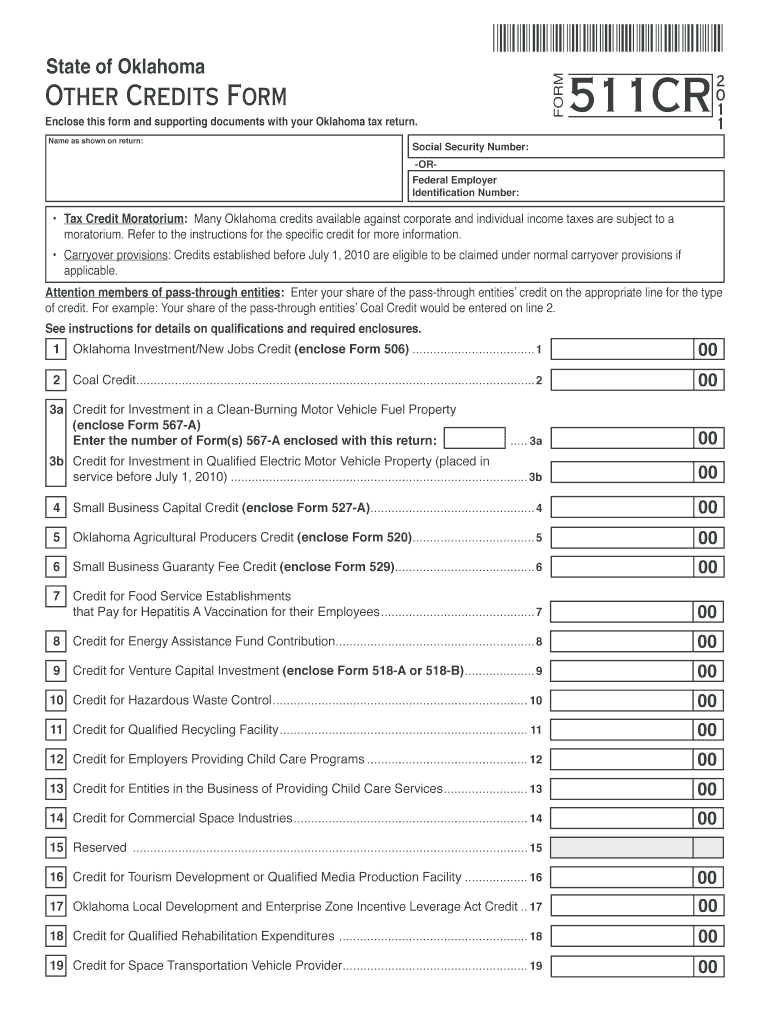

Other Credits Form Oklahoma Tax Commission State of Oklahoma

Understanding the Other Credits Form

The Other Credits Form from the Oklahoma Tax Commission is designed to help taxpayers claim various non-standard tax credits available in the state of Oklahoma. These credits may include those for specific investments, contributions, or other qualifying activities that do not fall under the usual categories. Understanding this form is crucial for ensuring that you receive all eligible tax benefits, potentially reducing your overall tax liability.

Steps to Complete the Other Credits Form

Completing the Other Credits Form requires careful attention to detail. First, gather all necessary documentation that supports your claim for credits. This may include receipts, certificates, or other proof of eligibility. Next, fill out the form accurately, ensuring that all sections are completed as required. Double-check your entries for accuracy, as errors can lead to delays or rejections. Finally, submit the form by the specified deadline, either online or via mail, depending on your preference.

Eligibility Criteria for the Other Credits Form

To qualify for the credits listed on the Other Credits Form, taxpayers must meet specific eligibility criteria set forth by the Oklahoma Tax Commission. These criteria can vary based on the type of credit being claimed. Generally, eligibility may depend on factors such as income level, the nature of the expense, and compliance with state regulations. It is essential to review these criteria carefully to ensure that you qualify before submitting the form.

Required Documents for Submission

When submitting the Other Credits Form, certain documents may be required to substantiate your claims. This typically includes proof of expenses related to the credits you are claiming. Examples of required documents can include tax receipts, invoices, or official letters confirming your eligibility for specific credits. Ensure that all supporting documents are organized and submitted along with the form to avoid processing delays.

Filing Deadlines for the Other Credits Form

Timely submission of the Other Credits Form is crucial to ensure that you receive your credits. The filing deadlines are typically aligned with the state’s tax return deadlines. It is important to check the Oklahoma Tax Commission’s official calendar for the most current deadlines to avoid penalties or missed opportunities for claiming credits.

Form Submission Methods

The Other Credits Form can be submitted through various methods to accommodate taxpayer preferences. Options typically include filing online through the Oklahoma Tax Commission's website, mailing a printed copy of the form, or submitting it in person at designated tax offices. Each method may have different processing times, so consider your needs when choosing how to submit your form.

Quick guide on how to complete other credits form oklahoma tax commission state of oklahoma

Prepare [SKS] effortlessly on any device

Online document management has gained signNow traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the features required to create, edit, and electronically sign your documents quickly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to edit and electronically sign [SKS] with ease

- Locate [SKS] and click Get Form to initiate the process.

- Utilize the tools available to complete your document.

- Emphasize important sections of the documents or redact sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then select the Done button to save your modifications.

- Decide how you want to share your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management requirements with just a few clicks from any device you prefer. Alter and electronically sign [SKS] to guarantee excellent communication at any point in your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Other Credits Form Oklahoma Tax Commission State Of Oklahoma

Create this form in 5 minutes!

How to create an eSignature for the other credits form oklahoma tax commission state of oklahoma

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Other Credits Form Oklahoma Tax Commission State Of Oklahoma used for?

The Other Credits Form Oklahoma Tax Commission State Of Oklahoma is utilized by taxpayers to claim various tax credits that do not fall under standard categories. It allows individuals and businesses to detail other relevant credits that might reduce their tax liability. Understanding this form can lead to signNow savings on your tax bill.

-

How can I efficiently complete the Other Credits Form Oklahoma Tax Commission State Of Oklahoma?

To efficiently complete the Other Credits Form Oklahoma Tax Commission State Of Oklahoma, it's important to gather all necessary documentation ahead of time. Utilizing airSlate SignNow can streamline the process with its intuitive eSignature features, making it easier to fill out and submit your form without delays.

-

Are there any fees associated with filing the Other Credits Form Oklahoma Tax Commission State Of Oklahoma?

Filing the Other Credits Form Oklahoma Tax Commission State Of Oklahoma itself does not incur a fee, but you may want to consider service fees for eSignature solutions like airSlate SignNow. These services often provide added efficiencies and secure documentation, which can save time and enhance accuracy during the submission process.

-

What benefits does airSlate SignNow provide when submitting the Other Credits Form Oklahoma Tax Commission State Of Oklahoma?

airSlate SignNow offers several benefits for users submitting the Other Credits Form Oklahoma Tax Commission State Of Oklahoma, including a user-friendly interface and secure document handling. You can easily collaborate with tax professionals or team members to verify the details, ensuring your form is accurate and complete before submission.

-

Can I use airSlate SignNow to track my Other Credits Form Oklahoma Tax Commission State Of Oklahoma submission?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your Other Credits Form Oklahoma Tax Commission State Of Oklahoma submission. You can receive notifications once the document has been signed and successfully submitted, giving you peace of mind throughout the process.

-

What integrations does airSlate SignNow offer that could assist with the Other Credits Form Oklahoma Tax Commission State Of Oklahoma?

airSlate SignNow integrates seamlessly with various applications including Google Drive, Dropbox, and more, making it easy to store and access the Other Credits Form Oklahoma Tax Commission State Of Oklahoma. These integrations enable efficient document management and ensure you can work within your preferred systems.

-

Is airSlate SignNow suitable for businesses helping clients with the Other Credits Form Oklahoma Tax Commission State Of Oklahoma?

Absolutely! airSlate SignNow is an excellent solution for businesses assisting clients with the Other Credits Form Oklahoma Tax Commission State Of Oklahoma. Its robust features allow for easy document sharing and eSigning, making it an ideal tool for tax professionals or agencies that handle multiple client submissions.

Get more for Other Credits Form Oklahoma Tax Commission State Of Oklahoma

Find out other Other Credits Form Oklahoma Tax Commission State Of Oklahoma

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form