Instructions for Form 100S S Corporation Tax Booklet Instructions for Form 100S S Corporation Tax Booklet

Understanding Form 100S and Its Purpose

The California Form 100S is specifically designed for S corporations operating within the state. This tax form allows S corporations to report their income, deductions, and credits to the California Franchise Tax Board (FTB). It is essential for ensuring compliance with state tax laws and for determining the corporation's tax liability. The form is crucial for S corporations as it helps in calculating the state taxes owed based on the corporation's financial performance over the tax year.

Key Elements of Form 100S Instructions

The instructions for Form 100S provide detailed guidance on how to complete the form accurately. Key elements include:

- Filing Requirements: Information on who must file and the deadlines for submission.

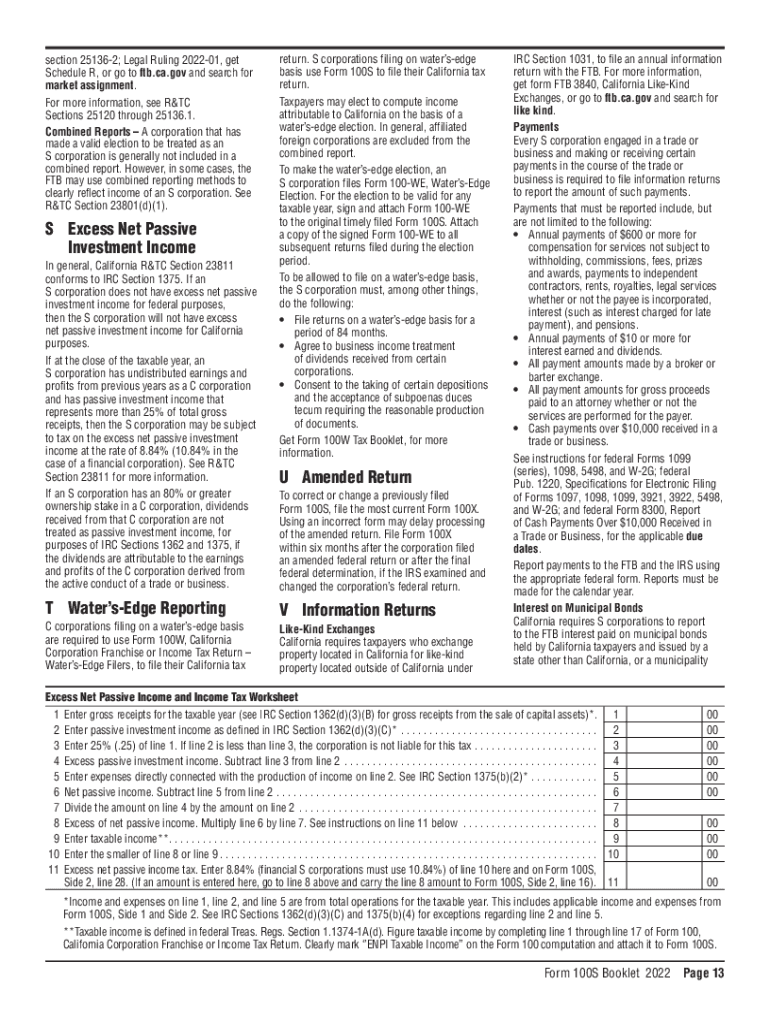

- Income Reporting: Guidelines for reporting various types of income, including business income and capital gains.

- Deductions and Credits: Instructions on allowable deductions and credits that can reduce taxable income.

- Signature Requirements: Information on who must sign the form and any additional documentation needed.

Steps to Complete Form 100S

Completing Form 100S involves several steps to ensure accuracy and compliance. Here are the essential steps:

- Gather necessary financial documents, including income statements and balance sheets.

- Fill out the form by entering income, deductions, and credits as per the instructions.

- Review the completed form for accuracy, ensuring all calculations are correct.

- Sign and date the form, ensuring it is submitted by the deadline.

Filing Deadlines for Form 100S

It is important to be aware of the filing deadlines for Form 100S to avoid penalties. Generally, the form is due on the 15th day of the third month after the close of the corporation's tax year. For corporations operating on a calendar year, this typically means the form is due by March 15. Extensions may be available, but they must be filed appropriately to avoid late fees.

Obtaining Form 100S Instructions

Form 100S instructions can be obtained directly from the California Franchise Tax Board's official website. The instructions are available in PDF format, allowing for easy access and printing. Additionally, many tax preparation software programs include the necessary forms and instructions, streamlining the filing process for S corporations.

Legal Use of Form 100S

Using Form 100S legally ensures that S corporations comply with California tax laws. Properly filing this form is essential for maintaining good standing with the state and avoiding potential penalties. It is crucial for S corporations to understand their obligations under California law and to keep accurate records to support their filings.

Quick guide on how to complete instructions for form 100s s corporation tax booklet instructions for form 100s s corporation tax booklet

Effortlessly Prepare Instructions For Form 100S S Corporation Tax Booklet Instructions For Form 100S S Corporation Tax Booklet on Any Device

The management of online documents has gained signNow traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to obtain the proper format and securely archive it online. airSlate SignNow furnishes you with all the necessary tools to swiftly create, edit, and eSign your documents without any delays. Handle Instructions For Form 100S S Corporation Tax Booklet Instructions For Form 100S S Corporation Tax Booklet on any platform using airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

How to Edit and eSign Instructions For Form 100S S Corporation Tax Booklet Instructions For Form 100S S Corporation Tax Booklet with Ease

- Obtain Instructions For Form 100S S Corporation Tax Booklet Instructions For Form 100S S Corporation Tax Booklet and click on Start Form to begin.

- Utilize the tools provided to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive details with the specialized tools offered by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional signature in ink.

- Review the information and click on the Finish button to store your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you choose. Edit and eSign Instructions For Form 100S S Corporation Tax Booklet Instructions For Form 100S S Corporation Tax Booklet and ensure exceptional communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 100s s corporation tax booklet instructions for form 100s s corporation tax booklet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ca 100s in the context of airSlate SignNow?

The term ca 100s refers to the capability of airSlate SignNow to facilitate the signing of hundreds of documents efficiently. This allows businesses to signNowly reduce the time spent on paperwork, ensuring that everything from contracts to agreements can be handled seamlessly.

-

How does airSlate SignNow benefit businesses looking to send ca 100s of documents?

AirSlate SignNow simplifies the process of sending ca 100s of documents by providing an intuitive interface and automation features. This means that users can manage bulk document sending with minimal effort, enhancing productivity and ensuring faster turnaround times.

-

What pricing options are available for companies needing ca 100s of electronic signatures?

AirSlate SignNow offers flexible pricing plans tailored for businesses that require ca 100s of electronic signatures. These plans ensure that you can choose a solution that fits your budget while benefiting from a robust eSigning platform.

-

What features make airSlate SignNow suitable for handling ca 100s of documents?

AirSlate SignNow comes equipped with powerful features such as bulk sending, personalized templates, and real-time tracking for ca 100s of documents. These features allow users to streamline their workflow and manage large volumes of documents with ease.

-

Can airSlate SignNow integrate with other software for managing ca 100s of documents?

Yes, airSlate SignNow seamlessly integrates with various CRM and productivity tools, making it perfect for users handling ca 100s of documents. These integrations facilitate a smooth workflow, allowing you to manage signatures and documents right alongside your existing systems.

-

How does airSlate SignNow enhance security while handling ca 100s of signatures?

AirSlate SignNow prioritizes security, implementing advanced encryption and compliance standards that protect the integrity of ca 100s of signatures. This ensures that your documents and data are safe from unauthorized access or bsignNowes.

-

What are the advantages of using airSlate SignNow for ca 100s of documents over traditional methods?

Using airSlate SignNow for ca 100s of documents offers numerous advantages over traditional methods, including faster processing times, reduced paperwork, and lower costs. This digital approach drastically improves efficiency, allowing businesses to focus more on growth rather than administrative tasks.

Get more for Instructions For Form 100S S Corporation Tax Booklet Instructions For Form 100S S Corporation Tax Booklet

- Telephone prospect card form

- Release of liability pine summitpdf pine summit christian camp hswintercamp cc ea form

- Bpst iii basic phonic skills test recording sheet for students bb form

- Bhmt direct deposit form ben hudnall memorial trust bhmt

- Swp 6851 009 010 dated 7 30 2014 subj foreign disclosure form

- Homeowner manual wolfe development form

- Risk assessment form for places of worship nacbancc

- Intyg om verklig huvudman eurocardse form

Find out other Instructions For Form 100S S Corporation Tax Booklet Instructions For Form 100S S Corporation Tax Booklet

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free

- How To eSignature Wyoming LLC Operating Agreement

- eSignature California Commercial Lease Agreement Template Myself

- eSignature California Commercial Lease Agreement Template Easy

- eSignature Florida Commercial Lease Agreement Template Easy

- eSignature Texas Roommate Contract Easy

- eSignature Arizona Sublease Agreement Template Free

- eSignature Georgia Sublease Agreement Template Online

- eSignature Arkansas Roommate Rental Agreement Template Mobile

- eSignature Maryland Roommate Rental Agreement Template Free

- How Do I eSignature California Lodger Agreement Template

- eSignature Kentucky Lodger Agreement Template Online

- eSignature North Carolina Lodger Agreement Template Myself

- eSignature Alabama Storage Rental Agreement Free

- eSignature Oregon Housekeeping Contract Computer