Tax Forms Illinois Department of Revenue

Understanding the 2022 Illinois Tax Forms

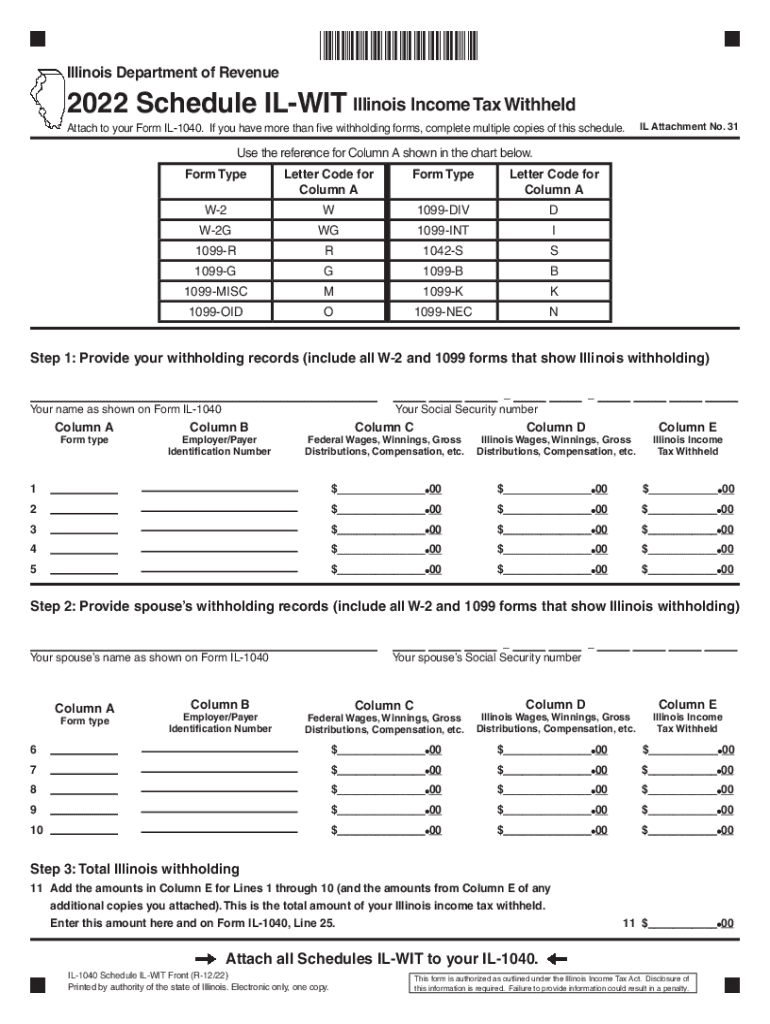

The 2022 Illinois tax forms, including the 2022 IL and 2022 IL-WIT, are essential for individuals and businesses filing their state income taxes. These forms are provided by the Illinois Department of Revenue and are designed to help taxpayers report their income accurately. The primary form, the 2022 IL-1040, is used for individual income tax returns, while the 2022 IL-WIT is specifically for reporting withheld income tax. Understanding these forms is crucial for compliance and ensuring that all applicable deductions and credits are claimed.

Steps to Complete the 2022 Illinois Tax Forms

Completing the 2022 Illinois tax forms involves several key steps:

- Gather necessary documentation, such as W-2s, 1099s, and other income statements.

- Obtain the correct forms, including the 2022 IL-1040 and 2022 IL-WIT, from the Illinois Department of Revenue website or through authorized tax preparation software.

- Fill out the forms accurately, ensuring all income, deductions, and credits are reported.

- Review the completed forms for accuracy before submission.

- Submit the forms either electronically or by mail, following the specific instructions provided for each form.

Filing Deadlines for 2022 Illinois Tax Forms

Timely filing of the 2022 Illinois tax forms is essential to avoid penalties. The general deadline for filing individual income tax returns is April 15, 2023. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions that may apply if additional time is needed to prepare their returns. It is important to check for any updates or changes to deadlines on the Illinois Department of Revenue website.

Required Documents for Filing

When preparing to file the 2022 Illinois tax forms, certain documents are necessary to ensure accurate reporting:

- W-2 forms from employers, detailing annual wages and taxes withheld.

- 1099 forms for other income sources, such as freelance work or interest income.

- Records of any deductions, such as mortgage interest statements or medical expenses.

- Previous year’s tax return for reference and consistency.

Legal Use of the 2022 Illinois Tax Forms

The 2022 Illinois tax forms must be used in accordance with state tax laws. Taxpayers are required to report all income accurately and claim only eligible deductions and credits. Misuse of these forms, such as falsifying information or failing to report income, can result in penalties, including fines and potential legal action. It is advisable to consult with a tax professional if there are uncertainties regarding the legal requirements of filing.

Form Submission Methods

Taxpayers have several options for submitting their 2022 Illinois tax forms. These methods include:

- Electronic filing through authorized tax preparation software, which is often the fastest and most efficient method.

- Mailing paper forms to the appropriate address provided by the Illinois Department of Revenue.

- In-person submission at designated tax offices, although this may require appointments or specific hours of operation.

Quick guide on how to complete tax forms illinois department of revenue

Complete Tax Forms Illinois Department Of Revenue effortlessly on any gadget

Managing documents online has gained traction among companies and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, enabling you to find the appropriate form and securely keep it in the cloud. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly without delays. Manage Tax Forms Illinois Department Of Revenue on any device with airSlate SignNow Android or iOS applications and enhance any document-driven procedure today.

How to modify and eSign Tax Forms Illinois Department Of Revenue with ease

- Find Tax Forms Illinois Department Of Revenue and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you want to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the stress of lost or misplaced documents, tedious form searches, or errors that necessitate reprinting documents. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Tax Forms Illinois Department Of Revenue and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax forms illinois department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2022 Illinois schedule for airSlate SignNow?

The 2022 Illinois schedule for airSlate SignNow outlines important dates for updates and feature releases. This schedule ensures that users can take full advantage of new functionalities as they become available, improving their document signing experience. Stay informed about the latest enhancements by checking the schedule regularly.

-

How can I access the 2022 Illinois schedule?

You can access the 2022 Illinois schedule directly on the airSlate SignNow website. Our resources page provides comprehensive details about our roadmap and any important announcements. This ensures you’re always up to date with the latest deadlines and updates.

-

What features are included in the 2022 Illinois schedule updates?

The 2022 Illinois schedule includes a range of exciting features aimed at streamlining your document management processes. These features enhance user interface, improve integrations with other applications, and increase the overall efficiency of the eSigning experience. Consult our schedule to see which features are set to launch and their expected impact.

-

Is there a cost associated with using the 2022 Illinois schedule functionalities?

The functionalities outlined in the 2022 Illinois schedule are integrated within our various pricing plans. airSlate SignNow offers a cost-effective solution, which means you can access these features based on the plan selected. Review our pricing options to find the best fit for your business needs while leveraging our schedule's benefits.

-

What are the benefits of following the 2022 Illinois schedule?

Staying updated with the 2022 Illinois schedule allows you to maximize the advantages of airSlate SignNow’s evolving features. Users who follow the schedule can anticipate changes, plan for implementation, and ensure seamless integration into their existing workflows. This proactive approach enhances productivity and keeps your business on track.

-

Can I integrate airSlate SignNow with other applications according to the 2022 Illinois schedule?

Yes, the 2022 Illinois schedule details various integrations available with airSlate SignNow and other applications. These integrations are designed to enhance your document signing process, linking tools you already use to streamline workflows. Check the schedule for upcoming integration updates to optimize your operations.

-

How does the 2022 Illinois schedule improve collaboration for teams?

The 2022 Illinois schedule includes features that enhance collaboration among team members using airSlate SignNow. Improved functionalities allow for better document sharing, real-time editing, and interactive signing processes. Following this schedule will help your team cooperate more effectively, resulting in quicker turnaround times.

Get more for Tax Forms Illinois Department Of Revenue

- Ohio mason return 2018 2019 form

- Ohio mason return 2014 form

- Ohio mason return 2017 2019 form

- Ohio it re reason and explanation of corrections form

- Ohio it re reason and explanation of corrections 101940884 form

- 2016 ohio it re reason and explanation of corrections ohiogov form

- Form sd long 2016 2019

- Tbor 1 2019 form

Find out other Tax Forms Illinois Department Of Revenue

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe