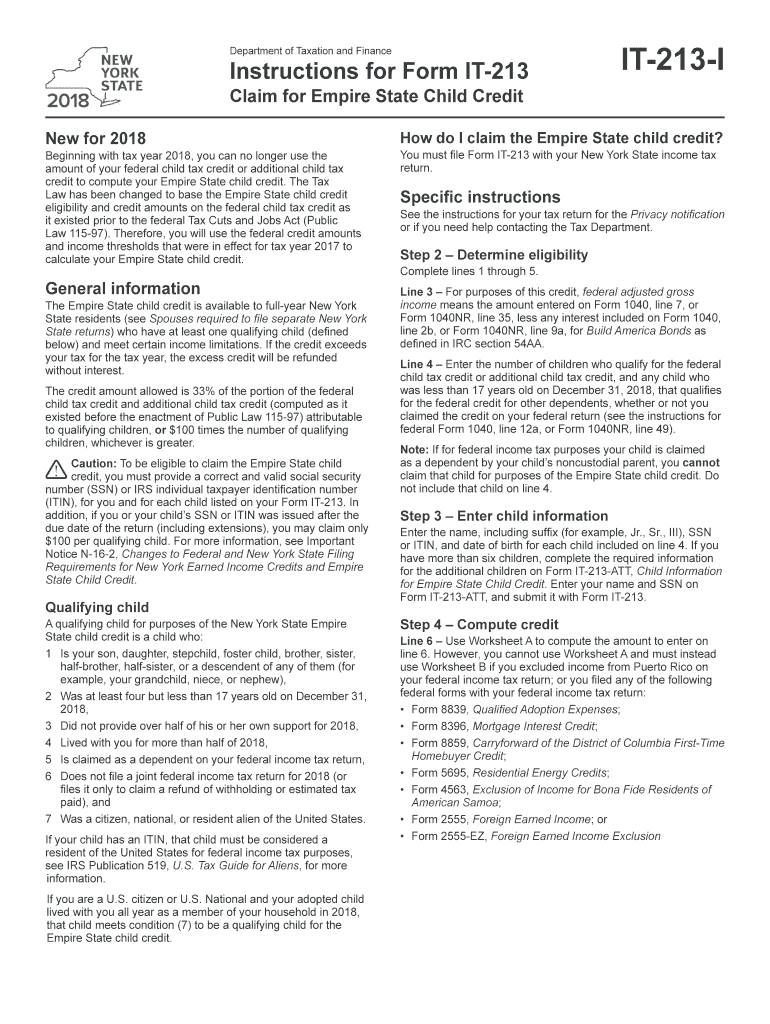

it 213 Form 2018

What is the IT 213 Form

The IT 213 form, also known as the New York State IT-213 Claim for Tax Credit, is a tax document used by residents of New York to claim certain tax credits. This form is specifically designed for individuals who have incurred expenses related to their education or who qualify for other specific credits. Understanding the purpose of the IT 213 form is essential for ensuring that taxpayers can maximize their eligible credits and comply with state tax regulations.

Steps to Complete the IT 213 Form

Completing the IT 213 form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documentation, including proof of expenses and any supporting documents related to your claim. Follow these steps:

- Fill in your personal information, including your name, address, and Social Security number.

- Detail the specific credits you are claiming, ensuring you have all required documentation to support your claims.

- Calculate the total amount of credits you are eligible for based on your expenses.

- Review your completed form for accuracy before submission.

How to Obtain the IT 213 Form

The IT 213 form can be obtained through several methods. Taxpayers can download the form directly from the New York State Department of Taxation and Finance website. Alternatively, individuals may request a physical copy by contacting the department or visiting a local tax office. It is important to ensure you are using the most current version of the form to avoid any compliance issues.

Legal Use of the IT 213 Form

The IT 213 form is legally recognized for claiming tax credits in New York State. To ensure compliance, taxpayers must adhere to the specific guidelines set forth by the New York State Department of Taxation and Finance. This includes accurately reporting all relevant information and maintaining proper documentation to support the claims made on the form. Failure to comply with these legal requirements may result in penalties or denial of the claimed credits.

Filing Deadlines / Important Dates

Filing deadlines for the IT 213 form are crucial for taxpayers to note. Typically, the form must be submitted by the same deadline as the New York State personal income tax return. This date often falls on April fifteenth, unless it is extended. Taxpayers should also be aware of any changes to deadlines due to state or federal regulations, especially during extraordinary circumstances such as natural disasters or public health emergencies.

Form Submission Methods

Taxpayers have multiple options for submitting the IT 213 form. The form can be filed electronically through the New York State Department of Taxation and Finance online services. Alternatively, individuals can choose to mail the completed form to the appropriate address provided by the department or submit it in person at a local tax office. Each submission method has its own processing times and requirements, so it is advisable to choose the method that best suits your needs.

Quick guide on how to complete it 213 instructions 2018 2019 form

Your assistance manual on preparing your It 213 Form

If you’re looking to learn how to complete and submit your It 213 Form, here are a few quick tips on how to make tax filing easier.

To begin, all you have to do is create your airSlate SignNow profile to transform how you manage documents online. airSlate SignNow is an exceptionally user-friendly and powerful documentation solution that enables you to edit, generate, and complete your tax documents with ease. With its editor, you can toggle between text, check boxes, and eSignatures and easily revisit answers to make changes as needed. Streamline your tax oversight with advanced PDF editing, eSigning, and seamless sharing.

Follow these steps to complete your It 213 Form in no time:

- Establish your account and start handling PDFs in a matter of minutes.

- Utilize our directory to locate any IRS tax document; explore different versions and schedules.

- Select Get form to open your It 213 Form in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to add your legally-recognized eSignature (if needed).

- Examine your document and amend any inaccuracies.

- Preserve changes, print your version, forward it to your recipient, and download it to your device.

Refer to this manual to submit your taxes electronically with airSlate SignNow. Note that traditional paper filing can result in mistakes on returns and delay refunds. Naturally, before e-filing your taxes, verify the IRS website for submission guidelines pertinent to your state.

Create this form in 5 minutes or less

Find and fill out the correct it 213 instructions 2018 2019 form

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

How do I fill out the BHU's form of B.Com in 2018 and crack it?

you can fill from to go through bhu portal and read all those instruction and download previous year question paper . that u will get at the portal and solve more and more question paper and read some basics from your study level .focus on study save ur time and energy .do best to achieve your goal .for more detail discus with gajendra ta mtech in iit bhu .AND PKN .good luck .

-

Is it advantageous to fill out the JEE Mains 2018 form as soon as possible?

Yes. It is advantageous to fill out the JEE Mains 2018 form as soon as possible? Click here to know more about what are the advantage of filling JEE Main Application Form Earlier.

-

Which ITR form should an NRI fill out for AY 2018–2019 if there are two rental incomes in India other than that from interests?

Choosing Correct Income Tax form is the important aspect of filling Income tax return.Lets us discuss it one by one.ITR -1 —— Mainly used for salary income , other source income, one house property income ( upto Rs. 50 Lakhs ) for Individual Resident Assessees only.ITR-2 —- For Salary Income , Other source income ( exceeding Rs. 50 lakhs) house property income from more than one house and Capital Gains / Loss Income for Individual Resident or Non- Resident Assessees and HUF Assessees only.ITR 3— Income from Business or profession Together with any other income such as Salary Income, Other sources, Capital Gains , House property ( Business/ Profession income is must for filling this form) . For individual and HUF Assessees OnlySo in case NRI Assessees having rental income from two house property , then ITR need to be filed in Form ITR 2.For Detail understanding please refer to my video link.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

Create this form in 5 minutes!

How to create an eSignature for the it 213 instructions 2018 2019 form

How to make an eSignature for the It 213 Instructions 2018 2019 Form online

How to generate an electronic signature for your It 213 Instructions 2018 2019 Form in Chrome

How to create an electronic signature for signing the It 213 Instructions 2018 2019 Form in Gmail

How to generate an eSignature for the It 213 Instructions 2018 2019 Form right from your mobile device

How to generate an eSignature for the It 213 Instructions 2018 2019 Form on iOS

How to generate an eSignature for the It 213 Instructions 2018 2019 Form on Android OS

People also ask

-

What is the It 213 Form and how is it used?

The It 213 Form is a tax form used for reporting income and calculating tax liabilities. It is essential for individuals and businesses to accurately report their financial information to ensure compliance with tax regulations. Using airSlate SignNow, you can easily prepare, sign, and send your It 213 Form securely.

-

How does airSlate SignNow help with completing the It 213 Form?

airSlate SignNow simplifies the process of completing the It 213 Form by providing a user-friendly interface for document management and electronic signatures. You can fill out the form online, add necessary signatures, and send it directly to the relevant parties, ensuring a seamless workflow.

-

Is there a cost associated with using airSlate SignNow for the It 213 Form?

Yes, airSlate SignNow offers a range of pricing plans that cater to different business needs. Our plans are designed to be cost-effective while providing comprehensive features for managing documents like the It 213 Form. You can select a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the It 213 Form?

airSlate SignNow provides various features for managing the It 213 Form, including customizable templates, electronic signatures, and cloud storage. Additionally, it offers secure sharing options and tracking capabilities to monitor the status of your form throughout the signing process.

-

Can I integrate airSlate SignNow with other software for handling the It 213 Form?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, enhancing your ability to manage the It 213 Form alongside your other business tools. Whether you use CRM systems, project management apps, or cloud storage services, our integrations ensure smooth data flow.

-

What are the benefits of using airSlate SignNow for the It 213 Form?

Using airSlate SignNow for the It 213 Form offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. You can complete and sign your forms electronically, which saves time and minimizes the risk of errors commonly associated with manual processes.

-

Is airSlate SignNow secure for signing the It 213 Form?

Yes, airSlate SignNow prioritizes security and ensures that all documents, including the It 213 Form, are protected with advanced encryption methods. We comply with industry standards for data protection, giving you peace of mind when sending and signing sensitive information.

Get more for It 213 Form

Find out other It 213 Form

- eSignature Alaska Debt Settlement Agreement Template Safe

- eSignature New Jersey Debt Settlement Agreement Template Simple

- eSignature New Mexico Debt Settlement Agreement Template Free

- eSignature Tennessee Debt Settlement Agreement Template Secure

- eSignature Wisconsin Debt Settlement Agreement Template Safe

- Can I eSignature Missouri Share Transfer Agreement Template

- eSignature Michigan Stock Purchase Agreement Template Computer

- eSignature California Indemnity Agreement Template Online

- eSignature New Mexico Promissory Note Template Now

- eSignature Pennsylvania Promissory Note Template Later

- Help Me With eSignature North Carolina Bookkeeping Contract

- eSignature Georgia Gym Membership Agreement Mobile

- eSignature Michigan Internship Contract Computer

- Can I eSignature Nebraska Student Data Sheet

- How To eSignature Michigan Application for University

- eSignature North Carolina Weekly Class Evaluation Now

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure