Ac 946 Form

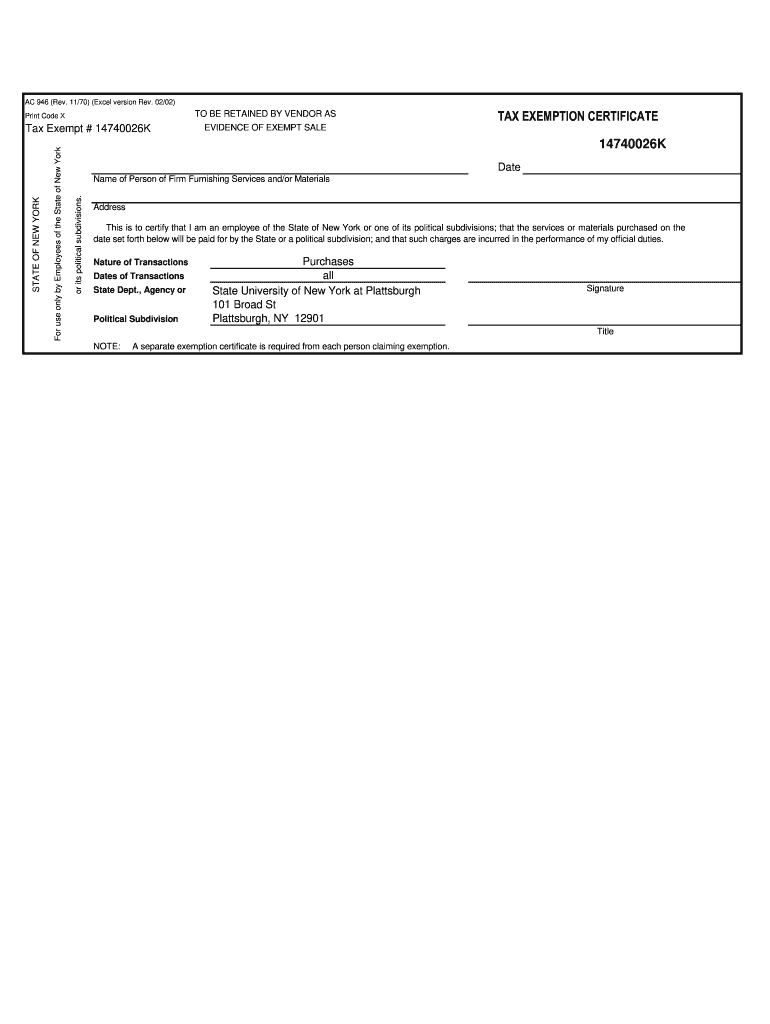

What is the AC 946?

The AC 946 form is a crucial document used primarily for tax exemption purposes in the United States. It serves as a declaration for individuals or entities seeking to claim specific tax benefits. Understanding the purpose of the AC 946 is essential for those who qualify for tax exemptions, as it outlines the necessary criteria and information required to complete the form accurately.

How to Use the AC 946

Using the AC 946 form involves several steps to ensure proper completion and submission. First, gather all relevant information, including personal details and financial data necessary for the tax exemption claim. Next, carefully fill out the form, ensuring that all sections are completed accurately. It is important to review the information for any errors before submission. Once completed, the form can be submitted electronically or via mail, depending on the specific requirements outlined by the issuing authority.

Steps to Complete the AC 946

Completing the AC 946 form involves a systematic approach to ensure accuracy and compliance. Follow these steps:

- Gather necessary documentation, including identification and financial records.

- Fill out personal information such as name, address, and taxpayer identification number.

- Provide details regarding the tax exemption being claimed, including relevant codes or descriptions.

- Review the form for completeness and accuracy.

- Submit the form according to the specified guidelines, either online or by mail.

Legal Use of the AC 946

The AC 946 form must be used in compliance with federal and state tax laws. It is essential to ensure that all information provided is truthful and accurate, as any discrepancies can lead to penalties or denial of the tax exemption. The form is legally binding, and submitting it under false pretenses can result in serious legal consequences.

IRS Guidelines for the AC 946

The Internal Revenue Service (IRS) provides specific guidelines for completing and submitting the AC 946 form. These guidelines include eligibility criteria, necessary documentation, and submission deadlines. It is important to familiarize yourself with these guidelines to ensure compliance and to avoid any potential issues with your tax exemption claim.

Form Submission Methods

The AC 946 form can be submitted through various methods to accommodate different preferences. Options include:

- Online Submission: Many taxpayers prefer to submit the form electronically for convenience and speed.

- Mail Submission: The form can also be printed and mailed to the appropriate tax authority.

- In-Person Submission: Some may choose to deliver the form in person at designated tax offices.

Quick guide on how to complete ac 946 37227718

Complete Ac 946 effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals alike. It offers a superb eco-friendly substitute for conventional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents swiftly without interruptions. Manage Ac 946 on any device using airSlate SignNow's Android or iOS applications, and enhance any document-centric process today.

How to modify and eSign Ac 946 effortlessly

- Find Ac 946 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the documents or redact sensitive information with specialized tools that airSlate SignNow offers for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you prefer to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Ac 946 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ac 946 37227718

The best way to create an eSignature for a PDF file in the online mode

The best way to create an eSignature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature straight from your smartphone

The way to generate an eSignature for a PDF file on iOS devices

The way to generate an electronic signature for a PDF document on Android

People also ask

-

What is form ac 946?

Form AC 946 is a critical document used by businesses to formalize agreements and streamline workflows. By leveraging airSlate SignNow, users can easily prepare, send, and eSign form ac 946, ensuring compliance and efficiency in their operations.

-

How can airSlate SignNow enhance my use of form ac 946?

airSlate SignNow simplifies the management of form ac 946 by offering features like electronic signatures and customizable templates. This allows users to prepare the form swiftly, obtain necessary approvals, and archive the document securely, enhancing overall productivity.

-

What are the pricing options for using airSlate SignNow with form ac 946?

airSlate SignNow offers various pricing plans to accommodate different business needs, starting with a free trial. Each plan provides essential features for managing form ac 946, making it a cost-effective solution for businesses looking to streamline their document workflows.

-

Can I integrate airSlate SignNow with other software while using form ac 946?

Yes, airSlate SignNow supports integrations with various applications such as Google Workspace, Salesforce, and others. This seamless integration allows users to incorporate form ac 946 into their existing workflows, enhancing efficiency and collaboration.

-

What security measures does airSlate SignNow implement for form ac 946?

airSlate SignNow prioritizes security with advanced encryption protocols and secure data storage. When handling form ac 946, users can rest assured that their sensitive information is protected against unauthorized access.

-

Is airSlate SignNow user-friendly for completing form ac 946?

Absolutely! airSlate SignNow's interface is designed with user experience in mind, making it intuitively easy to complete form ac 946. Even those unfamiliar with eSigning can navigate the platform effortlessly, ensuring a smooth signing process.

-

What are the benefits of using airSlate SignNow for form ac 946?

Using airSlate SignNow for form ac 946 offers numerous benefits including reduced turnaround time for document signing, increased accuracy, and enhanced compliance. Additionally, the ability to track document status ensures that every step is transparent and manageable.

Get more for Ac 946

Find out other Ac 946

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself