Ptax 329 Form

What is the Ptax 329?

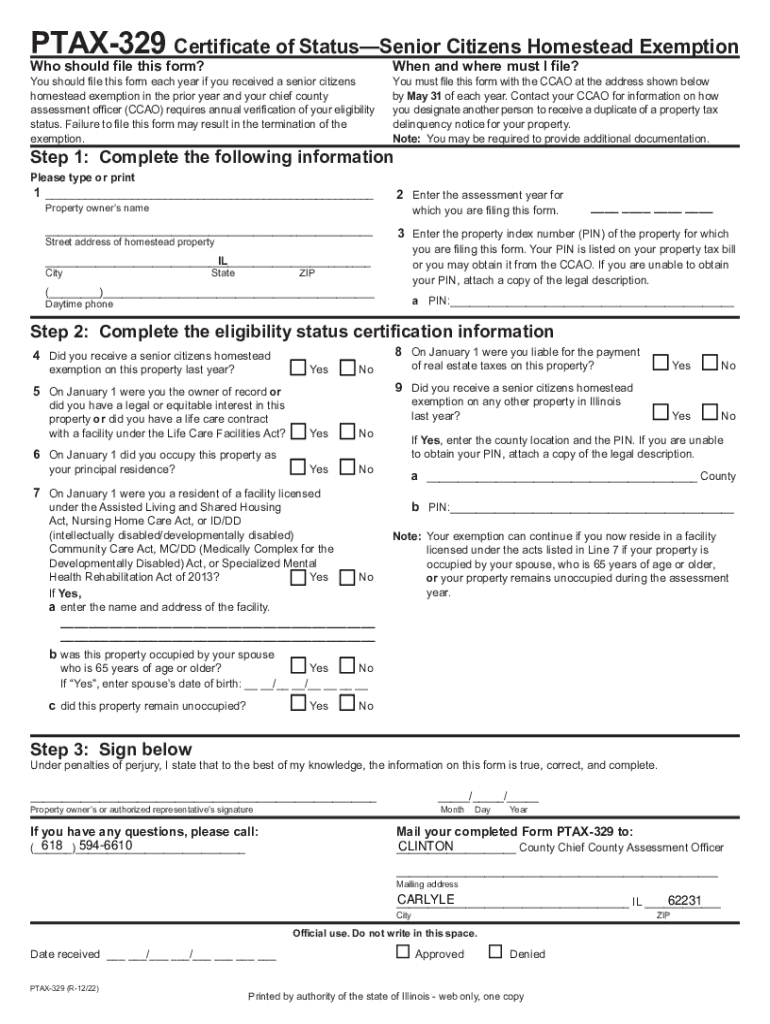

The Ptax 329 form is an essential document used in Illinois for claiming the Senior Citizens Homestead Exemption. This exemption allows eligible senior citizens to reduce their property tax burden, providing significant financial relief. The form is specifically designed to certify that the applicant meets the necessary criteria to qualify for this exemption, which is aimed at assisting seniors in maintaining their homes and managing their finances effectively.

Eligibility Criteria

To qualify for the Ptax 329, applicants must meet specific eligibility criteria set forth by the state of Illinois. Generally, the following conditions apply:

- The applicant must be at least sixty-five years old as of the assessment date.

- The property must be the applicant's primary residence.

- The applicant must have an ownership interest in the property.

- Income limitations may apply, depending on the specific exemption program.

It is important for applicants to review these criteria carefully to ensure they meet all requirements before submitting the form.

Steps to Complete the Ptax 329

Filling out the Ptax 329 form involves several straightforward steps. Here’s a guide to help you through the process:

- Obtain the Ptax 329 form from the local assessor's office or download it from a reliable source.

- Provide your personal information, including your name, address, and date of birth.

- Indicate your ownership interest in the property and confirm that it is your primary residence.

- Complete any additional sections that pertain to income or other exemptions you may be claiming.

- Review the form for accuracy before signing and dating it.

Following these steps will help ensure that your application is complete and accurate, reducing the chances of delays in processing.

How to Obtain the Ptax 329

The Ptax 329 form can be obtained through various methods. Applicants may:

- Visit their local county assessor's office to request a physical copy.

- Access the form online through official state resources or local government websites.

- Contact the assessor's office via phone or email to ask for a mailed copy.

It is advisable to ensure that the form is the most current version to avoid any issues during submission.

Form Submission Methods

Once the Ptax 329 form is completed, it can be submitted through several methods:

- In-person at the local assessor's office, where you can receive immediate confirmation of receipt.

- By mail, ensuring that you send it to the correct address and allowing sufficient time for delivery.

- Some counties may offer online submission options, which can expedite the process.

Choosing the right submission method can help ensure that your application is processed in a timely manner.

Key Elements of the Ptax 329

The Ptax 329 form includes several key elements that are crucial for applicants to understand:

- Applicant Information: Basic details about the applicant, including name and address.

- Property Details: Information about the property for which the exemption is being claimed.

- Eligibility Confirmation: Sections to confirm age, residency, and ownership status.

- Signature: A signature is required to validate the information provided on the form.

Understanding these elements can help applicants complete the form accurately and efficiently.

Quick guide on how to complete ptax 329 701697948

Complete Ptax 329 effortlessly on any device

Web-based document management has become increasingly favored by organizations and individuals alike. It offers an ideal environmentally friendly substitute to conventional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents swiftly without interruptions. Manage Ptax 329 on any device using airSlate SignNow's Android or iOS applications and enhance any document-centered process today.

The simplest way to modify and eSign Ptax 329 with ease

- Locate Ptax 329 and then click Get Form to initiate.

- Make use of the features we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which only takes seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Decide how you would like to share your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate concerns regarding lost or misplaced documents, tedious form searching, or errors that require printing new copies of documents. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign Ptax 329 and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ptax 329 701697948

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ptax 329 form and how does it work?

The ptax 329 form is a crucial document used for property tax appeals in Illinois. It allows property owners to challenge their property assessments, potentially leading to lower taxes. Understanding how to properly fill out the ptax 329 form can signNowly aid in your appeal process.

-

How can airSlate SignNow assist with the ptax 329 form?

airSlate SignNow offers an easy-to-use platform that streamlines the signing and sharing process for the ptax 329 form. Our electronic signature solutions ensure that your documents are securely signed and delivered on time. With our features, you can simplify your property tax appeal procedures efficiently.

-

Is there a cost associated with using airSlate SignNow for the ptax 329 form?

Yes, airSlate SignNow has flexible pricing plans that cater to varying needs. Whether you need basic functionalities or advanced features for managing the ptax 329 form, we have a plan that fits your budget. We also offer a free trial to help you explore our services first.

-

What benefits does airSlate SignNow provide for managing the ptax 329 form?

Using airSlate SignNow to manage the ptax 329 form provides several benefits, including increased efficiency, enhanced security, and easier collaboration. You can track the status of your documents, ensuring that everything is completed accurately and promptly. This can greatly improve your overall filing process.

-

Can I integrate airSlate SignNow with other software while working on the ptax 329 form?

Absolutely! AirSlate SignNow integrates seamlessly with a variety of third-party applications, making it easy to manage your ptax 329 form alongside other tools. This integration helps centralize your workflow and improve productivity in preparing tax-related documents.

-

How secure is my information when using airSlate SignNow for the ptax 329 form?

Security is a top priority at airSlate SignNow. When handling the ptax 329 form, all your data is encrypted to ensure its protection. We comply with industry standards, so you can trust that your sensitive information remains safe and confidential throughout the signing process.

-

Is airSlate SignNow user-friendly for completing the ptax 329 form?

Yes, airSlate SignNow is designed with user experience in mind, making it very user-friendly for completing the ptax 329 form. Our intuitive interface guides you through each step, ensuring that you can easily prepare your documents without needing extensive technical knowledge.

Get more for Ptax 329

Find out other Ptax 329

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy