Indiana Sales Tax Fill Out & Sign Online Form

Understanding the Indiana Exemption Application

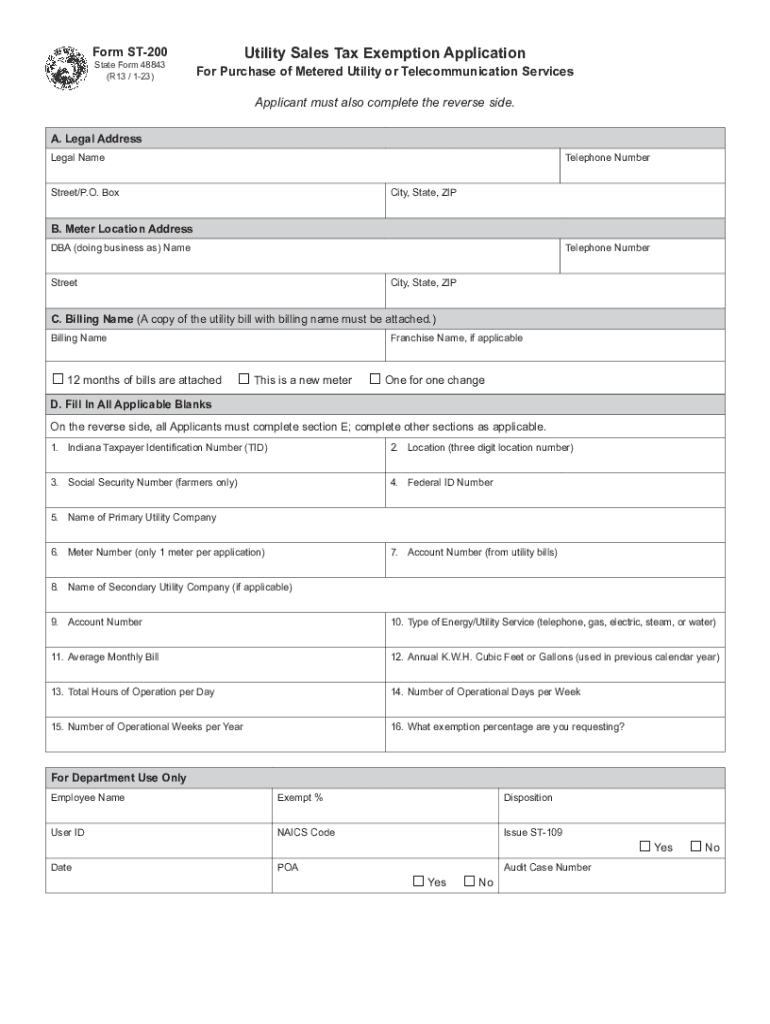

The Indiana exemption application is a crucial document for individuals and businesses seeking to claim exemptions from sales tax. This form allows eligible entities to avoid paying sales tax on certain purchases, which can lead to significant savings. Understanding the specific exemptions available under Indiana law is essential for proper compliance and financial planning.

Eligibility Criteria for the Indiana Exemption Application

To qualify for the Indiana exemption application, applicants must meet specific criteria set by the state. Generally, exemptions are available for certain types of organizations, such as non-profits, governmental entities, and specific industries. For example, educational institutions and religious organizations often qualify for sales tax exemptions. It is important to review the eligibility requirements carefully to ensure that all necessary conditions are met before submitting the application.

Steps to Complete the Indiana Exemption Application

Completing the Indiana exemption application involves several key steps:

- Gather required documentation, including proof of eligibility and identification.

- Fill out the Indiana ST-200 form accurately, providing all necessary information.

- Review the completed form for accuracy and completeness.

- Submit the application through the designated method, whether online, by mail, or in person.

Taking the time to follow these steps carefully can help prevent delays in processing and ensure a smooth application experience.

Required Documents for the Indiana Exemption Application

When applying for the Indiana exemption, specific documents must be submitted to support your application. Commonly required documents include:

- Proof of tax-exempt status, such as a letter from the IRS for non-profit organizations.

- Identification documents for the individual or business submitting the application.

- Any additional documentation that supports the claim for exemption, such as purchase orders or invoices.

Ensuring that all required documents are included will facilitate a smoother review process by the state.

Form Submission Methods for the Indiana Exemption Application

The Indiana exemption application can be submitted through various methods, allowing applicants flexibility in how they choose to apply. The available submission methods include:

- Online submission through the Indiana Department of Revenue's website.

- Mailing the completed form to the appropriate state office.

- In-person submission at designated state offices.

Each method has its own processing times, so applicants should consider their needs when choosing how to submit their application.

Key Elements of the Indiana Exemption Application

Understanding the key elements of the Indiana exemption application is vital for successful completion. Important components of the application include:

- Applicant information, including name, address, and contact details.

- Details regarding the nature of the exemption being requested.

- Signature of the applicant or authorized representative, confirming the accuracy of the information provided.

Focusing on these elements helps ensure that the application is complete and accurate, reducing the likelihood of delays.

Quick guide on how to complete indiana sales tax fill out ampamp sign online

Effortlessly prepare Indiana Sales Tax Fill Out & Sign Online on any device

The management of online documents has gained traction among businesses and individuals alike. It offers a superb environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to swiftly create, modify, and eSign your documents without any delays. Manage Indiana Sales Tax Fill Out & Sign Online on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to effortlessly edit and eSign Indiana Sales Tax Fill Out & Sign Online

- Locate Indiana Sales Tax Fill Out & Sign Online and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Indiana Sales Tax Fill Out & Sign Online to ensure clear communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the indiana sales tax fill out ampamp sign online

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Indiana exemption application?

The Indiana exemption application is a form that allows eligible individuals and businesses to apply for exemptions from certain taxes in Indiana. By using this application, you can streamline the process and ensure compliance with state requirements while benefiting from potential tax savings.

-

How can airSlate SignNow help with the Indiana exemption application?

airSlate SignNow provides an easy-to-use platform for preparing, sending, and eSigning the Indiana exemption application. Our solution simplifies document management, allowing you to efficiently handle your exemption applications without the hassle of traditional paperwork.

-

Is there a cost associated with using airSlate SignNow for my Indiana exemption application?

While airSlate SignNow offers flexible pricing plans, using our platform for your Indiana exemption application can be a cost-effective solution. We provide different tiers to accommodate various business needs, ensuring that you get the best value for managing your documents.

-

What features does airSlate SignNow offer for managing the Indiana exemption application?

AirSlate SignNow includes features such as customizable templates, automated reminders, and cloud storage, specifically designed to enhance the process of submitting your Indiana exemption application. These features improve efficiency and reduce the chances of errors, ensuring timely submissions.

-

How does airSlate SignNow ensure the security of my Indiana exemption application?

We prioritize the security of your documents, including the Indiana exemption application, by utilizing advanced encryption and secure cloud storage. This ensures that your sensitive information is protected throughout the signing and submission process.

-

Can I integrate airSlate SignNow with other tools for my Indiana exemption application?

Yes, airSlate SignNow offers numerous integrations with popular business tools and applications, allowing you to seamlessly connect your workflow for managing the Indiana exemption application. This capability enhances productivity and ensures that all relevant data is easily accessible.

-

What benefits can I expect from using airSlate SignNow for the Indiana exemption application?

By using airSlate SignNow for your Indiana exemption application, you can enjoy benefits like increased efficiency, reduced turnaround times, and the ability to track the status of your applications in real-time. Our platform is designed to help you simplify processes and focus on what really matters for your business.

Get more for Indiana Sales Tax Fill Out & Sign Online

- Form dc74a 2017 2019

- Registration renewal nsbaidrd form

- Registration renewal form nsbaidrd nevada state board of nsbaidrd state nv

- Nevada business registration online 2017 2019 form

- Nevada business registration online 2014 form

- Nv dept of taxation 2012 form

- Per11 appointment and drop off request nycgov form

- Char016a 2014 2019 form

Find out other Indiana Sales Tax Fill Out & Sign Online

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document