TAX RETURN 2023

What is the TAX RETURN

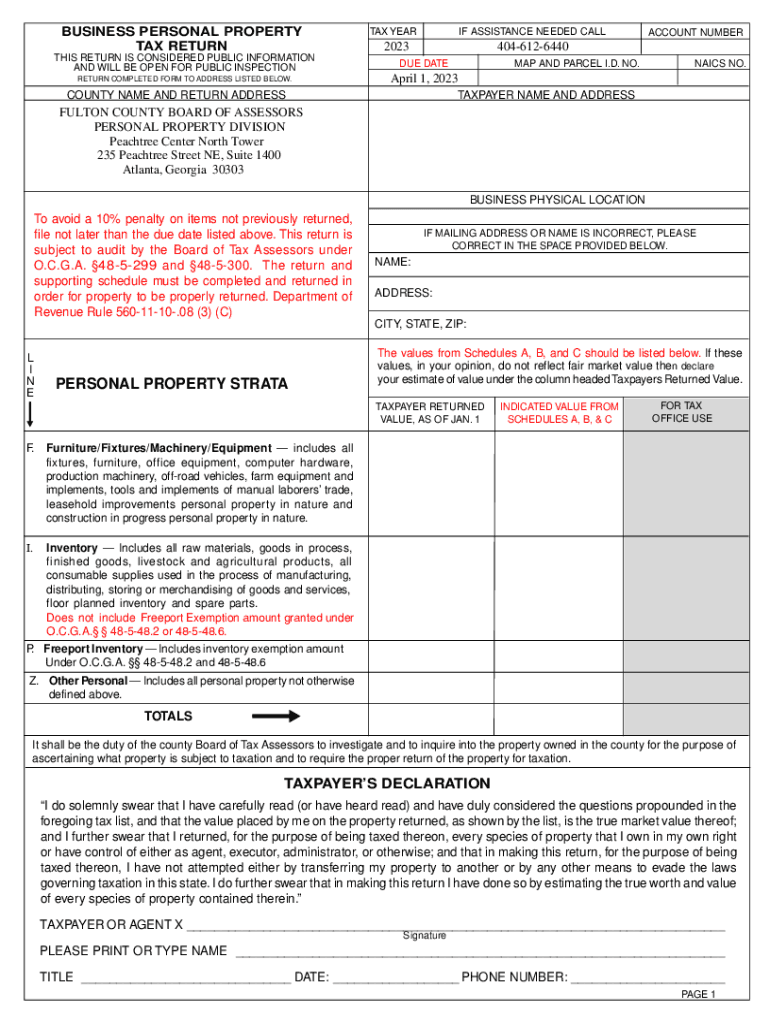

A tax return is a formal document that individuals and businesses in the United States submit to the Internal Revenue Service (IRS) to report income, expenses, and other relevant financial information. This document is crucial for determining tax liability, which is the amount of tax owed to the government. The tax return includes various forms, such as the 1040 for individuals and the 1120 for corporations, and it must be filed annually. Each return provides a comprehensive overview of the taxpayer's financial situation for the year, allowing the IRS to assess whether the correct amount of tax has been paid.

Steps to complete the TAX RETURN

Completing a tax return involves several critical steps to ensure accuracy and compliance with IRS regulations. First, gather all necessary financial documents, including W-2s, 1099s, and receipts for deductions. Next, choose the appropriate tax form based on your filing status and income level. After selecting the form, fill it out carefully, ensuring that all information is accurate and complete. Once the form is filled, review it for any errors, and then submit it either electronically or by mail. Finally, keep a copy of the submitted return and any supporting documents for your records.

Required Documents

To successfully file a tax return, certain documents are essential. These typically include:

- W-2 forms from employers, detailing annual wages and withheld taxes.

- 1099 forms for any freelance or contract work, reporting income received.

- Receipts for deductible expenses, such as medical costs or charitable contributions.

- Proof of identity, such as a Social Security number or Individual Taxpayer Identification Number (ITIN).

- Last year's tax return for reference and comparison.

Filing Deadlines / Important Dates

Taxpayers should be aware of critical deadlines associated with filing tax returns. The standard deadline for individual tax returns is April 15 each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, taxpayers can file for an extension, which typically allows an extra six months to submit the return, but any taxes owed must still be paid by the original deadline to avoid penalties and interest.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting tax returns. These guidelines include instructions on which forms to use, how to report income, and what deductions are allowable. Taxpayers are encouraged to review the IRS publications relevant to their tax situation, as these documents offer detailed information on compliance and best practices. Following these guidelines helps ensure that returns are filed correctly and minimizes the risk of audits or penalties.

Penalties for Non-Compliance

Failing to file a tax return or submitting inaccurate information can result in significant penalties. The IRS may impose fines for late filings, which can accumulate over time. Additionally, taxpayers who underreport their income or claim ineligible deductions may face further financial repercussions, including interest on unpaid taxes and potential legal action. It is essential for individuals and businesses to comply with tax laws to avoid these consequences.

Quick guide on how to complete tax return 660794894

Prepare TAX RETURN effortlessly on any device

Digital document management has gained traction with businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as it allows you to retrieve the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and eSign your documents quickly without delays. Manage TAX RETURN on any system using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The simplest way to alter and eSign TAX RETURN with ease

- Find TAX RETURN and then click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), an invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and eSign TAX RETURN and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax return 660794894

Create this form in 5 minutes!

How to create an eSignature for the tax return 660794894

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Tax Return eSigning in airSlate SignNow?

Tax Return eSigning in airSlate SignNow allows users to digitally sign tax documents securely and efficiently. This feature streamlines the submission of your TAX RETURN by eliminating the need for paper forms and manual signatures. It enhances the speed of processing and ensures compliance with legal standards for electronic signatures.

-

How does airSlate SignNow ensure the security of my Tax Return documents?

airSlate SignNow prioritizes the security of your TAX RETURN documents through advanced encryption and secure cloud storage. All documents are protected by industry-standard protocols which safeguard sensitive information from unauthorized access. Additionally, robust user authentication methods make sure that only authorized personnel can access your TAX RETURN files.

-

Is airSlate SignNow a cost-effective solution for eSigning Tax Returns?

Yes, airSlate SignNow offers competitive pricing plans tailored to fit various business needs, making it a cost-effective solution for eSigning TAX RETURN documents. By reducing paper usage and streamlining workflows, businesses can also save additional resources and time. You can choose from different subscription options based on your volume of document signing.

-

What features does airSlate SignNow offer for Tax Return processing?

airSlate SignNow provides robust features for processing TAX RETURN documents, including customizable templates, in-app chat for collaboration, and automated reminders for signers. The platform also supports mobile signing, ensuring that users can sign their TAX RETURN documents on the go. These features contribute to a more efficient and user-friendly experience.

-

Can I integrate airSlate SignNow with other tax software?

Yes, airSlate SignNow integrates seamlessly with popular tax software and accounting tools. This integration allows users to streamline the process of sending and signing TAX RETURN documents directly from their preferred applications. By linking these systems, you enhance productivity and minimize manual data entry errors.

-

What are the benefits of using airSlate SignNow for my TAX RETURN needs?

Using airSlate SignNow for your TAX RETURN needs offers numerous benefits, including faster document turnaround times and reduced paperwork. The electronic signature process enhances the accuracy and reliability of your submissions. Additionally, the user-friendly interface makes it easy for anyone to learn and implement, regardless of technical expertise.

-

How do I get started with airSlate SignNow for my Tax Return eSigning?

Getting started with airSlate SignNow for your TAX RETURN eSigning is quick and easy. First, sign up for an account on our website, then you can upload your tax documents and create signature fields. The onboarding process is straightforward, guiding you through setting up your first eSignature workflow for your TAX RETURN.

Get more for TAX RETURN

- Introduction to itpricecom router switchcom form

- Prom guest reg wayzata public schools form

- Download an account application solutions federal credit union solutionscu form

- Hertz giving application form

- Fairfield county municipal court juror information sheet fcmcourt

- Remicader bif form

- Classroom collection order request form

- Adopt 215 formfill out printable pdf forms online

Find out other TAX RETURN

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast