CDTFA 447, Statement Pursuant to Section 6247 of the California Sales and Use Tax Law 2018

Understanding the CDTFA 447

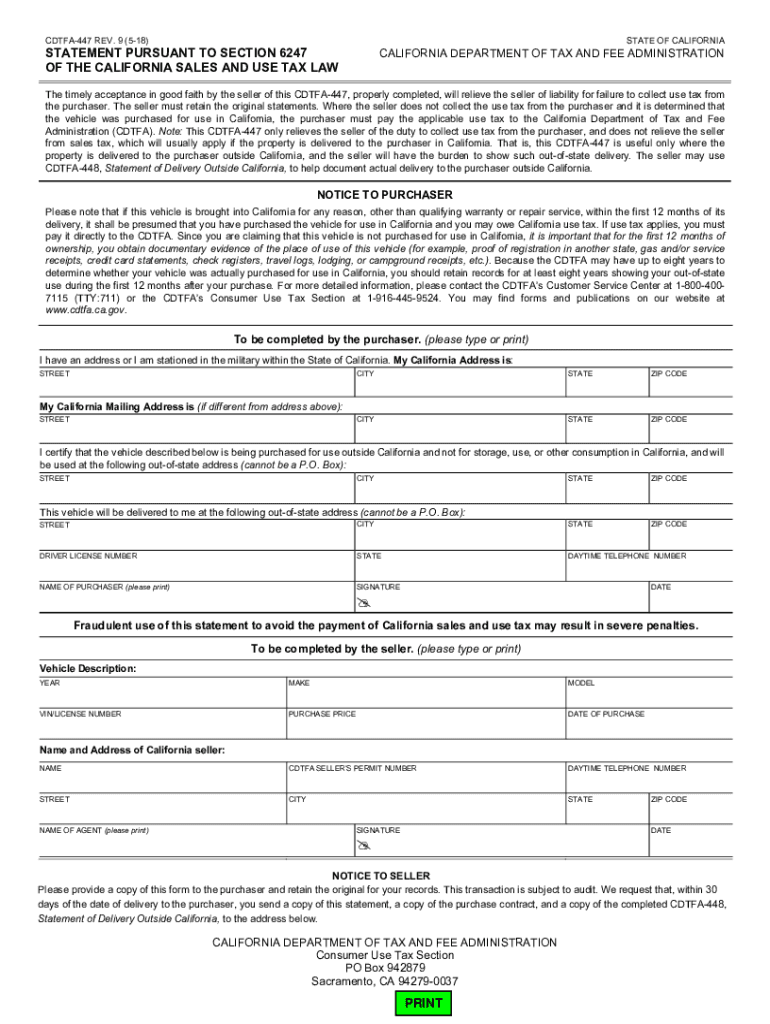

The CDTFA 447, formally known as the Statement Pursuant to Section 6247 of the California Sales and Use Tax Law, is a crucial document for businesses in California. This form is primarily utilized to report and explain the use of sales tax exemptions. It ensures that businesses comply with state tax regulations while providing a clear declaration of their tax obligations. Understanding the purpose and implications of this form is essential for maintaining compliance and avoiding potential penalties.

Steps to Complete the CDTFA 447

Completing the CDTFA 447 involves several key steps to ensure accuracy and compliance. First, gather all relevant information regarding your sales and use tax exemptions. This includes details about the transactions that qualify for exemption and the basis for these exemptions. Next, fill out the form by providing the necessary details, such as your business information and the specific exemptions claimed. It is important to review the completed form for accuracy before submission to prevent any issues with the California Department of Tax and Fee Administration.

Obtaining the CDTFA 447

To obtain the CDTFA 447 form, businesses can visit the official California Department of Tax and Fee Administration website. The form is available for download in PDF format, allowing for easy access and printing. Additionally, businesses can request a physical copy through the department's customer service channels if needed. Ensuring you have the most current version of the form is vital for compliance with state regulations.

Legal Use of the CDTFA 447

The CDTFA 447 is legally required for businesses that wish to claim sales tax exemptions under California law. Proper use of this form helps businesses document their tax-exempt purchases and provides the necessary information for state tax authorities to verify these claims. Failure to use the form correctly can lead to legal repercussions, including fines or audits. Therefore, understanding the legal implications of the CDTFA 447 is essential for all businesses operating in California.

Key Elements of the CDTFA 447

Several key elements are essential when filling out the CDTFA 447. These include the business name, address, and identification number, as well as a detailed description of the exempt transactions. It is also important to specify the reason for the exemption and to provide any supporting documentation that may be required. Accurate completion of these elements ensures that the form is processed efficiently and reduces the likelihood of inquiries from tax authorities.

Filing Deadlines and Important Dates

Businesses must be aware of specific filing deadlines associated with the CDTFA 447. Typically, the form should be submitted as part of the regular sales tax return process. It is crucial to stay informed about any changes in deadlines to avoid late submissions, which can incur penalties. Keeping a calendar of important dates related to tax filings can help ensure compliance and timely submissions.

Quick guide on how to complete cdtfa 447 statement pursuant to section 6247 of the california sales and use tax law

Complete CDTFA 447, Statement Pursuant To Section 6247 Of The California Sales And Use Tax Law easily on any device

Online document management has gained traction among businesses and individuals. It serves as an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Manage CDTFA 447, Statement Pursuant To Section 6247 Of The California Sales And Use Tax Law on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to modify and eSign CDTFA 447, Statement Pursuant To Section 6247 Of The California Sales And Use Tax Law effortlessly

- Acquire CDTFA 447, Statement Pursuant To Section 6247 Of The California Sales And Use Tax Law and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight essential sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal significance as a traditional wet ink signature.

- Review the information and then click the Done button to save your modifications.

- Decide how you want to deliver your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign CDTFA 447, Statement Pursuant To Section 6247 Of The California Sales And Use Tax Law to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct cdtfa 447 statement pursuant to section 6247 of the california sales and use tax law

Create this form in 5 minutes!

How to create an eSignature for the cdtfa 447 statement pursuant to section 6247 of the california sales and use tax law

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is cdtfa 447 and how does it relate to airSlate SignNow?

cdtfa 447 refers to a specific form used by businesses to report sales tax information to the California Department of Tax and Fee Administration. airSlate SignNow facilitates the process by allowing users to digitally sign and send these forms easily, ensuring compliance and efficiency.

-

How much does airSlate SignNow cost for using cdtfa 447?

airSlate SignNow offers various pricing plans depending on your business needs. Pricing is competitive and designed to be cost-effective, making it easier for businesses to manage documents like cdtfa 447 without breaking the budget.

-

What features does airSlate SignNow provide for managing cdtfa 447 forms?

airSlate SignNow enables users to create, edit, and eSign cdtfa 447 forms with ease. Key features include customizable templates, automated reminders, and secure cloud storage, all aimed at streamlining your document workflow.

-

Are there any benefits of using airSlate SignNow for cdtfa 447 processing?

Using airSlate SignNow for cdtfa 447 processing offers numerous benefits, including faster turnaround times, enhanced document security, and improved compliance. The platform minimizes errors and ensures that your forms are always accurately completed and submitted.

-

Can I integrate airSlate SignNow with my existing software for cdtfa 447?

Yes, airSlate SignNow supports seamless integrations with various business applications. This allows you to easily connect your current systems and automate the process of managing cdtfa 447 forms, enhancing overall efficiency.

-

Is it easy to eSign cdtfa 447 documents with airSlate SignNow?

Absolutely! eSigning cdtfa 447 documents with airSlate SignNow is user-friendly and requires just a few clicks. The intuitive interface makes the signing process straightforward, allowing you to focus on your core business activities.

-

What security measures are in place for handling cdtfa 447 with airSlate SignNow?

airSlate SignNow prioritizes your security with advanced encryption and strict data protection protocols for cdtfa 447 documents. This ensures that your sensitive business information remains safe and secure throughout the signing process.

Get more for CDTFA 447, Statement Pursuant To Section 6247 Of The California Sales And Use Tax Law

- Patient specific direction psd for university hospitals of form

- Write no objection letter from parents form

- Pretrial catalogue florida sample form

- Soil test pit log form owrp asttbc

- Cartus broker exclusion clause govtdoc form

- Request for impartial due process hearing hawaii state department form

- Geodis wilson sli shippers letter of instruction form

- Shippers letter of instruction geodis wilson form

Find out other CDTFA 447, Statement Pursuant To Section 6247 Of The California Sales And Use Tax Law

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document