In ST 103 Instructions Fill Out Tax Template Form

What is the Indiana ST-103 Form?

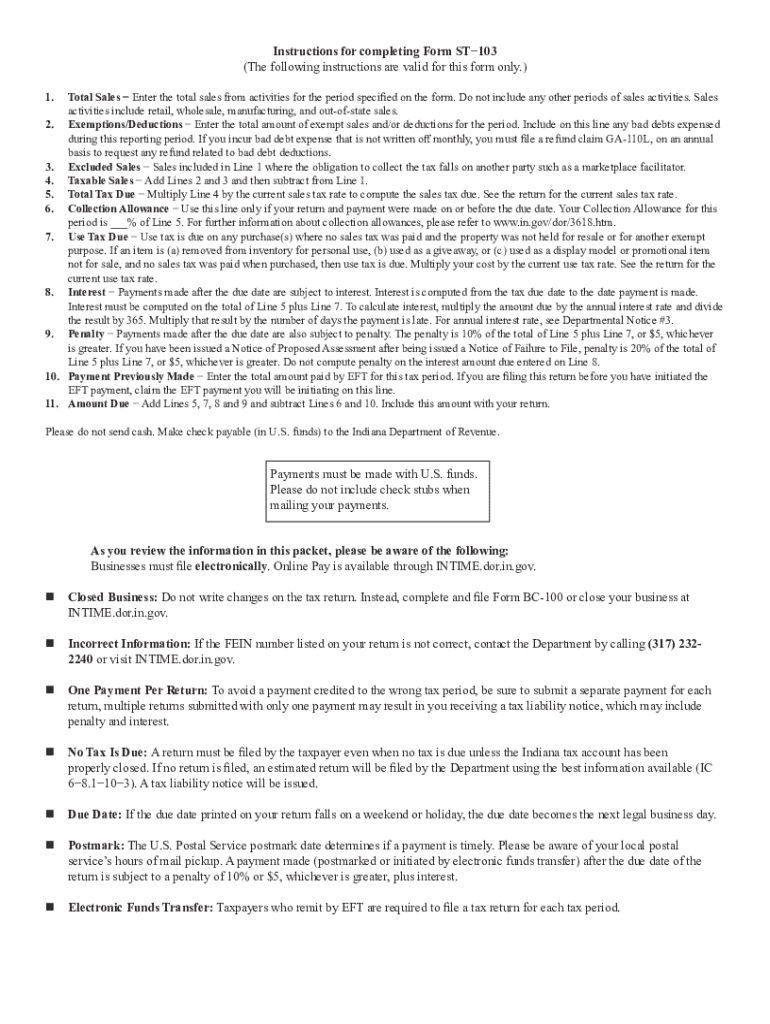

The Indiana ST-103 form is a state-specific tax document used primarily for sales tax exemption purposes. This form allows certain purchasers to claim an exemption from sales tax when acquiring tangible personal property or specific services. The ST-103 is essential for businesses and individuals who qualify for tax-exempt purchases, ensuring compliance with Indiana tax regulations.

Key Elements of the Indiana ST-103 Form

Understanding the key components of the Indiana ST-103 form is vital for accurate completion. The form typically includes:

- Purchaser Information: Name, address, and identification details of the purchaser.

- Seller Information: Name and address of the seller from whom the purchase is made.

- Reason for Exemption: A clear statement indicating the basis for the exemption, such as resale or specific use.

- Signature: The authorized signature of the purchaser, affirming the accuracy of the provided information.

Steps to Complete the Indiana ST-103 Form

Filling out the Indiana ST-103 form involves several straightforward steps:

- Gather necessary information, including your business details and the seller's information.

- Clearly identify the reason for claiming the sales tax exemption.

- Complete all sections of the form, ensuring accuracy in the details provided.

- Sign and date the form to validate your claim.

- Provide the completed form to the seller at the time of purchase.

How to Obtain the Indiana ST-103 Form

The Indiana ST-103 form can be obtained through various channels. It is available for download on the official Indiana Department of Revenue website. Additionally, businesses may request physical copies from their tax advisors or local tax offices. Ensuring you have the most current version of the form is crucial for compliance.

Legal Use of the Indiana ST-103 Form

The Indiana ST-103 form serves a legal purpose in the realm of sales tax exemptions. It is essential for purchasers to understand their eligibility and the legal implications of using this form. Misuse or fraudulent claims can lead to penalties, including fines and back taxes. Therefore, it is critical to only use the ST-103 for legitimate tax-exempt purchases.

Filing Deadlines and Important Dates

While the Indiana ST-103 form itself does not have specific filing deadlines, it is important to present it at the time of purchase to ensure the exemption is applied correctly. Keeping track of state tax deadlines for sales tax payments is also essential for maintaining compliance with Indiana tax regulations.

Quick guide on how to complete in st 103 instructions fill out tax template

Prepare IN ST 103 Instructions Fill Out Tax Template seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers a superb eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents rapidly without delays. Manage IN ST 103 Instructions Fill Out Tax Template on any device with airSlate SignNow's Android or iOS apps and streamline any document-related process today.

The easiest way to edit and eSign IN ST 103 Instructions Fill Out Tax Template effortlessly

- Acquire IN ST 103 Instructions Fill Out Tax Template and click Get Form to begin.

- Leverage the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with features that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal authority as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign IN ST 103 Instructions Fill Out Tax Template and ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the in st 103 instructions fill out tax template

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Indiana ST 103 form?

The Indiana ST 103 form is a sales tax exemption certificate used in Indiana. This form allows eligible entities to make tax-exempt purchases for resale or purposes outlined by Indiana law. It's essential for businesses that aim to streamline their purchasing processes while adhering to tax regulations.

-

How can airSlate SignNow help with the Indiana ST 103 form?

airSlate SignNow simplifies the process of completing and eSigning the Indiana ST 103 form. With our user-friendly platform, you can easily fill out the form electronically, ensuring that all necessary information is accurately captured. This efficiency helps businesses save time and reduce the risk of errors.

-

Is airSlate SignNow a cost-effective solution for handling the Indiana ST 103 form?

Yes, airSlate SignNow offers a cost-effective solution for managing the Indiana ST 103 form. Our pricing plans are designed to accommodate businesses of all sizes, ensuring you have access to essential features without breaking the bank. By using our platform, you can reduce administrative costs associated with paper forms.

-

What features does airSlate SignNow provide for the Indiana ST 103 form?

airSlate SignNow comes equipped with several features tailored for the Indiana ST 103 form, including templates, eSignature capabilities, and secure document storage. These features enhance the overall user experience, allowing for efficient handling and management of tax exemption forms. Automation tools further streamline your workflow.

-

Can I integrate airSlate SignNow with other software for managing the Indiana ST 103 form?

Absolutely! airSlate SignNow offers integration with various software applications to help you manage the Indiana ST 103 form seamlessly. Whether you are using accounting software or a customer relationship management (CRM) system, our platform can connect with these tools to enhance your workflow efficiency.

-

How secure is the process of submitting the Indiana ST 103 form using airSlate SignNow?

The security of your data is our top priority at airSlate SignNow. When submitting the Indiana ST 103 form, we ensure that all documents are encrypted and stored securely. Our platform complies with industry standards to protect sensitive information, giving you peace of mind during the eSigning process.

-

Can multiple users collaborate on the Indiana ST 103 form in airSlate SignNow?

Yes, airSlate SignNow allows multiple users to collaborate on the Indiana ST 103 form. You can easily invite team members to review and sign the document, streamlining the process while maintaining version control. This collaborative feature is particularly useful for businesses handling various tax exemption requests.

Get more for IN ST 103 Instructions Fill Out Tax Template

Find out other IN ST 103 Instructions Fill Out Tax Template

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU