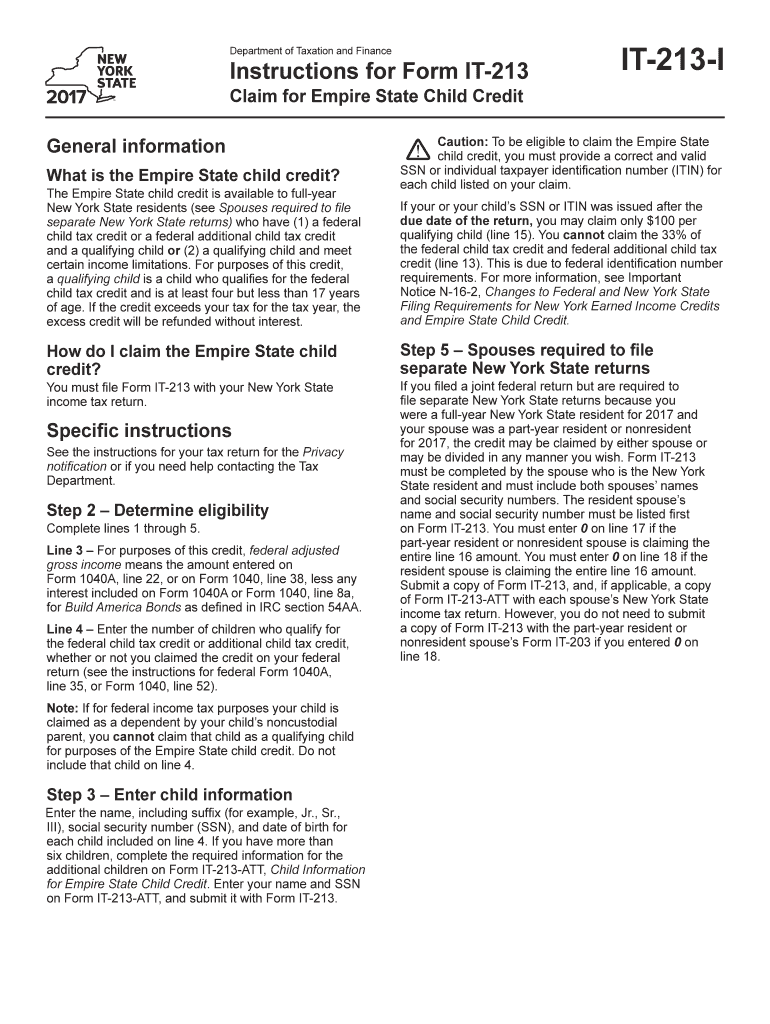

it 213 Instructions Form 2017

What is the It 213 Instructions Form

The It 213 Instructions Form is a specific document used primarily for tax purposes in the United States. It provides detailed guidance on how to fill out the associated tax form accurately. This form is essential for taxpayers who need to report specific financial information to the Internal Revenue Service (IRS). By following the instructions provided, individuals can ensure compliance with federal tax regulations, thereby avoiding potential penalties or issues with their tax filings.

How to use the It 213 Instructions Form

Using the It 213 Instructions Form involves several key steps. First, obtain the form from a reliable source, such as the IRS website or authorized tax preparation software. Next, carefully read through the instructions to understand the requirements for completing the form. Gather all necessary financial documents, such as W-2s or 1099s, to ensure you have accurate information. As you fill out the form, refer back to the instructions to verify that you are providing the correct details in each section. Once completed, review the form for any errors before submission.

Steps to complete the It 213 Instructions Form

Completing the It 213 Instructions Form requires a systematic approach to ensure accuracy. Follow these steps:

- Read the instructions thoroughly to understand the form's purpose and requirements.

- Gather all necessary documentation, including income statements and any relevant tax records.

- Fill out the form carefully, ensuring that all information is accurate and complete.

- Double-check your entries against the instructions to avoid mistakes.

- Sign and date the form where required.

- Submit the form electronically or by mail, depending on the submission guidelines provided.

Legal use of the It 213 Instructions Form

The It 213 Instructions Form is legally recognized by the IRS as a valid means of reporting tax information. To ensure legal compliance, taxpayers must adhere to the guidelines outlined in the instructions. This includes providing accurate information and submitting the form by the designated deadlines. Failure to comply with these legal requirements may result in penalties, including fines or audits. Therefore, understanding the legal implications of using this form is crucial for all taxpayers.

Filing Deadlines / Important Dates

Filing deadlines for the It 213 Instructions Form are critical to ensure timely compliance with tax regulations. Typically, the deadline for submitting tax forms falls on April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any specific deadlines related to extensions or special circumstances that may apply to their situation. Keeping track of these important dates helps avoid late penalties and ensures a smoother filing process.

Form Submission Methods (Online / Mail / In-Person)

The It 213 Instructions Form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online Submission: Many taxpayers choose to file electronically using IRS-approved software, which can streamline the process and reduce errors.

- Mail Submission: Taxpayers can print the completed form and send it to the designated IRS address. It is advisable to use certified mail for tracking purposes.

- In-Person Submission: Some individuals may opt to deliver their forms directly to local IRS offices, ensuring immediate receipt.

Quick guide on how to complete it 213 instructions 2017 2019 form

Your assistance manual on how to prepare your It 213 Instructions Form

If you’re interested in understanding how to create and submit your It 213 Instructions Form, here are some brief tips on simplifying tax submissions.

Initially, you simply need to set up your airSlate SignNow profile to enhance how you manage paperwork online. airSlate SignNow is a highly intuitive and effective document solution that allows you to modify, draft, and finalize your income tax documents effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures, and revisit to amend responses as necessary. Optimize your tax administration with sophisticated PDF editing, eSigning, and user-friendly sharing.

Follow the instructions below to complete your It 213 Instructions Form in just a few minutes:

- Create your account and start working on PDFs in no time.

- Browse our catalog to locate any IRS tax form; examine different versions and schedules.

- Click Obtain form to load your It 213 Instructions Form in our editor.

- Complete the necessary fillable fields with your details (text, numbers, checkmarks).

- Utilize the Sign Tool to add your legally-recognized eSignature (if required).

- Review your document and fix any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Leverage this manual to file your taxes electronically with airSlate SignNow. Keep in mind that paper submissions can increase return errors and delay refunds. Additionally, before e-filing your taxes, consult the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct it 213 instructions 2017 2019 form

Create this form in 5 minutes!

How to create an eSignature for the it 213 instructions 2017 2019 form

How to make an electronic signature for your It 213 Instructions 2017 2019 Form online

How to generate an eSignature for the It 213 Instructions 2017 2019 Form in Google Chrome

How to generate an eSignature for putting it on the It 213 Instructions 2017 2019 Form in Gmail

How to create an electronic signature for the It 213 Instructions 2017 2019 Form right from your smart phone

How to make an electronic signature for the It 213 Instructions 2017 2019 Form on iOS

How to make an electronic signature for the It 213 Instructions 2017 2019 Form on Android OS

People also ask

-

What is the IT 213 Instructions Form used for?

The IT 213 Instructions Form is designed to provide guidance for completing your New York State income tax return. It outlines the necessary steps and information required to accurately file your taxes. Understanding this form can help ensure compliance and maximize your tax benefits.

-

How can airSlate SignNow assist with the IT 213 Instructions Form?

With airSlate SignNow, you can easily send and eSign the IT 213 Instructions Form digitally. Our platform streamlines the document management process, allowing for quick and efficient completion of tax forms without the hassle of printing or mailing.

-

Is there a cost associated with using airSlate SignNow for the IT 213 Instructions Form?

Yes, airSlate SignNow offers flexible pricing plans that cater to different business needs. Whether you are a small business or a large enterprise, you can find a cost-effective solution that allows you to manage documents like the IT 213 Instructions Form efficiently.

-

What features does airSlate SignNow provide for managing the IT 213 Instructions Form?

airSlate SignNow offers a range of features for managing the IT 213 Instructions Form, including customizable templates, secure electronic signatures, and real-time tracking. These features facilitate a smooth workflow, ensuring that your documents are completed accurately and efficiently.

-

Can I integrate airSlate SignNow with other software for the IT 213 Instructions Form?

Absolutely! airSlate SignNow supports integrations with various third-party applications, allowing you to enhance your document management process for the IT 213 Instructions Form. This integration capability ensures that you can work seamlessly with your existing tools.

-

What are the benefits of using airSlate SignNow for tax forms like the IT 213 Instructions Form?

Using airSlate SignNow for the IT 213 Instructions Form offers numerous benefits, including increased efficiency, reduced turnaround time, and enhanced security. Additionally, our platform is user-friendly, making it easy for anyone to prepare and sign tax documents effortlessly.

-

Is airSlate SignNow secure for signing sensitive documents like the IT 213 Instructions Form?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your IT 213 Instructions Form and other sensitive documents are protected. We use advanced encryption and secure access protocols to safeguard your information throughout the signing process.

Get more for It 213 Instructions Form

- Format for applying for attender

- Mieterselbstauskunft home wohnen in eisenach de form

- Investigating climate change at the micro and macroscopic level answer key pdf form

- Arizona school health annual report chip az form

- Description the theatrical booking agency license is a requirement form

- Rights of youth in massachusetts public schools regarding form

- City or town of kennel license number inspection date form

- Ssa form 7050 f4 walkthrough request for social security

Find out other It 213 Instructions Form

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template