Nc Fuel Decals 2018

What are NC Fuel Decals?

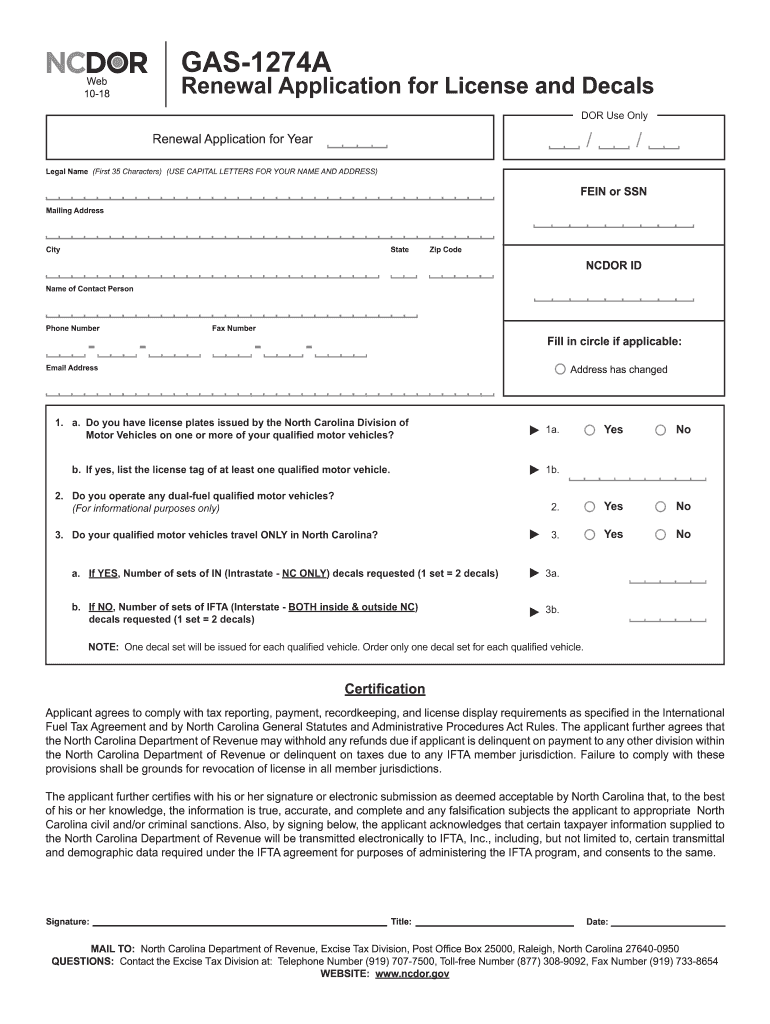

NC Fuel Decals are official stickers issued by the North Carolina Department of Revenue, designed for vehicles that operate under the International Fuel Tax Agreement (IFTA). These decals serve as proof that the vehicle is registered for fuel tax purposes and allows for the legal operation of commercial vehicles across state lines. The decals must be displayed prominently on the vehicle to comply with state regulations.

How to Obtain NC Fuel Decals

To obtain NC Fuel Decals, vehicle owners must first register their vehicles with the North Carolina Department of Revenue. This process includes submitting an application along with necessary documentation, such as proof of vehicle ownership and payment of applicable fees. Once the application is approved, the decals will be issued and can be affixed to the vehicle.

Steps to Complete the NC Fuel Decals Application

Completing the application for NC Fuel Decals involves several key steps:

- Gather required documents, including proof of ownership and identification.

- Complete the application form, ensuring all information is accurate and complete.

- Submit the application along with any required fees to the North Carolina Department of Revenue.

- Wait for processing, which may take several weeks, depending on the volume of applications.

- Receive the decals and affix them to your vehicle as instructed.

Legal Use of NC Fuel Decals

NC Fuel Decals must be used in accordance with state law. They are only valid for vehicles that are registered under IFTA and are intended for commercial use. Misuse of the decals, such as displaying them on unregistered vehicles or using them for personal vehicles, can result in penalties and fines. It is essential to ensure that all vehicles displaying these decals are compliant with IFTA regulations.

Filing Deadlines and Important Dates

When dealing with NC Fuel Decals, it is crucial to be aware of filing deadlines and important dates. Typically, fuel tax reports must be filed quarterly, with specific due dates set by the North Carolina Department of Revenue. Failure to file on time can lead to penalties and interest on unpaid taxes. Keeping a calendar of these deadlines can help ensure compliance and avoid unnecessary fees.

Penalties for Non-Compliance

Non-compliance with NC Fuel Decal regulations can lead to significant penalties. This may include fines for failure to display decals, late filing of fuel tax reports, or operating without proper registration. The North Carolina Department of Revenue enforces these regulations strictly, and repeated violations can result in more severe consequences, including the suspension of operating privileges.

Quick guide on how to complete gas 1274a 2018 2019 form

Your assistance manual on how to prepare your Nc Fuel Decals

If you're wondering how to create and submit your Nc Fuel Decals, here are some concise guidelines to simplify the tax filing process.

To start, you just need to set up your airSlate SignNow account to change the way you manage documents online. airSlate SignNow is an extremely user-friendly and powerful document solution that enables you to modify, draft, and finalize your income tax paperwork effortlessly. With its editor, you can alternate between text, checkboxes, and eSignatures and revert to modify details as necessary. Streamline your tax oversight with advanced PDF editing, eSigning, and user-friendly sharing.

Follow the steps below to finalize your Nc Fuel Decals within a few moments:

- Create your account and begin working on PDFs in no time.

- Utilize our library to find any IRS tax document; browse through editions and schedules.

- Click Get form to access your Nc Fuel Decals in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to add your legally-recognized eSignature (if required).

- Examine your document and rectify any errors.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to electronically file your taxes with airSlate SignNow. Please remember that paper submissions can lead to errors in returns and delays in refunds. Naturally, before e-filing your taxes, verify the IRS website for filing guidelines in your jurisdiction.

Create this form in 5 minutes or less

Find and fill out the correct gas 1274a 2018 2019 form

Create this form in 5 minutes!

How to create an eSignature for the gas 1274a 2018 2019 form

How to generate an electronic signature for the Gas 1274a 2018 2019 Form in the online mode

How to create an electronic signature for the Gas 1274a 2018 2019 Form in Chrome

How to create an eSignature for signing the Gas 1274a 2018 2019 Form in Gmail

How to generate an electronic signature for the Gas 1274a 2018 2019 Form right from your smart phone

How to generate an electronic signature for the Gas 1274a 2018 2019 Form on iOS devices

How to make an electronic signature for the Gas 1274a 2018 2019 Form on Android

People also ask

-

What is gas 1274a and how does it work?

Gas 1274a is a specialized product designed to streamline the eSignature process. It allows businesses to send and sign documents electronically, eliminating the need for physical signatures. With airSlate SignNow, you can utilize gas 1274a to enhance efficiency in document management and processing.

-

What features does gas 1274a offer?

Gas 1274a includes features such as customizable templates, real-time tracking, and secure cloud storage. These functionalities simplify the document signing process and ensure that your agreements are both professional and protected. Utilizing these features helps save time and resources for your business.

-

What are the benefits of using gas 1274a for eSigning?

The primary benefits of using gas 1274a include increased efficiency, reduced paperwork, and improved compliance. By adopting gas 1274a, businesses can speed up their contract execution times and reduce the risk of errors associated with manual signatures. These advantages contribute to a more responsive and agile business environment.

-

How much does gas 1274a cost?

The pricing for gas 1274a varies based on your business needs and the number of users. airSlate SignNow offers competitive pricing plans that cater to both small businesses and larger enterprises. Checking the pricing page for specific tiers will help you determine the best fit for your budget.

-

Can gas 1274a integrate with other applications?

Yes, gas 1274a can seamlessly integrate with various business applications such as CRM systems, payment processors, and project management tools. This capability enhances workflow efficiency by allowing users to manage documents directly within their preferred systems. Such integrations provide a holistic approach to business operations.

-

Is gas 1274a secure for sending sensitive documents?

Absolutely, gas 1274a prioritizes security through encryption and secure storage solutions. airSlate SignNow complies with industry standards to ensure that your sensitive documents remain protected during transmission and storage. Your trust is essential, and we take every measure to safeguard your information.

-

How user-friendly is the gas 1274a platform?

The gas 1274a platform is designed with user experience in mind, making it accessible for users of all technical levels. With an intuitive interface and straightforward navigation, you can easily create, send, and track documents. This ease of use ensures that businesses can adopt eSigning without extensive training.

Get more for Nc Fuel Decals

Find out other Nc Fuel Decals

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe

- How Can I eSign Maryland Non-Profit Credit Memo

- eSign Maryland Non-Profit Separation Agreement Computer

- eSign Legal PDF New Jersey Free

- eSign Non-Profit Document Michigan Safe

- eSign New Mexico Legal Living Will Now

- eSign Minnesota Non-Profit Confidentiality Agreement Fast

- How Do I eSign Montana Non-Profit POA

- eSign Legal Form New York Online

- Can I eSign Nevada Non-Profit LLC Operating Agreement

- eSign Legal Presentation New York Online

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement