Indiana Tax Power of Attorney Form Form 49357PDF 2023

What is the Indiana Tax Power Of Attorney Form Form 49357?

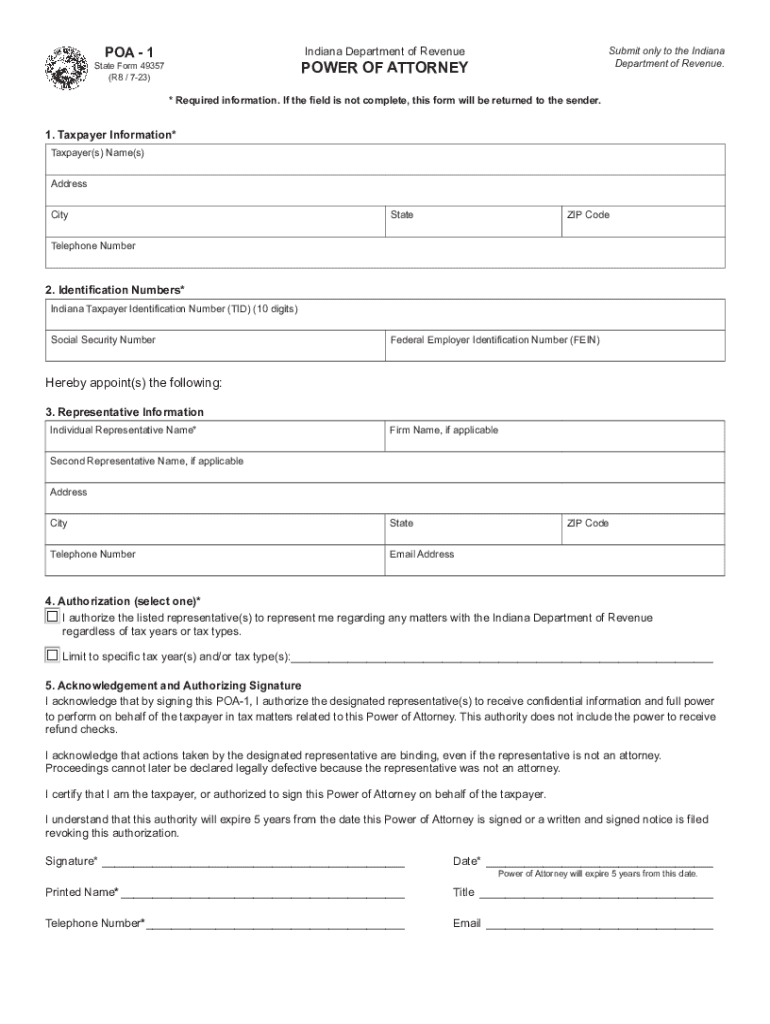

The Indiana Tax Power of Attorney Form, commonly referred to as Form 49357, is a legal document that allows an individual or entity to designate another person to represent them before the Indiana Department of Revenue (DOR) regarding tax matters. This form is essential for those who need assistance in managing their tax obligations, ensuring that the appointed representative has the authority to act on their behalf in various tax-related situations.

How to use the Indiana Tax Power Of Attorney Form Form 49357

To utilize the Indiana Tax Power of Attorney Form, the taxpayer must complete the form accurately, providing necessary details such as the names, addresses, and signatures of both the taxpayer and the representative. Once filled out, the form should be submitted to the Indiana DOR. This grants the appointed representative the authority to receive confidential tax information and communicate with the DOR on behalf of the taxpayer.

Steps to complete the Indiana Tax Power Of Attorney Form Form 49357

Completing the Indiana Tax Power of Attorney Form involves several key steps:

- Obtain the latest version of Form 49357 from the Indiana DOR website or a reliable source.

- Fill in the taxpayer's information, including name, address, and taxpayer identification number.

- Provide the representative's details, ensuring they are authorized to act on behalf of the taxpayer.

- Specify the tax matters for which the representative is granted authority.

- Sign and date the form to validate it.

- Submit the completed form to the Indiana DOR via mail or in person.

Key elements of the Indiana Tax Power Of Attorney Form Form 49357

The Indiana Tax Power of Attorney Form includes several critical elements:

- Taxpayer Information: Essential details about the taxpayer, including their name and identification number.

- Representative Information: Information about the individual or entity authorized to act on behalf of the taxpayer.

- Scope of Authority: A clear definition of the specific tax matters the representative can handle.

- Signatures: Required signatures from both the taxpayer and the representative to validate the document.

Legal use of the Indiana Tax Power Of Attorney Form Form 49357

The legal use of the Indiana Tax Power of Attorney Form is crucial for ensuring that the designated representative can effectively manage the taxpayer's obligations. This form is recognized by the Indiana DOR and provides the necessary authority for the representative to access confidential tax information, respond to inquiries, and represent the taxpayer during audits or disputes. Proper completion and submission of this form help prevent misunderstandings and ensure compliance with state tax laws.

Eligibility Criteria

To utilize the Indiana Tax Power of Attorney Form, certain eligibility criteria must be met:

- The taxpayer must be an individual or entity with tax obligations in Indiana.

- The representative must be a qualified individual, such as an attorney, accountant, or another authorized person.

- Both parties must provide accurate and truthful information on the form.

Quick guide on how to complete indiana tax power of attorney form form 49357pdf

Effortlessly prepare Indiana Tax Power Of Attorney Form Form 49357PDF on any gadget

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed papers, as you can access the necessary form and securely save it online. airSlate SignNow supplies you with all the resources required to create, modify, and electronically sign your documents quickly without delays. Manage Indiana Tax Power Of Attorney Form Form 49357PDF on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to alter and electronically sign Indiana Tax Power Of Attorney Form Form 49357PDF with ease

- Locate Indiana Tax Power Of Attorney Form Form 49357PDF and click Get Form to begin.

- Utilize the tools we offer to finish your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information thoroughly and click on the Done button to save your modifications.

- Choose how you would like to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced files, time-consuming form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow addresses all your requirements in document management with just a few clicks from any device of your choice. Edit and electronically sign Indiana Tax Power Of Attorney Form Form 49357PDF to ensure exceptional communication at any point of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct indiana tax power of attorney form form 49357pdf

Create this form in 5 minutes!

How to create an eSignature for the indiana tax power of attorney form form 49357pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1 poa form and how is it used?

The 1 poa form is a Power of Attorney document that grants authority to a designated individual to act on your behalf. It is widely used in various transactions, including financial and legal matters. With airSlate SignNow, you can easily create, send, and eSign your 1 poa form securely.

-

How can I create a 1 poa form using airSlate SignNow?

Creating a 1 poa form with airSlate SignNow is straightforward. You can start by choosing from our templates or creating a form from scratch. Our user-friendly interface allows you to customize fields and add necessary signers within minutes.

-

What features does airSlate SignNow offer for managing the 1 poa form?

airSlate SignNow provides essential features for managing your 1 poa form, including eSigning, document tracking, and seamless integrations with other applications. You can store documents securely in the cloud and access them anytime. This ensures a smooth workflow for all your signing needs.

-

Is there a cost associated with using the 1 poa form feature on airSlate SignNow?

Yes, airSlate SignNow offers flexible pricing plans that include access to the 1 poa form feature. Each plan is designed to cater to different business needs. You can check our website for detailed pricing tiers and choose the one that fits your requirements best.

-

Can I integrate airSlate SignNow with other platforms for handling the 1 poa form?

Absolutely! airSlate SignNow seamlessly integrates with various third-party applications such as Google Drive, Salesforce, and more. This allows you to manage your 1 poa form and related documents across different platforms efficiently.

-

What are the benefits of using the 1 poa form with airSlate SignNow?

Using the 1 poa form with airSlate SignNow simplifies the signing process and enhances security. You get real-time notifications on document status and can easily access signed documents in your account. This streamlines your workflow and saves valuable time.

-

Is the 1 poa form legally binding when signed with airSlate SignNow?

Yes, the 1 poa form signed using airSlate SignNow is legally binding. The platform complies with eSign regulations, ensuring that your electronically signed documents hold the same weight as traditional signatures. This provides peace of mind for all parties involved.

Get more for Indiana Tax Power Of Attorney Form Form 49357PDF

- Michigan boiler permit 2015 2019 form

- 2300 east grand river avenue suite 102 howell michigan 48843 7578 form

- Lg240b 2015 2019 form

- Lg240b application to conduct 2013 form

- Lg555 2013 2019 form

- Voucher authorization form 022013 with watermark web finalv3doc ci minneapolis mn

- Mn lg1004 2015 2018 form

- Application in kansas city 2012 2019 form

Find out other Indiana Tax Power Of Attorney Form Form 49357PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document