California Form 541 a Trust Accumulation of Charitable Amounts California Form 541 a Trust Accumulation of Charitable Amounts 2022

Understanding the California Form 541 A Trust Accumulation Of Charitable Amounts

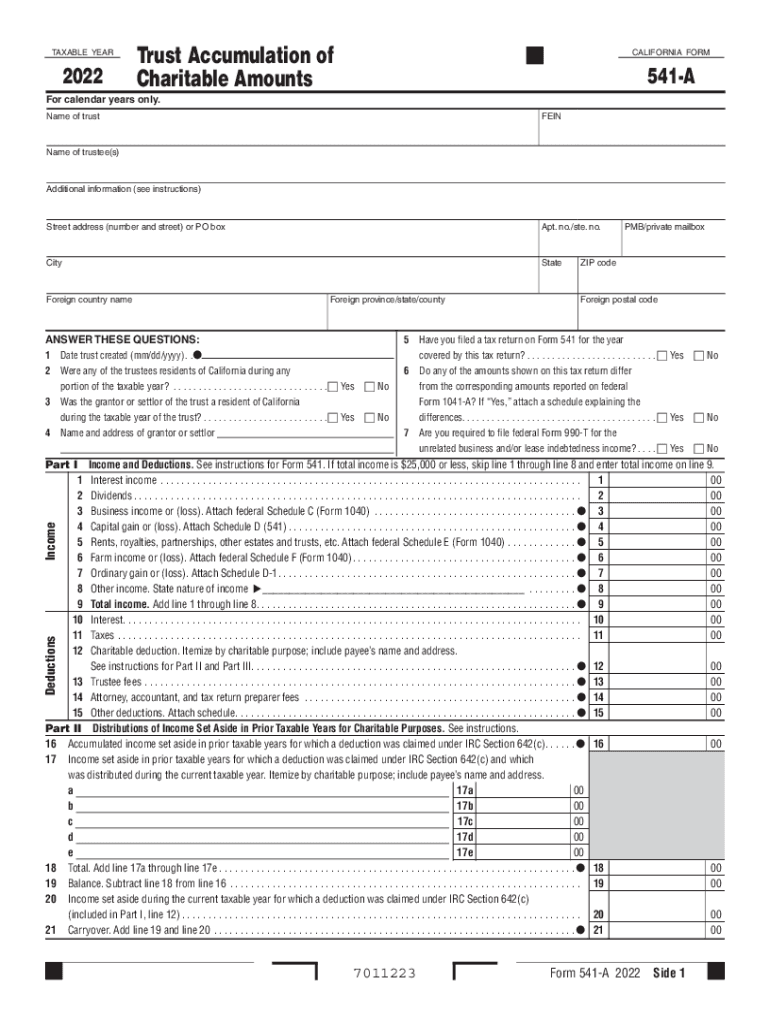

The California Form 541 A is designed for trusts that accumulate charitable amounts. This form is essential for reporting income and distributions related to charitable contributions made by the trust. It ensures compliance with state regulations while allowing trustees to manage charitable assets effectively. Understanding the purpose of this form is crucial for trustees who wish to maintain transparency and adhere to legal requirements.

Steps to Complete the California Form 541 A Trust Accumulation Of Charitable Amounts

Completing the California Form 541 A involves several key steps:

- Gather necessary financial documents, including income statements and records of charitable contributions.

- Fill out the form accurately, ensuring all income and distributions are reported.

- Review the completed form for accuracy and completeness.

- Submit the form by the designated deadline to avoid penalties.

Each step is vital for ensuring compliance with the California Franchise Tax Board regulations.

How to Obtain the California Form 541 A Trust Accumulation Of Charitable Amounts

The California Form 541 A can be obtained directly from the California Franchise Tax Board's website. It is available as a downloadable PDF, making it easy to access and print. Additionally, physical copies may be available at local tax offices or through professional tax preparers. Ensuring you have the latest version of the form is important for accurate filing.

Legal Use of the California Form 541 A Trust Accumulation Of Charitable Amounts

This form is legally required for trusts that accumulate charitable contributions. It serves to document the income generated by the trust and any distributions made to charitable organizations. Failure to file this form can result in penalties, making it essential for trustees to understand their legal obligations regarding charitable contributions.

Key Elements of the California Form 541 A Trust Accumulation Of Charitable Amounts

Several key elements must be included when filling out the California Form 541 A:

- Trust income, including interest, dividends, and capital gains.

- Details of charitable contributions made during the tax year.

- Information about the trust beneficiaries and their share of distributions.

Accurate reporting of these elements is crucial for compliance and for the trust's overall financial health.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines for the California Form 541 A. Typically, the form must be filed by the 15th day of the fourth month after the close of the trust's taxable year. For trusts operating on a calendar year, this usually means an April deadline. Missing this deadline can lead to penalties, so timely submission is essential.

Form Submission Methods

The California Form 541 A can be submitted through various methods. Trustees can file the form online via the California Franchise Tax Board's e-file system, which is often the quickest method. Alternatively, the form can be mailed to the appropriate tax office or submitted in person at designated locations. Each method has its own processing times, so choosing the right one can help ensure timely compliance.

Quick guide on how to complete california form 541 a trust accumulation of charitable amounts california form 541 a trust accumulation of charitable amounts

Complete California Form 541 A Trust Accumulation Of Charitable Amounts California Form 541 A Trust Accumulation Of Charitable Amounts seamlessly on any device

Digital document management has become widely accepted among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow provides all the instruments required to create, modify, and electronically sign your documents swiftly without delays. Manage California Form 541 A Trust Accumulation Of Charitable Amounts California Form 541 A Trust Accumulation Of Charitable Amounts on any platform using the airSlate SignNow apps for Android or iOS and simplify any document-related process today.

The easiest way to alter and eSign California Form 541 A Trust Accumulation Of Charitable Amounts California Form 541 A Trust Accumulation Of Charitable Amounts effortlessly

- Find California Form 541 A Trust Accumulation Of Charitable Amounts California Form 541 A Trust Accumulation Of Charitable Amounts and click Get Form to begin.

- Take advantage of the tools we provide to fill out your document.

- Emphasize important parts of your documents or redact sensitive information using the tools specifically designed by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Choose how you would like to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or disorganized documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Edit and eSign California Form 541 A Trust Accumulation Of Charitable Amounts California Form 541 A Trust Accumulation Of Charitable Amounts and guarantee outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct california form 541 a trust accumulation of charitable amounts california form 541 a trust accumulation of charitable amounts

Create this form in 5 minutes!

How to create an eSignature for the california form 541 a trust accumulation of charitable amounts california form 541 a trust accumulation of charitable amounts

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the CA Franchise Tax Board and how does it impact businesses?

The CA Franchise Tax Board (FTB) is the agency responsible for administering California's income tax programs. Businesses operating in California must adhere to the regulations set by the FTB, including filing taxes and managing franchise tax obligations. Understanding these requirements is crucial for compliance and avoiding potential penalties.

-

How can airSlate SignNow help with CA Franchise Tax Board documentation?

airSlate SignNow streamlines the process of managing and signing important documents required by the CA Franchise Tax Board. With its intuitive eSignature platform, you can easily send, eSign, and manage tax-related documents securely online, ensuring compliance with state regulations.

-

What pricing options are available for airSlate SignNow services?

airSlate SignNow offers flexible pricing plans to cater to businesses of all sizes. Whether you are a small business or a large organization, you can find an affordable plan that meets your needs while ensuring compliance with CA Franchise Tax Board regulations. Get started with a free trial to explore the features.

-

What features does airSlate SignNow provide for CA Franchise Tax Board-related tasks?

airSlate SignNow includes features such as document templates, automated workflows, and customizable forms, which simplify the creation and management of CA Franchise Tax Board documents. These tools help you save time and reduce errors when handling tax filings and related paperwork.

-

Are there any integrations available with airSlate SignNow for CA Franchise Tax Board compliance?

Yes, airSlate SignNow integrates seamlessly with various business applications, allowing you to manage CA Franchise Tax Board documents alongside your existing workflows. This connectivity enhances efficiency and ensures that all relevant documents are easily accessible and compliant with state regulations.

-

What are the key benefits of using airSlate SignNow for CA Franchise Tax Board interactions?

Using airSlate SignNow for CA Franchise Tax Board interactions provides benefits such as increased efficiency, reduced turnaround time, and enhanced security for your digital documents. With our electronic signature solution, you can quickly get documents signed and submitted, ensuring your business remains compliant.

-

How secure is airSlate SignNow for handling CA Franchise Tax Board documents?

Security is a top priority for airSlate SignNow. Our platform uses advanced encryption and compliant security measures to protect your documents, which is particularly important for sensitive information related to the CA Franchise Tax Board. You can rest assured that your data is safe and secure.

Get more for California Form 541 A Trust Accumulation Of Charitable Amounts California Form 541 A Trust Accumulation Of Charitable Amounts

- Cf1r alt 05 e certificate of compliance form

- Imm 5669 e schedule a background declaration cic gc form

- Membership card template the american legion of iowa amlegionauxwi form

- Doh 5088 form

- Dch 0838 2015 form

- 14 15 qualified income trust the state of new jersey state nj form

- Nuisance abatement manual texas attorney general texasatt nextmp form

- Nova hunting the elements form

Find out other California Form 541 A Trust Accumulation Of Charitable Amounts California Form 541 A Trust Accumulation Of Charitable Amounts

- How To eSign Hawaii High Tech Confidentiality Agreement

- How Do I eSign Hawaii High Tech Business Letter Template

- Can I eSign Hawaii High Tech Memorandum Of Understanding

- Help Me With eSign Kentucky Government Job Offer

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free

- eSign Maine Healthcare / Medical LLC Operating Agreement Now

- eSign Louisiana High Tech LLC Operating Agreement Safe

- eSign Massachusetts Government Quitclaim Deed Fast

- How Do I eSign Massachusetts Government Arbitration Agreement

- eSign Maryland High Tech Claim Fast

- eSign Maine High Tech Affidavit Of Heirship Now

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later