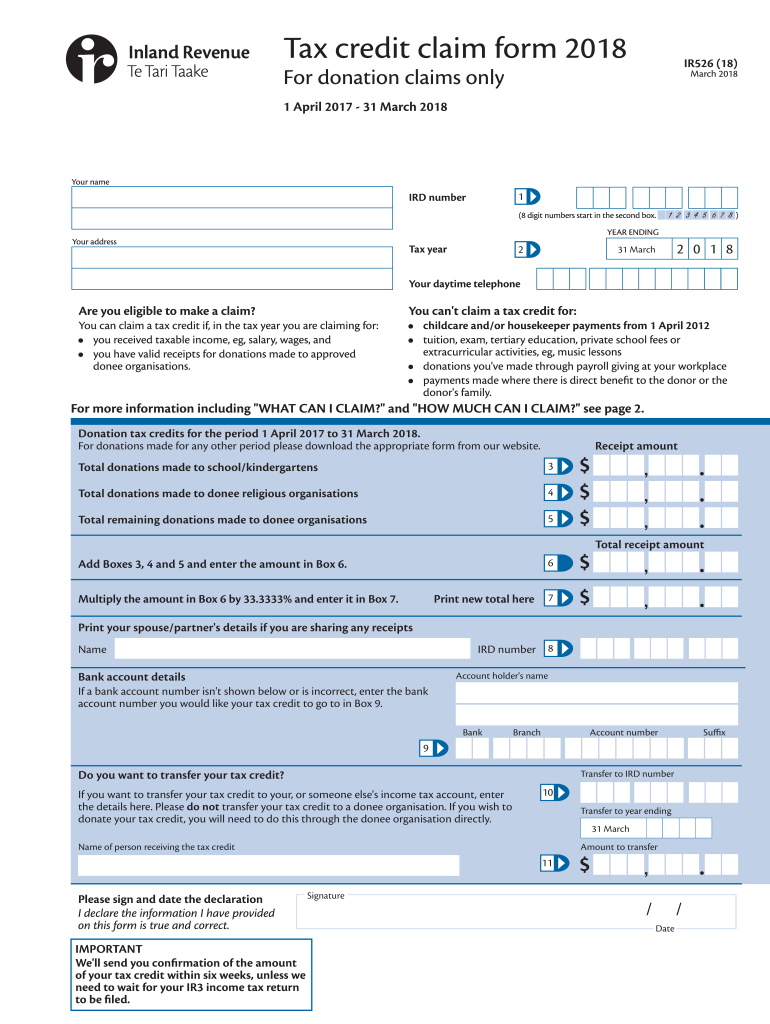

What is the IR526?

The IR526 form is a tax credit claim form used in the United States. It allows individuals to apply for various tax credits, which can reduce their overall tax liability. This form is particularly relevant for those who qualify for specific credits based on their income, expenses, or other qualifying factors. Understanding the purpose of the IR526 is essential for taxpayers seeking to maximize their tax benefits and ensure compliance with IRS regulations.

How to obtain the IR526

To obtain the IR526 form, individuals can visit the official IRS website or contact their local tax office. The form is typically available for download in a PDF format, allowing users to print it for completion. Additionally, tax professionals can provide assistance in acquiring the form and ensuring it is filled out correctly. It is important to ensure that you are using the most current version of the form to avoid any issues during submission.

Steps to complete the IR526

Completing the IR526 form involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including income statements and any relevant receipts or records that support your claim for tax credits. Next, fill out the form carefully, ensuring that all required fields are completed with accurate information. After completing the form, review it for any errors or omissions before submitting it to the appropriate tax authority. Properly following these steps can help prevent delays in processing your claim.

Legal use of the IR526

The IR526 form must be used in accordance with IRS guidelines to ensure its legal validity. This includes providing truthful information and supporting documentation. Submitting false information on the IR526 can lead to penalties, including fines or legal action. It is crucial for taxpayers to understand their obligations and ensure that they are using the form correctly to claim eligible tax credits without facing legal repercussions.

Required Documents

When filing the IR526 form, certain documents are required to substantiate your claims. These may include:

- W-2 forms showing income

- 1099 forms for additional income

- Receipts for deductible expenses

- Proof of eligibility for specific tax credits

Having these documents ready can streamline the filing process and help ensure that your claims are processed efficiently.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the IR526 form. Typically, the deadline for submitting the form aligns with the annual tax filing deadline, which is usually April 15. However, taxpayers should check for any updates or extensions that may apply in a given tax year. Missing the deadline can result in the loss of potential tax credits, so timely submission is crucial.

Quick guide on how to complete ir 526 2018 2019 form

A concise tutorial on how to assemble your Ir526

Finding the appropriate template can turn into a hurdle when you are required to submit official foreign paperwork. Even if you possess the correct form, it may be tedious to swiftly prepare it in alignment with all the standards if you are using paper copies rather than handling everything digitally. airSlate SignNow is the web-based electronic signature platform that assists you in navigating these challenges. It enables you to obtain your Ir526 and promptly fill it out and sign it on-site without the need to reprint documents in case of any typing errors.

Here are the actions you need to undertake to compile your Ir526 with airSlate SignNow:

- Hit the Get Form button to instantly add your document to our editor.

- Begin with the first vacant field, input your information, and proceed using the Next tool.

- Complete the empty fields utilizing the Cross and Check tools located in the toolbar above.

- Select the Highlight or Line options to emphasize the most crucial details.

- Click on Image and upload one if your Ir526 requires it.

- Utilize the right-side panel to add more fields for you or others to complete if needed.

- Review your responses and validate the document by clicking Date, Initials, and Sign.

- Create your eSignature by drawing, typing, uploading, or capturing it with a camera or QR code.

- Conclude modifying the document by clicking the Done button and selecting your file-sharing preferences.

Once your Ir526 is ready, you can share it in your preferred manner - send it to your recipients via email, SMS, fax, or even print it directly from the editor. You can also securely store all your completed documents in your account, organized in folders based on your choices. Don’t spend time on manual form filling; give airSlate SignNow a try!

Create this form in 5 minutes or less

Find and fill out the correct ir 526 2018 2019 form

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

How do I fill out a CLAT 2019 application form?

Hi thereFirst of all, let me tell you some important points:CLAT 2019 has gone OFFLINE this yearBut the application forms for CLAT 2019 have to be filled ONLINEThe payment of the application fees also should be made onlineNow, kindly note the important dates:Note the details regarding the application fees:Here, if you want the Previous Year Question papers, Rs.500 would be added to the application fees.Apart from this, there would be bank transaction charges added to the application fees.The application fees is non-refundable.Note one important point here that before you fill the application form, check for your eligibility.To know the complete details of filling the application form along with other information like the eligibility - in terms of age, educational qualification, list of NLUs participating and the seats offered under each category, CLAT Reservation policies, CLAT exam pattern, marking scheme, syllabus, important documents required to be kept ready before filling the form, kindly go to the link below:How to fill CLAT 2019 Application form? Registration OPEN | All you need to knowTo know how to prepare for one of the very important section of CLAT exam, GK and Current Affairs, kindly go to the link below:How to prepare GK & Current Affairs for CLAT 2019To practice, daily MCQs on Current Affairs, kindly go to the link below:#CLAT2019 | #AILET2019 | #DULLB2019 | GK and Current Affairs Series: 5 in 10 Series: Day 12For any other queries, kindly write to us at mailateasyway@gmail.comThanks & Regards!

-

How can I fill out an IRS form 8379?

Form 8379, the Injured Spouse declaration, is used to ensure that a spouse’s share of a refund from a joint tax return is not used by the IRS as an offset to pay a tax obligation of the other spouse.Before you file this, make sure that you know the difference between this and the Innocent Spouse declaration, Form 8857. You use Form 8379 when your spouse owes money for a legally enforeceable tax debt (such as a student loan which is in default) for which you are not jointly liable. You use Form 8857 when you want to be released from tax liability for an understatement of tax that resulted from actions taken by your spouse of which you had no knowledge, and had no reason to know.As the other answers have specified, you follow the Instructions for Form 8379 (11/2016) on the IRS Web site to actually fill it out.

Create this form in 5 minutes!

How to create an eSignature for the ir 526 2018 2019 form

How to make an electronic signature for your Ir 526 2018 2019 Form in the online mode

How to generate an electronic signature for the Ir 526 2018 2019 Form in Chrome

How to generate an eSignature for putting it on the Ir 526 2018 2019 Form in Gmail

How to generate an eSignature for the Ir 526 2018 2019 Form right from your smart phone

How to create an eSignature for the Ir 526 2018 2019 Form on iOS

How to create an eSignature for the Ir 526 2018 2019 Form on Android OS

People also ask

-

What is Ir526 and how does it relate to airSlate SignNow?

Ir526 refers to the IRS form used for certain tax-related filings. While airSlate SignNow isn’t directly associated with IRS forms, it offers a seamless solution for businesses needing to send and eSign important documents like the Ir526. Our platform ensures that your documents are securely signed and stored, making tax filing simpler.

-

How can airSlate SignNow help in signing the Ir526 form?

Using airSlate SignNow, you can easily upload the Ir526 form and send it for electronic signatures. Our platform allows multiple signers, so you can gather all required approvals quickly. This simplifies the process of completing and submitting your tax forms efficiently.

-

What are the pricing options for using airSlate SignNow for the Ir526 form?

airSlate SignNow offers various pricing plans tailored to fit different business needs. Whether you’re a small business or a large enterprise, our cost-effective solutions for managing documents like the Ir526 ensure you only pay for what you need. Check our website for detailed pricing information.

-

What features of airSlate SignNow are beneficial for handling the Ir526?

airSlate SignNow provides features like customizable templates, in-person signing, and advanced security protocols that are essential for handling forms like the Ir526. These features help streamline the signing process, reduce errors, and ensure compliance with legal requirements.

-

Is airSlate SignNow secure for signing sensitive documents such as the Ir526?

Yes, airSlate SignNow prioritizes security. When signing sensitive documents like the Ir526, we implement top-notch encryption and security measures to protect your data. You can trust that your information is safe while using our electronic signature platform.

-

Can airSlate SignNow integrate with other tools for managing the Ir526?

Absolutely! airSlate SignNow offers integrations with popular applications that help in managing your workflows, including document storage and tax preparation tools. This means you can easily incorporate the Ir526 form into your existing systems for a more efficient process.

-

What are the benefits of using airSlate SignNow over traditional signing methods for the Ir526?

Using airSlate SignNow for the Ir526 form eliminates the need for printing, scanning, and mailing documents. This not only saves time but also reduces costs associated with traditional signing methods. Plus, electronic signatures are legally recognized, ensuring that your submissions are valid.

Get more for Ir526

- Cui cover sheet form

- Nutrition questionnaire for clients form

- Orleans county traffic diversion program 24532987 form

- Element trading cards form

- Sciton ndyag 1064 nm informed consent

- Whatcom health care alliance power of attorney directive form

- Credit application this is the credit application form for meetings and conventions

- Iowa shiip form

Find out other Ir526

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word