Instructions for Form 540 Personal Income Tax Booklet Instructions for Form 540 Personal Income Tax Booklet

Understanding the California Form 540 Instructions

The California Form 540 instructions provide essential guidance for individuals filing their state income tax returns. This booklet outlines the necessary steps and requirements for completing the California state income tax form, ensuring taxpayers understand their obligations. The instructions detail how to report income, claim deductions, and calculate any taxes owed or refunds due.

Steps to Complete the California Form 540

Completing the California Form 540 involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Review the instructions carefully to understand the specific requirements for your situation.

- Fill out the form accurately, ensuring all income and deductions are reported correctly.

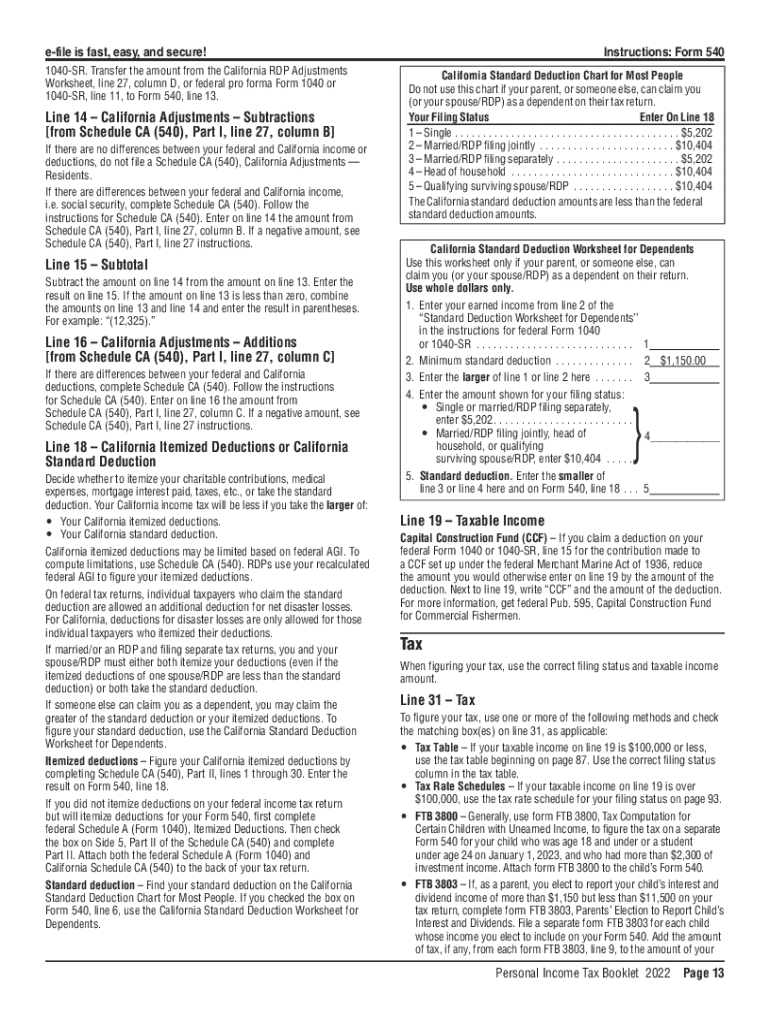

- Calculate your total tax liability using the California tax table provided in the instructions.

- Sign and date the form before submission.

Key Elements of the California Form 540 Instructions

The instructions for Form 540 cover several important elements:

- Eligibility Criteria: Guidelines on who must file and the income thresholds applicable.

- Filing Methods: Information on how to submit the form, whether online, by mail, or in person.

- Important Dates: Filing deadlines and any relevant dates for tax payments.

- Penalties for Non-Compliance: Potential consequences for failing to file or pay taxes on time.

Obtaining the California Form 540 Instructions

Taxpayers can obtain the California Form 540 instructions through various means:

- Download directly from the California Franchise Tax Board (FTB) website.

- Request a physical copy by contacting the FTB or visiting a local tax office.

- Access through tax preparation software that includes state filing capabilities.

Legal Use of the California Form 540 Instructions

The California Form 540 instructions are legally binding documents that outline the requirements for filing state income tax returns. Taxpayers are expected to adhere to these instructions to ensure compliance with state tax laws. Understanding these guidelines helps prevent errors that could lead to audits or penalties.

Examples of Using the California Form 540 Instructions

Utilizing the California Form 540 instructions can vary based on individual circumstances:

- A self-employed individual may need to reference specific sections regarding business income and deductions.

- A retiree might focus on how to report pension income and social security benefits.

- Students may look for guidance on education-related tax credits and deductions.

Quick guide on how to complete instructions for form 540 personal income tax booklet instructions for form 540 personal income tax booklet

Accomplish Instructions For Form 540 Personal Income Tax Booklet Instructions For Form 540 Personal Income Tax Booklet effortlessly on any device

Online document management has become increasingly popular with businesses and individuals. It offers a perfect environmentally friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Instructions For Form 540 Personal Income Tax Booklet Instructions For Form 540 Personal Income Tax Booklet on any platform with the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest method to modify and eSign Instructions For Form 540 Personal Income Tax Booklet Instructions For Form 540 Personal Income Tax Booklet seamlessly

- Find Instructions For Form 540 Personal Income Tax Booklet Instructions For Form 540 Personal Income Tax Booklet and click on Get Form to commence.

- Use the tools we offer to complete your document.

- Highlight pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow has specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you prefer to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form navigation, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign Instructions For Form 540 Personal Income Tax Booklet Instructions For Form 540 Personal Income Tax Booklet and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 540 personal income tax booklet instructions for form 540 personal income tax booklet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is California Form 540 and who needs to file it?

California Form 540 is the state's individual income tax return for residents. If you're a California resident and earned income during the tax year, you may need to file this form to report your earnings and calculate your tax liability. Filing California Form 540 is essential to comply with state tax requirements.

-

How can airSlate SignNow help me in filing California Form 540?

airSlate SignNow provides an efficient solution for sending, signing, and managing tax documents like California Form 540. With its user-friendly interface and integrations, you can easily prepare and eSign your tax forms. This streamlined process saves time and reduces the complexity involved in filing your California Form 540.

-

Is there a cost associated with using airSlate SignNow for California Form 540?

Yes, airSlate SignNow offers various pricing plans based on your business needs. Although there is a fee, many users find it to be a cost-effective solution for managing documents, including the California Form 540. Its features can ultimately save you time and increase efficiency, making it a valuable investment.

-

What features does airSlate SignNow offer for managing California Form 540?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking that make handling California Form 540 easier. These tools help ensure that your documents are correctly signed and submitted on time. Additionally, you can store and access your California Form 540 conveniently within the platform.

-

Can I use airSlate SignNow on mobile devices when filing California Form 540?

Absolutely! airSlate SignNow is accessible on mobile devices, allowing you to manage and eSign your California Form 540 anytime, anywhere. This mobile compatibility ensures that you can stay productive and submit documents promptly, even while on the go.

-

Are there any integrations available with airSlate SignNow that can assist with California Form 540?

Yes, airSlate SignNow integrates with various applications such as Google Drive, Dropbox, and CRM systems. These integrations facilitate easy access to your files, including California Form 540. By connecting your existing workflows with airSlate SignNow, you can enhance productivity and keep all related documents in one place.

-

What are the benefits of using airSlate SignNow for my California Form 540?

Using airSlate SignNow to manage your California Form 540 offers numerous benefits, including speed, ease of use, and enhanced document security. The platform allows for quick signing and sending of forms, which can signNowly reduce processing time. Additionally, your sensitive information is protected, ensuring that you comply with data privacy regulations.

Get more for Instructions For Form 540 Personal Income Tax Booklet Instructions For Form 540 Personal Income Tax Booklet

Find out other Instructions For Form 540 Personal Income Tax Booklet Instructions For Form 540 Personal Income Tax Booklet

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy

- How To Electronic signature Maryland Web Hosting Agreement

- Can I Electronic signature Maryland Web Hosting Agreement

- Electronic signature Michigan Web Hosting Agreement Simple

- Electronic signature Missouri Web Hosting Agreement Simple