Income Tax Forms for Tax Year Virginia 2021

Understanding the Virginia VA 8879 Form

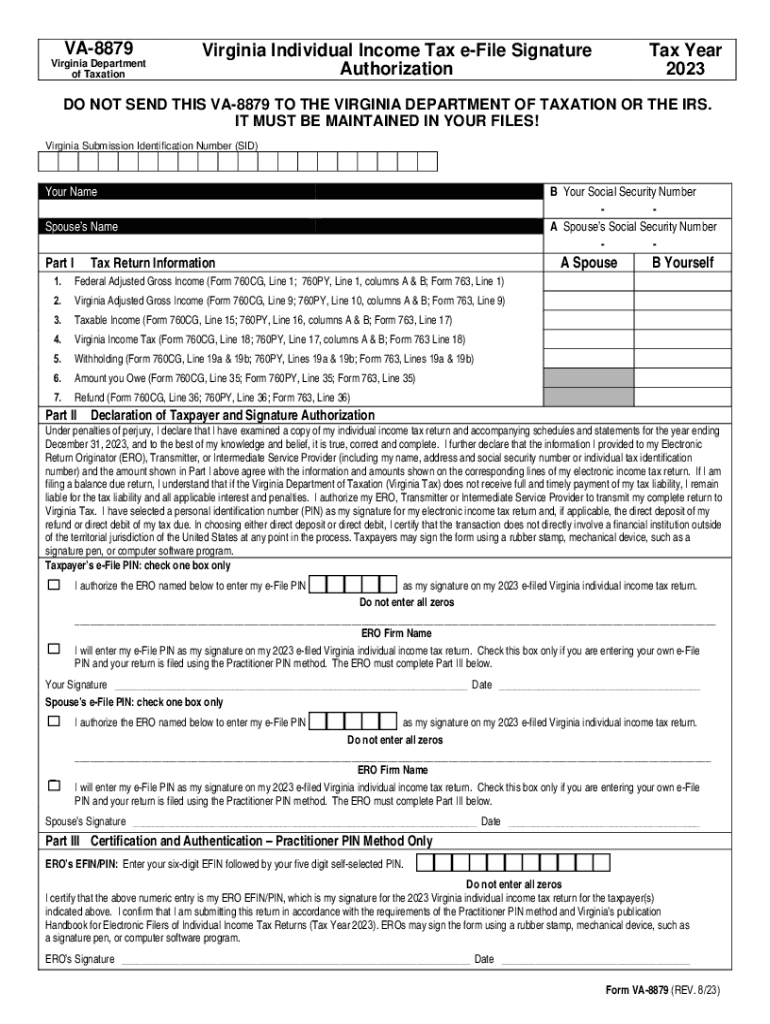

The Virginia VA 8879 form, also known as the Virginia Income Authorization, is a crucial document for taxpayers in Virginia. This form authorizes the electronic filing of individual income tax returns. It serves as a declaration that the taxpayer has reviewed their return and agrees to the electronic submission. Understanding this form is essential for ensuring compliance with state tax regulations.

Steps to Complete the Virginia VA 8879 Form

Completing the Virginia VA 8879 form involves several key steps:

- Gather necessary information, including your Social Security number and details from your tax return.

- Fill out the form accurately, ensuring all information matches your tax return.

- Review the completed form for any errors or omissions.

- Sign and date the form to authorize the electronic submission.

It is important to ensure that all information is correct to avoid delays in processing your tax return.

Obtaining the Virginia VA 8879 Form

The Virginia VA 8879 form can be obtained from the Virginia Department of Taxation's official website. You can also find printable versions of the form, which can be filled out manually if preferred. It is advisable to ensure you are using the most current version of the form to comply with any recent tax law changes.

Legal Use of the Virginia VA 8879 Form

The Virginia VA 8879 form is legally binding and must be used in accordance with state tax laws. By signing this form, taxpayers confirm that they have reviewed their tax return and authorize its electronic filing. Failure to properly complete or submit this form can result in penalties or delays in processing your tax return.

Filing Deadlines for the Virginia VA 8879 Form

Taxpayers should be aware of the filing deadlines associated with the Virginia VA 8879 form. Typically, the form must be submitted by the same deadline as your income tax return. For most individuals, this is usually April 15 of each year. It is important to file on time to avoid penalties and interest on any taxes owed.

Required Documents for the Virginia VA 8879 Form

To complete the Virginia VA 8879 form, you will need several documents:

- Your completed Virginia income tax return.

- Identification details, such as your Social Security number.

- Any supporting documentation that may be required for your tax return.

Having these documents ready will streamline the process of completing and submitting the VA 8879 form.

Examples of Using the Virginia VA 8879 Form

The Virginia VA 8879 form is commonly used by various taxpayer scenarios, including:

- Individuals filing their income tax returns electronically.

- Tax preparers submitting returns on behalf of clients.

- Self-employed individuals who need to authorize their tax filings.

Each of these scenarios demonstrates the importance of the VA 8879 form in facilitating the electronic filing process while ensuring compliance with state tax regulations.

Quick guide on how to complete income tax forms for tax year virginia

Complete Income Tax Forms for Tax Year Virginia seamlessly on any gadget

Online document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without any hold-ups. Handle Income Tax Forms for Tax Year Virginia on any gadget with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and electronically sign Income Tax Forms for Tax Year Virginia without any hassle

- Locate Income Tax Forms for Tax Year Virginia and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or conceal sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form: via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your preference. Alter and electronically sign Income Tax Forms for Tax Year Virginia to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct income tax forms for tax year virginia

Create this form in 5 minutes!

How to create an eSignature for the income tax forms for tax year virginia

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the VA 8879 form?

The VA 8879 form, also known as the IRS e-file Signature Authorization, allows taxpayers to electronically sign their tax returns. With airSlate SignNow, users can easily eSign the VA 8879 form, ensuring a secure and legal submission process.

-

How does airSlate SignNow simplify the process of signing the VA 8879?

airSlate SignNow streamlines the signing process for the VA 8879 by providing a user-friendly interface and easy navigation. You can upload your VA 8879 document, invite signers, and securely collect eSignatures, all in one platform, saving you time and effort.

-

Is there a cost associated with using airSlate SignNow for the VA 8879?

Yes, airSlate SignNow offers various pricing plans depending on your business needs. Each plan allows for unlimited use of features essential for managing documents like the VA 8879, making it a cost-effective solution for eSigning.

-

What features does airSlate SignNow offer that assist with the VA 8879?

airSlate SignNow provides features such as document templates, automated workflows, and secure cloud storage, all designed to help you manage the VA 8879 efficiently. These tools make it simple to prepare, send, and track your VA 8879 documentation.

-

Can airSlate SignNow integrate with other software for managing the VA 8879?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, helping you to easily manage your VA 8879 and other important documents. This integration ensures that your workflow remains uninterrupted and efficient.

-

How secure is the electronic signing process for the VA 8879 with airSlate SignNow?

Security is a top priority at airSlate SignNow. The electronic signing process for the VA 8879 utilizes advanced encryption methods and complies with industry standards, ensuring that your sensitive information remains protected during the signing and submission process.

-

What are the benefits of using airSlate SignNow for the VA 8879?

Using airSlate SignNow for the VA 8879 provides numerous benefits, such as faster processing times, improved accuracy, and reduced paperwork. Additionally, the ability to track document status enhances transparency throughout the signing process.

Get more for Income Tax Forms for Tax Year Virginia

- Liberty university transcripts form

- Official mail and distribution center fort rucker us army form

- Admission status change from conditional to regular gram form

- 3 gc mccollum administration building centralsan form

- Consortium agreement georgia college amp state university gcsu form

- Meal plan exemption request gonzaga university gonzaga form

- Grambling state university cheerleaders form

- Vsu employee self assessment amp goal setting form

Find out other Income Tax Forms for Tax Year Virginia

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure