Form it 40, State Form 47907 County Tax Schedule State

What is the Form IT 40, State Form 47907 County Tax Schedule State

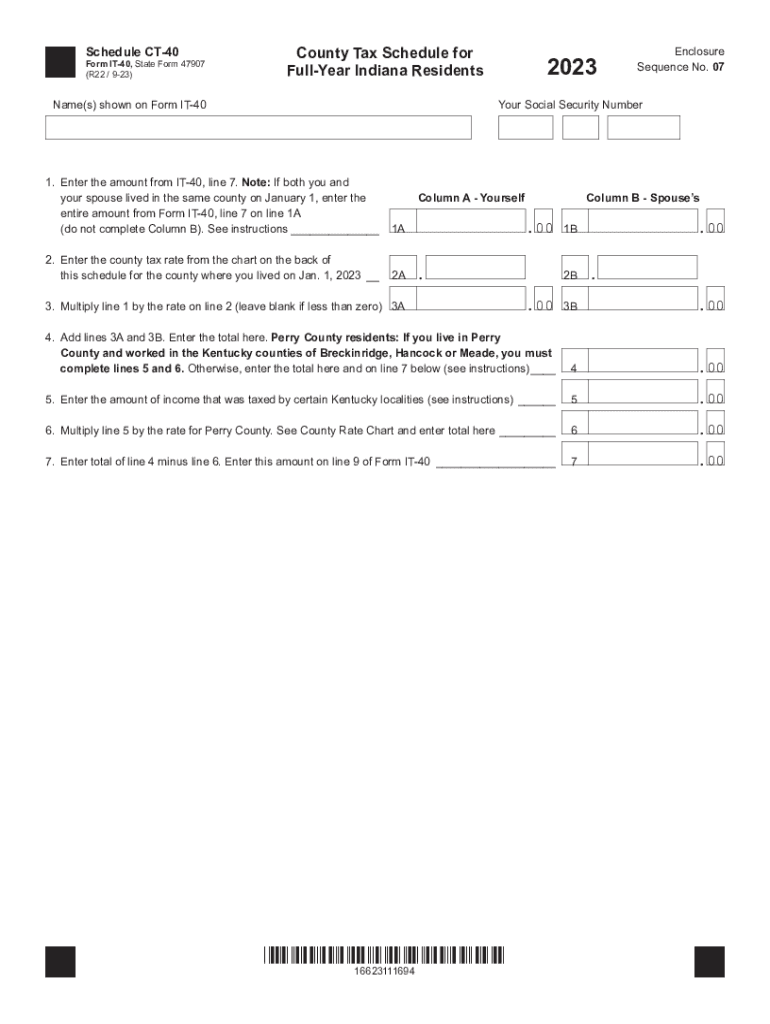

The Form IT 40, also known as the State Form 47907 County Tax Schedule State, is a tax document used by residents of Indiana to report their income and calculate their state tax obligations. This form is essential for individuals and businesses operating within the state, as it helps determine the amount of tax owed based on various income sources and deductions. It is specifically designed to facilitate the accurate reporting of income to ensure compliance with state tax laws.

How to use the Form IT 40, State Form 47907 County Tax Schedule State

Using the Form IT 40 involves several steps to ensure that all necessary information is accurately reported. Taxpayers should first gather all relevant financial documents, including W-2s, 1099s, and any other income statements. Next, individuals must fill out the form by entering their income details, deductions, and credits. It is important to follow the instructions carefully to avoid errors that could lead to penalties or delays in processing. Once completed, the form can be submitted electronically or via mail to the appropriate state tax authority.

Steps to complete the Form IT 40, State Form 47907 County Tax Schedule State

Completing the Form IT 40 requires a systematic approach:

- Gather all necessary documents, including income statements and receipts for deductions.

- Fill out personal information, including name, address, and Social Security number.

- Report all sources of income, including wages, dividends, and interest.

- Calculate deductions and credits applicable to your situation.

- Review the completed form for accuracy before submission.

- Submit the form either electronically or by mailing it to the designated tax office.

Key elements of the Form IT 40, State Form 47907 County Tax Schedule State

The Form IT 40 contains several key elements that taxpayers must be aware of:

- Personal Information: This section requires the taxpayer's name, address, and Social Security number.

- Income Reporting: Taxpayers must detail all sources of income, including wages and self-employment earnings.

- Deductions and Credits: This section allows for various deductions, such as those for dependents or education expenses.

- Tax Calculation: The form includes a section for calculating the total tax owed based on reported income and deductions.

- Signature: The taxpayer must sign and date the form to certify that the information provided is accurate.

Filing Deadlines / Important Dates

Filing deadlines for the Form IT 40 are crucial for compliance. Typically, the form must be submitted by April fifteenth of each year for the previous tax year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions that may apply and ensure that they file by the appropriate deadlines to avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

The Form IT 40 can be submitted through various methods, allowing taxpayers flexibility in how they file:

- Online Submission: Taxpayers can file electronically through the Indiana Department of Revenue's online portal.

- Mail: Completed forms can be printed and mailed to the appropriate tax office address.

- In-Person: Individuals may also choose to file in person at designated tax offices, where assistance may be available.

Quick guide on how to complete form it 40 state form 47907 county tax schedule state

Effortlessly prepare Form IT 40, State Form 47907 County Tax Schedule State on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Manage Form IT 40, State Form 47907 County Tax Schedule State on any device using airSlate SignNow's Android or iOS applications and enhance your document-related processes today.

Edit and eSign Form IT 40, State Form 47907 County Tax Schedule State with ease

- Locate Form IT 40, State Form 47907 County Tax Schedule State and select Get Form to begin.

- Utilize the tools available to fill out your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and select the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your preference. Edit and eSign Form IT 40, State Form 47907 County Tax Schedule State and guarantee outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form it 40 state form 47907 county tax schedule state

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form IT 40, State Form 47907 County Tax Schedule State used for?

The Form IT 40, State Form 47907 County Tax Schedule State is utilized for reporting income and calculating taxes owed to the state for individuals and businesses. This form is essential for ensuring compliance with state tax regulations and accurately assessing your tax obligations.

-

How can airSlate SignNow assist with the Form IT 40, State Form 47907 County Tax Schedule State?

airSlate SignNow streamlines the process of filling out the Form IT 40, State Form 47907 County Tax Schedule State by allowing users to electronically sign and send documents securely. This enhances productivity and reduces errors, ensuring that the form is completed efficiently and accurately.

-

Is there a cost associated with using airSlate SignNow for the Form IT 40, State Form 47907 County Tax Schedule State?

Yes, airSlate SignNow offers flexible pricing plans that make it a cost-effective solution for managing the Form IT 40, State Form 47907 County Tax Schedule State. Depending on your needs, you can choose from various subscription options that cater to different user requirements and budgets.

-

What features does airSlate SignNow offer for completing tax forms?

airSlate SignNow provides a variety of features to simplify the completion of tax forms, including templates, e-signatures, secure document storage, and collaboration tools. These features ensure that users can efficiently manage the Form IT 40, State Form 47907 County Tax Schedule State while enhancing accuracy and compliance.

-

Can I integrate airSlate SignNow with other tax software?

Absolutely! airSlate SignNow supports integration with various tax software applications, making it easy to import and export data relevant to the Form IT 40, State Form 47907 County Tax Schedule State. This integration helps streamline your workflow and manage your tax documents in one place.

-

How does airSlate SignNow ensure the security of my Form IT 40, State Form 47907 County Tax Schedule State documents?

airSlate SignNow employs advanced security measures, including encryption and secure user authentication, to protect your Form IT 40, State Form 47907 County Tax Schedule State documents. Our commitment to security ensures that your sensitive information remains confidential and secure.

-

Can I access my Form IT 40, State Form 47907 County Tax Schedule State documents on mobile devices?

Yes, airSlate SignNow is accessible on mobile devices, allowing you to manage your Form IT 40, State Form 47907 County Tax Schedule State documents anytime and anywhere. This mobile accessibility provides convenience and flexibility for users needing to fill out or review documents on the go.

Get more for Form IT 40, State Form 47907 County Tax Schedule State

- Authority to release assets from a deceased estate authority to release assets from a deceased estate form

- Ireland aa international permit application form

- United kingdom equal opportunity monitoring form

- Annual reportocc2021 form 1 instructions the annual report maryland2021 form 1 instructions the annual report maryland2021 form

- Public trustee form 1

- Ontario student assistance program form

- Out province claim form

- Annual enterprise survey stats nz form

Find out other Form IT 40, State Form 47907 County Tax Schedule State

- eSign Montana Lease agreement form Computer

- Can I eSign New Hampshire Lease agreement form

- How To eSign West Virginia Lease agreement contract

- Help Me With eSign New Mexico Lease agreement form

- Can I eSign Utah Lease agreement form

- Can I eSign Washington lease agreement

- Can I eSign Alabama Non disclosure agreement sample

- eSign California Non disclosure agreement sample Now

- eSign Pennsylvania Mutual non-disclosure agreement Now

- Help Me With eSign Utah Non disclosure agreement sample

- How Can I eSign Minnesota Partnership agreements

- eSign Pennsylvania Property management lease agreement Secure

- eSign Hawaii Rental agreement for house Fast

- Help Me With eSign Virginia Rental agreement contract

- eSign Alaska Rental lease agreement Now

- How To eSign Colorado Rental lease agreement

- How Can I eSign Colorado Rental lease agreement

- Can I eSign Connecticut Rental lease agreement

- eSign New Hampshire Rental lease agreement Later

- Can I eSign North Carolina Rental lease agreement