California State Taxes Do I Deduct $3000 Capital Loss from Form

Understanding Capital Loss Deductions in California

In California, taxpayers can deduct capital losses to offset capital gains, which can significantly reduce taxable income. If you incur a capital loss, such as a $3,000 loss, you may be eligible to deduct this amount from your taxable income. This deduction is particularly relevant for individuals who have realized capital gains during the tax year. The state allows you to carry forward any unused capital losses to future tax years, providing further tax relief.

Steps to Deduct a $3,000 Capital Loss in California

To deduct a capital loss on your California taxes, follow these steps:

- Determine your total capital gains and losses for the year.

- If your total capital losses exceed your gains, you can deduct up to $3,000 from your ordinary income.

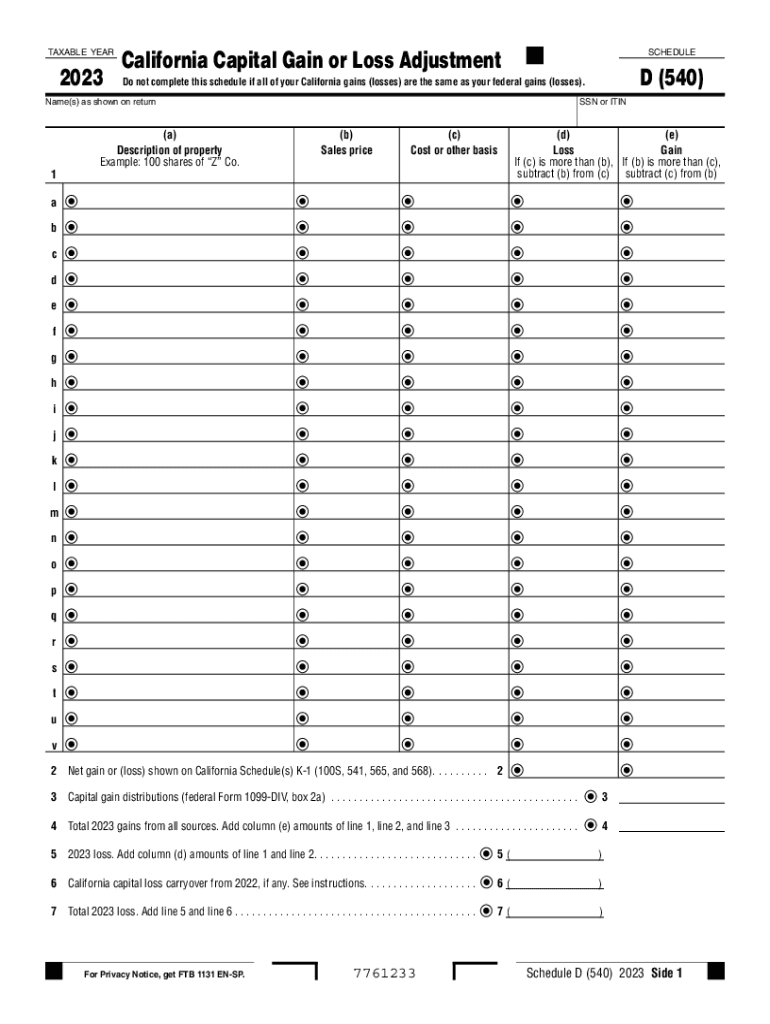

- Complete the California Schedule D (Form 540) to report your capital gains and losses.

- Include any carryover losses from previous years on your Schedule D.

- Submit your completed Schedule D with your California tax return.

Required Documents for Capital Loss Deduction

To successfully claim a capital loss deduction, gather the following documents:

- Records of all transactions that resulted in capital gains or losses.

- Form 540, which is the California Resident Income Tax Return.

- California Schedule D to report capital gains and losses.

- Any supporting documentation for transactions, such as purchase and sale receipts.

Eligibility Criteria for Claiming Capital Loss Deductions

To be eligible for a capital loss deduction in California, you must meet specific criteria:

- You must have realized capital losses from the sale of assets such as stocks, bonds, or real estate.

- The capital loss must be reported on your tax return for the year in which the loss occurred.

- Taxpayers can only deduct losses up to $3,000 against ordinary income if filing jointly or $1,500 if married filing separately.

Examples of Capital Loss Deductions

Consider the following scenarios to understand how capital loss deductions work:

- If you sold stock for a $5,000 loss and had no capital gains, you can deduct $3,000 from your ordinary income and carry forward the remaining $2,000 to future years.

- If you sold a rental property for a $10,000 loss and had $4,000 in capital gains from other investments, you can offset the gains entirely and deduct the remaining $6,000 in future years.

Filing Deadlines for Capital Loss Deductions

It is essential to be aware of the filing deadlines for capital loss deductions in California:

- The tax return for the previous year is typically due on April 15 of the current year.

- If you need to file an extension, the extended deadline is usually October 15.

- Ensure all forms, including Schedule D, are submitted by these deadlines to avoid penalties.

Quick guide on how to complete california state taxes do i deduct 3000 capital loss from

Complete California State Taxes Do I Deduct $3000 Capital Loss From effortlessly on any device

Online document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the correct forms and securely store them online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents rapidly without interruptions. Manage California State Taxes Do I Deduct $3000 Capital Loss From on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign California State Taxes Do I Deduct $3000 Capital Loss From with ease

- Locate California State Taxes Do I Deduct $3000 Capital Loss From and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow addresses your document management needs with just a few clicks from your chosen device. Alter and eSign California State Taxes Do I Deduct $3000 Capital Loss From and guarantee exceptional communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the california state taxes do i deduct 3000 capital loss from

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to california capital?

airSlate SignNow is a digital document management solution that enables businesses to send, sign, and manage documents electronically. It streamlines the signing process, making it more efficient for companies operating in california capital.

-

How much does airSlate SignNow cost for businesses in california capital?

airSlate SignNow offers various pricing plans designed to fit different business needs and budgets. For businesses located in california capital, the plans are affordable and conducive to seamless document management.

-

What features make airSlate SignNow suitable for companies in california capital?

airSlate SignNow provides an easy-to-use interface, advanced security features, and templates for fast document preparation. These features are particularly beneficial for businesses in california capital looking to enhance their workflow efficiency.

-

Can I integrate airSlate SignNow with other tools I use in california capital?

Yes, airSlate SignNow offers various integrations with popular business tools and software. This is especially advantageous for organizations in california capital that want to maintain their existing workflow while utilizing our eSigning capabilities.

-

What are the benefits of using airSlate SignNow for businesses in california capital?

Using airSlate SignNow allows businesses in california capital to save time and reduce operational costs by digitizing their document processes. This results in faster turnaround times and improved customer satisfaction.

-

Is airSlate SignNow compliant with legal requirements in california capital?

Yes, airSlate SignNow complies with all relevant legal standards for electronic signatures, which ensures that documents signed using our platform are legally binding in california capital and beyond.

-

How can airSlate SignNow help with remote work for companies in california capital?

airSlate SignNow is an ideal solution for remote work as it allows employees in california capital to sign documents from anywhere at any time. This flexibility enhances productivity and supports the growing trend of remote operations.

Get more for California State Taxes Do I Deduct $3000 Capital Loss From

- Fish wildlife service form 2014 2019

- 3 202 12 2013 2019 form

- Application national parks pass 2017 2019 form

- 3 2368 us fish and wildlife service fws form

- Assessment work 2013 2019 form

- Blm notice of intent form 2013 2019

- Depredation permit application us fish and wildlife service form

- 486 form 031808 2016 2019

Find out other California State Taxes Do I Deduct $3000 Capital Loss From

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe