Ohio it RE Reason and Explanation of Corrections Ohio Gov 2016

What is the Ohio IT RE Reason And Explanation Of Corrections Ohio gov

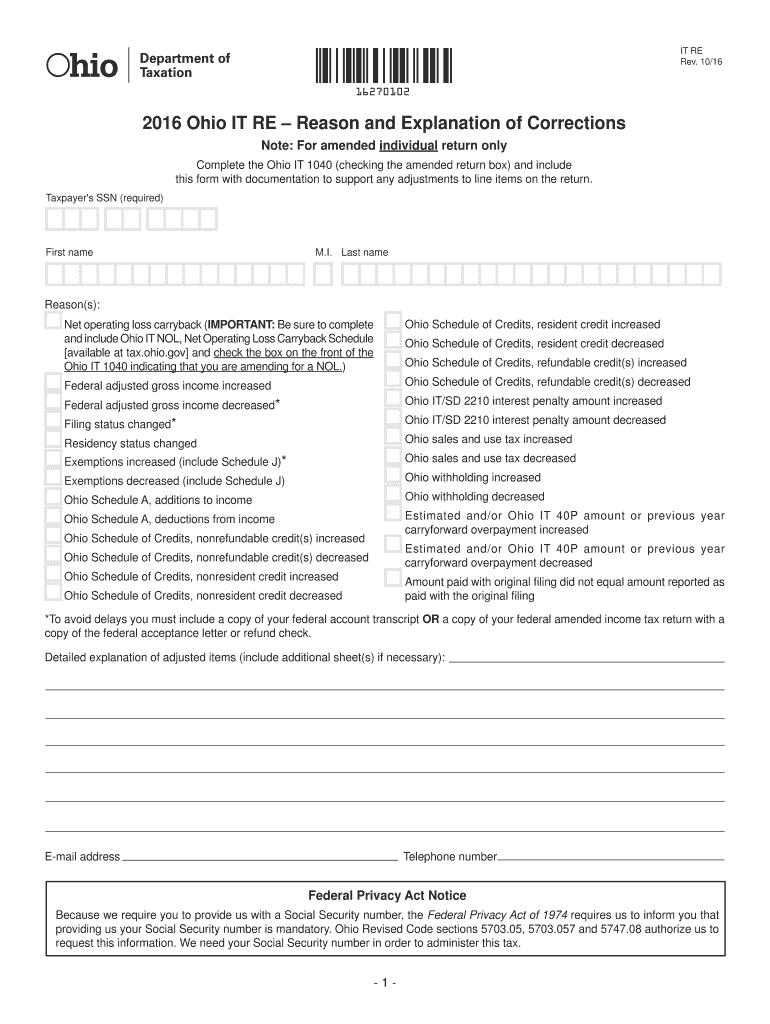

The Ohio IT RE Reason And Explanation Of Corrections form is a critical document used by taxpayers to explain corrections made to previously filed Ohio income tax returns. This form allows individuals to provide detailed reasons for any discrepancies or changes, ensuring that the Ohio Department of Taxation has a clear understanding of the adjustments. It is essential for maintaining accurate tax records and compliance with state tax regulations.

Steps to complete the Ohio IT RE Reason And Explanation Of Corrections Ohio gov

Completing the Ohio IT RE Reason And Explanation Of Corrections form involves several key steps:

- Gather all relevant documents, including the original tax return and any supporting documents that justify the corrections.

- Carefully read the instructions provided with the form to ensure compliance with state requirements.

- Fill out the form accurately, providing a clear explanation for each correction made.

- Review the completed form for accuracy and completeness before submission.

- Submit the form either online, by mail, or in person, depending on your preference and the guidelines provided.

Legal use of the Ohio IT RE Reason And Explanation Of Corrections Ohio gov

The Ohio IT RE Reason And Explanation Of Corrections form is legally recognized as a valid method for taxpayers to communicate corrections to their tax filings. When completed and submitted according to state guidelines, this form helps ensure that taxpayers remain compliant with Ohio tax laws. It is important to provide truthful and accurate information, as any false statements could lead to penalties or legal repercussions.

Key elements of the Ohio IT RE Reason And Explanation Of Corrections Ohio gov

Several key elements are essential when completing the Ohio IT RE Reason And Explanation Of Corrections form:

- Taxpayer Information: Include your name, address, and Social Security number for identification.

- Explanation of Corrections: Clearly state the reasons for the corrections, including any relevant details or supporting documentation.

- Signature: Ensure the form is signed and dated to validate the submission.

- Submission Method: Indicate how the form will be submitted, whether electronically or via mail.

Filing Deadlines / Important Dates

It is crucial to be aware of filing deadlines when submitting the Ohio IT RE Reason And Explanation Of Corrections form. Typically, corrections should be submitted as soon as discrepancies are identified. The Ohio Department of Taxation may have specific deadlines for corrections related to the tax year in question, so checking the latest guidelines is advisable to avoid any potential penalties.

Form Submission Methods (Online / Mail / In-Person)

The Ohio IT RE Reason And Explanation Of Corrections form can be submitted through various methods:

- Online: Taxpayers can complete and submit the form electronically through the Ohio Department of Taxation's website.

- Mail: The completed form can be printed and mailed to the appropriate address provided in the instructions.

- In-Person: Taxpayers may also choose to deliver the form in person at designated tax offices, ensuring immediate receipt.

Quick guide on how to complete 2016 ohio it re reason and explanation of corrections ohiogov

Your assistance manual on how to prepare your Ohio IT RE Reason And Explanation Of Corrections Ohio gov

If you wish to learn how to create and dispatch your Ohio IT RE Reason And Explanation Of Corrections Ohio gov, below are a few brief guidelines on how to simplify tax submissions.

To begin, all you need is to register your airSlate SignNow account to transform the way you manage documents online. airSlate SignNow is an incredibly user-friendly and powerful document solution that allows you to edit, create, and finalize your income tax forms with ease. With its editing tools, you can toggle between text, checkboxes, and eSignatures, returning to modify responses as necessary. Enhance your tax administration with advanced PDF editing, eSigning, and user-friendly sharing options.

Follow the instructions below to complete your Ohio IT RE Reason And Explanation Of Corrections Ohio gov in just minutes:

- Create your account and start working on PDFs in no time.

- Explore our repository to obtain any IRS tax form; browse through different versions and schedules.

- Click Obtain form to access your Ohio IT RE Reason And Explanation Of Corrections Ohio gov in our editor.

- Fill in the mandatory fields with your information (text, numbers, check marks).

- Utilize the Signature Tool to insert your legally-recognized eSignature (if necessary).

- Examine your document and correct any errors.

- Save changes, print your copy, forward it to your recipient, and download it onto your device.

Refer to this guide to electronically file your taxes with airSlate SignNow. Keep in mind that submitting paper forms may lead to more errors and delays in refunds. Moreover, before e-filing your taxes, visit the IRS website for the filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct 2016 ohio it re reason and explanation of corrections ohiogov

FAQs

-

When the forms of DU Medical College 2016 will be out and how to apply for it ?

I can't tell you the dates but i can tell that You have to download form from FMSC website, fill it, get it filled and attested by your school as a proof of your schooling from delhi. And after that you have to go to DU north campus Patel Chest Institute, FMSC has their office in the building, you submit your form over there and they will give you the confirmation slip

-

I just found out (super late) that my absentee ballot for the 2016 election was never accepted via voterstatus.sos.gov and reason is listed "N/A." I assume it is far too late already to find out why. Is that correct?

Call the voter registration office to see if they have a record. If not ask for the contact info for the agency in charge of the election.If it is serious, you want to be able to fix it before you try to vote again.

-

How can I fill my JEE Advance 2019 form if my mark sheet of class 10 and class 12 are not available? I have given it for correction. How am I supposed to fill the form?

There is also the choice of uploading your Birth Certificate.On the first page it where your particulars are entered it asks for Class X marksheet only but when you submit that page, the next page (where you upload the photo) asks for Class X Marksheet or Birth Certificate.

Create this form in 5 minutes!

How to create an eSignature for the 2016 ohio it re reason and explanation of corrections ohiogov

How to create an eSignature for the 2016 Ohio It Re Reason And Explanation Of Corrections Ohiogov online

How to create an electronic signature for the 2016 Ohio It Re Reason And Explanation Of Corrections Ohiogov in Google Chrome

How to make an electronic signature for putting it on the 2016 Ohio It Re Reason And Explanation Of Corrections Ohiogov in Gmail

How to make an electronic signature for the 2016 Ohio It Re Reason And Explanation Of Corrections Ohiogov right from your smart phone

How to create an electronic signature for the 2016 Ohio It Re Reason And Explanation Of Corrections Ohiogov on iOS devices

How to make an electronic signature for the 2016 Ohio It Re Reason And Explanation Of Corrections Ohiogov on Android OS

People also ask

-

What is Ohio IT RE Reason And Explanation Of Corrections Ohio gov?

Ohio IT RE Reason And Explanation Of Corrections Ohio gov is a structured document outlining corrections related to IT processes in Ohio. It provides clarity on the reasons for corrections and the procedures for remediation. This is crucial for businesses looking to comply with state regulations while maintaining efficient operations.

-

How does airSlate SignNow facilitate the process of submitting Ohio IT RE Reason And Explanation Of Corrections Ohio gov documents?

airSlate SignNow streamlines the process by allowing users to easily eSign and send the Ohio IT RE Reason And Explanation Of Corrections Ohio gov documents electronically. The platform provides a user-friendly interface that simplifies document management and ensures timely submissions. Additionally, it enhances compliance by maintaining document security and tracking.

-

What are the pricing options for using airSlate SignNow for Ohio IT RE Reason And Explanation Of Corrections Ohio gov?

airSlate SignNow offers flexible pricing plans tailored to various business needs, including options for teams managing Ohio IT RE Reason And Explanation Of Corrections Ohio gov documents. Pricing is competitive, ensuring organizations can access the features they need without overspending. You can expect transparent pricing with no hidden fees.

-

What features does airSlate SignNow offer for managing Ohio IT RE Reason And Explanation Of Corrections Ohio gov documents?

Key features of airSlate SignNow include customizable templates, automated workflows, and comprehensive eSigning capabilities. These tools enhance the efficiency of handling Ohio IT RE Reason And Explanation Of Corrections Ohio gov documents by reducing processing time and minimizing errors. Integration with third-party applications further increases its functionality.

-

Can airSlate SignNow integrate with other software for handling Ohio IT RE Reason And Explanation Of Corrections Ohio gov?

Yes, airSlate SignNow supports numerous integrations with popular business applications, making it easier to manage Ohio IT RE Reason And Explanation Of Corrections Ohio gov documents. Integration allows for smooth data transfer and improved workflow efficiency across platforms. This helps organizations maintain accurate records and streamlines the correction process.

-

What are the benefits of using airSlate SignNow for Ohio IT RE Reason And Explanation Of Corrections Ohio gov?

Using airSlate SignNow for Ohio IT RE Reason And Explanation Of Corrections Ohio gov offers several benefits, including enhanced compliance, increased security, and reduced turnaround time for document processing. The platform’s ease of use encourages adoption across teams, which boosts overall productivity. Additionally, businesses can track document status in real-time, ensuring accountability.

-

Is there customer support available for Ohio IT RE Reason And Explanation Of Corrections Ohio gov users of airSlate SignNow?

Absolutely, airSlate SignNow provides comprehensive customer support for users managing Ohio IT RE Reason And Explanation Of Corrections Ohio gov documents. The support team is accessible via multiple channels and offers resources to help users resolve issues quickly. This ensures that your experience with the platform remains smooth and efficient.

Get more for Ohio IT RE Reason And Explanation Of Corrections Ohio gov

- Return repair form for predator cues predator group products

- Commercial lines coverage checklist iiaiowacom form

- Internship timesheet 202478252 form

- Super bowl 100 squares box pool form

- Sample california immunization record cdph ca form

- Return of service agreement template form

- Return agreement template form

- Return to work after rehab agreement template form

Find out other Ohio IT RE Reason And Explanation Of Corrections Ohio gov

- How To Sign Tennessee Legal Cease And Desist Letter

- How Do I Sign Tennessee Legal Separation Agreement

- Sign Virginia Insurance Memorandum Of Understanding Easy

- Sign Utah Legal Living Will Easy

- Sign Virginia Legal Last Will And Testament Mobile

- How To Sign Vermont Legal Executive Summary Template

- How To Sign Vermont Legal POA

- How Do I Sign Hawaii Life Sciences Business Plan Template

- Sign Life Sciences PPT Idaho Online

- Sign Life Sciences PPT Idaho Later

- How Do I Sign Hawaii Life Sciences LLC Operating Agreement

- Sign Idaho Life Sciences Promissory Note Template Secure

- How To Sign Wyoming Legal Quitclaim Deed

- Sign Wisconsin Insurance Living Will Now

- Sign Wyoming Insurance LLC Operating Agreement Simple

- Sign Kentucky Life Sciences Profit And Loss Statement Now

- How To Sign Arizona Non-Profit Cease And Desist Letter

- Can I Sign Arkansas Non-Profit LLC Operating Agreement

- Sign Arkansas Non-Profit LLC Operating Agreement Free

- Sign California Non-Profit Living Will Easy