California Schedule 1067B Group Nonresident Return Payment Transfer Request California Schedule 1067B Group Nonresident Return P Form

Understanding the California Schedule 1067B Group Nonresident Return Payment Transfer Request

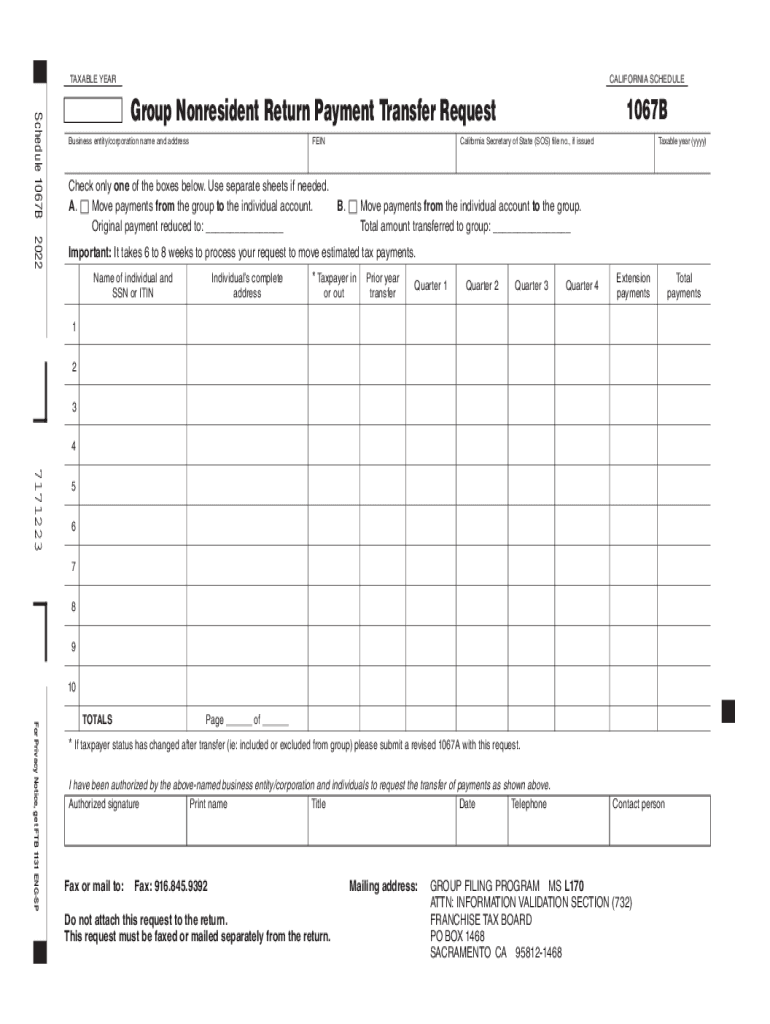

The California Schedule 1067B is a form specifically designed for nonresidents who are part of a group filing their tax returns. This form allows individuals to request the transfer of payments made on behalf of the group. It is essential for ensuring that all members of the group receive appropriate credit for any taxes paid, which can affect individual tax liabilities. Understanding its purpose is crucial for nonresidents who want to accurately report their income and taxes to the state of California.

Steps to Complete the California Schedule 1067B

Completing the California Schedule 1067B involves several key steps:

- Gather necessary information, including personal identification details and payment amounts.

- Ensure all group members are accounted for and have provided their consent for the transfer request.

- Fill out the form accurately, ensuring that all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form according to the specified submission methods, either online or via mail.

Obtaining the California Schedule 1067B

The California Schedule 1067B can be obtained through the California Department of Tax and Fee Administration (CDTFA) website. It is available for download in a printable format. Additionally, tax professionals may provide access to this form as part of their services. Ensure that you are using the most current version to avoid complications during the filing process.

Legal Use of the California Schedule 1067B

The legal use of the California Schedule 1067B is governed by California tax laws. This form is intended for nonresidents who are part of a group filing, ensuring compliance with state regulations. It is important to use this form correctly to avoid potential penalties or issues with the California tax authorities. Consulting with a tax professional can help clarify any legal concerns regarding its use.

Key Elements of the California Schedule 1067B

Key elements of the California Schedule 1067B include:

- Identification of all group members and their respective taxpayer identification numbers.

- Details of the payment amounts being transferred.

- Signature of the authorized representative of the group, confirming the accuracy of the information provided.

- Clear instructions for submission, including deadlines and acceptable methods.

Filing Deadlines for the California Schedule 1067B

Filing deadlines for the California Schedule 1067B align with the general tax filing deadlines for California. Typically, this means the form should be submitted by April 15 of the tax year. However, extensions may be available under certain circumstances. It is crucial to stay informed about any changes to deadlines to ensure timely submission and avoid penalties.

Quick guide on how to complete california schedule 1067b group nonresident return payment transfer request california schedule 1067b group nonresident return

Prepare California Schedule 1067B Group Nonresident Return Payment Transfer Request California Schedule 1067B Group Nonresident Return P effortlessly on any device

Digital document management has become prominent among businesses and individuals. It offers an ideal environmentally friendly substitute to traditional printed and signed paperwork, as you can locate the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle California Schedule 1067B Group Nonresident Return Payment Transfer Request California Schedule 1067B Group Nonresident Return P on any device with airSlate SignNow's Android or iOS applications and simplify any document-oriented tasks today.

The easiest way to alter and eSign California Schedule 1067B Group Nonresident Return Payment Transfer Request California Schedule 1067B Group Nonresident Return P stress-free

- Locate California Schedule 1067B Group Nonresident Return Payment Transfer Request California Schedule 1067B Group Nonresident Return P and then click Get Form to begin.

- Use the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you would like to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Alter and eSign California Schedule 1067B Group Nonresident Return Payment Transfer Request California Schedule 1067B Group Nonresident Return P and guarantee effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the california schedule 1067b group nonresident return payment transfer request california schedule 1067b group nonresident return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2022 CA transfer process?

The 2022 CA transfer process involves transferring ownership of assets or property within California while ensuring compliance with state regulations. Using airSlate SignNow, you can streamline this process by electronically signing and managing your documents efficiently. This ensures that you save time while adhering to the legal requirements for the 2022 CA transfer.

-

How much does airSlate SignNow cost for the 2022 CA transfer?

airSlate SignNow offers competitive pricing plans tailored to fit various business needs. For the 2022 CA transfer, you can choose from our different subscription options which provide access to features specifically designed to simplify the signing process. This cost-effective solution helps you manage your document workflows without exceeding your budget.

-

What features does airSlate SignNow offer for 2022 CA transfer?

airSlate SignNow includes features that are crucial for the 2022 CA transfer, such as template creation, bulk sending, and real-time tracking of document status. Additionally, we provide customizable workflows that enhance efficiency and ensure compliance. These features allow you to handle your document processes with ease and speed.

-

Can airSlate SignNow help with compliance for the 2022 CA transfer?

Yes, airSlate SignNow is designed to help you maintain compliance during the 2022 CA transfer. With eSignature technology that adheres to California's legal standards, our platform ensures that all digital signatures are legally binding. This compliance support is essential for any business engaging in high-stakes transactions.

-

Are there any integrations available for the 2022 CA transfer?

Absolutely! airSlate SignNow integrates seamlessly with various applications that can enhance your workflow for the 2022 CA transfer. From CRM systems to file storage services, our integrations ensure that you can manage your documents wherever you need, improving accessibility and efficiency.

-

What are the benefits of using airSlate SignNow for the 2022 CA transfer?

Using airSlate SignNow for the 2022 CA transfer provides numerous benefits, including increased efficiency, reduced paperwork, and improved document security. Our platform reduces the time spent on manual processes and gives you real-time updates on document progress. This advancement ultimately contributes to a smoother and faster transfer experience.

-

Is training available for using airSlate SignNow for the 2022 CA transfer?

Yes, airSlate SignNow provides comprehensive training resources to help users understand how to manage the 2022 CA transfer efficiently. We offer tutorials, webinars, and customer support to ensure you are well-equipped to leverage the full capabilities of our platform. This commitment to user education enhances your experience and maximizes your workflow.

Get more for California Schedule 1067B Group Nonresident Return Payment Transfer Request California Schedule 1067B Group Nonresident Return P

- Tax law article 1 section 37 article 9 a section 210 b form

- Quotinstructionsform mt 50beerfermented malt beveragesschedule aschedule bschedule cschedule dform mt 50form mt 51form mt 52

- Dtf 70 form online ny 2011

- Dtf 70 2014 2019 form

- Mt 50 2018 2019 form

- Mt 50 2014 form

- It 213 instructions 2018 2019 form

- It 213 instructions 2017 2019 form

Find out other California Schedule 1067B Group Nonresident Return Payment Transfer Request California Schedule 1067B Group Nonresident Return P

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation