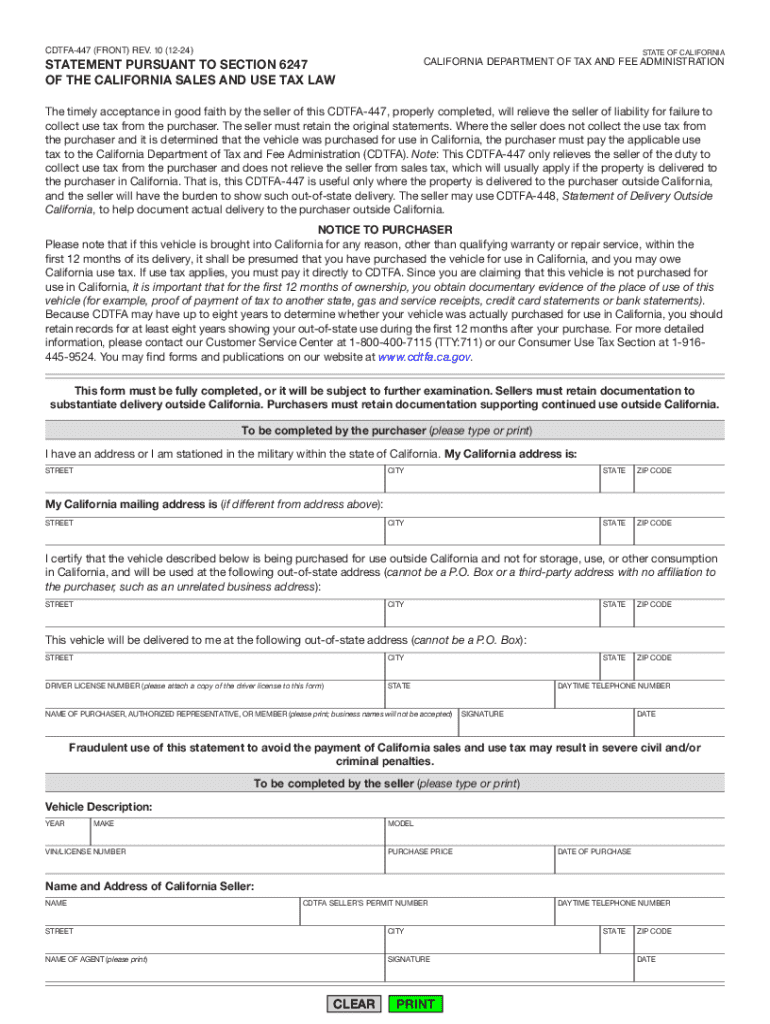

CDTFA 447; Statement Pursuant to Section 6247 of the California Sales and Use Tax Law 2024-2026

Understanding the CDTFA 447; Statement Pursuant To Section 6247 Of The California Sales And Use Tax Law

The CDTFA 447 is a crucial document for businesses operating in California, specifically related to sales and use tax compliance. This statement is filed pursuant to Section 6247 of the California Sales and Use Tax Law, which allows taxpayers to report and claim a refund for overpaid sales or use taxes. Understanding this form is essential for ensuring compliance with state tax regulations and for recovering any excess taxes paid.

Steps to Complete the CDTFA 447

Completing the CDTFA 447 requires careful attention to detail to ensure accuracy and compliance. Here are the general steps involved:

- Gather necessary documentation, including receipts and records of sales and use tax payments.

- Fill out the form with accurate information regarding the amounts overpaid.

- Provide a detailed explanation of the circumstances that led to the overpayment.

- Review the completed form for any errors or omissions.

- Submit the form to the California Department of Tax and Fee Administration (CDTFA) either electronically or via mail.

Legal Use of the CDTFA 447

The CDTFA 447 is legally recognized as a valid means for taxpayers to claim refunds for overpaid sales and use taxes in California. It is essential for businesses to understand the legal implications of this form, as improper use can lead to penalties or denial of the refund request. Ensuring that all information is truthful and accurately reported is critical for maintaining compliance with tax laws.

Required Documents for the CDTFA 447

When preparing to submit the CDTFA 447, certain documents are required to support the claim for a refund. These may include:

- Invoices or receipts showing the sales and use taxes paid.

- Records of transactions that justify the claim for a refund.

- Any correspondence with the CDTFA regarding previous tax payments or disputes.

Having these documents ready will facilitate a smoother review process by the CDTFA.

Form Submission Methods for the CDTFA 447

The CDTFA 447 can be submitted through various methods, allowing flexibility for businesses. Options include:

- Online submission through the CDTFA's official website, which provides a streamlined process.

- Mailing a physical copy of the completed form to the appropriate CDTFA address.

- In-person submission at a local CDTFA office, which may be beneficial for those needing immediate assistance.

Examples of Using the CDTFA 447

Understanding practical applications of the CDTFA 447 can help businesses navigate their tax obligations more effectively. Examples include:

- A retailer who overpaid sales tax due to a miscalculation in tax rates can use the CDTFA 447 to claim a refund.

- A business that purchased equipment and mistakenly paid use tax on an exempt item may file this form to recover those funds.

These scenarios illustrate the importance of the CDTFA 447 in ensuring tax equity for businesses.

Create this form in 5 minutes or less

Find and fill out the correct cdtfa 447 statement pursuant to section 6247 of the california sales and use tax law 772015960

Create this form in 5 minutes!

How to create an eSignature for the cdtfa 447 statement pursuant to section 6247 of the california sales and use tax law 772015960

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the CDTFA 447; Statement Pursuant To Section 6247 Of The California Sales And Use Tax Law?

The CDTFA 447; Statement Pursuant To Section 6247 Of The California Sales And Use Tax Law is a document required by the California Department of Tax and Fee Administration. It serves to report and clarify sales and use tax obligations for businesses operating in California. Understanding this statement is crucial for compliance and avoiding penalties.

-

How can airSlate SignNow help with the CDTFA 447; Statement Pursuant To Section 6247 Of The California Sales And Use Tax Law?

airSlate SignNow provides an efficient platform for businesses to prepare, send, and eSign the CDTFA 447; Statement Pursuant To Section 6247 Of The California Sales And Use Tax Law. Our solution simplifies the document management process, ensuring that your tax statements are completed accurately and submitted on time.

-

What features does airSlate SignNow offer for managing tax documents like the CDTFA 447?

airSlate SignNow offers features such as customizable templates, secure eSigning, and real-time tracking for documents like the CDTFA 447; Statement Pursuant To Section 6247 Of The California Sales And Use Tax Law. These tools enhance efficiency and ensure that all necessary information is included and verified.

-

Is airSlate SignNow cost-effective for small businesses needing to file the CDTFA 447?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small businesses. Our pricing plans are flexible, allowing you to choose the best option that fits your budget while ensuring you can efficiently manage documents like the CDTFA 447; Statement Pursuant To Section 6247 Of The California Sales And Use Tax Law.

-

Can I integrate airSlate SignNow with other software for tax management?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and tax management software. This allows you to streamline your workflow when handling documents such as the CDTFA 447; Statement Pursuant To Section 6247 Of The California Sales And Use Tax Law, ensuring all your data is synchronized and easily accessible.

-

What are the benefits of using airSlate SignNow for the CDTFA 447?

Using airSlate SignNow for the CDTFA 447; Statement Pursuant To Section 6247 Of The California Sales And Use Tax Law provides numerous benefits, including enhanced security, faster processing times, and improved accuracy. Our platform reduces the risk of errors and ensures that your documents are legally binding and compliant with California tax laws.

-

How does airSlate SignNow ensure the security of my CDTFA 447 documents?

airSlate SignNow prioritizes the security of your documents, including the CDTFA 447; Statement Pursuant To Section 6247 Of The California Sales And Use Tax Law. We utilize advanced encryption methods and secure cloud storage to protect your sensitive information, ensuring that only authorized users have access.

Get more for CDTFA 447; Statement Pursuant To Section 6247 Of The California Sales And Use Tax Law

- Certificate of buyer of taxable fuel lmc form

- Army packing list example form

- Lesson 7 problem solving practice distance on the coordinate plane answer key form

- 888 693 2401 form

- Zimmer biomet product experience report form

- Family 54 form

- Comm of mass deposit form

- In the matter of the application of for admission to the bar of american samoa application to the honorable chief justice of form

Find out other CDTFA 447; Statement Pursuant To Section 6247 Of The California Sales And Use Tax Law

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free