Rental Income and Expense Worksheet PDF 2019

What is the income and expense worksheet pdf?

The income and expense worksheet pdf is a financial document designed to help individuals and businesses track their income and expenses over a specific period. This worksheet serves as a valuable tool for budgeting, tax preparation, and financial analysis. By organizing financial data in a structured format, users can easily identify spending patterns, assess profitability, and make informed financial decisions.

How to use the income and expense worksheet pdf

Using the income and expense worksheet pdf involves several straightforward steps. First, download the form from a reliable source. Next, fill in your income sources, such as wages, rental income, or business revenue, in the designated sections. Then, list all your expenses, including fixed costs like rent or mortgage, and variable expenses like groceries and entertainment. After completing the form, review the totals to understand your financial situation better. This process can help you identify areas for potential savings or adjustments in your spending habits.

Key elements of the income and expense worksheet pdf

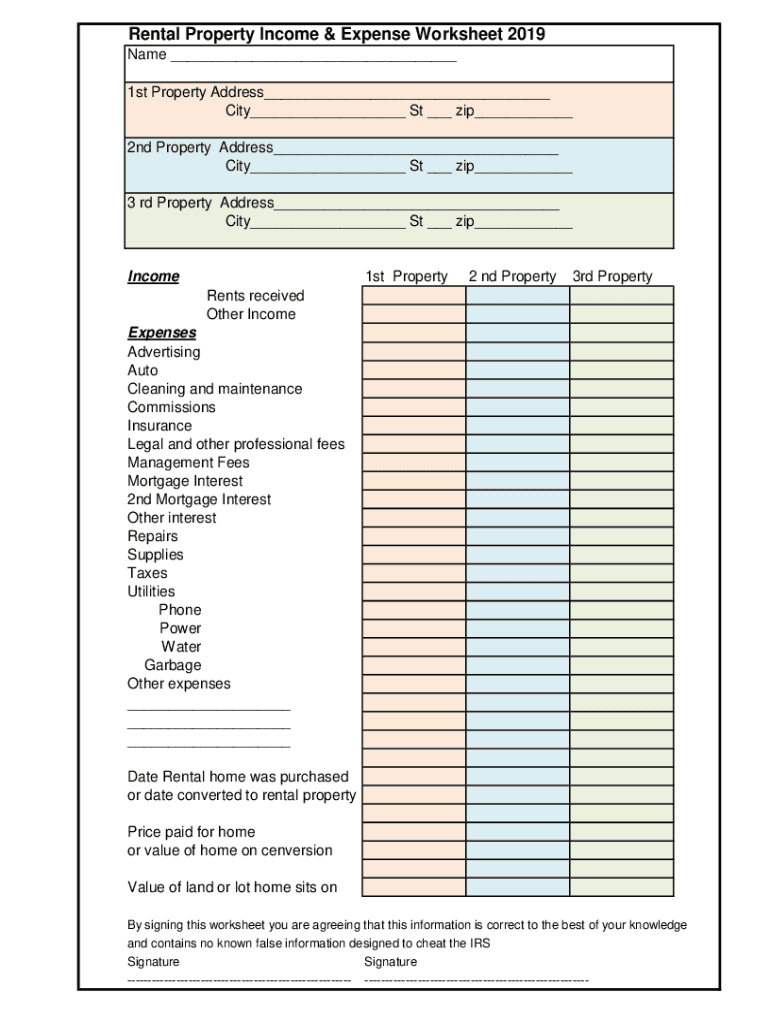

The income and expense worksheet pdf typically includes several key components. These include:

- Income Section: A space to record various sources of income.

- Expense Categories: Sections for different types of expenses, such as housing, transportation, and utilities.

- Total Income and Expenses: Calculations that summarize your financial situation.

- Net Income: A line to show the difference between total income and total expenses.

These elements work together to provide a comprehensive overview of financial health.

Steps to complete the income and expense worksheet pdf

Completing the income and expense worksheet pdf involves a series of methodical steps:

- Download the worksheet from a trusted source.

- Enter your income information in the appropriate fields.

- List all your monthly expenses, categorizing them for clarity.

- Calculate your total income and total expenses.

- Determine your net income by subtracting total expenses from total income.

- Review the completed worksheet for accuracy.

Following these steps ensures that you have an accurate representation of your financial status.

Legal use of the income and expense worksheet pdf

The income and expense worksheet pdf can be used for various legal and financial purposes. It is especially useful for tax preparation, as it provides a clear record of income and expenses that can be submitted to the IRS. Additionally, this worksheet can support loan applications, budgeting processes, and financial planning. To ensure its legal validity, it is essential to maintain accurate records and retain copies of any supporting documents.

Examples of using the income and expense worksheet pdf

There are numerous scenarios where the income and expense worksheet pdf can be beneficial. For instance:

- A freelancer can use the worksheet to track income from various clients and expenses related to their business.

- A landlord may utilize the worksheet to manage rental income and associated property expenses.

- A family can employ the worksheet to create a household budget, helping them allocate funds for savings and discretionary spending.

These examples illustrate the versatility of the income and expense worksheet pdf in different financial contexts.

Quick guide on how to complete rental income and expense worksheet pdf

Complete Rental Income And Expense Worksheet Pdf effortlessly on any gadget

Digital document management has become favored by companies and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can locate the appropriate form and securely preserve it online. airSlate SignNow provides all the resources you need to generate, modify, and eSign your documents swiftly without holdups. Handle Rental Income And Expense Worksheet Pdf on any gadget using airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

The easiest method to modify and eSign Rental Income And Expense Worksheet Pdf with minimal effort

- Obtain Rental Income And Expense Worksheet Pdf and click on Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature with the Sign tool, which takes moments and holds the same legal validity as a traditional handwritten signature.

- Verify the information and click on the Done button to save your modifications.

- Choose how you wish to submit your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow manages all your needs in document administration in just a few clicks from a device of your choice. Modify and eSign Rental Income And Expense Worksheet Pdf and ensure effective communication at any point of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct rental income and expense worksheet pdf

Create this form in 5 minutes!

How to create an eSignature for the rental income and expense worksheet pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an income and expense worksheet pdf?

An income and expense worksheet pdf is a document designed to help individuals and businesses track their income and expenditure efficiently. It provides a structured format for recording financial data, helping users make informed budgeting decisions.

-

How can airSlate SignNow help with my income and expense worksheet pdf?

airSlate SignNow streamlines the process of managing your income and expense worksheet pdf by allowing you to send, sign, and store the document all in one place. This ensures you can easily organize your finances and make adjustments as necessary.

-

Is there a cost associated with using airSlate SignNow for my income and expense worksheet pdf?

Yes, airSlate SignNow offers cost-effective pricing plans that cater to different business needs. Depending on the plan you choose, you can access features tailored to managing your income and expense worksheet pdf seamlessly.

-

What features does airSlate SignNow offer for managing an income and expense worksheet pdf?

airSlate SignNow includes features such as document editing, eSigning, and secure cloud storage, specifically designed to optimize your income and expense worksheet pdf. These tools enhance collaboration and make it easy to keep track of changes.

-

Can I integrate airSlate SignNow with other accounting software for my income and expense worksheet pdf?

Absolutely! airSlate SignNow integrates with a variety of accounting solutions, allowing you to link your income and expense worksheet pdf directly with your existing financial tools. This streamlines your workflow and helps maintain accurate financial records.

-

What are the benefits of using airSlate SignNow for my income and expense worksheet pdf?

Using airSlate SignNow for your income and expense worksheet pdf offers numerous benefits, including easy document sharing, convenient eSigning options, and reduced paperwork. It helps you manage your finances more effectively and efficiently.

-

How secure is my income and expense worksheet pdf when using airSlate SignNow?

airSlate SignNow prioritizes your security by employing advanced encryption and compliance measures. This ensures that your income and expense worksheet pdf and sensitive data remain protected throughout the entire signing and storage process.

Get more for Rental Income And Expense Worksheet Pdf

- Parkeerverbod aanvragen aalst form

- Non collusion certificate form

- Application for leave genl 59 form

- Cross curricular reading comprehension worksheets d 7 of 36 form

- Mnimpreso de autorizacin de empadronamiento v 1 0 doc palmademallorca form

- Fep blue tier exception form

- Alarm monitoring agreement template 787739022 form

- Aircraft purchase agreement template form

Find out other Rental Income And Expense Worksheet Pdf

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself