Income Tax Payroll Office Illinois State University Form

Understanding the Income Tax Payroll Office at Illinois State University

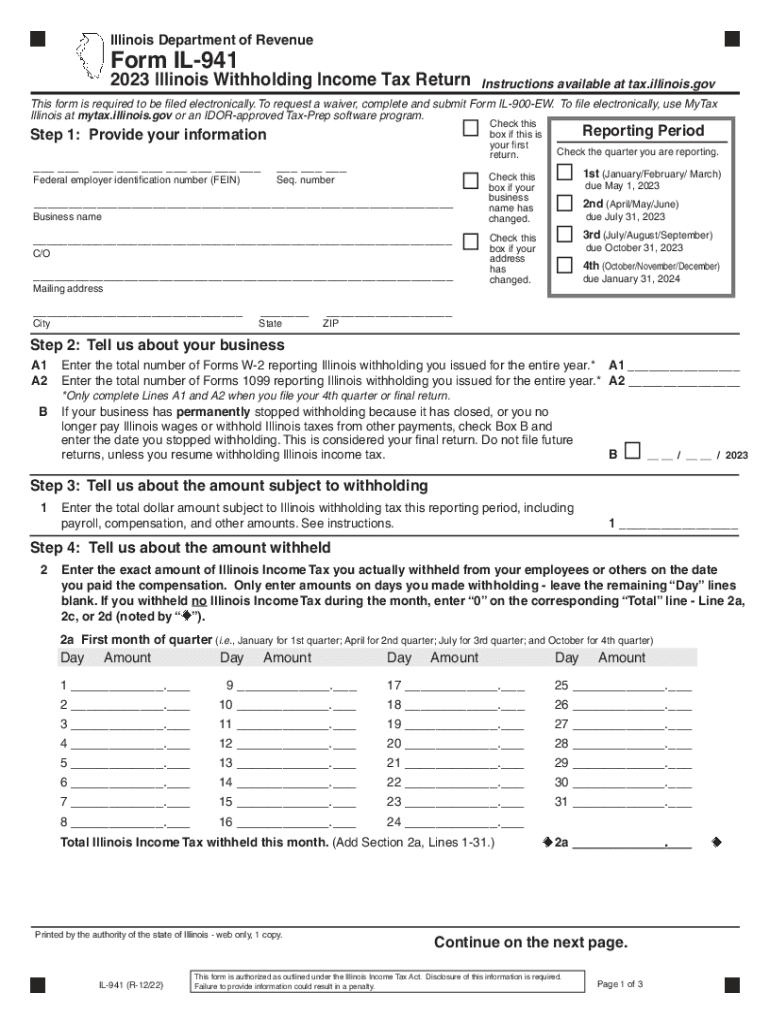

The Income Tax Payroll Office at Illinois State University serves as a crucial resource for managing tax-related matters for employees. This office is responsible for ensuring compliance with federal and state tax regulations, including the withholding of income taxes from employee paychecks. It provides guidance on various forms, including the IL withholding income tax form, and helps employees understand their tax obligations. The office also plays a role in educating staff about tax benefits and deductions applicable to their specific situations.

Steps to Utilize the Income Tax Payroll Office

To effectively use the Income Tax Payroll Office, employees should follow these steps:

- Gather necessary documentation, such as W-2 forms and previous tax returns.

- Schedule an appointment with a payroll specialist to discuss specific tax questions or concerns.

- Complete any required forms, including the IL withholding income tax form, accurately and promptly.

- Submit forms either online or in person, as directed by the office.

- Keep records of all submissions and communications with the office for future reference.

Required Documents for Tax Processing

When engaging with the Income Tax Payroll Office, certain documents are essential for efficient processing:

- W-2 forms from previous employers, if applicable.

- Current pay stubs to verify income and withholding amounts.

- Completed IL withholding income tax form.

- Any relevant documentation regarding deductions or credits that may apply.

Filing Deadlines and Important Dates

Staying informed about filing deadlines is vital to avoid penalties. Key dates include:

- January 31: Deadline for employers to provide W-2 forms to employees.

- April 15: Standard deadline for filing federal and state income tax returns.

- Quarterly deadlines for estimated tax payments, typically on April 15, June 15, September 15, and January 15 of the following year.

Legal Use of the Income Tax Payroll Office

The Income Tax Payroll Office operates within the legal framework established by federal and state tax laws. This includes adherence to the Internal Revenue Service (IRS) guidelines and Illinois state tax regulations. Employees are encouraged to consult with the office to ensure compliance and to understand their rights and responsibilities regarding tax withholding and reporting.

Penalties for Non-Compliance

Failure to comply with tax regulations can lead to significant penalties. These may include:

- Fines for late filing or underpayment of taxes.

- Interest accrual on unpaid tax balances.

- Potential legal action for persistent non-compliance.

Examples of Utilizing the Income Tax Payroll Office

Employees often engage with the Income Tax Payroll Office for various reasons, such as:

- Clarifying tax withholding amounts on paychecks.

- Seeking assistance with the completion of the IL 941 form for quarterly tax filings.

- Understanding eligibility for tax credits or deductions related to education or dependent care.

Quick guide on how to complete income tax payroll office illinois state university

Complete Income Tax Payroll Office Illinois State University effortlessly on any device

Online document management has become increasingly favored by businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can obtain the correct format and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents quickly without delays. Manage Income Tax Payroll Office Illinois State University on any platform using the airSlate SignNow Android or iOS applications and simplify any document-centric task today.

How to edit and eSign Income Tax Payroll Office Illinois State University effortlessly

- Obtain Income Tax Payroll Office Illinois State University and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method of sending your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Income Tax Payroll Office Illinois State University and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the income tax payroll office illinois state university

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it work?

airSlate SignNow is an eSignature solution that allows users to send and sign documents online. Its intuitive interface makes it easy for businesses to streamline their document workflows. With features like templates and mobile access, airSlate SignNow ensures you can manage your documents efficiently and securely.

-

How much does airSlate SignNow cost?

Pricing for airSlate SignNow is designed to be cost-effective, accommodating various business sizes and needs. Plans start at an affordable monthly rate, ensuring that your business can access premium eSigning features without breaking the budget. Additionally, you can benefit from a free trial to evaluate its capabilities.

-

What features does airSlate SignNow offer?

airSlate SignNow provides a range of features including document templates, custom branding, and in-person signing. These tools make it easier to create, send, and manage documents efficiently. The platform is designed to enhance your workflow and ensure that all signed documents are legally binding.

-

Can airSlate SignNow integrate with other software?

Yes, airSlate SignNow seamlessly integrates with popular software like Google Drive, Salesforce, and Zapier. This integration capability allows for enhanced functionality without disrupting your workflow. By connecting your existing tools, you can optimize document management processes across your organization.

-

Is airSlate SignNow secure for my documents?

Security is a top priority for airSlate SignNow; it employs strong encryption and compliance with industry standards to protect your documents. The platform ensures that all eSignatures are legally binding and can be verified. You can trust that your sensitive information remains secure throughout the signing process.

-

What are the benefits of using airSlate SignNow?

Using airSlate SignNow offers numerous benefits, including improved efficiency, reduced turnaround times for documents, and enhanced customer satisfaction. Its user-friendly interface allows teams to manage documents easily, while the cost-effectiveness makes it a valuable asset for businesses of all sizes. This helps in optimizing workflows and reducing operational costs.

-

Is there a mobile app for airSlate SignNow?

Yes, airSlate SignNow offers a mobile app that allows you to manage document signing on the go. This app ensures you can send, sign, and track documents from anywhere, enhancing flexibility and responsiveness. It is particularly useful for businesses that require mobility and quick access to important documents.

Get more for Income Tax Payroll Office Illinois State University

Find out other Income Tax Payroll Office Illinois State University

- How To eSign Illinois Rental application

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free

- eSign Colorado Real estate investment proposal template Simple

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now