Ohio it 1040 Tax Form 2018

What is the Ohio IT 1040 Tax Form

The Ohio IT 1040 tax form is the state income tax return form used by residents of Ohio to report their income and calculate their state tax liability. This form is essential for individuals who earn income within the state and are required to pay state income taxes. The Ohio IT 1040 is designed for personal income tax reporting and must be completed accurately to ensure compliance with state tax laws.

How to Use the Ohio IT 1040 Tax Form

To use the Ohio IT 1040 tax form, taxpayers must gather all necessary financial documents, including W-2s, 1099s, and any other income statements. The form requires detailed information about income, deductions, and credits. Taxpayers can fill out the form manually or use digital solutions to complete it online. It is important to follow the instructions provided with the form to ensure all sections are completed correctly.

Steps to Complete the Ohio IT 1040 Tax Form

Completing the Ohio IT 1040 tax form involves several steps:

- Gather all required documentation, including income statements and any applicable deductions.

- Fill out personal information, such as name, address, and Social Security number.

- Report all sources of income, including wages, interest, and dividends.

- Claim any deductions or credits for which you are eligible.

- Calculate your total tax liability and any refund or amount owed.

- Review the completed form for accuracy before submission.

Key Elements of the Ohio IT 1040 Tax Form

Key elements of the Ohio IT 1040 tax form include:

- Personal Information: Name, address, and Social Security number.

- Income Reporting: All sources of income must be reported accurately.

- Deductions and Credits: Taxpayers can claim various deductions and credits applicable to their situation.

- Tax Calculation: The form includes sections for calculating total tax owed or refunds due.

Filing Deadlines / Important Dates

Taxpayers must be aware of important deadlines when filing the Ohio IT 1040 tax form. Typically, the deadline for filing is the same as the federal tax deadline, which is usually April fifteenth. However, if this date falls on a weekend or holiday, the deadline may be extended. It is crucial to file on time to avoid penalties and interest on any taxes owed.

Form Submission Methods

The Ohio IT 1040 tax form can be submitted in various ways:

- Online: Taxpayers can file electronically using approved software or platforms.

- By Mail: Completed forms can be mailed to the appropriate state tax office.

- In-Person: Some taxpayers may choose to file in person at designated tax offices.

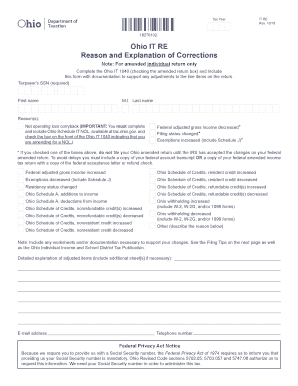

Quick guide on how to complete ohio it re reason and explanation of corrections

Your assistance manual on how to prepare your Ohio It 1040 Tax Form

If you’re curious about how to generate and submit your Ohio It 1040 Tax Form, here are some straightforward recommendations on how to streamline tax processing.

To begin with, you just need to create your airSlate SignNow account to revolutionize how you manage documents digitally. airSlate SignNow is an extremely intuitive and robust document solution that allows you to edit, create, and finalize your tax documents with ease. With its editor, you can alternate between text, checkboxes, and electronic signatures and return to modify details where necessary. Simplify your tax organization with sophisticated PDF editing, electronic signing, and seamless sharing.

Follow the instructions below to complete your Ohio It 1040 Tax Form in just a few minutes:

- Create your account and start editing PDFs within just a few minutes.

- Utilize our directory to find any IRS tax form; browse through variations and schedules.

- Click Acquire form to open your Ohio It 1040 Tax Form in our editor.

- Complete the mandatory fillable areas with your information (text, figures, checkmarks).

- Utilize the Signing Tool to add your legally-compliant eSignature (if necessary).

- Review your document and fix any inaccuracies.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Make the most of this guide to submit your taxes electronically with airSlate SignNow. Please be aware that filing on paper can increase errors and postpone refunds. Naturally, before e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct ohio it re reason and explanation of corrections

FAQs

-

What is the IRS form W-10 and how is it correctly filled out?

While you may have never heard of IRS Form W-10, you will if you’re currently paying or planning to pay someone to care for a child, dependent, or spouse? If you are, then you may qualify to claim what’s called the Child and Dependent Care credit on your federal income tax return. To claim this credit, your care provider must fill out a W-10. You may also need to fill out the form if you receive benefits from an employer sponsored dependent care plan.It’s certainly worth it to see if you qualify (and for this we recommend that you consult with a tax professional). The child and dependent care credit can be up to 35 percent of qualifying expenses, depending on adjusted gross income. For 2011, filers may use up to $3,000 of expenses paid in a year for one qualifying individual or $6,000 for two or more qualifying individuals. (When it comes time to figure your qualifying expenses, remember that they must be reduced by the amount of any dependent care benefits provided by your employer, if those benefits were deducted or excluded from your income.)Do You Qualify for the Credit?To see if you need to have your care provider fill out a W-10, first determine if you qualify for the credit for child and dependent care expenses. To qualify, the care must have been provided for one or more qualifying persons, generally a dependent child age 12 or younger when the care was provided. Certain other individuals, spouses and those who are incapable of self-care, may also be considered qualifying persons. (Note: each qualifying individual must be listed on your tax return.)Remember also that the amount you can claim as a credit is reduced as your income rises. According to the Tax Policy Center, “Families with income below $15,000 qualify for the 35 percent credit. That rate falls by 1 percentage point for each additional $2,000 of income (or part thereof) until it signNowes 20 percent for families with income of $43,000 or more.”Next, consider why the care was provided. To qualify, the person (or couple, if married and filing jointly) claiming the credit must have sought care so they could work or search for employment. Further, the individual or couple filing must be considered earned income earners. Wages, salaries, tips, other taxable employee compensation, and net earnings from self-employment all qualify individuals as having earned income. For married filers, one spouse may be considered as having earned income if they were a full-time student, or if they were unable to care for themselves.Who did you pay for care? Qualifying funds spent for care cannot be paid to a filer’s spouse, a dependent of the filer, or to the filer’s child, unless that child will signNow age 19 or older by the end of the year. (The rule for payments to the filer’s child does not change, even if the child is not the filer’s dependent.) Filers must identify care providers on their tax return.There are just a few more qualifying details. To qualify, filing status must be single, married filing jointly, head of household or qualifying widow(er) with a dependent child. The qualifying person must have lived with the person filing for over one half of the year. There are exceptions, for the birth or death of a qualifying person, and for children of divorced or separated parents.IRS Form W-10So, if you meet those criteria, then its time to make sure your care provider fills out a W-10. The form is simple to fill out, requiring only the provider’s name, address, signature and taxpayer identification number (usually their social security number). The form is only for your records; details about the provider will come when you fill out form 2441 for Child and Dependent Care Expenses.Source: The Child and Dependent Care Credit and IRS W-10 Form

-

How do I fill out the BHU's form of B.Com in 2018 and crack it?

you can fill from to go through bhu portal and read all those instruction and download previous year question paper . that u will get at the portal and solve more and more question paper and read some basics from your study level .focus on study save ur time and energy .do best to achieve your goal .for more detail discus with gajendra ta mtech in iit bhu .AND PKN .good luck .

-

Can I print a notice of intent form to homeschool in Nevada, fill it out, and turn it in?

It's best to ask homeschoolers in your state. Every state has different laws. What works in one may not work in another.This looks like the information you need: Notice of Intent (NOI)

-

There is curfew in my area and Internet service is blocked, how can I fill my exam form as today is the last day to fill it out?

Spend less time using your blocked Internet to ask questions on Quora, andTravel back in time to when there was no curfew and you were playing Super Mario Kart, and instead, fill out your exam form.

Create this form in 5 minutes!

How to create an eSignature for the ohio it re reason and explanation of corrections

How to make an eSignature for the Ohio It Re Reason And Explanation Of Corrections in the online mode

How to make an electronic signature for your Ohio It Re Reason And Explanation Of Corrections in Chrome

How to generate an eSignature for putting it on the Ohio It Re Reason And Explanation Of Corrections in Gmail

How to generate an eSignature for the Ohio It Re Reason And Explanation Of Corrections from your smartphone

How to create an electronic signature for the Ohio It Re Reason And Explanation Of Corrections on iOS devices

How to generate an electronic signature for the Ohio It Re Reason And Explanation Of Corrections on Android OS

People also ask

-

What is the 2015 Ohio IT 1040 tax form?

The 2015 Ohio IT 1040 tax form is the individual income tax return used by residents of Ohio to report their income for the year 2015. This form includes sections to calculate state tax liabilities and claim any applicable credits or deductions. It is important for Ohio residents to accurately complete this form to ensure compliance with state tax laws.

-

How can I eSign my 2015 Ohio IT 1040 tax form using airSlate SignNow?

With airSlate SignNow, you can easily upload your 2015 Ohio IT 1040 tax form and eSign it in a few simple steps. Our user-friendly platform allows you to add your signature electronically, ensuring that your tax form is compliant with state regulations. This electronic signing process saves time and provides a secure way to handle your important documents.

-

What are the benefits of using airSlate SignNow for the 2015 Ohio IT 1040 tax form?

Using airSlate SignNow for the 2015 Ohio IT 1040 tax form offers several benefits, including convenience, speed, and enhanced security. You can sign and send your tax documents from anywhere with an internet connection, making it easy to meet your filing deadlines. Additionally, our platform ensures that your personal information is protected during the signing process.

-

Is there a cost associated with using airSlate SignNow for my 2015 Ohio IT 1040 tax form?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be cost-effective. Our pricing plans accommodate various user needs and include features that make signing documents, including your 2015 Ohio IT 1040 tax form, straightforward and efficient. Consider choosing a plan that best fits your tax document needs.

-

Can I integrate airSlate SignNow with other software for handling the 2015 Ohio IT 1040 tax form?

Absolutely! airSlate SignNow offers seamless integrations with various software solutions, which can enhance your experience when managing the 2015 Ohio IT 1040 tax form. This allows you to connect your existing accounting or document management tools directly with our platform, streamlining your workflow and improving efficiency.

-

How does airSlate SignNow ensure the security of my 2015 Ohio IT 1040 tax form data?

airSlate SignNow prioritizes the security of your data, including the information on your 2015 Ohio IT 1040 tax form. We use advanced encryption methods and secure data storage protocols to protect your sensitive information. Rest assured, your documents and personal data remain private and secure throughout the eSigning process.

-

What support options are available if I need help with my 2015 Ohio IT 1040 tax form?

If you need assistance with your 2015 Ohio IT 1040 tax form on airSlate SignNow, we provide various support options to help you. Our dedicated customer service team is available via email and chat to answer your questions and resolve any issues. You can also access our extensive knowledge base for tutorials and FAQs.

Get more for Ohio It 1040 Tax Form

- Book report photocopiable ael publications form

- Inkomstdeklaration 4 form

- Nc electronic fingerprint information form

- Special event general liability application gls app 9s 11 14 form

- Irs form 4506t ez request for transcript of tax return

- Wallace community college selma transcript request form

- Graphic designer contract template form

- Graphics design contract template form

Find out other Ohio It 1040 Tax Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document