Form 1116 Foreign Tax Credit Individual, Estate, or Trust 2022

What is the Form 1116 Foreign Tax Credit Individual, Estate, Or Trust

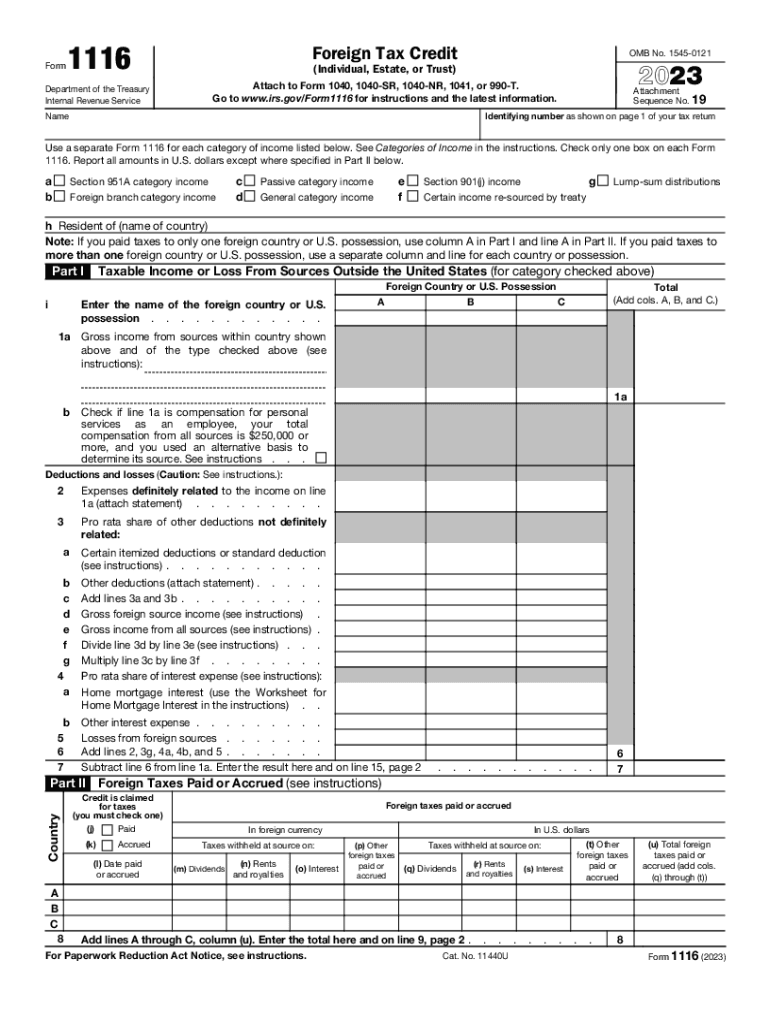

The Form 1116 is a tax form used by individuals, estates, or trusts to claim a foreign tax credit. This credit allows taxpayers to reduce their U.S. tax liability based on the amount of foreign taxes they have paid or accrued. The purpose of this form is to prevent double taxation on income that has already been taxed by a foreign government. By using Form 1116, taxpayers can report foreign income and the corresponding taxes paid, ensuring they receive the appropriate credit against their U.S. tax obligations.

How to use the Form 1116 Foreign Tax Credit Individual, Estate, Or Trust

To use Form 1116, taxpayers must first determine their eligibility for the foreign tax credit. This involves identifying foreign income sources and the taxes paid to foreign governments. Once eligibility is established, the taxpayer completes the form by providing detailed information about the foreign income, taxes paid, and any applicable deductions. Form 1116 requires careful attention to detail, as inaccuracies can lead to delays or denial of the credit. After completing the form, it should be submitted with the taxpayer's annual tax return.

Steps to complete the Form 1116 Foreign Tax Credit Individual, Estate, Or Trust

Completing Form 1116 involves several key steps:

- Gather necessary documentation, including records of foreign income and taxes paid.

- Determine the appropriate category of income (general, passive, etc.) for reporting.

- Fill out the form, ensuring all sections are accurately completed, including foreign tax details.

- Calculate the allowable foreign tax credit based on the completed form.

- Attach Form 1116 to your federal tax return when filing.

Key elements of the Form 1116 Foreign Tax Credit Individual, Estate, Or Trust

Form 1116 includes several key elements that taxpayers must understand:

- Part I: Information about foreign income and taxes paid.

- Part II: Calculation of the foreign tax credit based on the income type.

- Part III: Summary of the foreign taxes claimed for credit.

- Part IV: Additional information for specific situations, such as carryback or carryover of unused credits.

Filing Deadlines / Important Dates

Form 1116 must be filed with the taxpayer's annual federal income tax return. The standard deadline for filing individual tax returns is April 15. If additional time is needed, taxpayers can file for an extension, but any taxes owed must still be paid by the original deadline to avoid penalties. It is important to stay updated on any changes to tax deadlines that may arise due to special circumstances, such as natural disasters or federal announcements.

Eligibility Criteria

To qualify for the foreign tax credit using Form 1116, taxpayers must meet specific eligibility criteria:

- Taxpayers must have foreign income that is subject to taxation.

- Foreign taxes must have been paid or accrued during the tax year.

- Taxpayers must have a legal obligation to pay the foreign taxes claimed.

- The credit is generally limited to the lesser of the foreign taxes paid or the U.S. tax liability on the foreign income.

Quick guide on how to complete form 1116 foreign tax credit individual estate or trust

Effortlessly Prepare Form 1116 Foreign Tax Credit Individual, Estate, Or Trust on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely keep it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents quickly and without delays. Manage Form 1116 Foreign Tax Credit Individual, Estate, Or Trust on any device using the airSlate SignNow apps for Android or iOS and simplify any document-related process today.

How to Edit and eSign Form 1116 Foreign Tax Credit Individual, Estate, Or Trust with Ease

- Obtain Form 1116 Foreign Tax Credit Individual, Estate, Or Trust and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent paragraphs of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Select how you prefer to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

No more worrying about lost or misplaced files, tedious document searches, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in a few clicks from any device you choose. Edit and eSign Form 1116 Foreign Tax Credit Individual, Estate, Or Trust and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1116 foreign tax credit individual estate or trust

Create this form in 5 minutes!

How to create an eSignature for the form 1116 foreign tax credit individual estate or trust

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 1116 Foreign Tax Credit Individual, Estate, Or Trust?

Form 1116 Foreign Tax Credit Individual, Estate, Or Trust is used to claim a credit for foreign taxes paid on income that is also subject to U.S. tax. This form helps reduce double taxation for U.S. taxpayers with foreign income. Understanding how to fill out this form correctly can lead to signNow tax savings.

-

How can airSlate SignNow help with Form 1116 Foreign Tax Credit Individual, Estate, Or Trust?

airSlate SignNow simplifies the process of preparing and submitting Form 1116 Foreign Tax Credit Individual, Estate, Or Trust by allowing you to send, sign, and manage documents securely online. Our platform ensures that you can complete your forms efficiently, minimizing errors in paperwork. With our user-friendly interface, you can easily navigate through the requirements of this form.

-

What features does airSlate SignNow offer for managing tax documents like Form 1116 Foreign Tax Credit Individual, Estate, Or Trust?

airSlate SignNow offers features such as secure eSigning, document templates, and collaboration tools, tailored for tax documents like Form 1116 Foreign Tax Credit Individual, Estate, Or Trust. These features enhance the efficiency of signing and managing important tax documents. Plus, you can easily track document statuses and ensure compliance.

-

Is there a cost associated with using airSlate SignNow for Form 1116 Foreign Tax Credit Individual, Estate, Or Trust?

Yes, airSlate SignNow offers cost-effective pricing plans that suit various business needs. You can choose a plan based on the volume of documents you need to manage and sign. Investing in our services can help save time and reduce the complications associated with preparing Form 1116 Foreign Tax Credit Individual, Estate, Or Trust.

-

Can airSlate SignNow integrate with other accounting software for Form 1116 Foreign Tax Credit Individual, Estate, Or Trust?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, enabling you to manage Form 1116 Foreign Tax Credit Individual, Estate, Or Trust efficiently. This integration allows you to streamline the process of gathering tax information and ensures accurate filings. You can also easily synchronize data between platforms.

-

How does using airSlate SignNow benefit individuals filing Form 1116 Foreign Tax Credit Individual, Estate, Or Trust?

Using airSlate SignNow can greatly benefit individuals by providing a simplified and secure means to manage and file Form 1116 Foreign Tax Credit Individual, Estate, Or Trust. Our platform reduces the risk of errors, enhances document security, and accelerates the signing process. This ultimately allows individuals to focus on maximizing their tax credits.

-

What type of support does airSlate SignNow provide for users of Form 1116 Foreign Tax Credit Individual, Estate, Or Trust?

airSlate SignNow offers comprehensive support for users dealing with Form 1116 Foreign Tax Credit Individual, Estate, Or Trust. Our customer service team is readily available to assist with any questions or issues you might encounter. Additionally, we provide resources and guides to help you navigate through the submission process.

Get more for Form 1116 Foreign Tax Credit Individual, Estate, Or Trust

- Unladen wt form

- Arkansas tax amendment instructions and forms prepare

- 2019 tax tables form

- Form et 30120application for releases of estate tax lienet30

- Resident screening software resident check from mri form

- 2019 california form 3525 substitute for form w 2 wage and tax statement or form 1099 r distributions from pensions annuities

- 2019 form 540 2ez california income tax return 2019 form 540 2ez california income tax return

- 2019 california form 3521 low income housing credit 2019 california form 3521 low income housing credit

Find out other Form 1116 Foreign Tax Credit Individual, Estate, Or Trust

- Electronic signature PDF for Administrative Free

- Electronic signature Form for IT Easy

- Electronic signature Presentation for IT Easy

- Electronic signature Word for Administrative Online

- Electronic signature Form for IT Safe

- Electronic signature Word for Administrative Mobile

- Electronic signature Document for Administrative Online

- Electronic signature Document for Administrative Free

- How To Electronic signature Word for Administrative

- Electronic signature Document for Administrative Easy

- Electronic signature Form for Administrative Online

- Electronic signature Form for Administrative Computer

- Electronic signature Form for Administrative Now

- How Can I Electronic signature Form for Administrative

- Electronic signature Form for Administrative Free

- Electronic signature Form for Administrative Secure

- Can I Electronic signature Form for Administrative

- Electronic signature Form for Administrative Later

- Electronic signature PDF for Sales Teams Online

- Electronic signature PPT for Administrative Computer