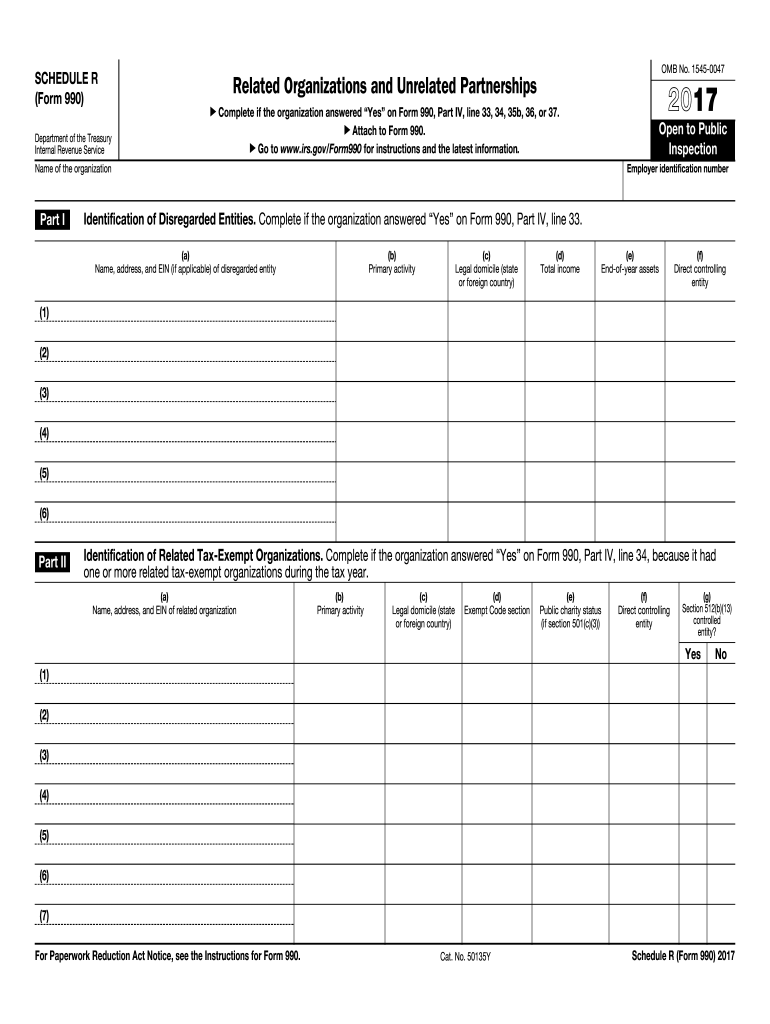

Schedule R Form 2017

What is the Schedule R Form

The Schedule R Form is a tax document used by individuals to claim the credit for the elderly or the disabled. This form is specifically designed for taxpayers who qualify based on age or disability status and helps them calculate the amount of credit they can receive. The Schedule R Form is typically filed alongside the Form 1040 or Form 1040-SR during the annual tax filing process. Understanding this form is essential for eligible taxpayers to ensure they maximize their tax benefits.

How to use the Schedule R Form

To use the Schedule R Form effectively, begin by gathering all necessary personal information, including your age or disability status, income details, and any other relevant financial data. Carefully read the instructions provided with the form to understand the eligibility criteria and the calculation process. Fill out the form with accurate information, ensuring that all required fields are completed. Once the form is filled out, it should be attached to your main tax return and submitted to the IRS by the designated deadline.

Steps to complete the Schedule R Form

Completing the Schedule R Form involves several key steps:

- Review eligibility requirements to confirm that you qualify for the credit.

- Gather necessary documentation, including proof of age or disability and income statements.

- Fill out the form, starting with your personal information and then moving to the credit calculation sections.

- Double-check all entries for accuracy, ensuring that no information is missing or incorrect.

- Attach the completed form to your main tax return before submitting it to the IRS.

Legal use of the Schedule R Form

The Schedule R Form must be used in accordance with IRS regulations to ensure it is legally valid. This includes using the most current version of the form, providing accurate information, and adhering to submission deadlines. Taxpayers should also be aware that any fraudulent claims or misrepresentation of information can lead to penalties, including fines or legal action. It is important to maintain all supporting documents in case of an audit.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule R Form align with the standard tax return deadlines. Typically, individual tax returns are due on April 15 of each year. If this date falls on a weekend or holiday, the deadline is extended to the next business day. Taxpayers should also be aware of any potential extensions they may apply for, which can provide additional time to file their returns, including the Schedule R Form.

Examples of using the Schedule R Form

Examples of using the Schedule R Form include situations where individuals over the age of sixty-five claim the credit due to their age or where individuals who are permanently disabled seek to reduce their tax liability. For instance, a retired individual with a limited income may fill out the Schedule R Form to receive a credit that alleviates their tax burden. Similarly, a disabled taxpayer may use this form to claim credits that support their financial situation.

Quick guide on how to complete 2017 schedule r form

Discover the easiest method to complete and endorse your Schedule R Form

Are you still spending time creating your official documents on physical copies instead of doing it online? airSlate SignNow provides a superior way to complete and endorse your Schedule R Form and related forms for public services. Our intelligent eSignature platform equips you with everything necessary to handle documents swiftly and in accordance with official standards - comprehensive PDF editing, management, protection, signing, and sharing tools readily available within a user-friendly interface.

You only need to follow a few steps to complete and endorse your Schedule R Form:

- Insert the editable template into the editor with the Get Form button.

- Review the information you need to enter in your Schedule R Form.

- Navigate through the fields with the Next option to avoid missing anything.

- Utilize Text, Check, and Cross features to fill in the blanks with your information.

- Update the content with Text boxes or Images from the upper toolbar.

- Emphasize what is essential or Conceal fields that are no longer relevant.

- Press Sign to create a legally binding eSignature using any preferred method.

- Insert the Date next to your signature and complete your task with the Done button.

Store your completed Schedule R Form in the Documents folder within your account, download it, or transfer it to your preferred cloud storage. Our platform also provides versatile form sharing options. There’s no necessity to print your templates when you need to submit them to the appropriate public office - do it via email, fax, or by requesting a USPS delivery from your account. Try it now!

Create this form in 5 minutes or less

Find and fill out the correct 2017 schedule r form

FAQs

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

How do I fill out the Delhi Polytechnic 2017 form?

Delhi Polytechnic (CET DELHI) entrance examination form has been published. You can visit Welcome to CET Delhi and fill the online form. For more details you can call @ 7042426818

-

How can I fill out an improvement form of the CBSE 2017?

IN the month of August the application form will be available on cbse official website which you have to fill online then it will ask in which you subject you want to apply for improvement…you can select all subjects and additional subjects also then you have to pay the amount for improvement exam which you have to pay at bank. take the print out of the acknowledgement and the e-challan and deposit the fees at bank… you also have to change your region when you type the pin code then according to that you will get your centre as well as new region means you region will change. it don't effect anything. after all these thing you have to send a xerox copy of your marksheet e-challan acknowledgement to the regional office which you get. the address will be returned on the acknowledgement after that you have to wait to get your admit card which you will get online on month of February…and improvement marksheet will be send to you address which you fill at time of applications form filling time. if you get less marks in improvement then old marksheet will be valid soAll The Best

-

How do I fill out the SSC CHSL 2017-18 form?

Its very easy task, you have to just put this link in your browser SSC, this page will appearOn this page click on Apply buttonthere a dialog box appears, in that dialog box click on CHSL a link will come “ Click here to apply” and you will signNow to registration page.I hope you all have understood the procedure. All the best for your exam

-

What is the link of the official website to fill out the IBPS RRB 2017-2018 form?

Hello,The notification of IBPS RRB 2017–18 is soon going to be announce by the Officials.With this news, the candidates are now looking for the official links to apply for the IBPS RRB Exam and the complete Step by step procedure of how to apply online.The link of Official website to apply is given below:Welcome to IBPS ::Below are the steps to apply online for the exam.Firstly, visit the official link mentioned above.After click on the link ‘CWE RRB’ at the left side of the page.As soon as the official sources will release the IBPS RRB Notification 2017, the candidates will be able to see another link ‘Common Written Examination – Regional Rural Banks Phase VI’ on the page.After clicking on this link, you can start your IBPS RRB Online Application process.Enter all the required details and upload scanned photographs and signature to proceed with the registration process.After entering all these details, candidates will get a registration number and password through which they can login anytime and make changes in IBPS RRB Online Application.For the final submission, fee payment is required.Application Fee for Officer Scale (I, II & III) and Office Assistant – INR 100 for ST/SC/PWD Candidates and INR 600 for all others.The payment can be made by using Debit Cards (RuPay/ Visa/ MasterCard/ Maestro), Credit Cards, Internet Banking, IMPS, Cash Cards/ Mobile Wallets by providing information as asked on the screen.8. Check all the details before you finally submit the form.9. Take a print out of the form for future use.Hope the above information is useful for you!Thankyou!

-

How do I fill out the UPSEAT 2017 application forms?

UPESEAT is a placement test directed by the University of Petroleum and Energy Studies. This inclination examination is called as the University of Petroleum and Energy Studies Engineering Entrance Test (UPESEAT). It is essentially an essential sort examination which permits the possibility to apply for the different designing projects on the web. visit - HOW TO FILL THE UPSEAT 2017 APPLICATION FORMS

Create this form in 5 minutes!

How to create an eSignature for the 2017 schedule r form

How to create an eSignature for your 2017 Schedule R Form online

How to generate an electronic signature for your 2017 Schedule R Form in Chrome

How to make an eSignature for signing the 2017 Schedule R Form in Gmail

How to generate an eSignature for the 2017 Schedule R Form right from your smartphone

How to make an electronic signature for the 2017 Schedule R Form on iOS devices

How to make an electronic signature for the 2017 Schedule R Form on Android

People also ask

-

What is the Schedule R Form and how can it benefit my business?

The Schedule R Form is a tax form used to calculate the credit for elderly or disabled individuals. By utilizing airSlate SignNow, you can easily prepare, eSign, and manage your Schedule R Form digitally, which streamlines your tax filing process and ensures accuracy.

-

How does airSlate SignNow simplify the process of filling out a Schedule R Form?

airSlate SignNow simplifies the Schedule R Form process by providing an intuitive interface that allows users to fill out the form electronically. You can also save your progress, add electronic signatures, and securely share the document with tax professionals, making the entire process more efficient.

-

Is there a cost associated with using airSlate SignNow for the Schedule R Form?

Yes, airSlate SignNow offers affordable pricing plans tailored to different business needs. Each plan includes features designed to make managing documents, including the Schedule R Form, cost-effective and accessible for businesses of all sizes.

-

Can I integrate airSlate SignNow with my existing accounting software for Schedule R Form submissions?

Absolutely! airSlate SignNow offers integrations with various accounting software, which allows for seamless submission of your Schedule R Form. This integration helps you streamline your workflow and reduces the manual effort needed for tax documentation.

-

What features does airSlate SignNow offer for managing the Schedule R Form?

airSlate SignNow provides features such as customizable templates, eSignature capabilities, and document tracking specifically for the Schedule R Form. These tools enhance your document management efficiency and ensure compliance with tax regulations.

-

How secure is my data when using airSlate SignNow for the Schedule R Form?

Data security is a top priority at airSlate SignNow. When handling your Schedule R Form, we utilize advanced encryption and secure cloud storage to protect your sensitive information, ensuring that your documents remain safe and private.

-

Can I access my Schedule R Form from multiple devices with airSlate SignNow?

Yes, airSlate SignNow is designed for flexibility, allowing you to access your Schedule R Form from any device with an internet connection. Whether you’re using a computer, tablet, or smartphone, you can easily manage and eSign your documents on the go.

Get more for Schedule R Form

- College report 206639159 form

- Meridian direct deposit form

- Administration form 100860122

- How to remove a caveat on a property in alberta form

- United states amendments 1 27 amendment i dom of form

- Energy crossword puzzle form

- Music non disclosure agreement template form

- Music producer agreement template form

Find out other Schedule R Form

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist