Or Oq Report Form

What is the Oregon OQ Report

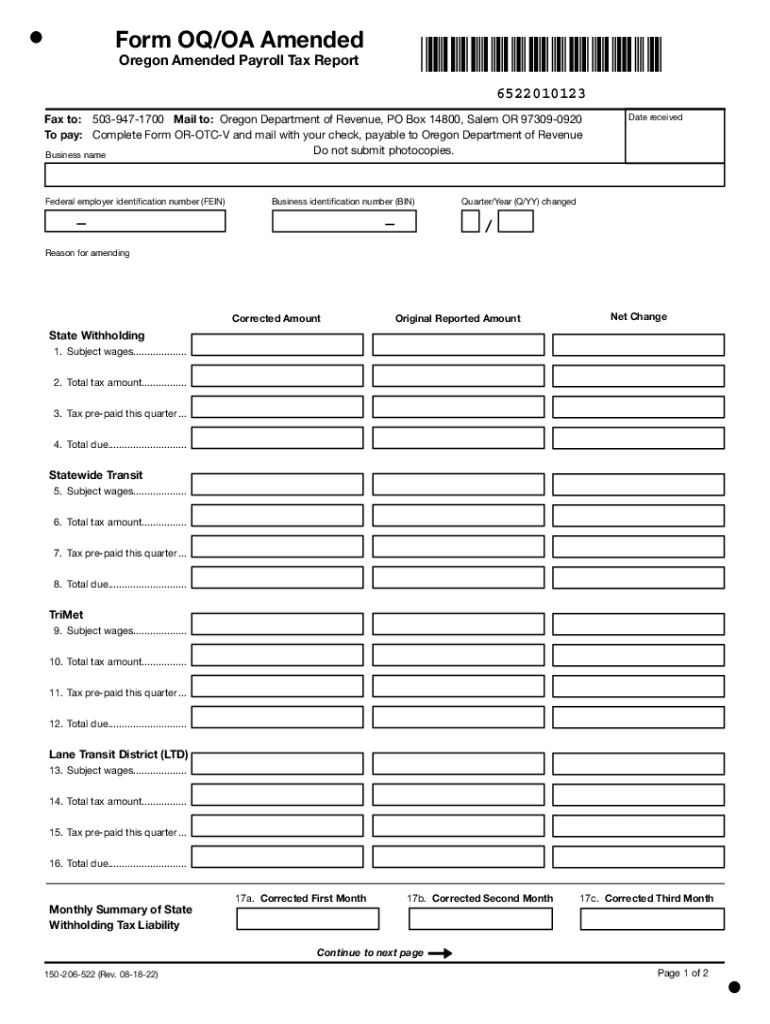

The Oregon OQ Report is a specific form used by businesses and individuals in Oregon to report their tax obligations. This report is crucial for ensuring compliance with state tax laws and helps in the accurate calculation of tax liabilities. The form is particularly relevant for those who need to document income, deductions, and other financial details pertinent to their tax situation. Understanding the purpose and components of the Oregon OQ Report is essential for effective tax management.

Steps to Complete the Oregon OQ Report

Completing the Oregon OQ Report involves several key steps that ensure accurate reporting. First, gather all necessary financial documents, including income statements and deduction records. Next, fill out the form by providing detailed information about your income, expenses, and any applicable deductions. It's important to double-check all entries for accuracy before submission. Finally, ensure you understand the filing deadlines and submit the report through the appropriate channels, whether online or by mail.

How to Obtain the Oregon OQ Report

The Oregon OQ Report can be obtained from the Oregon Department of Revenue's official website. The form is available in various formats, including PDF and fillable online versions, making it accessible for users to complete digitally. Users can also request a physical copy of the form by contacting the department directly. Ensuring you have the correct version of the form is vital for compliance with state regulations.

Required Documents for the Oregon OQ Report

To successfully complete the Oregon OQ Report, certain documents are required. These typically include your income statements, records of any deductions you plan to claim, and previous tax returns if applicable. Having these documents ready will facilitate a smoother completion process and help ensure that all information reported is accurate and comprehensive.

Form Submission Methods

The Oregon OQ Report can be submitted through various methods to accommodate different preferences. Users have the option to file online via the Oregon Department of Revenue’s e-filing system, which offers a streamlined process. Alternatively, the form can be mailed to the appropriate address provided on the form itself. For those who prefer in-person submissions, certain state offices may accept the form directly. Understanding these options can help ensure timely and accurate submission.

Penalties for Non-Compliance

Failing to file the Oregon OQ Report or submitting it inaccurately can lead to significant penalties. The Oregon Department of Revenue imposes fines for late submissions, which can accumulate over time. Additionally, discrepancies in reported income or deductions may trigger audits or further investigations. It is crucial to adhere to all filing requirements and deadlines to avoid these potential penalties and maintain compliance with state tax laws.

Quick guide on how to complete or oq report

Complete Or Oq Report effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents swiftly without any delays. Manage Or Oq Report on any platform with airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The simplest way to edit and electronically sign Or Oq Report effortlessly

- Locate Or Oq Report and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you want to share your form, via email, text message (SMS), an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Or Oq Report to ensure seamless communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the or oq report

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Oregon OQ and how does it relate to airSlate SignNow?

Oregon OQ refers to the requirements set for organizations operating in Oregon to ensure compliance and efficiency in their operations. airSlate SignNow is an ideal solution for businesses needing to manage and eSign documents while meeting these requirements effectively. By utilizing airSlate SignNow, organizations can streamline their document workflows and ensure they adhere to Oregon OQ standards.

-

How much does airSlate SignNow cost for Oregon OQ compliance?

The pricing for airSlate SignNow varies based on the plan you choose. For businesses in Oregon seeking to ensure compliance with Oregon OQ, it’s advisable to explore the pricing options that best fit your needs. airSlate SignNow offers competitive pricing designed to provide you with a cost-effective solution for your documentation needs.

-

What features does airSlate SignNow offer for Oregon OQ requirements?

airSlate SignNow includes a range of features tailored to meet the needs of businesses looking to comply with Oregon OQ. This includes secure eSigning, customizable templates, automated workflows, and compliance tracking. These features ensure your documents meet all regulatory requirements while enhancing overall productivity.

-

Can airSlate SignNow integrate with other tools for Oregon OQ compliance?

Yes, airSlate SignNow offers seamless integrations with various tools and applications that support compliance with Oregon OQ. This includes CRM systems, project management tools, and cloud storage solutions. These integrations help streamline your document workflows and ensure that all aspects of your business are aligned with Oregon OQ.

-

How does airSlate SignNow enhance the eSigning process for Oregon OQ?

airSlate SignNow simplifies the eSigning process, making it quick and efficient for businesses focused on Oregon OQ. Its user-friendly interface allows users to eSign documents from any device, ensuring that you can meet deadlines without compromising legal compliance. This efficiency is crucial for companies needing to adhere to Oregon OQ regulations.

-

Is customer support available for inquiries related to Oregon OQ?

Absolutely! airSlate SignNow provides robust customer support options for businesses navigating Oregon OQ compliance. Whether you have questions about features, pricing, or integrations, their support team is ready to assist you through various channels, ensuring you have all the information needed to maintain compliance.

-

What benefits does airSlate SignNow provide for businesses needing Oregon OQ solutions?

Using airSlate SignNow offers numerous benefits for businesses seeking Oregon OQ solutions. It enhances document security, speeds up the signing process, and provides tracking features that assure compliance. These benefits contribute to increased operational efficiency, making it easier for companies to focus on their core objectives.

Get more for Or Oq Report

- Form p 35

- Dc confidential statement form

- Realtors association of new mexico commercial form

- Realtor association of the fox valley rental application form

- Immunizaton date report maricopa county form

- Yardi dispute process form

- Commercial property inspection checklist john dixon amp associates 47316048 form

- Parent teen driving contract form

Find out other Or Oq Report

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe