Motion for Hearing to Correct One Third over Appraisal Error of Non Residence Homestead Property 2021

What is the Motion For Hearing To Correct One Third Over Appraisal Error Of Non Residence Homestead Property

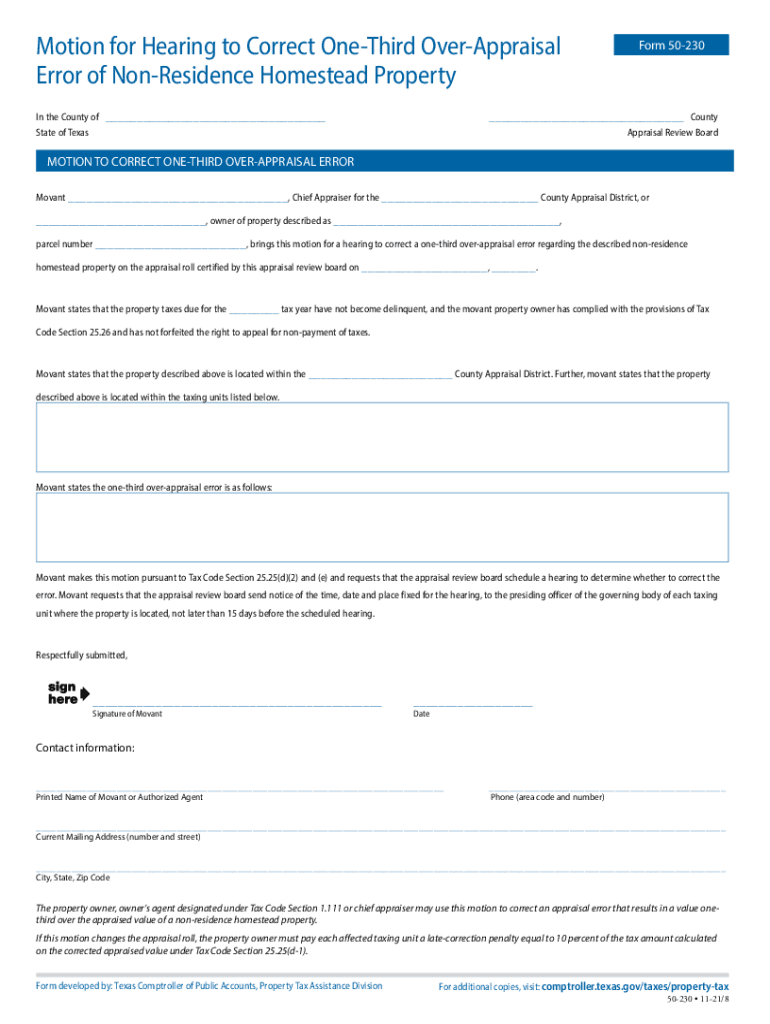

The Motion For Hearing To Correct One Third Over Appraisal Error Of Non Residence Homestead Property is a legal document used by property owners in the United States to contest an appraisal error related to non-residential homestead properties. This motion is typically filed when a property owner believes that the assessed value of their property exceeds its fair market value due to a miscalculation or oversight in the appraisal process. By submitting this motion, the property owner seeks a formal hearing to address the appraisal error and potentially adjust the property’s assessed value.

How to use the Motion For Hearing To Correct One Third Over Appraisal Error Of Non Residence Homestead Property

Using the Motion For Hearing To Correct One Third Over Appraisal Error involves several steps. First, the property owner must gather relevant documentation, including the original appraisal report and any evidence supporting the claim of error. Next, the motion must be completed with accurate information regarding the property and the specific appraisal error being contested. Once the motion is prepared, it should be filed with the appropriate local government office or tax assessor’s office. It is essential to follow any specific local rules regarding submission and ensure that all deadlines are met.

Steps to complete the Motion For Hearing To Correct One Third Over Appraisal Error Of Non Residence Homestead Property

Completing the Motion For Hearing To Correct One Third Over Appraisal Error involves the following steps:

- Gather necessary documents, including the appraisal report and supporting evidence.

- Fill out the motion form with accurate property details and a clear explanation of the appraisal error.

- Review the local rules regarding filing procedures and deadlines.

- Submit the completed motion to the appropriate office, ensuring all required signatures are included.

- Keep copies of all submitted documents for personal records.

Key elements of the Motion For Hearing To Correct One Third Over Appraisal Error Of Non Residence Homestead Property

Key elements of the Motion For Hearing To Correct One Third Over Appraisal Error include:

- The property owner’s name and contact information.

- A detailed description of the property, including its address and parcel number.

- An explanation of the specific appraisal error, including any discrepancies in value.

- Supporting documentation that substantiates the claim, such as comparative market analyses or expert opinions.

- The desired outcome, typically a request for a reassessment of the property’s value.

State-specific rules for the Motion For Hearing To Correct One Third Over Appraisal Error Of Non Residence Homestead Property

State-specific rules regarding the Motion For Hearing To Correct One Third Over Appraisal Error can vary significantly. Each state may have different requirements for filing, including deadlines for submission and specific forms that must be used. It is crucial for property owners to consult their state’s tax assessor’s office or legal resources to understand the particular regulations that apply to their situation. This ensures compliance with local laws and increases the likelihood of a successful outcome.

Filing Deadlines / Important Dates

Filing deadlines for the Motion For Hearing To Correct One Third Over Appraisal Error are critical to the process. These deadlines can differ by jurisdiction, often aligning with local tax assessment cycles. Property owners should be aware of the specific dates by which the motion must be filed to avoid missing the opportunity to contest the appraisal. It is advisable to check with the local tax assessor’s office for the most accurate and up-to-date information regarding important dates related to the filing process.

Quick guide on how to complete motion for hearing to correct one third over appraisal error of non residence homestead property

Effortlessly prepare Motion For Hearing To Correct One Third Over Appraisal Error Of Non Residence Homestead Property on any device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed papers, allowing you to find the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly and without delays. Manage Motion For Hearing To Correct One Third Over Appraisal Error Of Non Residence Homestead Property on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-centric process today.

How to modify and electronically sign Motion For Hearing To Correct One Third Over Appraisal Error Of Non Residence Homestead Property with ease

- Obtain Motion For Hearing To Correct One Third Over Appraisal Error Of Non Residence Homestead Property and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Create your electronic signature with the Sign tool, which takes just seconds and holds the same legal significance as a traditional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you'd like to send your form, whether by email, text message (SMS), an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that require new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Modify and electronically sign Motion For Hearing To Correct One Third Over Appraisal Error Of Non Residence Homestead Property to ensure exceptional communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct motion for hearing to correct one third over appraisal error of non residence homestead property

Create this form in 5 minutes!

How to create an eSignature for the motion for hearing to correct one third over appraisal error of non residence homestead property

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Motion For Hearing To Correct One Third Over Appraisal Error Of Non Residence Homestead Property?

A Motion For Hearing To Correct One Third Over Appraisal Error Of Non Residence Homestead Property is a formal request to address inaccuracies in property appraisal values that affect non-residential homestead properties. This process allows property owners to contest inflated appraisals, ensuring fair taxation. Understanding this motion can help you protect your financial interests.

-

How can airSlate SignNow assist with filing a Motion For Hearing To Correct One Third Over Appraisal Error Of Non Residence Homestead Property?

airSlate SignNow provides a user-friendly platform that simplifies the documentation process for a Motion For Hearing To Correct One Third Over Appraisal Error Of Non Residence Homestead Property. By utilizing our eSignature and document management tools, you can complete and submit all necessary forms efficiently. Our solution ensures your documents are securely signed and delivered.

-

What are the costs associated with using airSlate SignNow for my Motion For Hearing To Correct One Third Over Appraisal Error Of Non Residence Homestead Property?

Our pricing plans at airSlate SignNow are designed to be cost-effective, catering to various business needs when filing a Motion For Hearing To Correct One Third Over Appraisal Error Of Non Residence Homestead Property. We offer different subscription tiers based on features required, ensuring you only pay for what you need. Check our website for detailed pricing information.

-

Are there specific features that airSlate SignNow offers for facilitating a Motion For Hearing To Correct One Third Over Appraisal Error Of Non Residence Homestead Property?

Yes, airSlate SignNow includes features like customizable templates, robust eSignature capabilities, and secure cloud storage. These tools streamline the process of preparing and submitting a Motion For Hearing To Correct One Third Over Appraisal Error Of Non Residence Homestead Property. This efficiency minimizes paperwork errors and saves time.

-

Can I collaborate with others while preparing my Motion For Hearing To Correct One Third Over Appraisal Error Of Non Residence Homestead Property using airSlate SignNow?

Absolutely! airSlate SignNow allows for seamless collaboration with team members or advisors while drafting your Motion For Hearing To Correct One Third Over Appraisal Error Of Non Residence Homestead Property. You can share documents, gather feedback in real time, and ensure everyone involved is on the same page, enhancing the accuracy of your submission.

-

What benefits does airSlate SignNow provide for businesses filing a Motion For Hearing To Correct One Third Over Appraisal Error Of Non Residence Homestead Property?

Using airSlate SignNow for your Motion For Hearing To Correct One Third Over Appraisal Error Of Non Residence Homestead Property means increased efficiency and reduced costs. Our platform automates the signing and sending process, ensuring that your documents are handled quickly and reliably. Additionally, you'll have access to tracking features for peace of mind.

-

Does airSlate SignNow integrate with any third-party applications that could help with my Motion For Hearing To Correct One Third Over Appraisal Error Of Non Residence Homestead Property?

Yes, airSlate SignNow integrates seamlessly with various third-party applications like Google Drive, Dropbox, and various CRMs. These integrations make it easier to manage documents and streamline workflows related to filing a Motion For Hearing To Correct One Third Over Appraisal Error Of Non Residence Homestead Property. You can connect your existing tools for a more efficient process.

Get more for Motion For Hearing To Correct One Third Over Appraisal Error Of Non Residence Homestead Property

- Tp 400 2275 02 br smapdf parts manual form

- Child care emergency plan template scchildcare form

- Midrand state of the environment south africa soer environment gov form

- New apscurf membership form

- Coast guard edit aplicatiob 2015 2019 form

- Alvernia university transfer credit approval form alvernia

- Special inspector city of miami form

- Form 821d daca 2017 2019

Find out other Motion For Hearing To Correct One Third Over Appraisal Error Of Non Residence Homestead Property

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form

- eSign Michigan Car Insurance Quotation Form Online

- eSign Michigan Car Insurance Quotation Form Mobile

- eSignature Massachusetts Mechanic's Lien Online

- eSignature Massachusetts Mechanic's Lien Free

- eSign Ohio Car Insurance Quotation Form Mobile

- eSign North Dakota Car Insurance Quotation Form Online

- eSign Pennsylvania Car Insurance Quotation Form Mobile

- eSignature Nevada Mechanic's Lien Myself

- eSign California Life-Insurance Quote Form Online

- How To eSignature Ohio Mechanic's Lien

- eSign Florida Life-Insurance Quote Form Online

- eSign Louisiana Life-Insurance Quote Form Online

- How To eSign Michigan Life-Insurance Quote Form

- Can I eSign Colorado Business Insurance Quotation Form