Indiana Tax Power of Attorney Form 49357 EForms 2024

Understanding the Indiana POA 1 Form

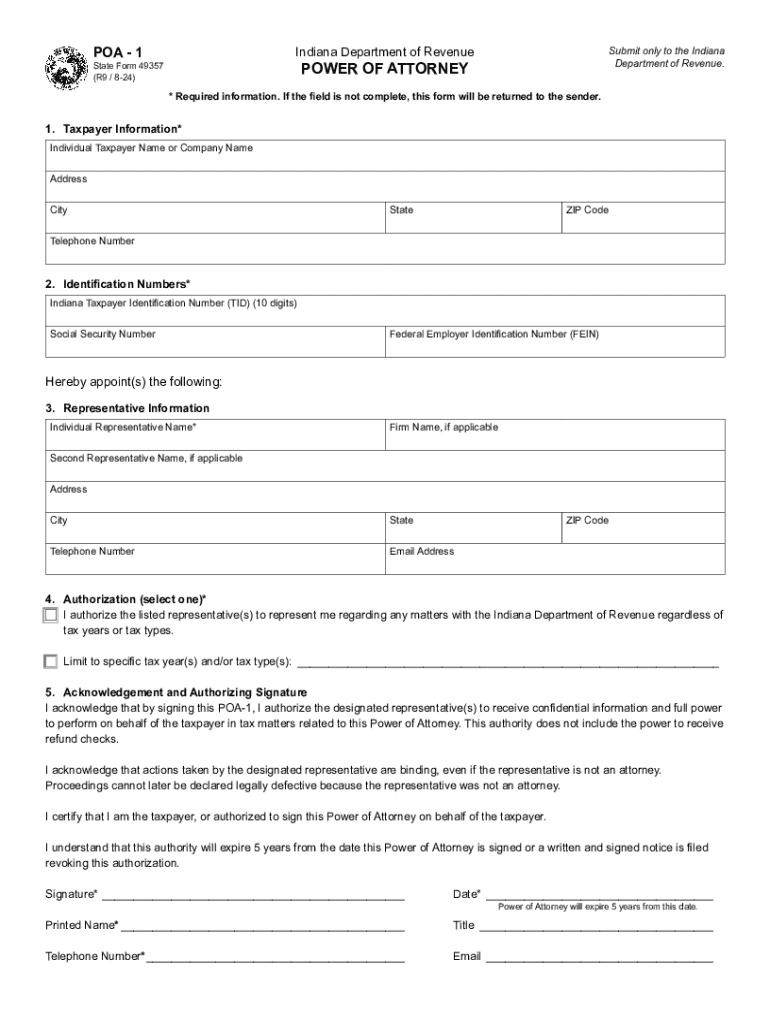

The Indiana POA 1 form, also known as the Indiana Power of Attorney form, is a legal document that allows an individual (the principal) to designate another person (the agent) to act on their behalf in various matters. This form is particularly important for financial and legal decisions, ensuring that the agent can manage affairs if the principal is unable to do so due to illness, absence, or incapacity. The Indiana POA 1 form is recognized by state law and must be executed according to specific guidelines to be valid.

Steps to Complete the Indiana POA 1 Form

Completing the Indiana POA 1 form involves several key steps to ensure accuracy and compliance with state requirements:

- Gather necessary information: Collect personal details for both the principal and the agent, including names, addresses, and contact information.

- Specify powers granted: Clearly outline the specific powers being granted to the agent. This may include financial decisions, legal matters, or healthcare decisions.

- Sign and date the form: The principal must sign and date the form in the presence of a notary public to validate the document.

- Distribute copies: Provide copies of the completed form to the agent and any relevant institutions, such as banks or healthcare providers.

Legal Use of the Indiana POA 1 Form

The Indiana POA 1 form is legally binding once properly executed. It allows the agent to act in the best interest of the principal, making decisions regarding finances, property, and healthcare. It is crucial for the principal to choose a trustworthy agent, as they will have significant control over important aspects of the principal's life. The form can be revoked at any time by the principal, provided they are of sound mind.

Obtaining the Indiana POA 1 Form

The Indiana POA 1 form can be obtained through various means:

- Online resources: Many legal websites offer downloadable versions of the form.

- Local government offices: The form may be available at county clerk offices or legal aid organizations.

- Legal professionals: Consulting with an attorney can provide guidance and ensure that the form is completed correctly.

Key Elements of the Indiana POA 1 Form

Several key elements must be included in the Indiana POA 1 form to ensure its validity:

- Principal's information: Full name and address of the individual granting power.

- Agent's information: Full name and address of the designated agent.

- Scope of authority: A detailed description of the powers granted to the agent.

- Signatures: Signatures of the principal and notary public to validate the document.

Eligibility Criteria for the Indiana POA 1 Form

To execute the Indiana POA 1 form, the principal must meet certain eligibility criteria:

- Age: The principal must be at least eighteen years old.

- Capacity: The principal must be of sound mind and capable of understanding the implications of granting power of attorney.

- Voluntary action: The decision to create the POA must be made voluntarily, without coercion.

Create this form in 5 minutes or less

Find and fill out the correct indiana tax power of attorney form 49357 eforms

Create this form in 5 minutes!

How to create an eSignature for the indiana tax power of attorney form 49357 eforms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Indiana POA 1 form?

The Indiana POA 1 form is a legal document that allows you to designate someone to act on your behalf in financial matters. This form is essential for ensuring that your financial affairs are managed according to your wishes, especially if you become unable to do so yourself.

-

How can I fill out the Indiana POA 1 form using airSlate SignNow?

Filling out the Indiana POA 1 form with airSlate SignNow is simple and efficient. You can easily upload the form, fill in the required fields, and add your electronic signature, all within a user-friendly interface that streamlines the process.

-

Is there a cost associated with using the Indiana POA 1 form on airSlate SignNow?

airSlate SignNow offers competitive pricing for its services, including the use of the Indiana POA 1 form. You can choose from various subscription plans that cater to different needs, ensuring you get the best value for your document signing requirements.

-

What features does airSlate SignNow offer for the Indiana POA 1 form?

airSlate SignNow provides a range of features for the Indiana POA 1 form, including customizable templates, secure cloud storage, and real-time tracking of document status. These features enhance the efficiency and security of managing your legal documents.

-

Can I integrate airSlate SignNow with other applications for the Indiana POA 1 form?

Yes, airSlate SignNow allows for seamless integration with various applications, making it easy to manage the Indiana POA 1 form alongside your other business tools. This integration helps streamline workflows and enhances productivity.

-

What are the benefits of using airSlate SignNow for the Indiana POA 1 form?

Using airSlate SignNow for the Indiana POA 1 form offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform ensures that your documents are signed quickly and stored safely, giving you peace of mind.

-

Is the Indiana POA 1 form legally binding when signed electronically?

Yes, the Indiana POA 1 form is legally binding when signed electronically through airSlate SignNow. The platform complies with all relevant e-signature laws, ensuring that your electronically signed documents hold the same legal weight as traditional signatures.

Get more for Indiana Tax Power Of Attorney Form 49357 EForms

Find out other Indiana Tax Power Of Attorney Form 49357 EForms

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document

- How Do I Electronic signature Minnesota Car Dealer Form