Mutual of Omaha Simplified Issue Life Insurance Form

Understanding Mutual Of Omaha Simplified Issue Life Insurance

Mutual Of Omaha Simplified Issue Life Insurance is a type of life insurance that offers a straightforward application process without the need for extensive medical examinations. This product is designed for individuals who seek life insurance coverage quickly and efficiently. The simplified issue approach allows applicants to provide basic health information and answer a few health-related questions, making it accessible for many people, including those who may have difficulty qualifying for traditional life insurance policies.

Steps to Complete the Application for Mutual Of Omaha Simplified Issue Life Insurance

Completing the application for Mutual Of Omaha Simplified Issue Life Insurance involves several key steps:

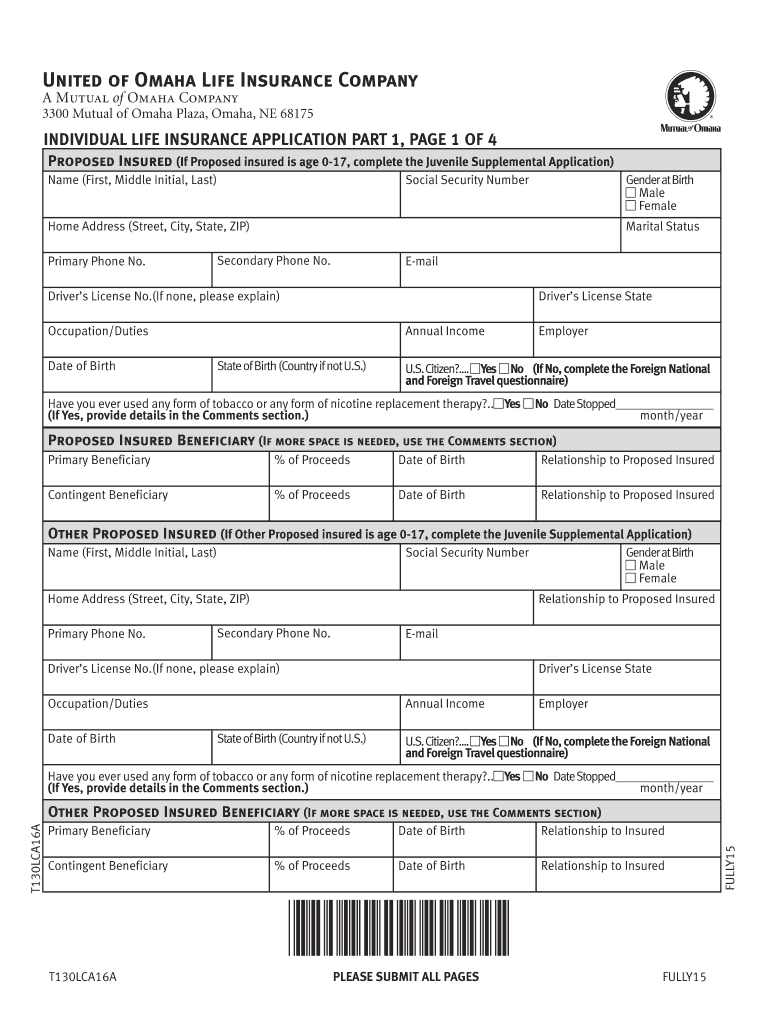

- Gather necessary information: Before starting the application, collect personal details such as your Social Security number, date of birth, and any relevant medical history.

- Complete the application form: Fill out the application with accurate information. Be prepared to answer health-related questions that will help the insurer assess your risk.

- Review your application: Double-check all entries for accuracy to avoid delays in processing.

- Submit the application: You can submit your application online, by mail, or in person, depending on your preference.

Eligibility Criteria for Mutual Of Omaha Simplified Issue Life Insurance

To qualify for Mutual Of Omaha Simplified Issue Life Insurance, applicants typically need to meet certain eligibility criteria. These may include:

- Age requirements, usually ranging from eighteen to seventy-five years.

- Residency in the United States.

- Ability to answer health questions honestly and accurately.

Meeting these criteria helps ensure that you can obtain coverage without extensive medical evaluations.

Key Elements of Mutual Of Omaha Simplified Issue Life Insurance

Several key elements define Mutual Of Omaha Simplified Issue Life Insurance:

- No medical exam: The application process does not require a medical exam, making it quicker and easier.

- Fixed premiums: Premiums remain consistent throughout the life of the policy, providing financial predictability.

- Death benefit: The policy pays a predetermined death benefit to beneficiaries upon the insured's passing.

How to Obtain Mutual Of Omaha Simplified Issue Life Insurance

Obtaining Mutual Of Omaha Simplified Issue Life Insurance can be a straightforward process. Follow these steps:

- Research options: Look into different coverage amounts and policy types available through Mutual Of Omaha.

- Contact a licensed agent: Speak with an insurance agent who can guide you through the options and help you understand the terms.

- Complete the application: Fill out the application as described in the previous section.

Once your application is submitted, the insurer will review it and provide feedback regarding your coverage.

Legal Use of Mutual Of Omaha Simplified Issue Life Insurance

Mutual Of Omaha Simplified Issue Life Insurance is legally recognized as a valid form of life insurance in the United States. It complies with state regulations governing insurance policies, ensuring that the terms and conditions are enforceable. Policyholders should be aware of their rights and obligations under the contract, including the requirement to pay premiums on time to keep the policy in force.

Quick guide on how to complete mutual of omaha simplified issue life insurance

Effortlessly Create Mutual Of Omaha Simplified Issue Life Insurance on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documentation, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources necessary to design, edit, and electronically sign your documents swiftly without any delays. Manage Mutual Of Omaha Simplified Issue Life Insurance on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused workflow today.

The most efficient way to modify and electronically sign Mutual Of Omaha Simplified Issue Life Insurance with ease

- Obtain Mutual Of Omaha Simplified Issue Life Insurance and then select Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal significance as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your modifications.

- Select your preferred method of sending your form, whether by email, SMS, an invitation link, or downloading it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searching, or errors that necessitate reprinting new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Mutual Of Omaha Simplified Issue Life Insurance and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mutual of omaha simplified issue life insurance

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is United Omaha Life Insurance?

United Omaha Life Insurance is a reliable insurance provider that offers various life insurance policies to ensure the financial security of policyholders and their families. This insurance product is designed to provide peace of mind through comprehensive coverage and competitive pricing.

-

How much does United Omaha Life Insurance cost?

The cost of United Omaha Life Insurance varies based on several factors, including age, health status, and the type of policy selected. To get an accurate quote, prospective customers can use online tools or contact an agent for personalized pricing that aligns with their needs.

-

What are the primary features of United Omaha Life Insurance?

United Omaha Life Insurance offers several key features, including flexible policy options, customizable coverage amounts, and the ability to add riders for additional benefits. Understanding these features can help customers tailor a plan that best fits their specific requirements.

-

What are the benefits of choosing United Omaha Life Insurance?

Choosing United Omaha Life Insurance provides policyholders with financial security and peace of mind for their loved ones. The policies are designed to cover expenses such as final costs, debts, and living expenses, ensuring that families are supported during difficult times.

-

Can I customize my United Omaha Life Insurance policy?

Yes, United Omaha Life Insurance allows for customization of policies according to individual needs. Customers can adjust coverage amounts, select policy durations, and add optional riders to enhance their insurance plan and better meet their financial goals.

-

Is there an application process for United Omaha Life Insurance?

The application process for United Omaha Life Insurance is straightforward and can often be completed online. Interested individuals are typically required to provide personal information, undergo a health assessment, and discuss their coverage needs with an agent for the best results.

-

Does United Omaha Life Insurance provide any digital management tools?

Yes, United Omaha Life Insurance offers digital tools that allow policyholders to manage their insurance accounts easily. Customers can access their policies, make payment arrangements, and update information from any device, enhancing customer experience and convenience.

Get more for Mutual Of Omaha Simplified Issue Life Insurance

- Form it 3 transmittal of wage and tax statements ohio

- Ty 2019 500 tax year 2019 500 individual taxpayer form

- Sch s supplemental schedule rev 7 19 income tax form

- Changing your name when you get marriednz government govtnz form

- 2018 publication or 40 fy oregon income tax full year resident forms and instructions 150 101 043

- 2018 pa schedule ue allowable employee business expenses pa 40 ue formspublications

- It 140 personal income tax forms and wv state tax

- X ray equipment amendment ohio department of health form

Find out other Mutual Of Omaha Simplified Issue Life Insurance

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy