Form 200 Local Intangibles Tax Return Rev 7 22 the Intangibles Tax is a Local Tax Levied on Gross Earnings Received from Intangi

Understanding Form 200 Local Intangibles Tax Return

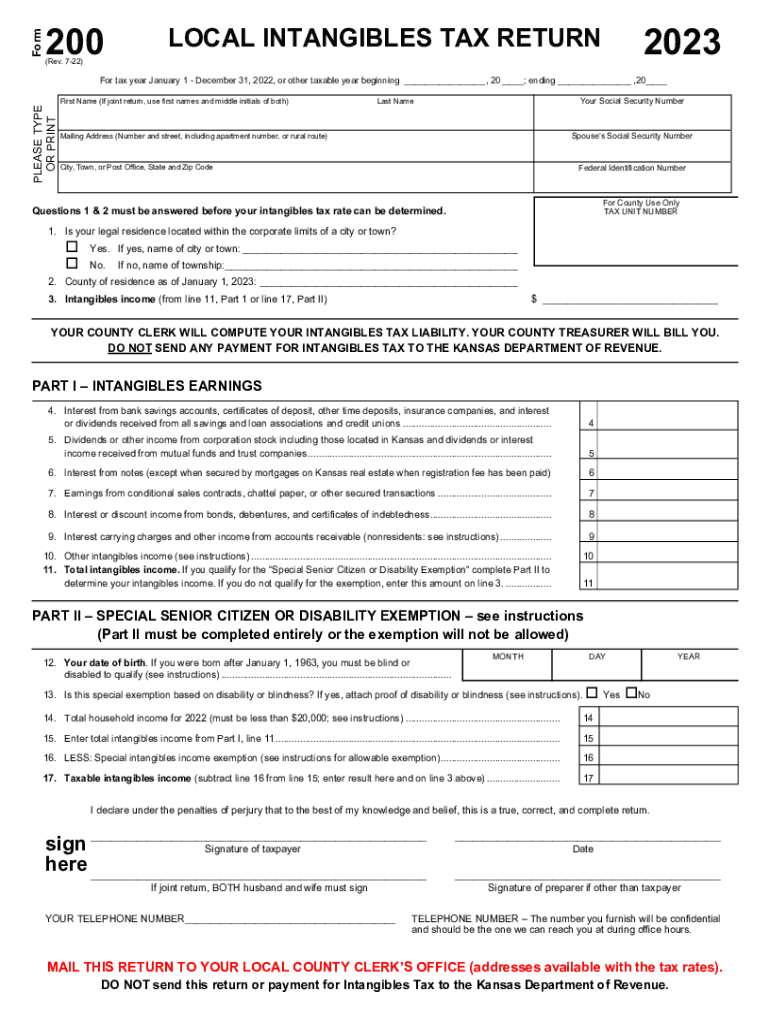

The Form 200 Local Intangibles Tax Return is a crucial document for reporting local intangibles tax. This tax is levied on gross earnings derived from intangible property, which includes savings accounts, stocks, bonds, accounts receivable, and mortgages. It is important to distinguish this tax from other forms of taxation, as it specifically targets earnings from intangible assets rather than tangible property or income from labor.

Steps to Complete the Form 200 Local Intangibles Tax Return

Completing the Form 200 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial information related to your intangible assets. Next, accurately report your gross earnings from these assets in the designated sections of the form. Be sure to double-check your entries for any discrepancies before submission. Finally, review the instructions provided with the form to ensure all required fields are completed.

Obtaining the Form 200 Local Intangibles Tax Return

The Form 200 can typically be obtained from your local tax authority's website or office. Many jurisdictions provide downloadable versions of the form for convenience. If you prefer a physical copy, you can visit your local tax office to request one. Ensure you have the most recent version, as tax forms are periodically updated.

Legal Use of the Form 200 Local Intangibles Tax Return

Using the Form 200 is legally required for individuals and businesses that hold intangible assets subject to local taxation. Filing this form accurately is essential to comply with local tax laws and avoid potential penalties. It is advisable to consult with a tax professional if you have questions about your obligations or the implications of the intangibles tax.

Filing Deadlines for the Form 200 Local Intangibles Tax Return

Filing deadlines for the Form 200 vary by jurisdiction but are generally set annually. It is important to be aware of these deadlines to avoid late fees or penalties. Typically, the form must be submitted by a specified date in the first quarter of the year. Check with your local tax authority for the exact dates applicable to your situation.

Penalties for Non-Compliance with the Form 200 Local Intangibles Tax Return

Failing to file the Form 200 or submitting inaccurate information can result in significant penalties. These may include fines, interest on unpaid taxes, or additional legal repercussions. To mitigate the risk of non-compliance, it is essential to file the form accurately and on time, and to keep thorough records of all intangible assets.

Quick guide on how to complete form 200 local intangibles tax return rev 7 22 the intangibles tax is a local tax levied on gross earnings received from

Complete Form 200 Local Intangibles Tax Return Rev 7 22 The Intangibles Tax Is A Local Tax Levied On Gross Earnings Received From Intangi effortlessly on any device

Digital document management has become favored by businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Form 200 Local Intangibles Tax Return Rev 7 22 The Intangibles Tax Is A Local Tax Levied On Gross Earnings Received From Intangi on any platform with airSlate SignNow's Android or iOS applications and enhance any document-dependent process today.

The easiest way to modify and eSign Form 200 Local Intangibles Tax Return Rev 7 22 The Intangibles Tax Is A Local Tax Levied On Gross Earnings Received From Intangi without any hassle

- Find Form 200 Local Intangibles Tax Return Rev 7 22 The Intangibles Tax Is A Local Tax Levied On Gross Earnings Received From Intangi and click Get Form to begin.

- Use the tools we offer to fill out your document.

- Select important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Decide how you'd like to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document versions. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 200 Local Intangibles Tax Return Rev 7 22 The Intangibles Tax Is A Local Tax Levied On Gross Earnings Received From Intangi and ensure exceptional communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 200 local intangibles tax return rev 7 22 the intangibles tax is a local tax levied on gross earnings received from

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 200 Local Intangibles Tax Return Rev 7 22?

The Form 200 Local Intangibles Tax Return Rev 7 22 is a document used to report and pay the local intangibles tax. This tax is levied on gross earnings received from intangible properties such as savings accounts, stocks, bonds, accounts receivable, and mortgages. It's important to note that this tax is not to be confused with other tax types.

-

How can I complete the Form 200 Local Intangibles Tax Return Rev 7 22 using airSlate SignNow?

You can easily complete the Form 200 Local Intangibles Tax Return Rev 7 22 using airSlate SignNow by utilizing our user-friendly platform to fill out and eSign the document electronically. This process simplifies tax filing, ensuring that all necessary information is correctly submitted. You can also save and store your completed forms for future reference.

-

What are the benefits of using airSlate SignNow for Form 200 filing?

Using airSlate SignNow for filing your Form 200 Local Intangibles Tax Return Rev 7 22 offers several benefits, including streamlined workflow, cost-effectiveness, and enhanced security. The platform enables quick and easy eSigning, reducing the time spent on paperwork while ensuring compliance with local tax laws. Additionally, you can track the status of your submissions in real-time.

-

Is there a pricing model for using airSlate SignNow to file the Form 200?

airSlate SignNow offers a flexible pricing model that caters to different business needs when filing the Form 200 Local Intangibles Tax Return Rev 7 22. You can choose from various subscription plans based on the volume of documents you need to manage and sign. This allows businesses to select a cost-effective solution that fits their requirements.

-

Can I integrate airSlate SignNow with other software for tax management?

Yes, airSlate SignNow supports integrations with various accounting and financial software, making it easier to manage your Form 200 Local Intangibles Tax Return Rev 7 22 alongside other financial documents. Integrating with other systems helps streamline your workflow and ensures consistent data across platforms, enhancing efficiency in tax management.

-

What kind of support does airSlate SignNow offer for users filling the Form 200?

airSlate SignNow provides comprehensive support for users completing the Form 200 Local Intangibles Tax Return Rev 7 22. Our support team is available to assist with any questions regarding the use of the platform and tax filing requirements. Additionally, we offer resources such as tutorials and FAQs to guide users through the process.

-

Are there any specific requirements for filing the Form 200 Local Intangibles Tax Return Rev 7 22?

When filing the Form 200 Local Intangibles Tax Return Rev 7 22, ensure that you have all relevant documentation related to your intangible properties, including earnings from savings accounts, stocks, and bonds. It is crucial to accurately report these figures to meet local tax regulations. Using airSlate SignNow can help organize and file these documents efficiently.

Get more for Form 200 Local Intangibles Tax Return Rev 7 22 The Intangibles Tax Is A Local Tax Levied On Gross Earnings Received From Intangi

Find out other Form 200 Local Intangibles Tax Return Rev 7 22 The Intangibles Tax Is A Local Tax Levied On Gross Earnings Received From Intangi

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation

- How Do I eSign Hawaii Charity Presentation

- How Can I eSign Illinois Charity Word

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form