Schedule E Form 1 Supplemental Income and Loss

What is the Schedule E Form 1 Supplemental Income And Loss

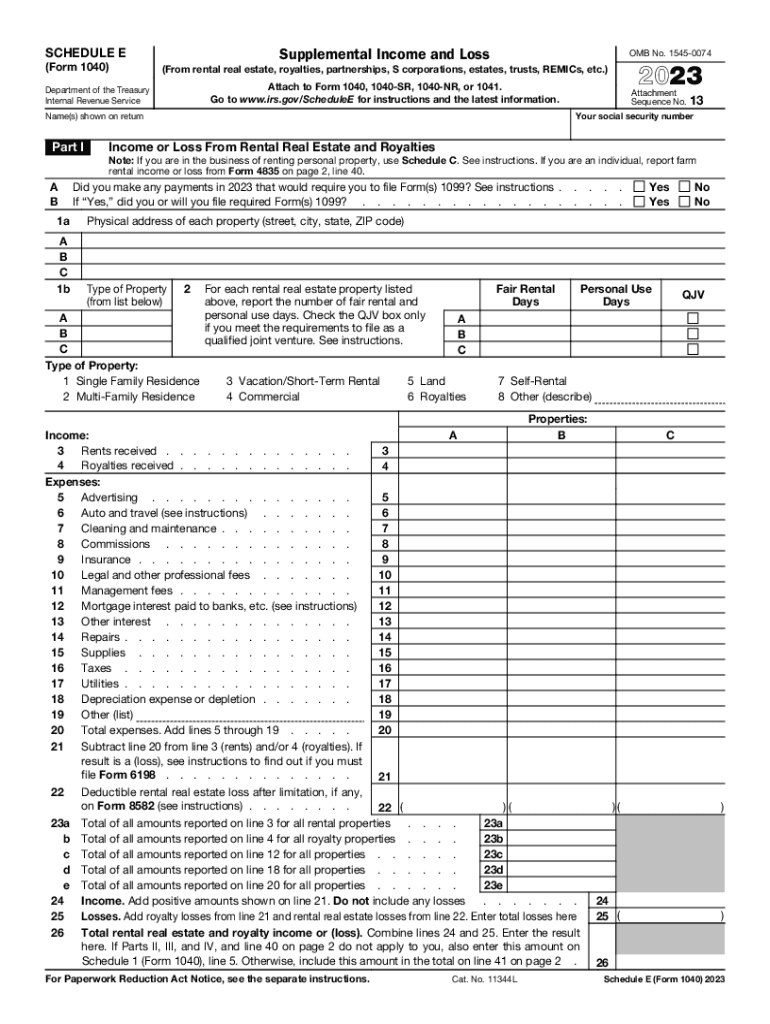

The Schedule E Form 1 is a tax document used by individuals to report supplemental income and loss. This form is essential for taxpayers who earn income from various sources, including rental properties, royalties, partnerships, S corporations, estates, and trusts. By accurately completing this form, taxpayers can ensure that all sources of income are reported to the IRS, allowing for proper tax calculations. The Schedule E helps in detailing the income generated from rental properties, which is crucial for tax obligations.

How to use the Schedule E Form 1 Supplemental Income And Loss

Using the Schedule E Form 1 involves several steps to ensure accurate reporting of supplemental income. Taxpayers should first gather all relevant documents, including rental agreements, income statements, and expense receipts. Next, they will need to fill out the form by entering their total rental income, followed by any expenses related to the property, such as repairs, maintenance, and property management fees. After completing the form, it should be attached to the taxpayer's main tax return, typically Form 1040.

Steps to complete the Schedule E Form 1 Supplemental Income And Loss

Completing the Schedule E Form 1 involves a systematic approach:

- Gather all necessary documents related to rental income and expenses.

- Fill out the top section with personal information, including name and Social Security number.

- List each rental property separately, providing details such as address and type of property.

- Enter the total rental income received for each property.

- Deduct allowable expenses, including mortgage interest, property tax, and maintenance costs.

- Calculate the net income or loss for each property and transfer this information to the main tax return.

IRS Guidelines

The IRS provides specific guidelines for completing the Schedule E Form 1. Taxpayers must ensure that all income and expenses are accurately reported, as discrepancies can lead to audits or penalties. It is essential to keep detailed records of all transactions related to rental properties. The IRS also outlines what qualifies as deductible expenses, which can include property management fees, repairs, and depreciation. Familiarizing oneself with these guidelines can help taxpayers maximize their deductions while remaining compliant.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule E Form 1 align with the general tax return deadlines. Typically, individual taxpayers must submit their returns by April 15 each year. If additional time is needed, taxpayers can file for an extension, which usually grants an additional six months. However, it is important to note that any taxes owed must still be paid by the original deadline to avoid penalties and interest. Staying aware of these deadlines is crucial for maintaining compliance with IRS regulations.

Required Documents

To accurately complete the Schedule E Form 1, several documents are necessary:

- Rental agreements or leases for each property.

- Records of rental income received, including bank statements.

- Receipts for any expenses related to property maintenance and management.

- Mortgage statements detailing interest paid.

- Property tax statements.

Having these documents organized and readily available can streamline the tax preparation process and ensure accuracy in reporting.

Quick guide on how to complete schedule e form 1 supplemental income and loss

Accomplish Schedule E Form 1 Supplemental Income And Loss effortlessly on any device

Digital document administration has gained traction with businesses and individuals alike. It serves as an ideal sustainable option to traditional printed and signed papers, allowing you to locate the correct template and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage Schedule E Form 1 Supplemental Income And Loss on any device using airSlate SignNow Android or iOS applications and enhance any document-related activity today.

Steps to edit and eSign Schedule E Form 1 Supplemental Income And Loss seamlessly

- Obtain Schedule E Form 1 Supplemental Income And Loss and select Get Form to begin.

- Make use of the tools we offer to input your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow supplies specifically for this purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Banish the worry of lost or misplaced files, tedious form hunting, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign Schedule E Form 1 Supplemental Income And Loss and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule e form 1 supplemental income and loss

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form e sign and how does it work?

Form e sign is a digital signature solution that allows users to electronically sign documents online. It streamlines the signing process by eliminating the need for physical paperwork, making it faster and more efficient. With airSlate SignNow, you can upload documents, add signers, and send them for e-signature in just a few clicks.

-

How much does airSlate SignNow's form e sign service cost?

airSlate SignNow offers flexible pricing plans to fit different business needs. Depending on the features and number of users, the costs can vary signNowly, but the service is designed to be cost-effective. You can easily get started with a free trial to see if it's the right fit for your form e sign needs.

-

What features are included with the form e sign service?

The form e sign solution from airSlate SignNow includes features such as customizable templates, document tracking, and advanced security measures. It also provides a user-friendly interface that simplifies the signing process for both senders and signers. These features ensure that you can manage your e-signing needs efficiently.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow supports a range of integrations with other popular applications and systems. This flexibility allows you to seamlessly connect your form e sign process with tools like CRMs, document management systems, and more. These integrations enhance workflow efficiency and data management.

-

What are the benefits of using form e sign for businesses?

Using form e sign can signNowly enhance business processes by reducing the time and resources spent on manual document handling. It also increases accessibility, allowing signers to e-sign from anywhere, at any time. This convenience can lead to faster turnaround times and improved customer satisfaction.

-

Is form e sign secure and compliant with regulations?

Absolutely, airSlate SignNow prioritizes the security of your documents and complies with industry regulations, including eSign Act and GDPR. The form e sign process uses encryption and secure storage to protect your data. This ensures that both your information and that of your clients remain confidential.

-

What types of documents can I sign with airSlate SignNow's form e sign feature?

You can use the form e sign feature to sign a wide variety of documents, including contracts, agreements, consent forms, and more. airSlate SignNow supports multiple file formats, making it versatile for various business needs. This flexibility enables businesses to implement e-signatures across diverse document types.

Get more for Schedule E Form 1 Supplemental Income And Loss

- Your infants babysitter mommy tracked form

- Igh parent code of conduct agreement form

- Program adult form

- Hipaa act information form

- Professional liability insurance occurrence application form

- Medical history somerhill dental practice somerhilldental co form

- Program title mgma annual conference healthcare innovation pavilion form

- Peff pdf form

Find out other Schedule E Form 1 Supplemental Income And Loss

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe