Form 50 230 Motion for Hearing to Correct One Third over Appraisal Error Motion for Hearing to Correct One Third over Appraisal 2016-2026

Understanding the Form 50 230 Motion for Hearing to Correct One Third Over Appraisal Error

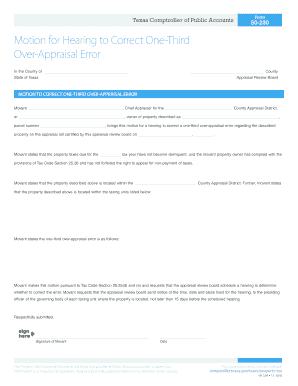

The Form 50 230, known as the Motion for Hearing to Correct One Third Over Appraisal Error, is a legal document used in the United States to address discrepancies in property appraisals. This form allows property owners to formally request a hearing to contest an appraisal that they believe inaccurately reflects the value of their property. The form is essential for those seeking to ensure that their property taxes are based on fair and accurate appraisals.

Steps to Complete the Form 50 230

Filling out the Form 50 230 requires careful attention to detail. Here are the steps to complete the form:

- Begin by entering your personal information, including your name, address, and contact details.

- Provide the property details, including the address and the parcel number.

- Clearly state the reason for contesting the appraisal, including any supporting evidence or documentation that justifies your claim.

- Sign and date the form to validate your request.

- Ensure that all information is accurate and complete before submission.

Legal Use of the Form 50 230

The Form 50 230 is primarily used in property tax disputes. It is a legal mechanism that allows property owners to challenge the assessed value of their property as determined by local tax authorities. By filing this form, individuals can seek a reassessment of their property value, which may lead to a reduction in property taxes if the appraisal is found to be incorrect.

Key Elements of the Form 50 230

When completing the Form 50 230, several key elements must be included to ensure its validity:

- Your full name and contact information.

- The property address and parcel identification number.

- A detailed explanation of the appraisal error, including specific facts and figures.

- Any supporting documentation, such as comparable property sales or previous appraisals.

- Your signature and the date of submission.

Obtaining the Form 50 230

The Form 50 230 can typically be obtained from your local county assessor's office or their official website. It may also be available at legal aid offices or through real estate professionals. Ensuring that you have the most current version of the form is essential for a successful submission.

Examples of Using the Form 50 230

There are various scenarios in which the Form 50 230 may be utilized:

- A homeowner believes their property was overvalued due to a recent increase in market value that does not reflect their property's condition.

- A property owner contests an appraisal based on the sale prices of similar properties in the area.

- Individuals may use the form if they believe there was an error in the property description that led to an inflated appraisal.

Quick guide on how to complete form 50 230 motion for hearing to correct one third over appraisal error motion for hearing to correct one third over appraisal

Prepare Form 50 230 Motion For Hearing To Correct One Third Over Appraisal Error Motion For Hearing To Correct One Third Over Appraisal effortlessly on any device

Online document management has gained immense popularity among organizations and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, enabling you to access the correct form and securely store it in the cloud. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents promptly without any delays. Manage Form 50 230 Motion For Hearing To Correct One Third Over Appraisal Error Motion For Hearing To Correct One Third Over Appraisal on any platform with the airSlate SignNow Android or iOS applications and enhance any document-focused workflow today.

The easiest way to edit and eSign Form 50 230 Motion For Hearing To Correct One Third Over Appraisal Error Motion For Hearing To Correct One Third Over Appraisal without hassle

- Obtain Form 50 230 Motion For Hearing To Correct One Third Over Appraisal Error Motion For Hearing To Correct One Third Over Appraisal and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the document or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal significance as a traditional handwritten signature.

- Review the details and click the Done button to save your changes.

- Select your preferred delivery method for your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 50 230 Motion For Hearing To Correct One Third Over Appraisal Error Motion For Hearing To Correct One Third Over Appraisal to ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 50 230 motion for hearing to correct one third over appraisal error motion for hearing to correct one third over appraisal

Create this form in 5 minutes!

How to create an eSignature for the form 50 230 motion for hearing to correct one third over appraisal error motion for hearing to correct one third over appraisal

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 50 230 form?

The 50 230 form is a critical document used in various business transactions. It typically involves the authorization and signature of relevant parties, ensuring that all legal formalities are met. Understanding how to effectively manage and sign the 50 230 form can enhance your business's workflow.

-

How does airSlate SignNow simplify the process of signing the 50 230 form?

AirSlate SignNow streamlines the signing process for the 50 230 form by offering an intuitive platform for electronic signatures. With features like customizable templates and secure authentication, you can send and eSign the document quickly. This signNowly reduces the time it takes to complete essential paperwork.

-

Is there pricing information available for airSlate SignNow related to the 50 230 form?

Yes, airSlate SignNow offers flexible pricing plans that cater to different business needs. You can choose a plan that suits your frequency of use for the 50 230 form and other documents. Each plan includes various features to help simplify your eSignature process.

-

Can I create templates for the 50 230 form using airSlate SignNow?

Absolutely! AirSlate SignNow allows you to create reusable templates for the 50 230 form, saving you time and effort. Once you set up a template, you can easily customize it for your specific needs and send it for signatures as often as required.

-

What security features does airSlate SignNow offer for the 50 230 form?

AirSlate SignNow prioritizes security, especially for sensitive documents like the 50 230 form. Features include encryption, secure storage, and compliance with major eSignature laws. This ensures that your documents remain confidential and legally valid.

-

Does airSlate SignNow integrate with other applications for managing the 50 230 form?

Yes, airSlate SignNow seamlessly integrates with various applications, enhancing your ability to manage the 50 230 form. You can connect it with CRM systems, cloud storage, and other tools to ensure a smooth workflow. This integration simplifies document management across platforms.

-

What are the benefits of using airSlate SignNow for the 50 230 form?

Using airSlate SignNow for the 50 230 form offers numerous benefits, including enhanced efficiency, cost savings, and improved compliance. The platform allows for faster document turnaround times, enabling your business to operate smoothly. Additionally, it simplifies the signature process for all parties involved.

Get more for Form 50 230 Motion For Hearing To Correct One Third Over Appraisal Error Motion For Hearing To Correct One Third Over Appraisal

- Advanced pain management general referral form

- Masjid farooq form

- Which king was purple and had many wives form

- Site candidate information package

- Affidavit death of trustee succession of successor trustee b2015b bb form

- Form 2441

- Rider agreement template form

- Right of first offer agreement template form

Find out other Form 50 230 Motion For Hearing To Correct One Third Over Appraisal Error Motion For Hearing To Correct One Third Over Appraisal

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement

- Sign Georgia Real Estate Residential Lease Agreement Simple

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe