K 210 Underpayment of Individual Estimated Tax Rev 7 23 If You Are an Individual Taxpayer Including Farmer or Fisher, Use This S 2022

Understanding the K-210 Form

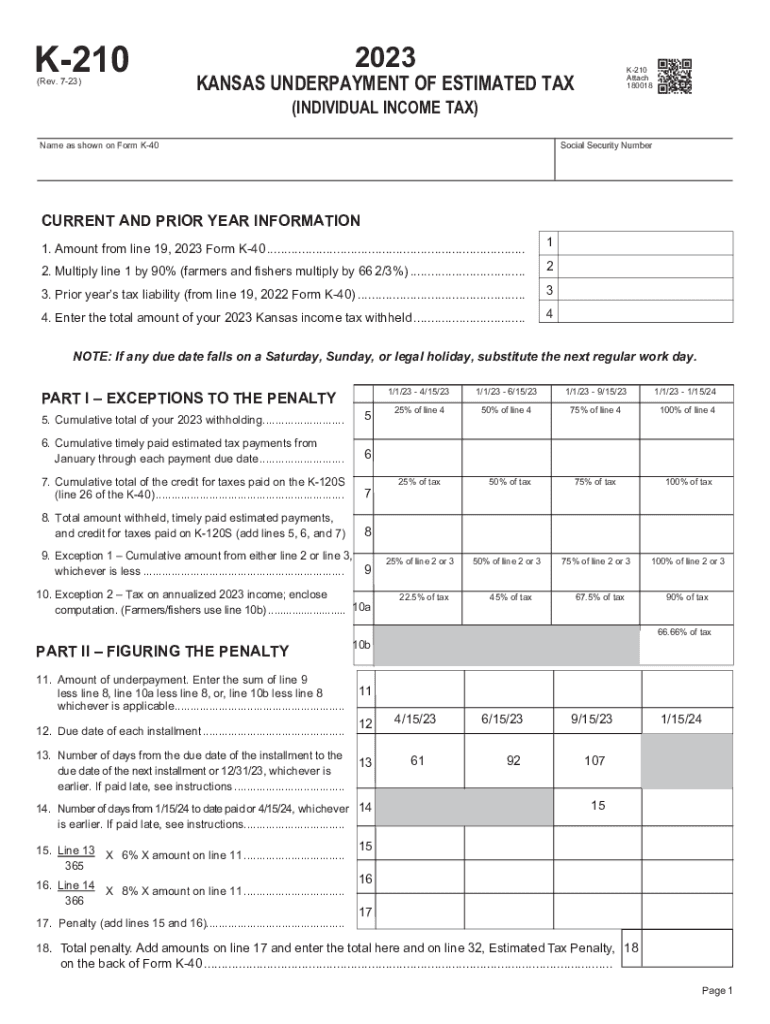

The K-210 Underpayment of Individual Estimated Tax Rev 7 23 is a schedule designed for individual taxpayers, including farmers and fishermen, to assess whether their income tax obligations have been met throughout the year. This form helps determine if the tax withheld and any estimated tax payments made are sufficient to cover the taxpayer's total tax liability. It is essential for individuals who may not have had enough tax withheld from their income or who have income from sources that do not have withholding, such as self-employment or investments.

How to Utilize the K-210 Form

To effectively use the K-210 form, taxpayers should first gather all relevant income information for the year. This includes wages, self-employment income, and any other taxable income. Next, individuals will calculate their total tax liability based on this income. The K-210 form will guide users through comparing their total tax liability to the amounts withheld and any estimated tax payments made during the year. This comparison will help determine if there has been an underpayment, which may result in penalties or interest charges.

Steps for Completing the K-210 Form

Completing the K-210 form involves several key steps:

- Gather all income documentation, including W-2s and 1099s.

- Calculate your total income and corresponding tax liability for the year.

- Document the total amount of tax withheld and any estimated tax payments made.

- Use the K-210 form to compare your total tax liability with the amounts already paid.

- Determine if you owe additional taxes or if you have overpaid.

Legal Considerations for the K-210 Form

Using the K-210 form is a legal requirement for individuals who may not have had sufficient tax withheld. It is important to complete this form accurately to avoid potential penalties for underpayment. Taxpayers should be aware that failure to file or inaccuracies can lead to additional interest and penalties imposed by the IRS. Understanding the legal implications of underpayment can help ensure compliance and avoid unnecessary financial burdens.

Key Components of the K-210 Form

The K-210 form includes several critical components that taxpayers must understand:

- Taxpayer identification information, including name and Social Security number.

- Income details, including all sources of income for the year.

- Calculation of total tax liability based on the reported income.

- Documentation of tax withheld and any estimated payments made.

- Final determination of underpayment or overpayment status.

Filing Deadlines for the K-210 Form

Taxpayers should be aware of the filing deadlines associated with the K-210 form. Typically, this form is due on the same date as the individual income tax return, which is generally April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. It is crucial to file the K-210 form on time to avoid penalties and ensure compliance with tax regulations.

Quick guide on how to complete k 210 underpayment of individual estimated tax rev 7 23 if you are an individual taxpayer including farmer or fisher use this

Complete K 210 Underpayment Of Individual Estimated Tax Rev 7 23 If You Are An Individual Taxpayer including Farmer Or Fisher, Use This S effortlessly on any device

Web-based document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute to conventional printed and signed documents, allowing you to find the appropriate form and securely keep it online. airSlate SignNow provides all the resources necessary to create, amend, and electronically sign your documents promptly without hindrances. Administer K 210 Underpayment Of Individual Estimated Tax Rev 7 23 If You Are An Individual Taxpayer including Farmer Or Fisher, Use This S on any platform using airSlate SignNow Android or iOS applications and simplify any document-related processes today.

The simplest method to modify and eSign K 210 Underpayment Of Individual Estimated Tax Rev 7 23 If You Are An Individual Taxpayer including Farmer Or Fisher, Use This S without hassle

- Obtain K 210 Underpayment Of Individual Estimated Tax Rev 7 23 If You Are An Individual Taxpayer including Farmer Or Fisher, Use This S and click Get Form to initiate.

- Make use of the resources we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and has the same legal validity as a traditional handwritten signature.

- Verify the details and click on the Done button to store your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Modify and eSign K 210 Underpayment Of Individual Estimated Tax Rev 7 23 If You Are An Individual Taxpayer including Farmer Or Fisher, Use This S and guarantee outstanding communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct k 210 underpayment of individual estimated tax rev 7 23 if you are an individual taxpayer including farmer or fisher use this

Create this form in 5 minutes!

How to create an eSignature for the k 210 underpayment of individual estimated tax rev 7 23 if you are an individual taxpayer including farmer or fisher use this

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 'K 210 Underpayment Of Individual Estimated Tax Rev 7 23' form?

The 'K 210 Underpayment Of Individual Estimated Tax Rev 7 23' form is utilized to assess if individual taxpayers, including farmers and fishers, fully paid their income taxes throughout the year. It helps in figuring out whether withholding and estimated tax payments were sufficient to meet tax obligations, ensuring compliance with IRS regulations.

-

How can airSlate SignNow help with the K 210 form?

With airSlate SignNow, users can easily fill out, sign, and send the K 210 Underpayment Of Individual Estimated Tax Rev 7 23 form electronically. This streamlines the preparation process and ensures that all necessary information is accurately recorded and submitted on time, minimizing the risk of underpayment penalties.

-

Is airSlate SignNow affordable for individual taxpayers?

Yes, airSlate SignNow offers a cost-effective solution for individuals looking to manage their tax documentation, including the K 210 Underpayment Of Individual Estimated Tax Rev 7 23 form. The pricing is designed to accommodate individual taxpayers and small businesses, making it accessible to all who need it.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow provides a range of features including e-signatures, document templates, and secure cloud storage. These features are especially beneficial for preparing tax forms like the K 210 Underpayment Of Individual Estimated Tax Rev 7 23, allowing individuals to organize and manage their tax-related documents efficiently.

-

Can airSlate SignNow integrate with accounting software?

Absolutely! airSlate SignNow seamlessly integrates with various accounting software solutions, enhancing your ability to handle tax documents, including the K 210 Underpayment Of Individual Estimated Tax Rev 7 23 form. This integration ensures a streamlined workflow and helps maintain accurate financial records for compliance.

-

What benefits can I expect from using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax documentation, such as the K 210 Underpayment Of Individual Estimated Tax Rev 7 23, allows for increased efficiency, accuracy, and security. Benefits include easy access to templates, electronic signatures, and the ability to track document status, which can signNowly simplify your tax filing process.

-

Is it safe to use airSlate SignNow for sensitive tax documents?

Yes, airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards, ensuring that sensitive documents like the K 210 Underpayment Of Individual Estimated Tax Rev 7 23 are protected. Users can trust that their information is secure while managing their tax filings.

Get more for K 210 Underpayment Of Individual Estimated Tax Rev 7 23 If You Are An Individual Taxpayer including Farmer Or Fisher, Use This S

Find out other K 210 Underpayment Of Individual Estimated Tax Rev 7 23 If You Are An Individual Taxpayer including Farmer Or Fisher, Use This S

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form

- Help Me With eSign Hawaii Business Operations Presentation

- How Do I eSign Idaho Car Dealer Document

- How Do I eSign Indiana Car Dealer Document

- How To eSign Michigan Car Dealer Document

- Can I eSign Michigan Car Dealer PPT

- How Can I eSign Michigan Car Dealer Form

- Help Me With eSign Kansas Business Operations PPT

- How Can I eSign Mississippi Car Dealer Form

- Can I eSign Nebraska Car Dealer Document

- Help Me With eSign Ohio Car Dealer Document

- How To eSign Ohio Car Dealer Document

- How Do I eSign Oregon Car Dealer Document

- Can I eSign Oklahoma Car Dealer PDF

- How Can I eSign Oklahoma Car Dealer PPT

- Help Me With eSign South Carolina Car Dealer Document

- How To eSign Texas Car Dealer Document

- How Can I Sign South Carolina Courts Document

- How Do I eSign New Jersey Business Operations Word