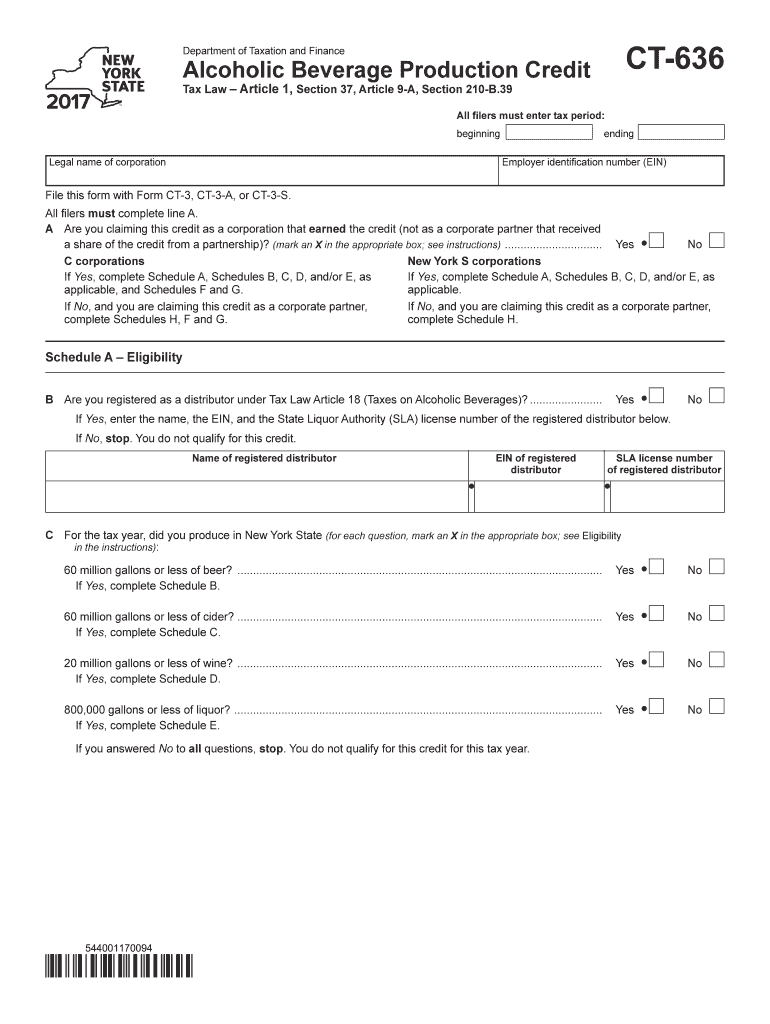

Tax Law Article 1, Section 37, Article 9 A, Section 210 B 2017

What is the Tax Law Article 1, Section 37, Article 9 A, Section 210 B

The Tax Law Article 1, Section 37, Article 9 A, Section 210 B refers to specific regulations within U.S. tax legislation that outlines certain requirements and provisions for taxpayers. This section is essential for understanding how various tax obligations are structured and enforced. It may involve aspects such as deductions, credits, or compliance measures that taxpayers must adhere to when filing their income taxes. Familiarity with this law can help taxpayers navigate their responsibilities more effectively.

Steps to complete the Tax Law Article 1, Section 37, Article 9 A, Section 210 B

Completing the Tax Law Article 1, Section 37, Article 9 A, Section 210 B form involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including income statements, previous tax returns, and any relevant financial records. Next, access the form online through a secure platform like signNow, which allows for easy filling and eSigning. Carefully fill in all required fields, ensuring that the information matches your documentation. After completing the form, review it for any errors or omissions before signing it electronically. Finally, submit the completed form according to the specified guidelines.

Legal use of the Tax Law Article 1, Section 37, Article 9 A, Section 210 B

The legal use of the Tax Law Article 1, Section 37, Article 9 A, Section 210 B is critical for maintaining compliance with federal tax regulations. This form must be filled out accurately to avoid potential legal issues, including audits or penalties. Understanding the legal implications of this form helps taxpayers ensure that they meet all requirements set forth by the IRS. Utilizing an eSignature solution like signNow can enhance the legal standing of your submission, as it complies with the ESIGN Act, ensuring that electronic signatures are recognized as valid.

IRS Guidelines

The IRS provides specific guidelines for completing the Tax Law Article 1, Section 37, Article 9 A, Section 210 B form. These guidelines cover aspects such as eligibility criteria, required documentation, and deadlines for submission. Taxpayers should familiarize themselves with these guidelines to ensure that they are following the correct procedures. The IRS also offers resources and support for individuals who may have questions about the form or its requirements, making it easier to comply with tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the Tax Law Article 1, Section 37, Article 9 A, Section 210 B form are crucial for taxpayers to observe. Typically, the deadline for submitting tax forms is April fifteenth of each year, but this may vary depending on specific circumstances or extensions. It is important for taxpayers to mark their calendars and ensure that they submit their forms on time to avoid penalties. Keeping track of important dates related to tax filing can help streamline the process and ensure compliance with federal regulations.

Required Documents

To complete the Tax Law Article 1, Section 37, Article 9 A, Section 210 B form, certain documents are required. These may include income statements such as W-2s or 1099s, previous tax returns, and any supporting documentation for deductions or credits claimed. Having these documents readily available can facilitate a smoother filing process. It is advisable to double-check that all necessary documents are included to avoid delays or complications with your tax submission.

Quick guide on how to complete tax law article 1 section 37 article 9 a section 210 b

Your assistance manual on how to prepare your Tax Law Article 1, Section 37, Article 9 A, Section 210 B

If you’re interested in learning how to create and submit your Tax Law Article 1, Section 37, Article 9 A, Section 210 B, here are some straightforward instructions to simplify tax submission.

To begin, you simply need to register your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an extremely user-friendly and robust document solution that enables you to modify, create, and complete your income tax documents effortlessly. Using its editor, you can switch between text, checkboxes, and eSignatures and return to amend information as necessary. Streamline your tax administration with advanced PDF editing, eSigning, and seamless sharing.

Follow the steps below to complete your Tax Law Article 1, Section 37, Article 9 A, Section 210 B in just a few minutes:

- Create your account and start working on PDFs within moments.

- Utilize our catalog to find any IRS tax form; browse through versions and schedules.

- Click Get form to access your Tax Law Article 1, Section 37, Article 9 A, Section 210 B in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Utilize the Sign Tool to add your legally-binding eSignature (if required).

- Review your document and correct any inaccuracies.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Leverage this guide to file your taxes electronically with airSlate SignNow. Keep in mind that filing in paper form may increase return errors and delay reimbursements. Before e-filing your taxes, ensure to check the IRS website for submission regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct tax law article 1 section 37 article 9 a section 210 b

FAQs

-

How did the assenting justices get around Article 1, Section 9 of the U.S. Constitution: “No Tax or Duty shall be laid on Articles exported from any State?” (Letter to the Editor, WSJ. from Joan Glacy)

The article was designed to prevent states from imposing taxes and tariffs on goods sold to other states. But a state may tax any purchase that occurs in their state. Given the location of the purchaser, the states may impose a sales tax on internet goods purchased for use in their state, regardless of the source. Because it applies to goods on a blanket basis, rather than items from a location or a specific type of product, it has been upheld as a right of the individual states.

Create this form in 5 minutes!

How to create an eSignature for the tax law article 1 section 37 article 9 a section 210 b

How to create an eSignature for the Tax Law Article 1 Section 37 Article 9 A Section 210 B in the online mode

How to make an electronic signature for your Tax Law Article 1 Section 37 Article 9 A Section 210 B in Chrome

How to create an eSignature for signing the Tax Law Article 1 Section 37 Article 9 A Section 210 B in Gmail

How to generate an electronic signature for the Tax Law Article 1 Section 37 Article 9 A Section 210 B right from your smart phone

How to make an electronic signature for the Tax Law Article 1 Section 37 Article 9 A Section 210 B on iOS

How to create an electronic signature for the Tax Law Article 1 Section 37 Article 9 A Section 210 B on Android

People also ask

-

What is the significance of Tax Law Article 1, Section 37, Article 9 A, Section 210 B in electronic signatures?

Tax Law Article 1, Section 37, Article 9 A, Section 210 B outlines regulatory standards that govern electronic signatures. Understanding these legal frameworks is crucial for businesses looking to ensure compliance while using eSignature solutions like airSlate SignNow. Our platform aligns with these regulations for secure and valid document signing.

-

How does airSlate SignNow support compliance with Tax Law Article 1, Section 37, Article 9 A, Section 210 B?

airSlate SignNow offers advanced security features and audit trails that help businesses comply with Tax Law Article 1, Section 37, Article 9 A, Section 210 B. By providing legally binding signatures and secure data handling, we ensure your document processes remain compliant with legal requirements.

-

What pricing options does airSlate SignNow offer for businesses incorporating Tax Law Article 1, Section 37, Article 9 A, Section 210 B compliance?

airSlate SignNow provides various pricing tiers to suit different business needs, ensuring compliance with Tax Law Article 1, Section 37, Article 9 A, Section 210 B. Our plans are designed to deliver cost-effective solutions while including features essential for tax compliance, such as security and ease of use.

-

What features does airSlate SignNow include to assist with Tax Law Article 1, Section 37, Article 9 A, Section 210 B?

airSlate SignNow includes features such as customizable templates, secure storage, and audit trails, which are essential for complying with Tax Law Article 1, Section 37, Article 9 A, Section 210 B. These features streamline the document process while ensuring information integrity and legal validity.

-

Can airSlate SignNow integrate with other platforms for tax-related processes governed by Tax Law Article 1, Section 37, Article 9 A, Section 210 B?

Yes, airSlate SignNow integrates seamlessly with various business platforms that handle tax-related documentation and compliance related to Tax Law Article 1, Section 37, Article 9 A, Section 210 B. This interoperability optimizes workflows and enhances overall efficiency.

-

What are the benefits of using airSlate SignNow for documents subject to Tax Law Article 1, Section 37, Article 9 A, Section 210 B?

Using airSlate SignNow for documents pertaining to Tax Law Article 1, Section 37, Article 9 A, Section 210 B provides numerous benefits, including improved workflow efficiency, reduced paper usage, and enhanced compliance. Our platform simplifies the signing process while maintaining the legal standing of your documents.

-

Is airSlate SignNow suitable for both small and large businesses dealing with Tax Law Article 1, Section 37, Article 9 A, Section 210 B?

Absolutely! airSlate SignNow is designed for businesses of all sizes, making it ideal for both small enterprises and large corporations managing documentation covered by Tax Law Article 1, Section 37, Article 9 A, Section 210 B. We provide scalable solutions that adapt to your business needs.

Get more for Tax Law Article 1, Section 37, Article 9 A, Section 210 B

- Explorers chart answer key form

- Form cit rcf 1 02 12

- Consociate fsa form

- Missouri medicaid application form

- General authorization for release of information humana military

- Reg3164 parking placard application for persons form

- William penn life insurance company of new york form

- Glynne diggle customer service sales representative form

Find out other Tax Law Article 1, Section 37, Article 9 A, Section 210 B

- How Do I Electronic signature South Carolina Advance Healthcare Directive

- eSignature Kentucky Applicant Appraisal Form Evaluation Later

- Electronic signature Colorado Client and Developer Agreement Later

- Electronic signature Nevada Affiliate Program Agreement Secure

- Can I Electronic signature Pennsylvania Co-Branding Agreement

- Can I Electronic signature South Dakota Engineering Proposal Template

- How Do I Electronic signature Arizona Proforma Invoice Template

- Electronic signature California Proforma Invoice Template Now

- Electronic signature New York Equipment Purchase Proposal Now

- How Do I Electronic signature New York Proforma Invoice Template

- How Can I Electronic signature Oklahoma Equipment Purchase Proposal

- Can I Electronic signature New Jersey Agreement

- How To Electronic signature Wisconsin Agreement

- Electronic signature Tennessee Agreement contract template Mobile

- How To Electronic signature Florida Basic rental agreement or residential lease

- Electronic signature California Business partnership agreement Myself

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement