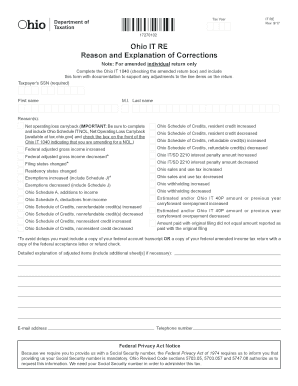

Ohio it RE Reason and Explanation of Corrections 2017

What is the Ohio IT RE Reason And Explanation Of Corrections

The Ohio IT RE Reason And Explanation Of Corrections form is a tax document used by taxpayers in Ohio to clarify and correct errors on previously filed income tax returns. This form allows individuals to provide a detailed explanation of the corrections made, ensuring that the Ohio Department of Taxation has the necessary information to process the changes accurately. It is essential for maintaining compliance with state tax regulations and can help mitigate potential penalties associated with incorrect filings.

How to use the Ohio IT RE Reason And Explanation Of Corrections

Using the Ohio IT RE Reason And Explanation Of Corrections form involves a few straightforward steps. First, gather all relevant documents related to the original tax return, including any notices received from the Ohio Department of Taxation. Next, fill out the form by providing your personal information, the tax year in question, and a clear explanation of the corrections being made. It's important to be as detailed as possible to avoid any misunderstandings. Once completed, submit the form according to the specified submission methods.

Steps to complete the Ohio IT RE Reason And Explanation Of Corrections

Completing the Ohio IT RE Reason And Explanation Of Corrections form requires careful attention to detail. Follow these steps:

- Review your original tax return and identify the errors that need correction.

- Obtain the Ohio IT RE Reason And Explanation Of Corrections form from the Ohio Department of Taxation website or other official sources.

- Fill in your personal information, including your name, address, and Social Security number.

- Specify the tax year for which you are making corrections.

- Provide a detailed explanation of the corrections, including any supporting documentation.

- Double-check all entries for accuracy before submission.

- Submit the form via the designated method, ensuring you keep a copy for your records.

Legal use of the Ohio IT RE Reason And Explanation Of Corrections

The Ohio IT RE Reason And Explanation Of Corrections form is legally recognized as a valid method for taxpayers to rectify mistakes on their income tax returns. By submitting this form, taxpayers affirm their commitment to compliance with Ohio tax laws. It is crucial to ensure that all information provided is truthful and accurate, as any discrepancies may result in penalties or further legal complications.

Required Documents

When preparing to submit the Ohio IT RE Reason And Explanation Of Corrections form, certain documents may be required to support your corrections. These may include:

- Your original tax return for the relevant tax year.

- Any notices or correspondence received from the Ohio Department of Taxation.

- Documentation that substantiates the corrections being made, such as W-2s, 1099s, or receipts.

Form Submission Methods

The Ohio IT RE Reason And Explanation Of Corrections form can be submitted through various methods, providing flexibility for taxpayers. Options typically include:

- Online submission through the Ohio Department of Taxation's e-filing system.

- Mailing a printed version of the form to the appropriate address provided by the Ohio Department of Taxation.

- In-person submission at designated tax offices, if applicable.

Quick guide on how to complete ohio it re reason and explanation of corrections 101940884

Your assistance manual on how to prepare your Ohio IT RE Reason And Explanation Of Corrections

If you’re curious about how to finalize and submit your Ohio IT RE Reason And Explanation Of Corrections, here are some brief guidelines on how to simplify tax filing.

To start, all you need to do is register your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an exceptionally intuitive and powerful document platform that allows you to modify, create, and finalize your tax papers with convenience. Utilizing its editor, you can toggle between text, checkboxes, and eSignatures and revisit to update details as necessary. Streamline your tax handling with advanced PDF editing, eSigning, and user-friendly sharing.

Follow the instructions below to accomplish your Ohio IT RE Reason And Explanation Of Corrections within minutes:

- Establish your account and begin working on PDFs shortly.

- Utilize our directory to find any IRS tax form; peruse through variations and schedules.

- Click Get form to access your Ohio IT RE Reason And Explanation Of Corrections in our editor.

- Populate the mandatory fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to add your legally-binding eSignature (if required).

- Review your document and fix any errors.

- Store changes, print your copy, dispatch it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Please keep in mind that submitting on paper can lead to increased errors and delays in refunds. Of course, before e-filing your taxes, consult the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct ohio it re reason and explanation of corrections 101940884

FAQs

-

What is the IRS form W-10 and how is it correctly filled out?

While you may have never heard of IRS Form W-10, you will if you’re currently paying or planning to pay someone to care for a child, dependent, or spouse? If you are, then you may qualify to claim what’s called the Child and Dependent Care credit on your federal income tax return. To claim this credit, your care provider must fill out a W-10. You may also need to fill out the form if you receive benefits from an employer sponsored dependent care plan.It’s certainly worth it to see if you qualify (and for this we recommend that you consult with a tax professional). The child and dependent care credit can be up to 35 percent of qualifying expenses, depending on adjusted gross income. For 2011, filers may use up to $3,000 of expenses paid in a year for one qualifying individual or $6,000 for two or more qualifying individuals. (When it comes time to figure your qualifying expenses, remember that they must be reduced by the amount of any dependent care benefits provided by your employer, if those benefits were deducted or excluded from your income.)Do You Qualify for the Credit?To see if you need to have your care provider fill out a W-10, first determine if you qualify for the credit for child and dependent care expenses. To qualify, the care must have been provided for one or more qualifying persons, generally a dependent child age 12 or younger when the care was provided. Certain other individuals, spouses and those who are incapable of self-care, may also be considered qualifying persons. (Note: each qualifying individual must be listed on your tax return.)Remember also that the amount you can claim as a credit is reduced as your income rises. According to the Tax Policy Center, “Families with income below $15,000 qualify for the 35 percent credit. That rate falls by 1 percentage point for each additional $2,000 of income (or part thereof) until it signNowes 20 percent for families with income of $43,000 or more.”Next, consider why the care was provided. To qualify, the person (or couple, if married and filing jointly) claiming the credit must have sought care so they could work or search for employment. Further, the individual or couple filing must be considered earned income earners. Wages, salaries, tips, other taxable employee compensation, and net earnings from self-employment all qualify individuals as having earned income. For married filers, one spouse may be considered as having earned income if they were a full-time student, or if they were unable to care for themselves.Who did you pay for care? Qualifying funds spent for care cannot be paid to a filer’s spouse, a dependent of the filer, or to the filer’s child, unless that child will signNow age 19 or older by the end of the year. (The rule for payments to the filer’s child does not change, even if the child is not the filer’s dependent.) Filers must identify care providers on their tax return.There are just a few more qualifying details. To qualify, filing status must be single, married filing jointly, head of household or qualifying widow(er) with a dependent child. The qualifying person must have lived with the person filing for over one half of the year. There are exceptions, for the birth or death of a qualifying person, and for children of divorced or separated parents.IRS Form W-10So, if you meet those criteria, then its time to make sure your care provider fills out a W-10. The form is simple to fill out, requiring only the provider’s name, address, signature and taxpayer identification number (usually their social security number). The form is only for your records; details about the provider will come when you fill out form 2441 for Child and Dependent Care Expenses.Source: The Child and Dependent Care Credit and IRS W-10 Form

-

How do I fill out the BHU's form of B.Com in 2018 and crack it?

you can fill from to go through bhu portal and read all those instruction and download previous year question paper . that u will get at the portal and solve more and more question paper and read some basics from your study level .focus on study save ur time and energy .do best to achieve your goal .for more detail discus with gajendra ta mtech in iit bhu .AND PKN .good luck .

-

Can I print a notice of intent form to homeschool in Nevada, fill it out, and turn it in?

It's best to ask homeschoolers in your state. Every state has different laws. What works in one may not work in another.This looks like the information you need: Notice of Intent (NOI)

-

There is curfew in my area and Internet service is blocked, how can I fill my exam form as today is the last day to fill it out?

Spend less time using your blocked Internet to ask questions on Quora, andTravel back in time to when there was no curfew and you were playing Super Mario Kart, and instead, fill out your exam form.

Create this form in 5 minutes!

How to create an eSignature for the ohio it re reason and explanation of corrections 101940884

How to make an eSignature for the Ohio It Re Reason And Explanation Of Corrections 101940884 in the online mode

How to generate an eSignature for the Ohio It Re Reason And Explanation Of Corrections 101940884 in Google Chrome

How to make an eSignature for signing the Ohio It Re Reason And Explanation Of Corrections 101940884 in Gmail

How to create an electronic signature for the Ohio It Re Reason And Explanation Of Corrections 101940884 from your smartphone

How to generate an eSignature for the Ohio It Re Reason And Explanation Of Corrections 101940884 on iOS

How to generate an eSignature for the Ohio It Re Reason And Explanation Of Corrections 101940884 on Android OS

People also ask

-

What is the Ohio IT RE Reason And Explanation Of Corrections?

The Ohio IT RE Reason And Explanation Of Corrections refers to the specific guidelines and requirements related to correcting data in IT-related documents. Understanding these corrections is important for businesses to maintain compliance and accuracy in their documentation. airSlate SignNow facilitates this process by offering tools to eSign and manage your documents effectively.

-

How does airSlate SignNow help with the Ohio IT RE Reason And Explanation Of Corrections?

airSlate SignNow helps businesses streamline the management of corrections by providing an easy-to-use platform for eSigning and editing documents. This ensures that your Ohio IT RE Reason And Explanation Of Corrections are handled correctly and efficiently, allowing you to focus on your core business operations.

-

What are the pricing options for airSlate SignNow related to Ohio IT RE Reason And Explanation Of Corrections?

airSlate SignNow offers a variety of pricing plans that cater to different business needs, making it cost-effective for handling Ohio IT RE Reason And Explanation Of Corrections. You can choose from monthly or annual subscriptions that provide access to essential features for document management and eSigning.

-

What features does airSlate SignNow provide for Ohio IT RE Reason And Explanation Of Corrections?

airSlate SignNow includes features such as customizable templates, real-time document tracking, and automatic reminders aimed at assisting businesses with Ohio IT RE Reason And Explanation Of Corrections. These tools help ensure that your documents are accurate and compliant with state requirements.

-

Can I integrate airSlate SignNow with other software for managing Ohio IT RE Reason And Explanation Of Corrections?

Yes, airSlate SignNow seamlessly integrates with various software solutions, aiding businesses in managing Ohio IT RE Reason And Explanation Of Corrections more efficiently. Popular integrations include CRM systems and cloud storage platforms, enhancing your workflows and document management processes.

-

What are the benefits of using airSlate SignNow for Ohio IT RE Reason And Explanation Of Corrections?

Using airSlate SignNow for Ohio IT RE Reason And Explanation Of Corrections simplifies document management and enhances compliance. The platform not only improves efficiency but also reduces the risk of errors, allowing you to focus on your business goals.

-

Is airSlate SignNow secure for handling Ohio IT RE Reason And Explanation Of Corrections?

Absolutely! airSlate SignNow prioritizes the security of your documents involved in Ohio IT RE Reason And Explanation Of Corrections. With advanced encryption methods and secure cloud storage, you can trust that your sensitive information is protected.

Get more for Ohio IT RE Reason And Explanation Of Corrections

- Imm5906e work permit cic gc ca cic gc form

- Certificado de supervivencia pdf form

- Porsche pps form

- Expiration date 1231 form

- Gpf nomination first schedule rule 5 3 gpf account no form

- Form no 15 h see rule 29 c 1a the karur vysya bank

- Suitability form guggenheim life and annuity company

- Retreat agreement template form

Find out other Ohio IT RE Reason And Explanation Of Corrections

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors