Wisconsin 1cns Form

What is the Wisconsin 1cns Form

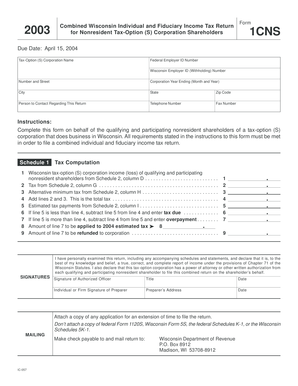

The Wisconsin 1cns form is a fiduciary income tax return specifically designed for estates and trusts in the state of Wisconsin. This form is essential for reporting income, deductions, and credits on behalf of the estate or trust. It helps ensure compliance with state tax laws and provides a clear framework for fiduciaries to fulfill their tax obligations. Understanding the purpose of this form is crucial for anyone managing an estate or trust in Wisconsin.

How to use the Wisconsin 1cns Form

Using the Wisconsin 1cns form involves several steps to accurately report the income and expenses of the estate or trust. First, gather all necessary financial documents, including income statements, deduction records, and any relevant tax forms. Next, fill out the form by providing information about the estate or trust, including its name, address, and taxpayer identification number. Ensure that all income and deductions are reported correctly, as this will affect the overall tax liability. Finally, review the completed form for accuracy before submission.

Steps to complete the Wisconsin 1cns Form

Completing the Wisconsin 1cns form requires careful attention to detail. Follow these steps:

- Collect all relevant financial information related to the estate or trust.

- Enter the basic identification information, such as the name and address of the estate or trust.

- Report all sources of income, including interest, dividends, and rental income.

- Detail any allowable deductions, such as administrative expenses and distributions to beneficiaries.

- Calculate the total income and deductions to determine the taxable income.

- Sign and date the form, ensuring that it is submitted by the appropriate deadline.

Legal use of the Wisconsin 1cns Form

The legal use of the Wisconsin 1cns form is governed by state tax regulations. It is important for fiduciaries to understand their responsibilities when filing this form. The form must be submitted for any estate or trust that has a filing requirement under Wisconsin law. Failure to file can result in penalties and interest on unpaid taxes. Therefore, it is essential to ensure that the form is completed accurately and submitted on time to avoid legal repercussions.

Key elements of the Wisconsin 1cns Form

Key elements of the Wisconsin 1cns form include sections for reporting income, deductions, and tax credits. The form requires detailed information about the estate or trust, including:

- Name and address of the estate or trust.

- Taxpayer identification number.

- Income sources, such as dividends and interest.

- Deduction categories, including administrative expenses and distributions.

- Signature of the fiduciary or authorized representative.

Filing Deadlines / Important Dates

Filing deadlines for the Wisconsin 1cns form are crucial for compliance. Typically, the form must be filed by the 15th day of the fourth month following the close of the estate's or trust's tax year. For estates or trusts operating on a calendar year, this means the due date is April 15. It is important to keep track of these dates to avoid penalties and ensure timely submission.

Quick guide on how to complete wisconsin 1cns form

Effortlessly Create Wisconsin 1cns Form on Any Device

Managing documents online has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to obtain the necessary form and securely archive it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents swiftly without delays. Handle Wisconsin 1cns Form on any device with the airSlate SignNow applications for Android or iOS and enhance any document-focused workflow today.

How to Modify and Electronically Sign Wisconsin 1cns Form with Ease

- Locate Wisconsin 1cns Form and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or obscure confidential information with the tools specifically provided by airSlate SignNow for that purpose.

- Produce your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a classic wet ink signature.

- Review the details and then click the Done button to preserve your modifications.

- Choose how you wish to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the hassles of lost or misfiled documents, tiresome form searches, or mistakes that necessitate printing additional copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your preference. Modify and electronically sign Wisconsin 1cns Form and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wisconsin 1cns form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Wisconsin 1CNS and how does it work?

Wisconsin 1CNS refers to the electronic signing solution offered by airSlate SignNow that complies with state regulations. This tool allows users in Wisconsin to electronically sign documents safely and securely, simplifying the signing process for both businesses and individuals.

-

How much does airSlate SignNow cost for Wisconsin 1CNS users?

The pricing for airSlate SignNow varies based on the plan you select, but it is designed to be cost-effective for businesses utilizing Wisconsin 1CNS. You can expect competitive pricing with flexible options to suit various organizational needs, ensuring that eSigning is accessible for all.

-

What features are included with Wisconsin 1CNS?

Wisconsin 1CNS includes features such as customizable templates, real-time tracking, and advanced security measures. It empowers users to manage and send documents with ease, ensuring compliance with Wisconsin's regulations for electronic signatures.

-

What are the benefits of using Wisconsin 1CNS for my business?

Using Wisconsin 1CNS can signNowly enhance your business efficiency by streamlining the signing process. It reduces turnaround times, minimizes paperwork, and ensures your business adheres to local compliance, ultimately saving you time and resources.

-

Can I integrate Wisconsin 1CNS with other software applications?

Yes, airSlate SignNow offers robust integrations with popular software applications to enhance your workflow. Whether you use CRM systems, cloud storage, or project management tools, integrating Wisconsin 1CNS can help centralize your document management processes.

-

Is Wisconsin 1CNS secure for handling sensitive information?

Absolutely, Wisconsin 1CNS prioritizes security by employing encryption, authentication protocols, and other safeguards. This allows businesses to handle sensitive information confidently, knowing that their documents are protected throughout the signing process.

-

What kind of support does airSlate SignNow provide for Wisconsin 1CNS users?

airSlate SignNow offers comprehensive support for Wisconsin 1CNS users, including online resources, tutorials, and direct customer service. Whether you're a new user or need assistance with features, support is available to ensure you get the most from the platform.

Get more for Wisconsin 1cns Form

- Tuberculosis sign amp symptom review michigan form

- Consent for mental health evaluation andor treatment patient name date of birth i voluntarily consent that my child will form

- Dhs 3043 earned income tax credit temporary assistance for needy families tanf earned income tax credit tanf form

- Toll 800 381 5111 local 517 284 4400 www mi form

- Fia 1920 release of information authorization

- Michigan energy assistance program state of michigan form

- Medicare patient consent and aob form revised 12

- Intake and medical history form tennessee state government

Find out other Wisconsin 1cns Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation