Sf 425 Form

What is the SF-425 Form

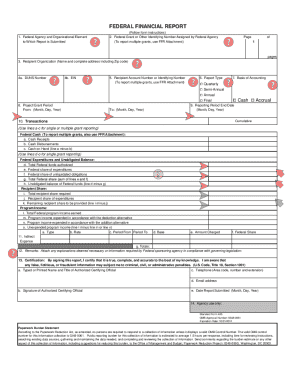

The SF-425 form, also known as the Federal Financial Report, is a standard form used by federal grant recipients to report on the financial status of their grants. This form captures essential financial data, including expenditures, income, and the status of funds. It is a critical tool for ensuring transparency and accountability in the use of federal funds.

How to Use the SF-425 Form

Using the SF-425 form involves several steps to ensure accurate reporting. Recipients must gather financial data related to their grant, including total expenditures, program income, and any unliquidated obligations. The form is structured to guide users through the reporting process, requiring specific details about the grant period and the financial activities undertaken. It is important to follow the instructions carefully to ensure compliance with federal regulations.

Steps to Complete the SF-425 Form

Completing the SF-425 form requires careful attention to detail. Here are the key steps:

- Gather all relevant financial information related to the grant.

- Fill in the recipient organization’s name, address, and grant number at the top of the form.

- Report the total expenditures for the reporting period, ensuring all figures are accurate.

- Include any program income earned during the period.

- Detail any unliquidated obligations that remain at the end of the reporting period.

- Review the completed form for accuracy before submission.

Key Elements of the SF-425 Form

The SF-425 form includes several key elements that are essential for accurate reporting. These elements are:

- Recipient Information: Details about the organization receiving the grant.

- Grant Number: The unique identifier for the grant.

- Expenditures: Total costs incurred during the reporting period.

- Program Income: Any income generated from the grant activities.

- Unliquidated Obligations: Funds that have been committed but not yet spent.

Form Submission Methods

The SF-425 form can be submitted through various methods, depending on the requirements of the federal agency managing the grant. Common submission methods include:

- Online Submission: Many agencies allow for electronic submission through their grant management systems.

- Mail: Recipients may also send a hard copy of the completed form via postal service.

- In-Person: Some agencies may accept forms submitted in person at designated offices.

Penalties for Non-Compliance

Failure to accurately complete and submit the SF-425 form can result in penalties for grant recipients. These penalties may include:

- Loss of funding or future grant eligibility.

- Requirement to repay improperly used funds.

- Legal action or sanctions imposed by federal agencies.

Quick guide on how to complete sf 425 form 73920505

Effortlessly Prepare Sf 425 Form on Any Device

Digital document management has gained popularity among organizations and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, enabling you to access the required form and safely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Manage Sf 425 Form on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The Easiest Way to Edit and Electronically Sign Sf 425 Form

- Locate Sf 425 Form and click on Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools provided by airSlate SignNow specifically for that task.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to deliver your form, whether via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choice. Modify and electronically sign Sf 425 Form to ensure exceptional communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sf 425 form 73920505

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a federal financial report template?

A federal financial report template is a pre-designed document that helps organizations report their financial status to federal agencies in a standardized format. Utilizing this template can streamline the reporting process and ensure compliance with federal requirements.

-

How does airSlate SignNow help with the federal financial report template?

airSlate SignNow simplifies the process of filling out and signing your federal financial report template. Our platform allows you to easily eSign documents and collaborate with team members, making the submission process more efficient and compliant.

-

Is there a cost associated with using the federal financial report template on airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans to provide access to the federal financial report template along with its other features. You can choose a plan that fits your budget and needs, with options for individuals and teams.

-

What features are included with the federal financial report template?

Our federal financial report template includes user-friendly design, customizable fields, and the ability to integrate eSignature options. These features help ensure that your financial reports are accurate, compliant, and easy to submit.

-

Can I customize the federal financial report template in airSlate SignNow?

Absolutely! The federal financial report template in airSlate SignNow can be fully customized to fit your specific reporting requirements. You can modify fields, add logos, and tailor the layout to better represent your organization's branding.

-

Does airSlate SignNow integrate with other software for federal financial reporting?

Yes, airSlate SignNow offers seamless integrations with various accounting and financial software. This ensures that you can easily import data into your federal financial report template, saving time and reducing errors during reporting.

-

What are the benefits of using airSlate SignNow for federal financial reporting?

Using airSlate SignNow for your federal financial report template can enhance efficiency by reducing the time spent on paperwork. Additionally, the eSigning feature expedites the approval process, ensuring timely submissions and compliance with federal deadlines.

Get more for Sf 425 Form

- City of tuscaloosa business license form

- Annual privilege license application in leighton al form

- Get downloadsfilescatering contract pdf camp toknowhim us legal forms

- New business license form pub

- Business phila govmediasip application andstorefront improvement program application philadelphia form

- Issuu com cityofalabaster docsrevenue application for business license form

- Missouri liquor license application form

- Odessa city hall odessa mo 125 s 2nd st executive form

Find out other Sf 425 Form

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist