96 097 Utah State Tax Commission Official Website 2021-2026

Understanding the Utah TC 69C Form

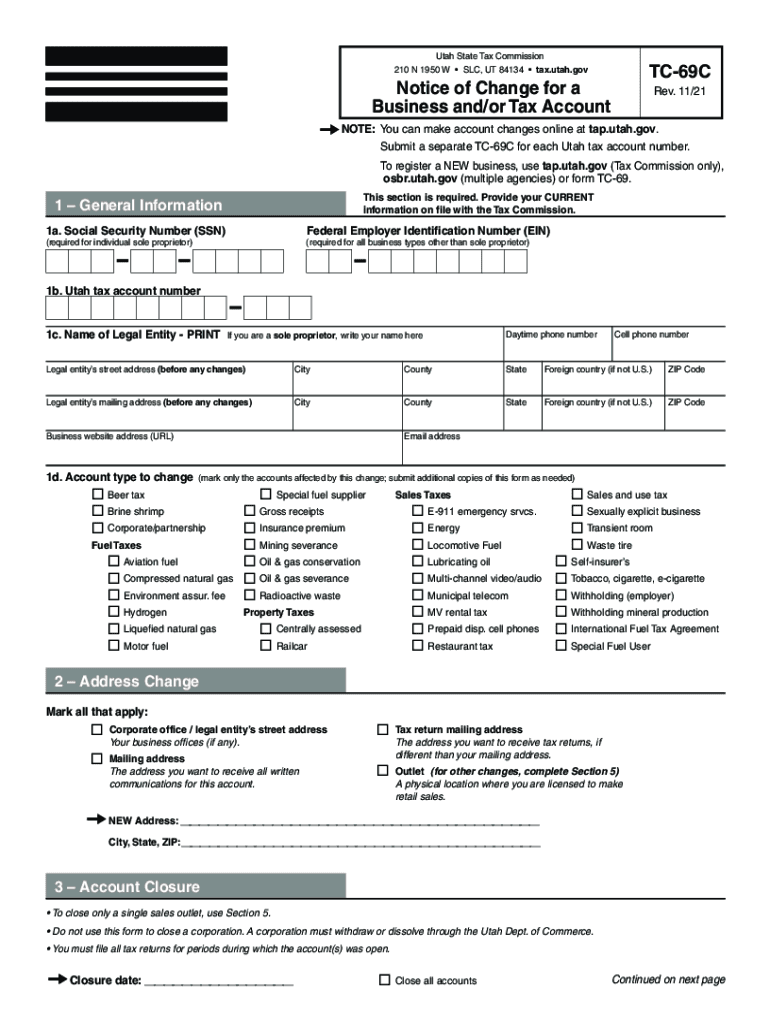

The Utah TC 69C form is utilized for making changes to business accounts with the Utah State Tax Commission. This form is essential for businesses that need to update their information, such as ownership changes, address modifications, or changes in business structure. Understanding the specific requirements and implications of this form can help ensure compliance with state regulations.

Steps to Complete the Utah TC 69C Form

Completing the Utah TC 69C form involves several key steps:

- Gather necessary information: Collect all relevant details about your business, including the current account information and the changes you wish to make.

- Access the form: Download the TC 69C form from the Utah State Tax Commission website or obtain a physical copy.

- Fill out the form: Carefully complete all sections of the form, ensuring accuracy to avoid delays.

- Review and sign: Double-check the information provided and ensure that the form is signed by an authorized representative.

- Submit the form: Send the completed form to the Utah State Tax Commission via the preferred submission method.

Legal Use of the Utah TC 69C Form

The legal validity of the Utah TC 69C form hinges on its proper completion and submission. When filed correctly, it serves as an official document for the state, reflecting any changes made to a business's tax status. It is crucial to follow all state guidelines and ensure that the form is signed appropriately to maintain its legal standing.

Required Documents for the Utah TC 69C Form

When submitting the TC 69C form, certain documents may be required to support the changes being made. These may include:

- Proof of identity for the business owner or authorized representative.

- Documentation that supports the changes, such as a certificate of amendment or partnership agreement.

- Any previous tax documents that may be relevant to the changes.

Form Submission Methods for the Utah TC 69C

The TC 69C form can be submitted through various methods, ensuring flexibility for businesses. Options include:

- Online submission through the Utah State Tax Commission's e-filing system.

- Mailing a physical copy of the form to the appropriate address.

- In-person delivery at designated state tax offices.

Penalties for Non-Compliance with the Utah TC 69C Form

Failure to submit the TC 69C form or inaccuracies in the information provided can lead to penalties. These may include:

- Fines imposed by the Utah State Tax Commission.

- Delays in processing changes, which can affect business operations.

- Potential legal repercussions if the changes impact tax obligations.

Quick guide on how to complete 96 097 utah state tax commission official website

Complete 96 097 Utah State Tax Commission Official Website seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed forms, enabling you to locate the appropriate template and securely keep it stored online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Manage 96 097 Utah State Tax Commission Official Website across any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign 96 097 Utah State Tax Commission Official Website effortlessly

- Obtain 96 097 Utah State Tax Commission Official Website and select Get Form to begin.

- Utilize our tools to fill out your document.

- Emphasize pertinent sections of your documents or redact sensitive information using tools specifically designed by airSlate SignNow for this task.

- Create your signature with the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to preserve your changes.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, time-consuming form searches, or mistakes that necessitate printing new copies. airSlate SignNow takes care of all your document management requirements in just a few clicks from any device you choose. Edit and eSign 96 097 Utah State Tax Commission Official Website and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 96 097 utah state tax commission official website

Create this form in 5 minutes!

How to create an eSignature for the 96 097 utah state tax commission official website

How to create an e-signature for a PDF file in the online mode

How to create an e-signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The best way to create an electronic signature straight from your smartphone

How to generate an e-signature for a PDF file on iOS devices

The best way to create an electronic signature for a PDF document on Android

People also ask

-

What is 69com and how does it relate to airSlate SignNow?

69com refers to our streamlined electronic signature solution offered by airSlate SignNow. It enables businesses to easily send, sign, and manage documents electronically, increasing efficiency and reducing paperwork.

-

What features does 69com offer for document signing?

69com includes a variety of features such as customizable templates, bulk sending, and real-time tracking. These tools empower users to manage their signatures seamlessly while maintaining compliance and security.

-

Is 69com cost-effective for my business needs?

Absolutely! 69com is designed to be a cost-effective solution for businesses of all sizes. With flexible pricing plans and a straightforward pricing structure, you can optimize your document management without breaking the bank.

-

How do integrations work with 69com?

69com integrates smoothly with many popular applications such as Google Drive, Dropbox, and CRM systems. This connectivity allows you to work within your existing frameworks and ensures a seamless user experience.

-

Can I try 69com before committing to a subscription?

Yes! airSlate SignNow offers a free trial of 69com, allowing you to explore all its features without commitment. This trial helps you understand how 69com can enhance your document signing process.

-

What are the security measures in place with 69com?

69com prioritizes security by employing advanced encryption methods and secure cloud storage solutions. Your documents are protected throughout the signing process, ensuring confidentiality and integrity.

-

How does 69com improve business efficiency?

By using 69com, businesses can reduce the time spent on paperwork and approval processes. The platform streamlines workflows, allowing teams to focus on core business activities rather than getting bogged down in administrative tasks.

Get more for 96 097 Utah State Tax Commission Official Website

- Kansas amendment to postnuptial property agreement kansas form

- Ks property form

- Kansas 10 day notice to pay rent or lease terminates lease pay period greater than or equal to 3 months form

- Kansas assignment of mortgage by corporate mortgage holder form

- Notice intent vacate form

- Kansas notice of dishonored check civil keywords bad check bounced check form

- Kansas commercial rental lease application questionnaire form

- Kansas residential rental lease agreement form

Find out other 96 097 Utah State Tax Commission Official Website

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free