Form 3840 California Like Kind Exchanges Form 3840 California Like Kind Exchanges

Understanding the California Form 3840 for Like-Kind Exchanges

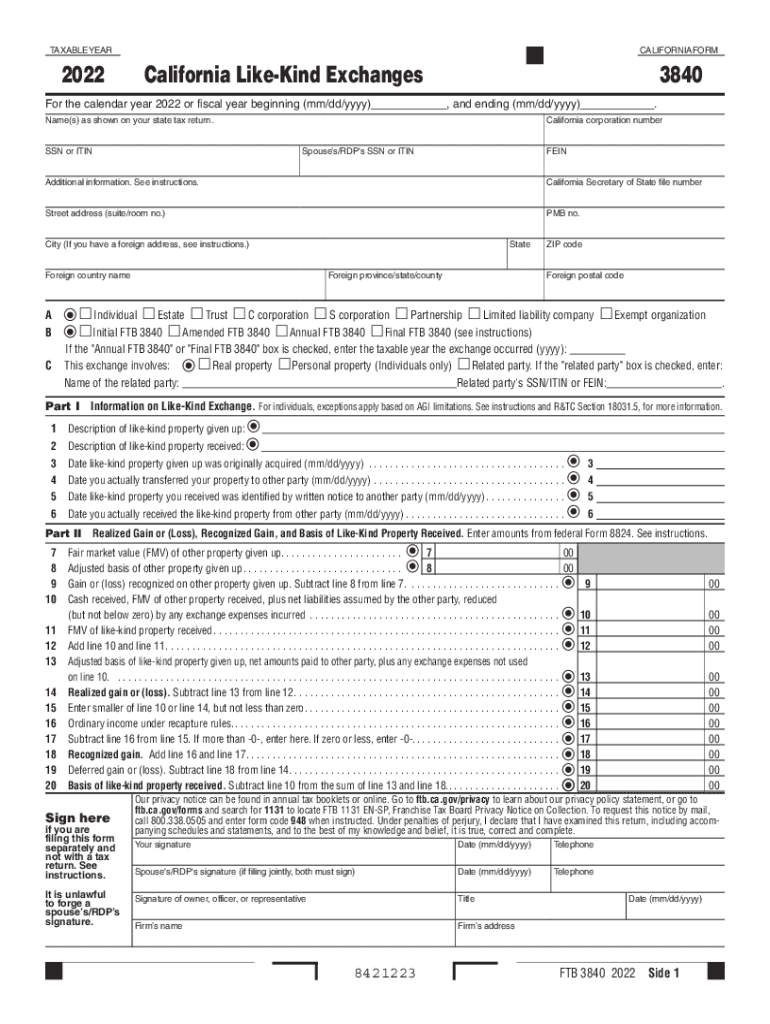

The California Form 3840 is designed for reporting like-kind exchanges under California tax law. This form allows taxpayers to defer recognizing capital gains on the exchange of certain types of property, provided the properties exchanged are of a similar nature or character. It is essential for individuals and businesses engaging in real estate transactions to understand the implications of this form, as it can significantly affect tax liabilities.

How to Complete the California Form 3840

Completing the California Form 3840 involves several key steps. First, gather all necessary information regarding the properties involved in the exchange, including purchase prices, sale prices, and any additional costs associated with the transactions. Next, fill out the form by providing details about the properties, including their descriptions and the dates of acquisition and exchange. It is crucial to ensure accuracy in reporting to avoid potential penalties.

Key Elements of the California Form 3840

The form includes essential sections that require detailed information. Taxpayers must provide their name, address, and Social Security number or taxpayer identification number. Additionally, the form requires information about the properties involved in the exchange, including their fair market values and the nature of the exchange. Understanding these elements can help taxpayers accurately report their transactions and take advantage of tax deferral opportunities.

Important Filing Deadlines for Form 3840

Timely submission of the California Form 3840 is critical to avoid penalties. The form must be filed along with the taxpayer's California income tax return for the year in which the exchange took place. Typically, this means the form is due on April 15 of the following year, unless an extension has been granted. Awareness of these deadlines helps ensure compliance with state tax regulations.

Eligibility Criteria for Using Form 3840

Not all exchanges qualify for reporting on Form 3840. To be eligible, the properties exchanged must be held for productive use in a trade or business or for investment purposes. Personal property exchanges or transactions not meeting the like-kind criteria do not qualify. Understanding these eligibility requirements is vital for taxpayers to utilize the form correctly and avoid complications with the California tax authorities.

Obtaining the California Form 3840

The California Form 3840 can be obtained through the California Franchise Tax Board's official website or by contacting their office directly. Additionally, many tax preparation software programs include the form, making it easier for taxpayers to complete their filings digitally. Accessing the form through these channels ensures that taxpayers have the most current version and instructions for completing it accurately.

Quick guide on how to complete form 3840 california like kind exchanges form 3840 california like kind exchanges

Effortlessly Prepare Form 3840 California Like Kind Exchanges Form 3840 California Like Kind Exchanges on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can obtain the necessary form and securely store it in the cloud. airSlate SignNow equips you with all the tools required to create, modify, and eSign your files quickly and without delay. Manage Form 3840 California Like Kind Exchanges Form 3840 California Like Kind Exchanges on any platform using the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

Edit and eSign Form 3840 California Like Kind Exchanges Form 3840 California Like Kind Exchanges With Ease

- Find Form 3840 California Like Kind Exchanges Form 3840 California Like Kind Exchanges and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight relevant sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Choose how you wish to send your form—via email, SMS, or invite link—or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and eSign Form 3840 California Like Kind Exchanges Form 3840 California Like Kind Exchanges and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 3840 california like kind exchanges form 3840 california like kind exchanges

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the CA Form 3840, and why do I need it?

The CA Form 3840 is used to report capital gains on the sale of your assets in California. Understanding this form is crucial for accurate tax reporting and can help you take advantage of potential tax deductions. Completing the CA Form 3840 correctly ensures compliance and may prevent future audits.

-

How can airSlate SignNow help me with the CA Form 3840?

airSlate SignNow simplifies the process of completing and signing the CA Form 3840 digitally. With our easy-to-use platform, you can fill out and eSign the form from anywhere, making tax season seamless and efficient. Our solution helps ensure that your documents are securely stored and accessible whenever you need them.

-

What are the pricing plans for using airSlate SignNow for document management?

airSlate SignNow offers various pricing plans tailored to your needs, starting from a free trial to affordable monthly subscriptions. Each plan includes features that assist with managing forms like the CA Form 3840, making it a cost-effective choice for individuals and businesses alike. You can choose a plan that fits your budget and usage requirements.

-

Is airSlate SignNow secure for signing important documents like the CA Form 3840?

Yes, airSlate SignNow prioritizes security and utilizes advanced encryption protocols to protect your sensitive documents, including the CA Form 3840. Our platform ensures that your data is safe during transmission and storage, providing peace of mind when signing important financial forms. Compliance with industry standards is also a top priority for us.

-

Can I integrate airSlate SignNow with other tools for processing the CA Form 3840?

Absolutely! airSlate SignNow supports integrations with various productivity tools and applications, enhancing your workflow when working with the CA Form 3840. These integrations allow for easy import/export of data and streamline your document management processes, making your experience even more efficient.

-

What are the key features of airSlate SignNow that benefit CA Form 3840 users?

Key features of airSlate SignNow include easy document creation, built-in templates for forms like the CA Form 3840, real-time collaboration, and secure eSignature options. These functionalities simplify the entire process, from form filling to document signing, ensuring that users save time and reduce errors while meeting compliance requirements.

-

How do I get started with airSlate SignNow for the CA Form 3840?

Getting started with airSlate SignNow is quick and easy. Simply sign up for a free trial on our website, and you can begin using our features to manage your CA Form 3840 and other documents right away. Our intuitive interface makes navigation simple, so you can focus on completing your tax forms effectively.

Get more for Form 3840 California Like Kind Exchanges Form 3840 California Like Kind Exchanges

- Inf1100 form

- Hemochromatosis family letter centers for disease control and cdc form

- 052015 rev ct form

- Cy 321 day care agreement form

- Cdph 278 b cdph ca form

- Supplemental questionnaire to determine entitlement for a us passport state form

- Cacfp meal count form nj

- Form cem 6201b supplemental notice of potential claim dot ca

Find out other Form 3840 California Like Kind Exchanges Form 3840 California Like Kind Exchanges

- How Do I eSign Idaho Medical Records Release

- Can I eSign Alaska Advance Healthcare Directive

- eSign Kansas Client and Developer Agreement Easy

- eSign Montana Domain Name Registration Agreement Now

- eSign Nevada Affiliate Program Agreement Secure

- eSign Arizona Engineering Proposal Template Later

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free

- Can I eSign Florida Proforma Invoice Template

- eSign New Jersey Proforma Invoice Template Online

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement

- Can I eSign Georgia Business purchase agreement

- How Can I eSign Idaho Business purchase agreement