Staple Forms Here CT 184 M Amended Return Employer Identification Number New York State Department of Taxation and Finance Trans

Understanding the Staple Forms Here CT 184 M Amended Return

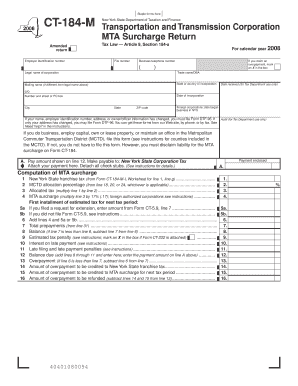

The Staple Forms Here CT 184 M Amended Return is a crucial document for businesses operating within New York State, specifically for those subject to the Metropolitan Transportation Authority (MTA) surcharge. This form is designed for employers who need to amend their previously filed returns under Tax Law Article 9, Section 184-a. It includes the Employer Identification Number (EIN) and is essential for accurate reporting of transportation and transmission corporation taxes.

Steps to Complete the Staple Forms Here CT 184 M Amended Return

Completing the CT 184 M Amended Return involves several steps to ensure compliance with New York State tax regulations. First, gather all necessary financial records and previous tax returns. Next, accurately fill out the form with updated information, including any changes in income, deductions, or credits. Be sure to include your EIN and any relevant schedules. After completing the form, review it for accuracy before submission.

Required Documents for the CT 184 M Amended Return

To successfully file the CT 184 M Amended Return, certain documents are required. These include:

- Previous tax returns that need amendment

- Financial statements reflecting the amended figures

- Any supporting documentation for deductions or credits

- Correspondence from the New York State Department of Taxation and Finance, if applicable

Having these documents ready will facilitate a smoother filing process.

Legal Use of the CT 184 M Amended Return

The CT 184 M Amended Return must be used in accordance with New York State tax laws. It is legally binding and should reflect accurate and truthful information. Filing this form is necessary to correct any discrepancies in previously submitted returns, ensuring compliance with applicable tax obligations. Failure to file or incorrect filings may result in penalties or interest charges.

Form Submission Methods

The CT 184 M Amended Return can be submitted through various methods. Taxpayers have the option to file online via the New York State Department of Taxation and Finance website, submit by mail, or deliver the form in person at designated offices. Each method has its own processing times and requirements, so it is essential to choose the one that best fits your needs.

Filing Deadlines for the CT 184 M Amended Return

Filing deadlines for the CT 184 M Amended Return are critical for compliance. Generally, amended returns should be filed within three years of the original filing date or within two years from the date the tax was paid, whichever is later. Keeping track of these deadlines helps avoid penalties and ensures that any refunds due are processed promptly.

Quick guide on how to complete staple forms here ct 184 m amended return employer identification number new york state department of taxation and finance 983763

Effortlessly Prepare [SKS] on Any Device

Managing documents online has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents quickly and without delays. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to Modify and Electronically Sign [SKS] with Ease

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Select important sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Verify all details and click on the Done button to save your modifications.

- Decide how you prefer to send your form—via email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device of your choice. Modify and electronically sign [SKS] and ensure excellent communication throughout the document preparation phase with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the staple forms here ct 184 m amended return employer identification number new york state department of taxation and finance 983763

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for completing the Staple Forms Here CT 184 M Amended Return?

To complete the Staple Forms Here CT 184 M Amended Return, start by gathering your Employer Identification Number and any necessary documents related to the New York State Department Of Taxation And Finance. Follow the guidelines provided for the Transportation and Transmission Corporation MTA Surcharge Return under Tax Law Article 9, Section 184 a For Calendar. Ensure all information is accurate before submission.

-

How can airSlate SignNow assist with the Staple Forms Here CT 184 M Amended Return?

airSlate SignNow simplifies the process of preparing and submitting Staple Forms Here CT 184 M Amended Return. Our platform allows for easy document eSigning and management, ensuring that your Employer Identification Number and relevant details are securely processed. With user-friendly tools, you can streamline your submissions to the New York State Department Of Taxation And Finance.

-

What features does airSlate SignNow offer for managing tax return documents?

airSlate SignNow provides a variety of features tailored to manage tax return documents, including eSignature capabilities and customizable templates for Staple Forms Here CT 184 M Amended Return. Our platform also offers automatic reminders and tracking for submissions, which helps you stay compliant with the New York State Department Of Taxation And Finance requirements.

-

Is airSlate SignNow cost-effective for businesses handling multiple tax returns?

Yes, airSlate SignNow is a cost-effective solution for businesses handling multiple tax returns, including the Staple Forms Here CT 184 M Amended Return. With flexibility in pricing plans, our platform suits businesses of all sizes, making it easier to manage expenses related to document processing and compliance with tax regulations.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various tax preparation software, enhancing the efficiency of completing the Staple Forms Here CT 184 M Amended Return. By connecting our platform with your existing tools, you can automate data entry and ensure that your Employer Identification Number and other necessary information is accurately populated.

-

What are the benefits of using airSlate SignNow for tax return submissions?

Using airSlate SignNow for tax return submissions, including the Staple Forms Here CT 184 M Amended Return, streamlines the entire process. The platform offers enhanced security features for sensitive documents and improves collaboration between stakeholders, which is vital for compliances with the New York State Department Of Taxation And Finance.

-

How does airSlate SignNow ensure the security of my tax documents?

airSlate SignNow employs advanced security measures to protect your tax documents, including the Staple Forms Here CT 184 M Amended Return. All data is encrypted, and access controls are in place to ensure only authorized personnel can view your Employer Identification Number and other critical information.

Get more for Staple Forms Here CT 184 M Amended Return Employer Identification Number New York State Department Of Taxation And Finance Trans

Find out other Staple Forms Here CT 184 M Amended Return Employer Identification Number New York State Department Of Taxation And Finance Trans

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free

- eSign Massachusetts Real Estate Quitclaim Deed Myself

- eSign Missouri Real Estate Affidavit Of Heirship Simple

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed