FP 31 Personal Property Tax Return Fill in Version 2016

What is the FP 31 Personal Property Tax Return Fill in Version

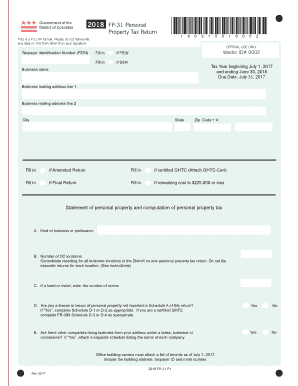

The FP 31 Personal Property Tax Return Fill in Version is a specific tax form used by individuals and businesses in the United States to report personal property for taxation purposes. This form is essential for accurately assessing the value of personal property owned, which may include vehicles, equipment, and other tangible assets. By completing this form, taxpayers provide necessary information to their local tax authority, ensuring compliance with state and local tax regulations.

How to use the FP 31 Personal Property Tax Return Fill in Version

Using the FP 31 Personal Property Tax Return Fill in Version involves several straightforward steps. First, gather all relevant information regarding your personal property, including descriptions, values, and acquisition dates. Next, access the fillable version of the form, which allows for easy entry of data. Carefully input the required information in the designated fields, ensuring accuracy to avoid potential issues. Once completed, review the form for any errors before submitting it to the appropriate tax authority.

Steps to complete the FP 31 Personal Property Tax Return Fill in Version

Completing the FP 31 Personal Property Tax Return Fill in Version requires a systematic approach:

- Collect documentation related to your personal property, such as purchase receipts and valuation statements.

- Obtain the latest fillable version of the FP 31 form from your local tax authority or authorized website.

- Fill in the form with accurate details about each piece of personal property, including its type, value, and location.

- Double-check all entries for completeness and correctness.

- Submit the completed form by the specified deadline, either online, by mail, or in person, depending on local regulations.

Key elements of the FP 31 Personal Property Tax Return Fill in Version

Several key elements are crucial when filling out the FP 31 Personal Property Tax Return Fill in Version. These include:

- Taxpayer Information: This section requires personal identification details, such as name, address, and taxpayer identification number.

- Property Description: Clearly describe each item of personal property, including its type and purpose.

- Valuation: Provide the fair market value of each property item, which is essential for tax assessment.

- Signature: The form must be signed to certify that the information provided is accurate and complete.

Filing Deadlines / Important Dates

Filing deadlines for the FP 31 Personal Property Tax Return Fill in Version vary by state and local jurisdiction. Typically, taxpayers are required to submit their forms annually, with deadlines often falling on specific dates, such as April 15 or May 15. It is important to check with your local tax authority for the exact deadlines applicable to your area to avoid any penalties for late submission.

Form Submission Methods (Online / Mail / In-Person)

The FP 31 Personal Property Tax Return Fill in Version can be submitted through various methods, depending on local regulations. Common submission methods include:

- Online Submission: Many jurisdictions offer an online portal for electronic filing, allowing for quick and efficient submission.

- Mail: Completed forms can be printed and mailed to the appropriate tax authority, ensuring that they are sent well before the deadline.

- In-Person: Taxpayers may also have the option to deliver their forms in person at designated tax offices.

Quick guide on how to complete fp 31 personal property tax return fill in version

Effortlessly Prepare FP 31 Personal Property Tax Return Fill in Version on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, enabling you to easily find the necessary form and securely save it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents swiftly and without hold-ups. Manage FP 31 Personal Property Tax Return Fill in Version from any device using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

How to Edit and eSign FP 31 Personal Property Tax Return Fill in Version with Ease

- Find FP 31 Personal Property Tax Return Fill in Version and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method to send your form—via email, SMS, or invite link—or download it to your computer.

Say goodbye to lost or misplaced files, tedious form navigation, and mistakes that necessitate printing new document copies. airSlate SignNow simplifies all your document management needs in just a few clicks from your chosen device. Edit and eSign FP 31 Personal Property Tax Return Fill in Version and ensure excellent communication throughout your form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fp 31 personal property tax return fill in version

Create this form in 5 minutes!

How to create an eSignature for the fp 31 personal property tax return fill in version

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the FP 31 Personal Property Tax Return Fill in Version?

The FP 31 Personal Property Tax Return Fill in Version is a user-friendly tool designed to simplify the process of preparing and submitting personal property tax returns. It allows individuals and businesses to complete their forms accurately, ensuring compliance with local tax regulations.

-

How can I access the FP 31 Personal Property Tax Return Fill in Version?

You can easily access the FP 31 Personal Property Tax Return Fill in Version through our website. After registering for an account, you will have immediate access to the fillable form, enabling you to start your tax return process right away.

-

Is there a cost associated with the FP 31 Personal Property Tax Return Fill in Version?

Yes, there is a nominal fee to use the FP 31 Personal Property Tax Return Fill in Version, which is a cost-effective solution compared to hiring a professional. This fee grants you full access to our features, ensuring a smooth and efficient tax return process.

-

What features are included in the FP 31 Personal Property Tax Return Fill in Version?

The FP 31 Personal Property Tax Return Fill in Version includes various features such as easy form filling, error detection, and the ability to save and edit your return. Additionally, our solution allows you to eSign documents securely, streamlining your tax submission experience.

-

How does the FP 31 Personal Property Tax Return Fill in Version benefit users?

Using the FP 31 Personal Property Tax Return Fill in Version benefits users by simplifying the tax filing process. It reduces the risk of errors, saves time with easy form navigation, and ensures all necessary information is included before submission.

-

Can I integrate the FP 31 Personal Property Tax Return Fill in Version with other software?

Yes, the FP 31 Personal Property Tax Return Fill in Version can be integrated with various accounting and tax software. This seamless integration allows for a more streamlined workflow and ensures that your financial information is consistent and accurate.

-

Is customer support available for the FP 31 Personal Property Tax Return Fill in Version?

Absolutely! We provide comprehensive customer support for users of the FP 31 Personal Property Tax Return Fill in Version. Our dedicated team is available to assist with any questions or issues you may encounter during the tax filing process.

Get more for FP 31 Personal Property Tax Return Fill in Version

Find out other FP 31 Personal Property Tax Return Fill in Version

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast