How to Claim Rental Property on Your Income Tax 2022-2026

Understanding How to Claim Rental Property on Your Income Tax

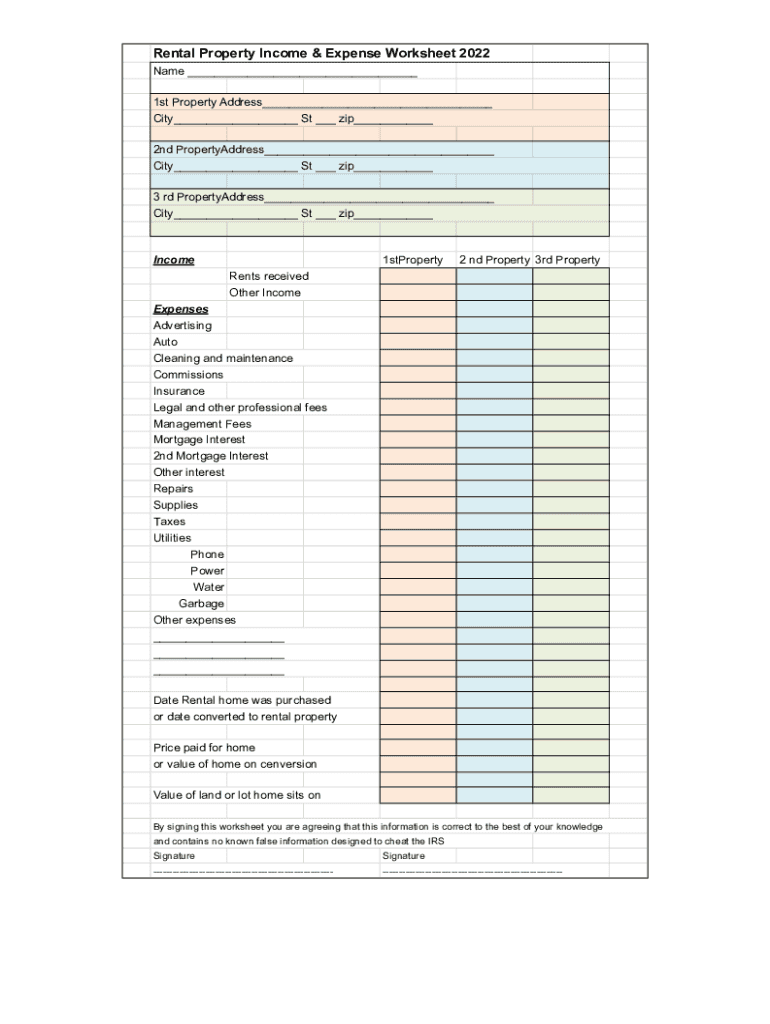

Claiming rental property on your income tax involves reporting the income earned from renting out property and deducting allowable expenses. This process is essential for landlords and property owners to accurately reflect their earnings and comply with tax regulations. The IRS requires specific forms, such as Schedule E, to report rental income and expenses. It is important to understand the types of income that must be reported and the deductions that can be claimed, including mortgage interest, property taxes, repairs, and depreciation.

Steps to Complete the Rental Property Income Tax Worksheet

Completing the income tax worksheet for rental property requires careful attention to detail. Begin by gathering all relevant documents, including rental agreements, receipts for expenses, and records of income received. Next, fill out the worksheet by entering your total rental income. Then, list all deductible expenses, ensuring you categorize them correctly. After calculating your net rental income, transfer this information to your tax return. It is advisable to review the completed worksheet for accuracy before submission.

Required Documents for Claiming Rental Property Income

To claim rental property income on your tax return, you will need several key documents. These include:

- Rental agreements or leases

- Records of rental payments received

- Receipts for expenses related to property maintenance, repairs, and improvements

- Documentation of property taxes and mortgage interest

- Form 1099 if you paid contractors for repairs

Having these documents organized will streamline the process and help ensure compliance with IRS requirements.

IRS Guidelines for Rental Property Reporting

The IRS provides specific guidelines for reporting rental property income and expenses. According to IRS regulations, landlords must report all rental income received, including advance rent and security deposits. Additionally, the IRS allows various deductions, but it is crucial to differentiate between personal and rental use of the property. Familiarizing yourself with IRS Publication 527 can provide further insights into allowable deductions and the overall reporting process.

Filing Deadlines and Important Dates

Understanding filing deadlines is essential for landlords to avoid penalties. Typically, individual tax returns are due on April 15 each year. If you require additional time, you can file for an extension, which gives you until October 15 to submit your return. However, any taxes owed must still be paid by the original deadline to avoid interest and penalties. Keeping track of these dates is vital for maintaining compliance with tax obligations.

Penalties for Non-Compliance with Rental Income Reporting

Failing to report rental income or incorrectly claiming deductions can result in significant penalties from the IRS. Common penalties include fines for underreporting income and interest on unpaid taxes. In severe cases, the IRS may impose additional penalties for fraud or negligence. It is crucial to maintain accurate records and ensure that all income and expenses are reported correctly to avoid these consequences.

Quick guide on how to complete how to claim rental property on your income tax

Complete How To Claim Rental Property On Your Income Tax with ease on any device

Managing documents online has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to acquire the necessary forms and securely store them online. airSlate SignNow provides all the tools you need to create, edit, and eSign your documents quickly and without delays. Handle How To Claim Rental Property On Your Income Tax on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related operation today.

How to edit and eSign How To Claim Rental Property On Your Income Tax effortlessly

- Locate How To Claim Rental Property On Your Income Tax and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or mask sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and then click the Done button to save your changes.

- Choose how you want to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, and mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and eSign How To Claim Rental Property On Your Income Tax and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct how to claim rental property on your income tax

Create this form in 5 minutes!

How to create an eSignature for the how to claim rental property on your income tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an income tax worksheet PDF?

An income tax worksheet PDF is a form used to organize and calculate your income tax details before filing. It helps you keep track of deductions, credits, and other essential financial data. Using an income tax worksheet PDF can streamline the tax preparation process signNowly.

-

How can airSlate SignNow help with an income tax worksheet PDF?

AirSlate SignNow allows you to securely eSign your income tax worksheet PDF, making the submission process easier and more efficient. With our platform, you can upload, sign, and share your tax documents seamlessly. This ensures that your income tax worksheet PDF is handled digitally, saving time and resources.

-

Are there any costs associated with using airSlate SignNow for income tax worksheet PDFs?

AirSlate SignNow offers various pricing plans, including a free trial, allowing you to use the benefits for your income tax worksheet PDF at no initial cost. Once you see how our platform can enhance your document management, you can choose a plan that fits your needs. Our competitive pricing ensures you get great value for your money.

-

What features does airSlate SignNow offer for managing income tax worksheet PDFs?

AirSlate SignNow offers features like document templates, secure eSigning, and customizable workflows that cater to income tax worksheet PDFs. You can create templates for your tax documents, making future filings faster and easier. Additionally, our platform ensures data security and compliance with relevant regulations.

-

Can I integrate airSlate SignNow with other applications for my income tax worksheet PDF?

Yes, airSlate SignNow offers integration with various popular applications, which can enhance the management of your income tax worksheet PDF. Connect with platforms like Google Drive, Dropbox, and more to facilitate easy document access and sharing. This integration streamlines your workflow, making tax preparation more efficient.

-

Is airSlate SignNow user-friendly for generating income tax worksheet PDFs?

Absolutely! AirSlate SignNow is designed to be intuitive, allowing users of all skill levels to easily create and manage income tax worksheet PDFs. The platform features straightforward navigation and helpful support resources, ensuring a smooth experience for your eSigning and document management needs.

-

What are the benefits of using airSlate SignNow for income tax worksheet PDFs?

Using airSlate SignNow for your income tax worksheet PDFs comes with numerous benefits, including enhanced security for your documents, faster turnaround times, and reduced paperwork. Our digital solution eliminates the hassles associated with traditional methods, allowing you to focus on more critical tax-related tasks. Furthermore, the electronic trail of actions taken on your documents provides peace of mind regarding compliance.

Get more for How To Claim Rental Property On Your Income Tax

- Forms division of federal employees compensation dfec office

- Omb no 21260013 2018 2019 form

- Omb no 21260013 2016 form

- Ttb f 2015 2019 form

- Dd form 2860 2011 2019

- This report and the summary report table are to be completed by the applicant when submitting a 510k that references a national form

- Alaska form 6020 2014 2019

- Rmt tax return ver02 ao2016 66 prep4nonfillablepdf form

Find out other How To Claim Rental Property On Your Income Tax

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online

- eSign Delaware Healthcare / Medical Living Will Now

- eSign Healthcare / Medical Form Florida Secure

- eSign Florida Healthcare / Medical Contract Safe

- Help Me With eSign Hawaii Healthcare / Medical Lease Termination Letter

- eSign Alaska High Tech Warranty Deed Computer

- eSign Alaska High Tech Lease Template Myself

- eSign Colorado High Tech Claim Computer

- eSign Idaho Healthcare / Medical Residential Lease Agreement Simple

- eSign Idaho Healthcare / Medical Arbitration Agreement Later

- How To eSign Colorado High Tech Forbearance Agreement