Dfa Reduced Manufacturing Utility Tax Form

What is the Dfa Reduced Manufacturing Utility Tax Form

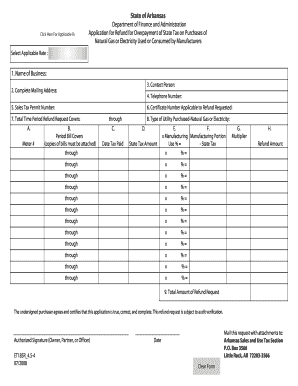

The Dfa Reduced Manufacturing Utility Tax Form is a specific document used by manufacturers in the United States to apply for a reduction in utility taxes. This form is essential for businesses that qualify under certain criteria set by state tax authorities. By completing this form, manufacturers can potentially lower their tax burden related to utility usage, which can significantly impact their operational costs.

How to use the Dfa Reduced Manufacturing Utility Tax Form

Using the Dfa Reduced Manufacturing Utility Tax Form involves several key steps. First, ensure that your business qualifies for the tax reduction by reviewing the eligibility criteria. Next, gather all necessary documentation that supports your application, such as utility bills and proof of manufacturing activities. Once you have completed the form accurately, submit it according to the instructions provided, either online or via mail, depending on your state’s requirements.

Steps to complete the Dfa Reduced Manufacturing Utility Tax Form

Completing the Dfa Reduced Manufacturing Utility Tax Form requires careful attention to detail. Follow these steps:

- Review the eligibility criteria to ensure your business qualifies.

- Collect supporting documents, including recent utility bills and evidence of manufacturing operations.

- Fill out the form accurately, providing all requested information.

- Double-check your entries for accuracy and completeness.

- Submit the form through the designated method, ensuring you keep a copy for your records.

Legal use of the Dfa Reduced Manufacturing Utility Tax Form

The legal use of the Dfa Reduced Manufacturing Utility Tax Form is governed by state tax laws. It is important to ensure that the form is filled out correctly and submitted within the required timeframe to avoid penalties. The form serves as a formal request for tax reduction, and any misrepresentation or errors could lead to legal repercussions. Therefore, businesses must adhere to all regulations and guidelines associated with this form.

Key elements of the Dfa Reduced Manufacturing Utility Tax Form

Several key elements are crucial when completing the Dfa Reduced Manufacturing Utility Tax Form. These include:

- Business Information: Name, address, and tax identification number of the manufacturing entity.

- Utility Usage: Detailed information about the types and amounts of utilities used in manufacturing processes.

- Supporting Documentation: Proof of manufacturing activities and utility bills that justify the tax reduction request.

- Signature: An authorized representative must sign the form to validate the application.

Filing Deadlines / Important Dates

Filing deadlines for the Dfa Reduced Manufacturing Utility Tax Form can vary by state. It is essential for businesses to be aware of these deadlines to ensure timely submission. Missing a deadline can result in the loss of the tax reduction opportunity. Typically, forms must be submitted annually or quarterly, depending on state regulations, so staying informed about these dates is crucial for compliance.

Quick guide on how to complete dfa reduced manufacturing utility tax form

Complete Dfa Reduced Manufacturing Utility Tax Form effortlessly on any gadget

Digital document management has become widely adopted by organizations and individuals. It offers an ideal sustainable alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage Dfa Reduced Manufacturing Utility Tax Form on any device using airSlate SignNow Android or iOS applications and enhance any document-focused task today.

How to modify and electronically sign Dfa Reduced Manufacturing Utility Tax Form with ease

- Obtain Dfa Reduced Manufacturing Utility Tax Form and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight pertinent sections of your documents or cover sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you select. Modify and electronically sign Dfa Reduced Manufacturing Utility Tax Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dfa reduced manufacturing utility tax form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Dfa Reduced Manufacturing Utility Tax Form?

The Dfa Reduced Manufacturing Utility Tax Form is a documentation requirement for manufacturing businesses to apply for reduced utility taxes in their state. This form helps ensure that businesses benefit from applicable tax reductions, promoting growth and sustainability. Understanding its details can aid businesses in maximizing financial advantages.

-

How can airSlate SignNow help with the Dfa Reduced Manufacturing Utility Tax Form?

airSlate SignNow provides an efficient platform for businesses to electronically sign and send the Dfa Reduced Manufacturing Utility Tax Form. By using our service, you can streamline the process, reduce paperwork, and ensure that all submissions are securely stored and easily retrievable. This convenience makes it easier for businesses to meet documentation deadlines.

-

What features does airSlate SignNow offer to assist with tax forms?

airSlate SignNow offers features such as custom workflows, templates for the Dfa Reduced Manufacturing Utility Tax Form, and secure e-signature capabilities. These features help simplify the process of preparing and submitting tax forms, ensuring compliance and accuracy. Additionally, our platform allows for real-time collaboration among team members.

-

Is there a cost associated with using airSlate SignNow for the Dfa Reduced Manufacturing Utility Tax Form?

Yes, airSlate SignNow offers various pricing plans tailored to the needs of different businesses. These plans allow users to access the necessary tools for submitting the Dfa Reduced Manufacturing Utility Tax Form efficiently. With scalable options, businesses can choose a plan that fits their budget and requirements.

-

Are there any integrations available for airSlate SignNow?

airSlate SignNow integrates with various third-party applications, enhancing your workflow when handling the Dfa Reduced Manufacturing Utility Tax Form. Whether you're using CRM systems or financial software, these integrations allow for seamless data transfer. This ensures that your processes remain efficient and interconnected.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for tax documents like the Dfa Reduced Manufacturing Utility Tax Form provides numerous benefits including increased efficiency, secure storage, and easy accessibility. Businesses can save valuable time and resources by automating processes that would typically require manual handling. Furthermore, our platform enhances compliance by maintaining a clear audit trail for all documents.

-

Can airSlate SignNow handle multiple signers for the Dfa Reduced Manufacturing Utility Tax Form?

Yes, airSlate SignNow is designed to accommodate multi-signer workflows, making it easy to manage the Dfa Reduced Manufacturing Utility Tax Form signatures from multiple parties. This feature streamlines collaboration among stakeholders and ensures that all required approvals are obtained efficiently. You can track the signing process in real-time for peace of mind.

Get more for Dfa Reduced Manufacturing Utility Tax Form

Find out other Dfa Reduced Manufacturing Utility Tax Form

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF