Updating Business Information Utah State Tax Commission 2021

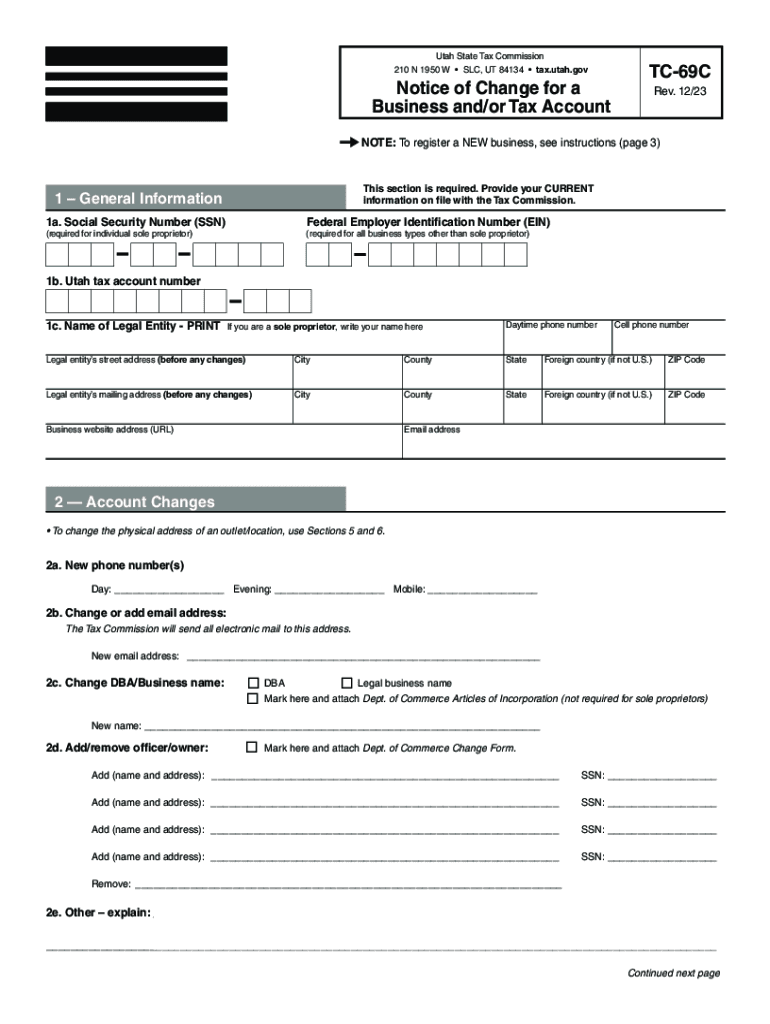

Understanding the TC 69C Form

The TC 69C form is a crucial document used by the Utah State Tax Commission for updating business information. This form allows businesses to report changes in their operational details, ensuring that the state has accurate records. It is essential for maintaining compliance with state regulations and for facilitating smooth communication between businesses and tax authorities.

Steps to Complete the TC 69C Form

Filling out the TC 69C form requires careful attention to detail. Here are the steps to ensure accurate completion:

- Gather necessary business information, including your business name, address, and identification number.

- Clearly indicate the specific updates you wish to make, such as changes in ownership or business structure.

- Review the form for any required signatures or additional documentation that may be needed.

- Submit the completed form to the Utah State Tax Commission via the appropriate method.

Required Documents for TC 69C Submission

When submitting the TC 69C form, certain documents may be required to support your updates. These can include:

- Proof of business ownership, such as articles of incorporation or partnership agreements.

- Identification documents for the business owner or authorized signatory.

- Any previous correspondence with the Utah State Tax Commission regarding your business.

Form Submission Methods

The TC 69C form can be submitted through various methods to accommodate different preferences:

- Online: Some businesses may have the option to submit the form electronically through the Utah State Tax Commission's website.

- Mail: You can print the completed form and send it to the designated address provided by the Tax Commission.

- In-Person: Businesses may also choose to deliver the form directly to a local Tax Commission office.

Legal Use of the TC 69C Form

The TC 69C form is legally recognized as a means for businesses to update their information with the Utah State Tax Commission. Proper use of this form is essential for compliance with state tax laws. Failing to keep business information current can lead to penalties or issues with tax filings.

Filing Deadlines for the TC 69C Form

It is important to adhere to filing deadlines associated with the TC 69C form. While specific deadlines may vary based on the nature of the updates, businesses should aim to submit the form promptly after any changes occur. Staying proactive helps avoid complications with tax compliance and ensures that the state has the most accurate information on file.

Quick guide on how to complete updating business information utah state tax commission

Prepare Updating Business Information Utah State Tax Commission effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Updating Business Information Utah State Tax Commission on any device using airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

How to modify and eSign Updating Business Information Utah State Tax Commission with ease

- Obtain Updating Business Information Utah State Tax Commission and click Get Form to commence.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent paragraphs of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal value as a traditional wet ink signature.

- Review all the details and click on the Done button to save your adjustments.

- Choose how you wish to send your form, through email, text message (SMS), or an invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your needs in document management in just a few clicks from any device of your preference. Modify and eSign Updating Business Information Utah State Tax Commission and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct updating business information utah state tax commission

Create this form in 5 minutes!

How to create an eSignature for the updating business information utah state tax commission

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the tc 69c utah fillable form and how is it used?

The tc 69c utah fillable form is a customizable document designed for various business processes in Utah. It allows users to fill out essential information electronically, simplifying the completion and submission process. Utilizing this fillable form can enhance accuracy and efficiency in handling business documents.

-

How does airSlate SignNow enhance the use of the tc 69c utah fillable form?

airSlate SignNow provides a user-friendly platform for creating, sending, and signing the tc 69c utah fillable form electronically. The solution ensures that documents remain secure and accessible, facilitating faster turnaround times. With the blend of eSignature capabilities and editable forms, businesses can streamline their workflows.

-

Is the tc 69c utah fillable form compatible with other document formats?

Yes, the tc 69c utah fillable form can be easily integrated with various document formats, allowing seamless transitions between fillable fields and standard documents. This compatibility ensures that users can work with documents in their preferred formats. AirSlate SignNow supports this flexibility, making it easier for businesses to manage their paperwork.

-

What is the pricing structure for using airSlate SignNow with the tc 69c utah fillable form?

AirSlate SignNow offers a range of pricing plans to accommodate different business needs, whether you're using the tc 69c utah fillable form occasionally or regularly. Packages typically include features like unlimited document sending and signing, with options for more advanced capabilities. You can find a suitable plan that aligns with your organization's budget and requirements.

-

What benefits can I expect from using the tc 69c utah fillable with airSlate SignNow?

Using the tc 69c utah fillable form with airSlate SignNow allows for faster document processing and greater compliance with U.S. standards. The fillable feature reduces manual errors, and electronic signatures minimize paperwork, leading to improved efficiency. Additionally, automated reminders can help you stay on track with document deadlines.

-

Can I store my completed tc 69c utah fillable forms in airSlate SignNow?

Absolutely! airSlate SignNow offers cloud storage for your completed tc 69c utah fillable forms. This ensures that your documents are securely stored and easily retrievable when needed. You can also organize your files systematically within the platform, simplifying access to your signed agreements.

-

Do you offer customer support for using the tc 69c utah fillable form?

Yes, airSlate SignNow provides robust customer support to assist users with the tc 69c utah fillable form and other features. You can signNow out via live chat, email, or phone for quick assistance. Our support team is dedicated to ensuring your experience with the platform is seamless.

Get more for Updating Business Information Utah State Tax Commission

- Evaluation memorandum form

- Release and waiver associated students of sdsu san diego as sdsu form

- Docusign envelope id 4c4f70fd 5a0e 45fd 82c5 fa9922bfd18d form

- Student login ashford university form

- Transportation grade form

- Orpa guidance for principal investigators and administrators when form

- Villanova application form

- Direct deposit authorization form 5742766

Find out other Updating Business Information Utah State Tax Commission

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later