Form 1099 R Distributions from Pensions, Annuities, Retirement or Profit Sharing Plans, IRAs, Insurance Contracts, Etc

What is the Form 1099-R?

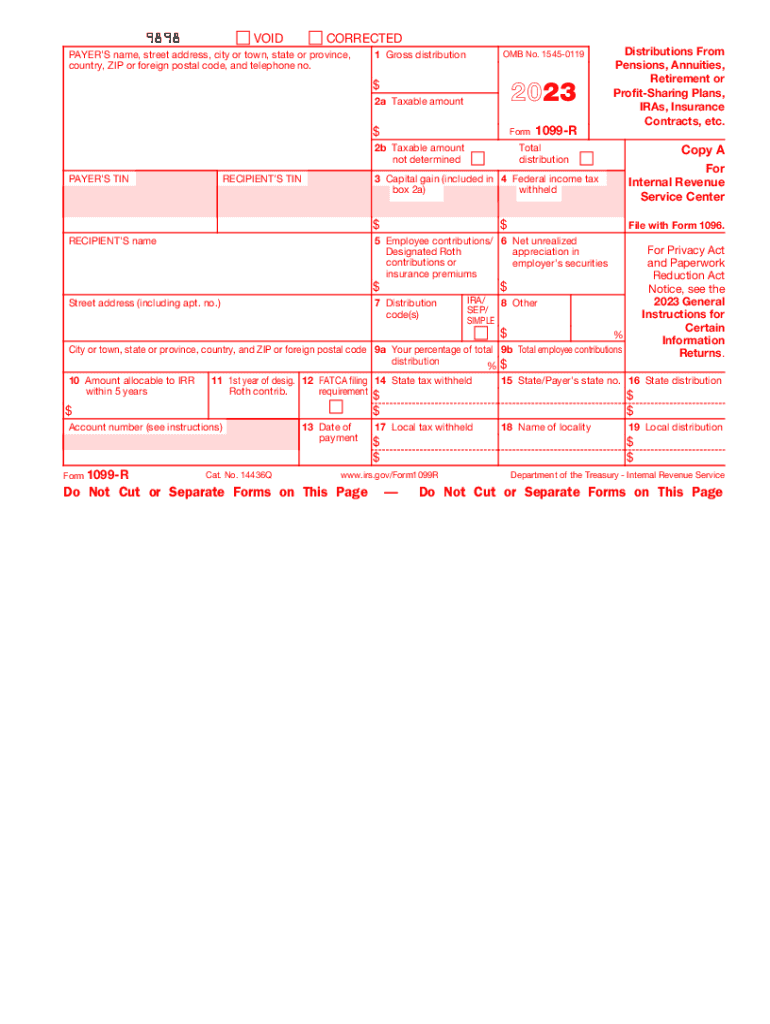

The Form 1099-R is an IRS document used to report distributions from pensions, annuities, retirement or profit-sharing plans, IRAs, and insurance contracts. This form provides essential information regarding the amount of money distributed to an individual during the tax year. It is crucial for taxpayers to understand this form as it impacts their taxable income and tax filing obligations.

Typically, the payer of the distribution issues the Form 1099-R, detailing the total amount distributed and any taxes withheld. This form also includes various distribution codes that indicate the nature of the distribution, which is vital for accurate tax reporting.

Key Elements of the Form 1099-R

Understanding the key elements of the Form 1099-R is essential for accurate tax reporting. The form includes several important sections:

- Payer Information: This section contains the name, address, and taxpayer identification number (TIN) of the entity issuing the form.

- Recipient Information: Here, the recipient's name, address, and TIN are listed, ensuring proper identification for tax purposes.

- Distribution Amount: This box shows the total distribution amount received by the taxpayer during the year.

- Tax Withheld: If any federal income tax was withheld from the distribution, it is reported in this section.

- Distribution Codes: These codes explain the type of distribution and any special tax implications associated with it.

Steps to Complete the Form 1099-R

Completing the Form 1099-R requires careful attention to detail. Follow these steps to ensure accuracy:

- Gather all relevant information, including payer and recipient details.

- Enter the total distribution amount in the appropriate box.

- If applicable, include any federal income tax withheld.

- Assign the correct distribution code based on the nature of the distribution.

- Review the completed form for accuracy before submission.

IRS Guidelines for Form 1099-R

The IRS provides specific guidelines for the use of Form 1099-R. It is essential for both payers and recipients to be aware of these rules to ensure compliance:

- Form 1099-R must be issued for any distribution over ten dollars.

- Payers are required to send copies of the form to both the IRS and the recipient by the designated deadlines.

- It is important to retain copies of the form for personal records and future reference.

Who Issues the Form 1099-R?

The Form 1099-R is typically issued by financial institutions, pension plans, or insurance companies that manage retirement accounts. These entities are responsible for reporting distributions made to individuals, ensuring that all necessary tax information is accurately conveyed to the IRS. Understanding who issues this form can help recipients verify their records and ensure they are receiving the correct documentation for their tax filings.

Quick guide on how to complete form 1099 r distributions from pensions annuities retirement or profit sharing plans iras insurance contracts etc

Complete Form 1099 R Distributions From Pensions, Annuities, Retirement Or Profit Sharing Plans, IRAs, Insurance Contracts, Etc effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, as you can easily find the correct form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents promptly without delays. Manage Form 1099 R Distributions From Pensions, Annuities, Retirement Or Profit Sharing Plans, IRAs, Insurance Contracts, Etc on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to edit and eSign Form 1099 R Distributions From Pensions, Annuities, Retirement Or Profit Sharing Plans, IRAs, Insurance Contracts, Etc effortlessly

- Obtain Form 1099 R Distributions From Pensions, Annuities, Retirement Or Profit Sharing Plans, IRAs, Insurance Contracts, Etc and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of your documents or redact confidential information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Verify all details and click on the Done button to save your changes.

- Select how you'd like to share your form, either by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, the hassle of searching for forms, or errors that require printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device. Edit and eSign Form 1099 R Distributions From Pensions, Annuities, Retirement Or Profit Sharing Plans, IRAs, Insurance Contracts, Etc and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1099 r distributions from pensions annuities retirement or profit sharing plans iras insurance contracts etc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1099 R form 2023?

The 1099 R form 2023 is a tax document used to report distributions from pensions, annuities, retirement plans, or other deferred compensation. It is essential for taxpayers to receive this form for accurate filing of their income taxes. Understanding the details on your 1099 R form 2023 can help ensure compliance and prevent any issues with the IRS.

-

How can airSlate SignNow help with the 1099 R form 2023?

airSlate SignNow simplifies the process of sending and eSigning your 1099 R form 2023. With our secure platform, you can easily share the document with recipients and collect signatures electronically, making it faster and more efficient. This digital solution helps you keep track of your 1099 R forms without the hassle of paper.

-

Is there a cost associated with using airSlate SignNow for the 1099 R form 2023?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. While there are costs associated with our services, the value gained through efficient document management and eSigning greatly outweighs the investment. Check our pricing page for details on the best plan that fits your requirements for handling the 1099 R form 2023.

-

Can I integrate airSlate SignNow with other software for the 1099 R form 2023?

Absolutely! airSlate SignNow supports integration with numerous applications that you may already use, such as accounting software and document management systems. This seamless integration allows you to streamline your processes related to the 1099 R form 2023 and maintain a consistent workflow across platforms.

-

What features does airSlate SignNow provide for managing the 1099 R form 2023?

airSlate SignNow provides features like customizable templates, advanced security, and tracking capabilities specifically for documents like the 1099 R form 2023. These features ensure that your forms are not only legally compliant but also handled securely and efficiently. Additionally, you'll receive notifications when your forms are signed and completed.

-

How secure is airSlate SignNow when dealing with the 1099 R form 2023?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and compliance measures to protect your 1099 R form 2023 and other sensitive documents. Our platform is designed to ensure that both your data and the signatures collected are secure, providing peace of mind during the eSigning process.

-

Can I access my 1099 R form 2023 on mobile devices using airSlate SignNow?

Yes! airSlate SignNow offers a mobile-friendly application, allowing you to access, send, and eSign your 1099 R form 2023 from your smartphone or tablet. This flexibility is ideal for busy professionals who need to manage documents on the go without compromising functionality or security.

Get more for Form 1099 R Distributions From Pensions, Annuities, Retirement Or Profit Sharing Plans, IRAs, Insurance Contracts, Etc

Find out other Form 1099 R Distributions From Pensions, Annuities, Retirement Or Profit Sharing Plans, IRAs, Insurance Contracts, Etc

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement