Indiana Department of Revenue Power of Attorney Tax 2014

What is the Indiana Department Of Revenue Power Of Attorney Tax

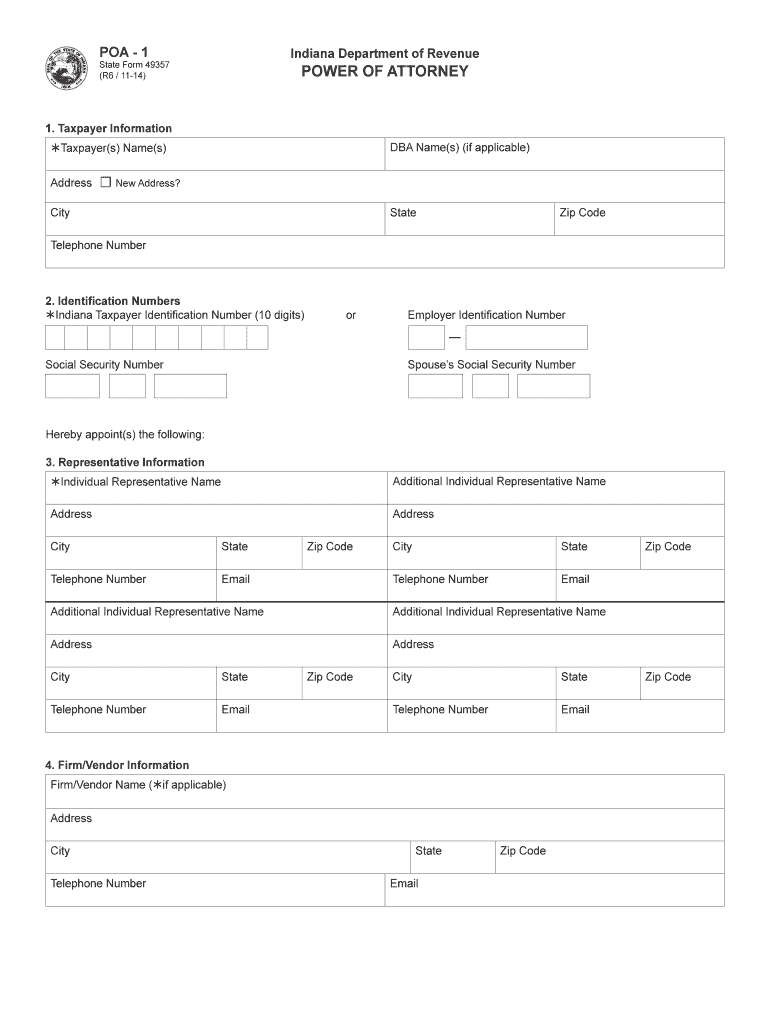

The Indiana Department Of Revenue Power Of Attorney Tax form allows a taxpayer to designate another individual to act on their behalf regarding tax matters. This legal document grants authority to the appointed representative to handle various tax-related issues, including filing returns, receiving information, and making decisions about tax payments. It is essential for individuals who may not be able to manage their tax affairs due to various reasons, such as health issues or being out of the state.

How to use the Indiana Department Of Revenue Power Of Attorney Tax

To effectively use the Indiana Department Of Revenue Power Of Attorney Tax form, the taxpayer must complete the document accurately, providing necessary details about both the taxpayer and the representative. The form should specify the powers granted to the representative, which can range from general authority to specific tax matters. Once completed, the form must be signed and dated by the taxpayer to validate the appointment. It is advisable to keep a copy for personal records and provide a copy to the representative for their reference.

Steps to complete the Indiana Department Of Revenue Power Of Attorney Tax

Completing the Indiana Department Of Revenue Power Of Attorney Tax form involves several key steps:

- Obtain the official form from the Indiana Department of Revenue website or appropriate sources.

- Fill in the taxpayer's information, including name, address, and taxpayer identification number.

- Provide the representative's details, ensuring accurate contact information.

- Clearly outline the scope of authority granted to the representative.

- Sign and date the form to finalize the appointment.

- Submit the completed form to the Indiana Department of Revenue, either online or via mail.

Key elements of the Indiana Department Of Revenue Power Of Attorney Tax

Several key elements must be included in the Indiana Department Of Revenue Power Of Attorney Tax form for it to be valid:

- Taxpayer Information: Full name, address, and taxpayer identification number.

- Representative Information: Name and contact details of the appointed individual.

- Scope of Authority: Specific powers granted, such as filing returns or discussing tax matters.

- Signatures: The taxpayer's signature is mandatory for validation.

- Date: The date of signing must be included.

Legal use of the Indiana Department Of Revenue Power Of Attorney Tax

The Indiana Department Of Revenue Power Of Attorney Tax form is legally binding when completed correctly. It allows the designated representative to act on behalf of the taxpayer in various tax-related situations. Compliance with state laws and regulations is crucial to ensure the document's validity. The form must be submitted to the Indiana Department of Revenue to be recognized officially. Failure to adhere to the legal requirements may result in the form being deemed invalid, which could hinder the representative's ability to act on behalf of the taxpayer.

Quick guide on how to complete indiana department of revenue power of attorney tax

Prepare Indiana Department Of Revenue Power Of Attorney Tax effortlessly on any device

Digital document management has gained immense popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the resources needed to create, edit, and electronically sign your documents swiftly without delays. Manage Indiana Department Of Revenue Power Of Attorney Tax on any device using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

How to modify and eSign Indiana Department Of Revenue Power Of Attorney Tax with ease

- Obtain Indiana Department Of Revenue Power Of Attorney Tax and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to submit your form—via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, and mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Indiana Department Of Revenue Power Of Attorney Tax and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct indiana department of revenue power of attorney tax

Create this form in 5 minutes!

People also ask

-

What is the Indiana Department Of Revenue Power Of Attorney Tax form?

The Indiana Department Of Revenue Power Of Attorney Tax form allows taxpayers to authorize someone to represent them in tax matters. This form is crucial for ensuring that your tax affairs are managed by a trusted individual, whether for advice or filing. By using airSlate SignNow, you can easily eSign and submit this form, streamlining the process.

-

How can airSlate SignNow help with the Indiana Department Of Revenue Power Of Attorney Tax?

airSlate SignNow simplifies the preparation and submission of the Indiana Department Of Revenue Power Of Attorney Tax form. With our easy-to-use eSigning solution, you can quickly fill out and sign the form online. This not only saves time but also ensures that your documents are secure and compliant with state requirements.

-

Is there a fee to use airSlate SignNow for the Indiana Department Of Revenue Power Of Attorney Tax?

Yes, while airSlate SignNow offers competitive pricing, the specific fee for using our service varies based on your chosen plan. However, the value of efficient eSigning for documents like the Indiana Department Of Revenue Power Of Attorney Tax often outweighs the cost. We recommend checking our pricing page for the most accurate and current information.

-

Can I integrate airSlate SignNow with my existing software for managing Indiana Department Of Revenue Power Of Attorney Tax documents?

Absolutely! airSlate SignNow offers various integrations with popular software applications, allowing users to manage Indiana Department Of Revenue Power Of Attorney Tax documents seamlessly. This compatibility enhances your workflow efficiency and ensures that you can handle all tax-related documents smoothly.

-

What features does airSlate SignNow offer specifically for Indiana Department Of Revenue Power Of Attorney Tax?

airSlate SignNow provides robust features such as customizable templates, advanced security measures, and the ability to track document status for Indiana Department Of Revenue Power Of Attorney Tax forms. With these features, users can ensure that their documents are not only completed but also securely stored and easily accessible.

-

How secure is the eSigning process for the Indiana Department Of Revenue Power Of Attorney Tax with airSlate SignNow?

The security of your documents is a top priority at airSlate SignNow. Our platform uses advanced encryption and security protocols to protect your eSigned Indiana Department Of Revenue Power Of Attorney Tax forms. This ensures that your sensitive information remains confidential and secure throughout the signing process.

-

Can I use airSlate SignNow on mobile for the Indiana Department Of Revenue Power Of Attorney Tax?

Yes, airSlate SignNow is fully optimized for mobile use, allowing you to complete the Indiana Department Of Revenue Power Of Attorney Tax form anytime, anywhere. Our mobile application provides all the functionalities required for eSigning, making it convenient for users who are often on the go.

Get more for Indiana Department Of Revenue Power Of Attorney Tax

- Adjudication division form

- Opmf36 paraglider warrant of fitness form

- Fin533 agentadjuster name or address change request form

- One emergency evacuation drill a drill or rapid dismissal shall be conducted during the first ten days of the new school year form

- Tax code declaration ir330 2021 ird form

- Completed applications must be hand delivered to the office of public safety administration opsahuman form

- Welcome to commission of pardons ampamp parole idahoprobation ampamp parolevirginia department of correctionsparole form

- Virginia beach fire department vbgovcom form

Find out other Indiana Department Of Revenue Power Of Attorney Tax

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement